Lingering Quandaries about System Development (Part 2)

Posted by Mark on January 22, 2013 at 06:33 | Last modified: January 23, 2013 01:49This series details different aspects of nebulous understanding that prevent my advancement along the System Development learning curve. In http://www.optionfanatic.com/2013/01/18/lingering-quandries-about-system-development-part-1/, I began by describing confusion over the chosen subjective function RAR/MDD.

As mentioned, one possibility is to select a different subjective function and for me, Profit Factor (PF) leads the pack of contenders. PF describes the number of dollars made per $1 lost. This does not vary by number of trades or position size–two factors that affect exposure and therefore affect RAR/MDD. With PF, I can study one ticker or multiple tickers and generate comparable statistics regardless of initial equity and position sizing.

One downside to PF is that it does not account for distribution of profits and losses. Having one big winner among many fractional profits could generate a large PF where the equity curve would tell a different story. This argues for inclusion of standard deviation (SD) to the subjective function.

Another downside to PF is disregard for DD. For example, AAPL had a 50% return from 2008 to 2011, but there was also a 60% drawdown in the middle. While this spanned several years, it could certainly occur over any time frame and would be more than I could tolerate despite a decent overall PF. Perhaps some metric like PF / (MDD * SD) would be useful.

Another possibility is to stick with RAR/MDD and backtest just one ticker at a time. The cumulative effect of trading multiple tickers would likely be a lower RAR/MDD than reflected by any single ticker alone but that is unimportant because consistent comparisons would be achieved. Besides, whether by different tickers or different systems, I want multiple trades with the potential of concentrated profit (large RAR/MDD) on each one.

I believe the bigger issues with multiple tickers have to do with backtesting validity, portfolio heat, and what exactly it takes in order to be a robust finding.

To be continued…

Categories: System Development | Comments (1) | PermalinkLingering Quandaries about System Development (Part 1)

Posted by Mark on January 18, 2013 at 15:45 | Last modified: January 23, 2013 01:42While this series is strictly personal, I do believe that anyone seeking to master System Development will need to arrive at their own resolutions to these issues. On my journey, I remain “in consolidation” due to conflicting subdivisions of System Development. More than anything else, this series will help me keep track of where I’ve been and where I am so that I can better understand where I still have to go.

My first unresolved issue is identification of an acceptable subjective function. I addressed this in a six-part series beginning with http://www.optionfanatic.com/2012/10/04/the-subjective-function-part-1. In the end, I settled on Risk Adjusted Return / Maximum Drawdown (RAR/MDD). I like systems that are surgical in their efficiency–systems that trade infrequently but generate large profits when triggered. RAR rewards systems for decreased exposure. I also think MDD should be factored into system evaluation. Drawdown (DD) becoming too large to bear threatens to stop me from trading a system. DD will keep me awake at night because DD gets me thinking about Ruin.

My initial foray into System Development involved backtesting one ticker. Through that exercise, I began to develop a sense for how RAR/MDD varies. The problem arose when I expanded the backtest to include other tickers and encountered a drastic reduction in RAR/MDD. In retrospect, this makes sense because trading multiple tickers increases exposure proportionally. RAR is therefore decreased along with the subjective function. Comparing this to values seen previously was like comparing apples to oranges and I could not relate.

One alternative to circumvent this problem is to backtest one ticker at a time. I would then see RAR/MDD in an apples-to-apples fashion across tickers. Another alternative is to choose a different subjective function altogether.

I will explore these possibilities in my next post.

Categories: System Development | Comments (2) | PermalinkTruth in Backtesting (Part 10)

Posted by Mark on December 28, 2012 at 05:36 | Last modified: December 11, 2012 05:21In http://www.optionfanatic.com/2012/12/27/truth-in-backtesting-part-9/, I discovered that trading the CDC on S&P 500 stocks may require holding up to 235-250 stock positions at any one time. With this discovery, I am finally starting to gather some truth in backtesting.

To be prepared for a more extreme future, I want to budget for 300. At some point the markets will present a more extreme case than anything seen in the 33 years of backtesting–it’s just a matter of when. Truth in backtesting: if I cannot manage 300 open positions then this system is untradable for me.

The next question regards what initial account equity I need to preserve system performance. In #21478, I cut initial equity to $3M and only got 41,477 trades rather than 41,710. That’s too large of a cut. In #21479, I went up to $30M and got the 41,710 trades back. I was able to preserve performance with initial equity as low as $10M. Truth in backtesting: if my account isn’t at least $10M in size then I should not expect to see the kind of performance recorded in this backtest.

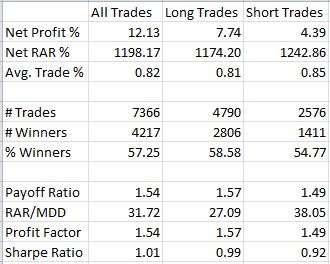

Perhaps I can further cut initial account equity by taking only long trades. Out of 41,710 trades, 26,711 trades are long. Cutting max open positions doesn’t help. Cutting initial equity to $5M also reduces total trades so that doesn’t help.

Can I cut initial account equity by decreasing position size? In #21497 I reduce position size from $100K to $10K, which not only decreases total trades but also PF from 1.48 to 1.36. With initial equity of $5M and a $50K position size, the long-only PF is 1.46–still a bit lower than 1.48.

I’ll make some concluding remarks in my next post.

Categories: Backtesting, System Development | Comments (1) | PermalinkTruth in Backtesting (Part 9)

Posted by Mark on December 27, 2012 at 03:50 | Last modified: December 7, 2012 18:41I have been describing a layperson’s approach to trading the CDC system on S&P 500 stocks. http://www.optionfanatic.com/2012/12/26/truth-in-backtesting-part-8/ got me to the point where I was encouraged by the system. Now, I need to better understand system exposure.

The truth in backtesting (or lack thereof) exists in the consistency between live trading and tacit backtesting assumptions. Although the backtesting says trading this system could generate a PF of 1.48 for long trades, as written the system requires an account size of $50M and the ability to manage 500 open positions. These are no-can-do for me. Were I to try and execute this system right now then I could expect great difference in live trading performance from that seen in backtesting. Better or worse? Probably worse. This is how markets work and I would be foolish to take a gamble on it.

To pin down actual exposure, I first must determine how many open positions the system may require. Were I more skilled at programming then I could code AmiBroker to chart the number of open positions over time. Since I am not, my solution is to decrease the maximum number of allowable open positions in subsequent backtests and watch to see when the performance statistics begin to change. Here are the baseline performance statistics for backtest #21471, which includes the 200-MA filter but not the BB filter:

In backtests #21472 and #21473, I reduced the max number of open positions to 400 and 300 with no change in performance statistics. This tells me no more than 300 open positions were ever seen in the backtest. I was subsequently able to narrow this down between 235-250.

I will continue the analysis in my next post.

Categories: Backtesting, System Development | Comments (1) | PermalinkTruth in Backtesting (Part 6)

Posted by Mark on December 21, 2012 at 02:47 | Last modified: December 7, 2012 13:24So far in this series (e.g. http://www.optionfanatic.com/2012/12/04/truth-in-backtesting-part-5/), I have discussed the misleading nature of EOD backtesting when trade delays are not used. Today I want to use the Consecutive Directional Close (CDC) system to start discussing another misleading aspect of backtesting: multiple positions.

Consider this the beginning of a new day. I wake up bright and early (well not so bright because I really do like to wake up extremely early), jump out of bed, and shake off all book knowledge pertaining to system development that I have accumulated over the past couple of years. My mind reverts to old patterns of knowledge. I just got AmiBroker and now I’m ready to play.

I start by coding the CDC system and setting the filter to S&P 500 stocks. I set initial equity to $50,000,000, maximum number of open positions to 500, number of CDCs to four, and length of trades to five. I set position size to $100,000 and I include a couple other filters in the buy and short conditions: Bollinger Band breakdown or breakout and price above or below the 200-SMA for long and short trades, respectively. I include a liquidity filter to make sure the position size divided by closing price is less than 1% of the average daily volume over the past 50 days. Backtesting dates are 1/1/1980 through 11/30/2012. Commissions are assessed at $8/trade. Buys and sells are executed at the next open.

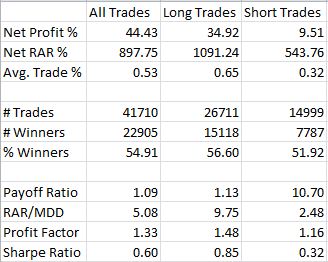

The results for backtest #21463 are as follows:

RAR = risk-adjusted return (i.e. performance if the system were in the market 100% of the time)

Payoff Ratio = average winning trade / average losing trade

RAR/MDD = the subjective function

I will use PF and SR as abbreviations for Profit Factor and Sharpe Ratio, respectively.

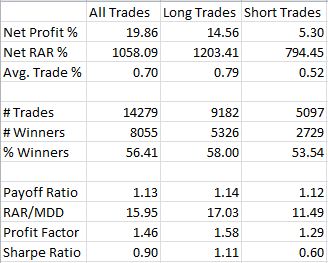

These results aren’t bad, but I want to see if I can make the system more efficient. I increase CDC to five. Here are the results of backtest #21464:

These results are better. While net profit is lower, the system has become more efficient (PF is higher along with payoff ratio, subjective function, and SR).

I will continue this analysis in my next post.

Categories: Backtesting, System Development | Comments (1) | PermalinkSystem Development for Individuals (Part 4)

Posted by Mark on December 20, 2012 at 05:08 | Last modified: November 16, 2012 06:50My previous posts on this topic have led me to understand System Development as an endeavor people must learn on their own based in part on individual trading experience.

Understanding System Development as an individualistic pursuit also means your potential takeaway from my blog is limited. Even if I develop worthy systems to trade, many potential factors may prevent you from trading them–not the least of which is the fact that you might be foolish to trade what I claim to be profitable without replicating the work yourself as a matter of due diligence.

What you can do is study my process and use that as a starting point after which to pattern your own work. This is what books have done for me. Only I can bring myself the rest of the way.

It was not my intent to make any grandiose claims with this mini-series but rather to summarize my experience to date. I originally learned about systematic trading and backtesting as a contrast to discretionary trading. I then learned about trading strategies vs. trading systems and system development. I purchased what I believed to be the most comprehensive and inexpensive software package and then started to read books. It was at this point that I found different books to have limited content overlap.

Once I set out on my own system development journey, I edged closer to the holes in understanding that I grapple with today. I believe research awaits to better understand how patterns I see in backtesting correlate with live trading performance, but this will be personal science only applicable to my trading concept and to my trading preferences.

Categories: System Development | Comments (0) | PermalinkSystem Development for Individuals (Part 3)

Posted by Mark on December 19, 2012 at 04:45 | Last modified: November 16, 2012 06:35In this mini-series, I have been challenging the notion that System Development exists as an objective discipline applicable to a widespread audience of traders. Understanding system development as a wholly individualistic pursuit makes me better understand why past attempts to organize a system development group have failed.

Of the limited number of people who trade, I was looking for people with a significant amount of time to devote to system development. This may exclude people with separate full-time jobs. I was then looking for people in/near my city.

By now, the field of potential collaborators was probably narrowed to a handful and many selection criteria still remained. How can I find these people? I tried www.meetup.com without success. Are they on Craigslist, Facebook, or LinkedIn? Each of these is a different avenue. It’s probable that some candidates were ill-suited to work with me because I demanded a degree of open-mindedness, willingness to suspend judgment, and substantial freedom from commercial influence (e.g. trader education companies, affiliate programs, etc.). I also demanded they use my preferred software package since I had already spent 18 months arduously working to learn it.

Additional selection criteria make this seem like another instance of the knowledge-specificity monster where at the end of the road, nothing remains (see http://www.optionfanatic.com/2012/12/17/system-development-for-individuals-part-1). Candidates would have needed to use the same or comparable brokerage platform (else one or more of us might have to change), shared desired markets and time frames to trade, perhaps shared attitudes toward fundamentals or other potential means to generate trading candidates, etc. The greater the number of selection criteria, the more restrictive the overall requirements and the fewer people available to meet them all.

Categories: System Development | Comments (1) | PermalinkSystem Development for Individuals (Part 2)

Posted by Mark on December 18, 2012 at 06:44 | Last modified: November 16, 2012 06:07In http://www.optionfanatic.com/2012/12/17/system-development-for-individuals-part-1 , I started to develop the thesis that System Development as an objective discipline may not exist because what it is to each person is too specific for global application.

With book content of limited use because of macro factors like software package, the amount of usable information shrinks further due to personal factors. If my brokerage differs from the author’s then I may not be able to execute the same kinds of orders or use the same kinds of alerts. I may prefer to monitor different time frames or enter different orders–maybe use use limit orders with a larger offset or no offset at all just waiting for the fill. What if I don’t get filled? These are unables that may differentially affect system results. Do the author and I treat these the same? What about slippage?

Perhaps most damning for the prospect of System Development is the observation that most everything discussed in the last paragraph is hardly addressed in most writings. Partial education from books must now be supplemented with personal experience, which means System Development will be different for everybody.

Also damning for the prospect of System Development as an objective discipline is the likelihood that a complete education may require some gambling. The personal experience just mentioned–how can I even attain that before having a complete understanding of system development? “Cart before the horse” comes to mind. I cannot attain it through backtesting or paper trading, which have limited resemblance to live trading. I am therefore left to learn from my live trading performance itself. Without having a developed system, I may or may not have an edge.

Who wants to gamble when they can participate in other forms of discretionary trading that can allegedly be taught?

Categories: System Development | Comments (0) | PermalinkSystem Development for Individuals (Part 1)

Posted by Mark on December 17, 2012 at 03:08 | Last modified: November 16, 2012 05:46I would love to see a “Dummies” book on system development, but I’m not sure such a book is plausible. What system development is and how to approach it may vary so much from one person to the next that System Development for Dummies may never come to fruition.

I addressed subjectivity and system development in six blog posts beginning with http://www.optionfanatic.com/2012/10/04/the-subjective-function-part-1. Howard Bandy’s books define and discuss the objective function. I renamed this “subjective function” upon realizing the irony that where system development and backtesting sound like scientifically-oriented endeavors, if the measure of success varies from one person to the next then perhaps there’s nothing objective about them at all.

Some of the subjectivity is related to specificity of knowledge. If I want to know something very specific then I can Google until I’m blue in the face without finding what I need. Family Law is one example. As a citizen trying to learn and prepare for a case, I almost need to get reviews on a particular lawyer (since different lawyers will define and strategize differently) in a particular county of a particular state. This is going to be very difficult information to find because every case is different. The only place I may be able to get related information is on a particular attorney’s web site, which is not objective enough for my taste.

Education about system development starts with what I can read in books. Authors of different books use different software packages, though. Use of one software package limits what I can take away from an author who uses another because anything about the programming language, backtesting capabilities, and even system development definitions may be different from what I know using different software.

I will continue to explicate the knowledge filter in my next post.

Categories: System Development | Comments (1) | PermalinkFlushing Out the Arbitrary

Posted by Mark on December 12, 2012 at 07:00 | Last modified: November 26, 2012 07:16In the journey to succeed with System Development or anything trading-related, critical elements in the category “what I don’t know I don’t know” must become illuminated, become analyzed, and become known. Today I will attempt to illustrate this by describing my initial concept and the present concept System Development has become.

The reason I bought AmiBroker was to backtest systems I read about in books and on-line to verify whether the purported results were accurate. I have talked about some initial claims (see http://www.optionfanatic.com/2012/12/05/trading-system-2-consecutive-directional-close-part-11/). I have coded them into the software and run the backtesting to verify those claims. I originally believed this was the entirety of due diligence required in order to obtain tradable systems.

Not even close.

Perhaps the biggest missing detail is optimization, which I also discussed in http://www.optionfanatic.com/2012/10/18/laziness-dissected. If a trading system holds for W days (or uses X as a critical value, or Y and Z as indicator periods, etc.), how do I know whether its success was just lucky? While the reading is inspirational and alluring (think “trader porn”), if the profits are unlikely to persist then it is simply another useless Best Seller in the minefield that is Wall Street.

Optimization forces me to flush out the arbitrary by identifying variable parameters. The total number of potential trading systems is the product of potential values for each parameter. I must plot the subjective function vs. values of the parameters, identify plateau vs. spike regions, and identify the viable trading system candidates.

Next up is Monte Carlo simulation to better understand potential DDs (see http://www.optionfanatic.com/2012/12/11/trading-system-3-naked-puts-part-4/ ), position sizing, and Walk-Forward Analysis.

For this trader working to learn System Development, flushing out the arbitrary has been the biggest component to date of “what I don’t know I don’t know.” With this block now destroyed, hopefully personal and professional growth can occur at an accelerated pace.

Categories: System Development | Comments (2) | Permalink