Ghost Education (Part 4)

Posted by Mark on February 17, 2015 at 06:28 | Last modified: May 11, 2015 11:39The last sentence of Lane’s article told us the key to profit is to buy options traded in high volume with no discernible cause. Because this seems a bit weak, I want to scrub the cited Options Alpha article to make sure I have not missed anything.

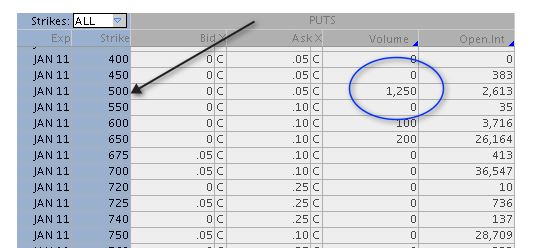

The Options Alpha article gives an example of high SPX option trading volume:

The article writes:

> CLEARLY, this is a classic example of hedging buy [sic]

> a large institutional trader and/or hedge fund.

This is an unverifiable claim and there is nothing “clear” about it. Yes, this could be a deliberate attempt to hedge, which is #2 of three main reasons the article gives for high option trading volume. This could also be #3: an example of “an idiot getting loose in the market” and speculating on a big drop by purchasing cheap OTM options. This could also be #1: upcoming news. We see predictions almost every day in the financial media warning of a catastrophic market crash just over the horizon. Maybe someone read one of these news articles and thought there was reason to buy this option.

To muddle the waters further, I will suggest this could have been a trading error! Any seasoned trader will talk about “Laurel and Hardy” trading mistakes. Maybe the trader(s) intended to buy 1000 strike puts and selected the 500 strike instead. Maybe the trader intended to buy 125 contracts instead of 1250. Purchase of 1250 contracts at a nickel each would only have cost $6,250 plus commissions. That could be but a pittance for an institutional trader, but it could be a retail trader as well (yet another detail that isn’t clear like the article suggests).

The article continues:

> Once you find out who is buying these options then only

> can you decide how YOU would like to make money off THEM.

No, we can never find out who is “buying” these options. Does this mean we can never do anything in terms of making money “off THEM?”

I will continue next time.

Categories: optionScam.com | Comments (1) | PermalinkGhost Education (Part 3)

Posted by Mark on February 13, 2015 at 06:36 | Last modified: May 11, 2015 11:31I am in search of instruction on how to trade for profit, which this article’s title promised to be forthcoming. In 4+ paragraphs thus far, Terry Lane has failed to deliver on that promise. Today I will continue with the final paragraph:

> Options trade at higher volumes when the strike price is close

> to the current market price, as they are more likely to expire

> “in the money.”

This does not tell me how to trade for profit.

> An option trading at 200 percent or more than similar strike

> prices signals unusually high volume, according to Option

> Alpha.

Here is another article citation. Still in search of that secret to profit…

> Trading volume can be high because of news events, such as

> earnings or product launches, or from hedging by institutional

> investors.

Potential reasons for high volume do not tell me how to profit…

> When these events can’t discount the volume, it may signal

> that investors have reasons to be optimistic about the

> options and could be a buying opportunity.

That’s the end! No more. This must be therefore be the secret to profit: buy options traded in high volume without any apparent reason.

I should scrub the Options Alpha article to make sure I haven’t missed anything. As good writing practice, Lane should have highlighted relevant points from that article in his. I will double check.

The Option Alpha article is entitled “Learn How To Profit From Unusual And Abnormally High Options Trading Volume.” The article says three main reasons exist for high options volume: upcoming news, hedging, and uninformed retail investors.

I think these are possible reasons but how can we ever know? In order to know why options volume is high I would have to interview everyone who traded that option on the day in question. This can never be done since buyers and sellers are anonymous. The door is wide open to speculation and the financial media takes full advantage of this each and every day.

I will continue in the next post.

Categories: optionScam.com | Comments (1) | PermalinkGhost Education (Part 2)

Posted by Mark on February 10, 2015 at 06:25 | Last modified: May 11, 2015 09:05I previously introduced an exemplar of what I am calling “ghost education.” Its title is what drew me to the article via a Google search and I discussed how the title seems to fit the marketing mold quite well. Let’s look now to determine whether the rest of the article is good as advertised.

How are we going to profit, Terry Lane?

The first paragraph defines “volume,” “options,” and “calls.” He makes no mention about profit.

The second paragraph explains why people trade call and put options. Lane also writes:

> Options can be risky investments that are often traded by

> advanced and sophisticated investors.

I would say options are not risky when traded by advanced and sophisticated investors who thoroughly understand them. When traded by newbies who have been blinded by outrageous promises of excess return, yes they are very risky. I see nothing in this paragraph about profit, though.

The third paragraph describes an options chain. Again, he writes nothing here about profit.

The fourth paragraph talks about volume and slippage. Once again, Lane writes nothing about profit. The article is only five paragraphs long, which means my sole purpose for reading must be immediately forthcoming!

With baited breath, I embark onto the fifth paragraph:

> Unusually high trading volumes can indicate a buying

> opportunity, according to The Options Playbook.

A “buying opportunity” suggests an opportunity for profit. Since the title said “How to Trade… for Profit” this would seem to be false advertising since profit and the opportunity for profit are different. Nevertheless, we can click on the link to see what Terry is citing.

The Options Playbook was written by Brian Overby. Overby is a Senior Options Analyst at TradeKing. I have watched a number of his presentations and I respect him a lot for his ability and approach to teaching.

In Overby’s cited article, however, no mention is made about profit. This is an article about open interest and liquidity. Why did Lane cite it?

Perhaps we need to read on to find out…

Categories: optionScam.com | Comments (1) | PermalinkGhost Education (Part 1)

Posted by Mark on February 5, 2015 at 07:05 | Last modified: May 8, 2015 10:42Today I am going to detail a particular sort of content available across the internet. For lack of a better term, I am going to call this “ghost education.” I believe to succeed as traders, we should understand what ghost education is and how it fits into the financial landscape.

In order to develop this concept of ghost education, I am going to pick on one particular article. Please understand, however, that what I discuss here applies to a plethora of articles I have found over the years.

This is the article I will dissect today. I encourage you to go to the link and take a quick read.

I am no marketing guru but in order to design a successful advertising campaign, here might be some observations to keep in mind:

1) People are interested in ways to make money.

2) People tend to be especially interested in quick ways to make a buck.

3) The less people have to pay for 1) and 2) the better.

The title of this article is an embodiment of this psychology:

> How to Trade High Volume Call Options for Profit

1) is described by the last word: “profit.”

2) is communicated by the word “options.” People tend to think options are speculative and risky. Many people consider them to be gambling. They are known as a way to make fast money especially if stock direction can be correctly predicted.

3) is suggested by the first words. “How to” material is usually educational. When found on the internet, these articles are often free. How-to seminars also exist but quite often cost thousands of dollars. I think people are very willing to take a couple minutes reading an article that might provide some useful information especially given the alternative of taking a chance by spending thousands of dollars on something that might teach them very little.

I will continue in the next post.

Categories: optionScam.com | Comments (0) | PermalinkWhy Earnings Just Don’t Make Sense (Part 5)

Posted by Mark on January 22, 2015 at 05:08 | Last modified: May 6, 2015 09:49Reports on Google’s 2013 Q4 earnings announcement left me utterly confused. This is the main reason I wonder whether earnings are another case of optionScam.com.

A whole sub-industry has been made out of providing earnings data, using fundamental analysis to calculate price projections, and determining what stocks to buy and sell based on those fundamentals (earnings). Ultimately, if fundamental parameters are not objectively quantifiable (i.e. no consensus!) then who is providing the right data? Surely we should be using the right data to make accurate stock picks, right?

Aside from the whole issue of data accuracy, I am not even certain any statistically significant correlation between earnings results and subsequent stock price movement exists. Certainly the people at Tasty Trade don’t. I have not replicated their backtesting results but what they have presented suggests stock price to be somewhat correlated with direction of the overall market. They actually claim the distribution of directional moves to be pretty much random +/- a bit of positive drift. That would be about 53% up and 47% down, which is consistent with overall market movement.

It would be very difficult to perform a comprehensive analysis of post-earnings stock price changes stratified by good/bad earnings results. The biggest challenge would probably be determining consensus as to whether the results are good or bad. What estimates should be used? How do we define consensus? Should we look at earnings? Revenue? Something else? Do we factor in a margin of error?

As mentioned above, looking at the post-earnings price changes independent of any estimates makes a decent argument for “randomness” despite a limited number of tickers studied.

Let’s review:

1) Many companies specialize in selling information about earnings estimates and earnings analysis.

2) Data are now available to suggest nothing about earnings may actually be predictive of subsequent stock price changes.

3) The sub-industry described in 1) makes lots of money at the expense of investors who don’t know or understand 2).

That’s a pretty good formula for optionScam.com, folks!

Categories: optionScam.com | Comments (0) | PermalinkWhy Earnings Just Don’t Make Sense (Part 4)

Posted by Mark on January 20, 2015 at 06:13 | Last modified: May 6, 2015 09:21I find pretty much everything about these reports on Google’s 2013 Q4 earnings announcement to be confusing.

My review suggests different media outlets can interpret corporate earnings differently.

Poor writing can make it seem like one media outlet doesn’t even agree with itself!

Also confusing is the post-earnings stock movement. Intuitively, I would expect a stock to go up (down) following a good (bad) earnings report. Sometimes it may be hard to say what is good or what is bad, though.

I do believe that eventually (i.e. within a few days), the media usually does a pretty good job of retroactively explaining stock price reaction. They do this by pointing out something in the announcement that is either good or bad. This can be done because rarely, if ever, is every fundamental measure revealed from an earnings announcement good or bad. The media can always cite something to support its report whether it be positive or negative in tone.

I don’t believe any of this retrospective analysis to be actionable, however, in terms of developing potentially profitable trading strategies. I am also not convinced that any fundamental measure is significantly correlated with subsequent stock price changes. Show me the data if you believe otherwise.

Can you see why this is categorized under optionScam.com? I will take one more blog post to explicitly state that argument.

Categories: optionScam.com | Comments (2) | PermalinkWhy Earnings Just Don’t Make Sense (Part 3)

Posted by Mark on January 16, 2015 at 07:13 | Last modified: May 6, 2015 08:51Last time, I began to discuss three reports on Google’s 2013 Q4 earnings announcement and ended up somewhat confused. Today I will focus closer on the numbers to see if we can gain some clarity.

Report #1 said Google made $9.93 in Q4, which missed the consensus estimate by $0.41. This implies the consensus estimate to be $10.34. Report #3 said they made $12.01, which missed the consensus estimate of $12.26. The two reports are inconsistent with regard to the consensus estimate. I’m not sure how that can be since I understand “consensus” to be the average of all published analyst estimates. What’s worse, though, is that the two reports don’t agree on Google’s actual earnings! Maybe one reporter was sick or had excessive wax build-up preventing him/her from hearing on that day?

Once again, I am confused.

I suspect Report #3 is poorly written. The last sentence says “last quarter, Google… earned $10.47.” As mentioned above, Report #3 said they made $12.01: in the same paragraph! Did they just state two different earnings numbers just three sentences apart?! That can’t be. I must be misunderstanding. I can only surmise that “last quarter” means 2013 Q3 while the current report covers 2013 Q4. In other words, “last quarter” is Q3 and “this quarter” would be Q4.

Focusing on the revenue numbers provides a bit more clarity. Reports #1 and #3 say Google posted revenue of $16.86 billion. Report #2 says revenue was $16.9 billion, which is equal to the others taken to one decimal place. Finally we get some consistency! Report #2 does say that revenue was for “last quarter,” though. Evidently for Report #2, “last quarter” is 2013 Q4 and maybe 2013 Q3 would have been “the quarter before last.” This is different syntax than applied in Report #3 where “last quarter” referred to 2013 Q3 as discussed above.

Deep breaths…

I will continue in the next post.

Categories: optionScam.com | Comments (2) | PermalinkWhy Earnings Just Don’t Make Sense (Part 2)

Posted by Mark on January 13, 2015 at 06:21 | Last modified: May 6, 2015 08:34Last time, I presented three reports on Google’s 2013 Q4 earnings announcement. Today I will discuss them.

First question: was this a good or bad earnings report?

Headline for Report #1: “Google misses, shares up.” That sounds like a bad report but a good outcome. On the other hand, if shares are up then maybe it’s a good report. “Misses” has a negative connotation though.

Right out of the gate, I’m confused.

Report #2 says “Google earnings top expectations.” This seems contradictory to Report #1, which said Google “missed.” Topping expectations is more consistent with the stock moving higher but then is Report #1 wrong about the miss? Maybe the judgment call refers to different measures (e.g. revenue, earnings, margins). Is the writing sloppy because the antecedent was not specified? Report #2 later clarifies by saying “Google’s earnings figures were pretty hot,” which tells us that earnings, at least, were good.

Report #3 says “strong revenue growth,” which suggests that revenue was good. Earnings and revenue were good, then, so what “missed” according to Report #1? Actually, Report #3 says revenue growth was strong but it says nothing about estimates. Maybe Google still missed its revenue estimates despite revenue being strong?

Report #3 goes on to say: “the search giant missed earnings expectations by a wide margin but wasn’t punished by traders.” Report #2 said earnings topped expectations. Which is it: did they top or did they miss by a wide margin? There’s no fuzziness with this comparison: they are in stark contrast with one another!

I will take a closer look at the numbers in the next post.

Categories: optionScam.com | Comments (3) | PermalinkWhy Earnings Just Don’t Make Sense (Part 1)

Posted by Mark on January 8, 2015 at 06:54 | Last modified: May 5, 2015 14:19Earnings just don’t make sense to me with regard to stock price movement.

While I have seen many anecdotal instances to support this hypothesis, I will use one example to keep this blog series short: Google 2013 Q4 results, which were reported on January 31, 2014. I will present three reports on the earnings announcement.

In no particular order, here is Report #1 from Zacks:

> Google Misses, Shares Up Regardless

>

> Google Inc (GOOG) reported fourth-quarter earnings of $9.93,

> missing the Zacks Consensus Estimate by 41 cents, or 4.1%…

> shares jumped 4.1% after-hours, after rallying 2.6% during

> the day. Google’s gross revenue came in at $16.86 billion…

Here is Report #2 from The Motley Fool:

> Google and Amazon Earnings

>

> Google earnings top expectations. Google this: Shares of

> the search engine that you probably used two minutes ago

> jumped more than 4% in after-hours trading Thursday, after

> Google (NASDAQ: GOOG ) reported a projection-beating

> $16.9 billion in revenues last quarter.

>

> The takeaway is that Google’s earnings figures were

> pretty hot…

Here is Report #3 from The Verge:

> Google Q4 2013: strong revenue growth driven by Play

> Store and hardware sales

>

> The search giant missed earnings expectations by a

> wide margin but wasn’t punished by traders.

>

> It seems like Google can do no wrong with the markets

> these days. The consensus estimate on Wall Street was

> that Google would deliver $16.75 billion in revenue

> and earnings of $12.26 a share. It hit the top of that

> line, with $16.86 billion in revenue, but missed on

> the bottom with earnings of $12.01 a share. Still,

> the stock was up slightly in after-hours trading.

> Google made $14.4 billion in revenue and earned

> $8.62 a share for this same period a year ago. Last

> quarter Google brought in $14.8 billion and earned

> $10.47 a share.

I will compare and contrast Report #1, Report #2, and Report #3 in the next post.

Categories: optionScam.com | Comments (3) | PermalinkAnother Way to be Fooled by Randomness (Part 2)

Posted by Mark on January 5, 2015 at 07:06 | Last modified: May 5, 2015 09:32Disclaimer: except for the title, this post has nothing to do with the last one.

About one year ago, I saw this in a trading forum:

> Hey guys,

>

> We’re giving away 5 free subscriptions to Born To Sell’s

> covered call screener on Feb 22. One of them will be

> based on skill and the other 4 are random drawings.

>

> To win the skill-based contest, you have to guess the

> closing value of the DJIA on Feb’s option expiration

> day (Feb 21). The other 4 prizes will be chosen at

> random from among the submissions.

>

> Enter on or before Feb 1 here…

This post captured my eye because of its flawed differentiation between “random drawings” and “based on skill.” How could we possibly tell if guessing the DJIA on a particular date was a matter of skill or a matter of random luck? Based on one instance we absolutely could never do so.

Statistically speaking, in order to demonstrate “skill” that is significantly better than chance (randomness) we would need a sufficiently large sample size of correct predictions. The winner may certainly make claims about his/her prowess based on one prediction but these claims would be premature. To truly be a skill, the requisite sample of correct predictions must not be retrospective and must not make use of hindsight. Predictions made in advance must be verifiable, too. To be sure, con artists have historically used any and all of these means to dupe unsuspecting customers.

I make no claims about the reliability or accuracy of the “Born to Sell” service because I know nothing about it. I do not, in any way, shape, or form, endorse the product. I only mean to provide a brief commentary on “skill” vs. “luck/randomness:” two concepts that are often confused, sometimes deliberately, for the sake of advertising and marketing.

Be on guard for optionScam.com!

Categories: optionScam.com | Comments (0) | Permalink