The Stealthy Sisters of Spin and Speculation (Part 5)

Posted by Mark on September 10, 2015 at 07:47 | Last modified: October 15, 2015 12:23I highly recommend the book Practical Speculation by Laurel Kenner and Victor Niederhoffer (2003).

Part 1 [no need to waste your time reading Part 2] talks about a variety of ways people in trading/investing circles spin things. Kenner and Niederhoffer discuss unfounded claims, bogus statistics, and an overall lack of science that exists in the financial industry. I believe this is mandatory information for anybody aiming to make a serious go at trading/investing. Understanding the dangers/limits of speculation can help keep traders safe.

Speaking of making a “serious go,” remember my “forest for the trees” analogy that suggests many people think they are doing the right thing when in fact they are merely speculating. I regard speculation as gambling and one reason so many traders [allegedly] fail. To satisfy the ego, people may wager on things and boast loudly when they win. Like the slot machines at a casino, the loud boasting is an advertisement to others that they, too, can be right at sometime in the future and win big. The boasting therefore serves to sustain the speculative enterprise.

The losers will probably exit the spotlight quietly with tail between their legs. All the better if nobody notices them slinking out the side door to save embarrassment and ego insult.

Speculation is not the way to make consistent income in the markets. Speculation is the only thing many people know, however. These folks have not learned any “responsible trading/investing” strategies. They haven’t studied the markets enough to understand what risk is really about. Some think they know to varying degrees but they land far short. For them, the intermittent trade or investment and the occasional winner produce a feeling of mastery. That will likely come tumbling down with tragic consequences later if they have been “fooled by randomness” for far too long.

Categories: optionScam.com, Trader Ego | Comments (0) | PermalinkThe Stealthy Sisters of Spin and Speculation (Part 4)

Posted by Mark on September 8, 2015 at 06:17 | Last modified: October 15, 2015 11:42I left off with a mess, basically. If necessary, please go back and read the previous installments to refresh your memory.

With regard to group discussion about trading/investing, it might be beneficial to identify everyone’s background in advance. It’s easy for anybody to say things that sound good whether they be full-time traders or part-time speculators. What might be said by the latter can be toxic to the former, though. Speculative content is also not generally actionable for people looking to get involved with responsible trading/investing. Laypeople should have the opportunity to align themselves with where they want to be.

The challenge then becomes educating people on what makes for speculative vs. responsible trading/investing content.

I trade full-time for a living and I lean strongly to the “responsible trading/investing” side. If I screw up then I’m out of business and I go back to a conventional, corporate job. While I did say speculation may be okay in small doses, my personal bias is to do it outside the markets altogether [as an aside, because many laypeople think all trading/investing is gambling I often get a laugh when asked if I ever play casino games because I respond “I don’t gamble”].

Besides myself, financial advisers and wealth management professionals also shy away from speculation. Many of their clients are closer to retirement and speculation flies in the face of capital preservation.

Financial advisers avoid speculation but make constant use of spin. This has been addressed in previous blog posts.

The end result of spin and speculation can be similar and that’s my reason for describing them as sisters. They are stealthy because people don’t recognize them and see the complete landscape (i.e. the “forest for the trees” analogy). Laypeople think the spin and speculation are responsible trading/investing, which they are not. Both spin and speculation lead people to trade/invest in managers/strategies they believe will generate profits. More often than not, though, I believe this works out to their detriment.

An insightful book has been written on speculation. I will discuss that in the next post.

Categories: optionScam.com | Comments (0) | PermalinkThe Stealthy Sisters of Spin and Speculation (Part 3)

Posted by Mark on September 2, 2015 at 05:39 | Last modified: October 15, 2015 11:21Something feels wrong to me about the part-time futures day trader Mr. Know It All. Hobbies are part-time activities and I believe this level of commitment usually fares poorly in the markets. Why bother, then? I suspect many people who dabble in trading do not realize this is what they are actually doing.

Consistent losses belong in the gambling/speculation category. Whether it be the lottery, slot machines, Blackjack, etc., repeated small losses are the norm rather than the exception. Sure I have the chance of winning huge but the odds are against me and the law of large numbers says if I play enough then I will go to zero.

I feel my last blog post went off on a tangent and completely rehashed an earlier one. Perhaps there is something slightly new here in terms of flushing out speculation, though.

I think the problem with general discussion/debate about the markets is a failure to understand where participants are coming from. A speculator has completely different motives than someone looking to make consistent money. Speculation cannot be used to make consistent money in the markets. I think everyone would consider that idea to be foolhardy: it’s nothing more than gambling. We therefore have to pay close attention to what is actionable (responsible trading/investing) vs. what is spin (speculation) and that is where critical thinking can truly be useful.

This is a huge thesis for me and one I should probably develop further.

One complicating factor is that speculation can arguably be okay in small doses. Perhaps Mr. Know It All has 70% of his total net worth with an investment adviser and a couple checking accounts for daily expenses. He may then have some money leftover that he can use for speculative purposes (e.g. day trading futures, a lottery ticket every now and then, the occasional visit to MGM Grand, etc.). Many people still believe the ancient Greek ideal “everything in moderation.” Similar to rewarding a healthy, disciplined diet with a small serving of junk food, a small amount of speculation is probably okay if the overall portfolio is healthy.

Categories: optionScam.com | Comments (1) | PermalinkThe Stealthy Sisters of Spin and Speculation (Part 1)

Posted by Mark on August 28, 2015 at 05:34 | Last modified: October 14, 2015 10:46I believe in large part, people mistake the forest for the trees when it comes to trading and investing. To explain this, I will step back and review some of the things I have seen over these last couple weeks.

I saw a lot of spin on August 11 with Mr. Black Box: the guy selling an algorithmic trading system. Spin is advertising or marketing. In my view, spin dominates the financial industry. Spin is misdirection, illusion, and non-information. Spin is everything that sounds good but doesn’t actually work.

Spin is not what trading/investing is about and I think many people fail to realize this. Spin often wins when a financial adviser gains a new customer. Spin wins when an investing newsletter [service] gets a new subscriber. Spin wins when someone decides to pay money for a trading system. Most of this is [inadequately] tested and/or does not have a high probability of working in the future. What jumps to mind is optionScam.com.

With regard to the cliché, I believe people look at “spin trees” and think they are seeing the whole forest. Unfortunately, many people get taken in by this, suffer catastrophic losses, and swear off investing altogether as a risky pursuit. They never realize that besides the spin, many other trees representing responsible trading/investing also live in the forest.

What’s worse is they feel so violated, embarrassed, and ashamed that they never want to tell anybody about their negative experience. Just like [physical, emotional, sexual, etc.] abuse, con-artistry perpetuates because it lives in the dark corners of the room. It’s like a vampire that would burn were sunlight ever shined upon it. In classic literature, light often represents “the good” and “knowledge.” People get taken advantage of because they lack knowledge.

Is Speculation one of Spin’s sinister sisters? I will address that in the next post.

Categories: optionScam.com, Trader Ego | Comments (5) | PermalinkCorrelation Confound (Part 5)

Posted by Mark on April 10, 2015 at 06:57 | Last modified: May 18, 2015 11:13Along with “diversification” and “pairs trading,”, “risk tolerance” can also be discussed in terms of advertising. How much product, in terms of AUM, has been sold by investment advisers (IA) purporting to use special care in recommending only what suits your unique situation, your goals, and your personal risk tolerance?

Like correlation confound #1 where historical values change in the future, risk tolerance can also change. How many investors prior to 2008 answered the questionnaire with 30% but started to experience rapid heartbeat, panic, and insomnia when their account was down only 10% during the last correction?

Psychological questionnaires are designed to ask enough questions to confirm responses and to avoid drawing conclusions based on fluke answers. I hope IA’s do the same. One multiple choice question isn’t good enough. Go into detail about a world with catastrophic headlines in the newspapers, blatant fear across Facebook, and dramatic shock and awe on the evening news. How would you feel in this scenario? What is your risk tolerance now?

Risk tolerance may not even be measurable and if this is the case, all mention about a “personal touch” employed to accurately assess it may reduce to deceptive marketing. An online search turned up this:

> I say this from several decades experience in advising

> thousands of clients. Psychological risk tolerance is not

> a worthwhile a priori input. People routinely falsely report

> it or can’t really self-assess. Further, it changes over

> time, due to various factors, including the client’s age

> and other non-portfolio wealth factors.

Maybe risk tolerance should be taken out of the equation altogether?

At the very least, I think we should all be aware that “risk tolerance” is another buzzword often used by IA’s as an opportunity to express deep-rooted care and concern for our financial well-being.

I just hope it’s not an unquantifiable illusion—a manifestation of optionScam.com.

Categories: optionScam.com | Comments (0) | PermalinkCorrelation Confound (Part 4)

Posted by Mark on April 7, 2015 at 06:14 | Last modified: May 17, 2015 08:50Today I continue by bringing optionScam.com into the discussion.

“Correlation,” “diversification,” and “pairs trading” are significant buzzwords for the financial industry. The former is a buzzword used as a tool to achieve the latter two. The latter two are buzzwords for minimizing loss, sleeping well at night, and profitability.

It’s all good!

I wonder how much product, in terms of AUM, has been sold based on the advertising of “portfolio diversification?”

I wonder how much product, in terms of investment newsletters, trading services, and educational seminars, has been sold based on the advertising of “pairs trading?”

I would guess most of the advertising for either has made use of correlation and charts/tables to argue its efficacy as a profit-generating tool.

The story is usually incomplete, however, and this is where advertising becomes optionScam.com.

Correlation confound #1: correlations based on historical price changes can and will change in the future. The industry advertises diversification as having the potential to improve returns for a particular level of risk you choose based on your goals, time horizon, and tolerance for volatility.* If I think I have achieved diversification by including noncorrelated assets in my portfolio then I may be surprised when the next market crash hits and all correlations converge to +1.0.

Correlation confound #2: I thought I had good pairs to trade since they met the criteria for correlation but nobody told me about cointegration. The concept of pairs trading is a very marketable idea because it makes sense that following divergence, two markets tending to move together will snap back toward each other like a stretched rubber band after release. The problem is that correlated markets can move together but still, over time, be moving apart. Pairs trading without cointegration will be a losing proposition.

Correlation confounds can be optionScam.com when I make less money than expected or even lose money while somebody else is making money off me.

*—to be addressed in the next post

Categories: optionScam.com | Comments (1) | PermalinkThe Myth of “Unusual Option Activity” (Part 2)

Posted by Mark on March 6, 2015 at 06:49 | Last modified: May 12, 2015 12:33Last time, I suggested our inability to identify all components of a position prevents us from making valid conclusions based on volume and open interest data.

Another source of uncertainty when we see unusual option activity is whether options were bought or sold. This was Christine’s question on the Option Alpha article. Purchases and sales both count as volume. Open interest is even more complicated because not only can purchases and sales both change open interest, either can increase or decrease open interest depending on whether a position was opened or closed. If the underlying is so thinly traded that I can see what pieces match up in terms of spread legs and/or underlying share/contract volume then I have a liquidity disaster waiting to happen. This may be a position I can enter with ease but should I be forced into a rapid exit, hefty slippage may await me at the door (think Black Flag’s Roach Motel).

Although it sounds eloquent, I do not even believe “as one piece of the trading puzzle, option activity is worthwhile to follow.” Whether I ever want to make a bullish or bearish conclusion from volume or open interest data, reasonable doubt to the contrary will always exist. For this reason, I should always be skeptical about strategies that use only big prints as trading signals. I should also beware confirmation bias in any advertising of this (or any) strategy when all coverage is given to profitable trades and none given to trades gone bad.

In other words, beware optionScam.com when unusual option activity is purported to be a source of profitable trade ideas.

My personal belief is more often than not, inexperienced retail traders will be the ones blindly following “unusual option activity.” Instead of following the smart money, this approach may lead them into a crowd stampede with the general public only to become a loss leader on the general ledger.

Categories: optionScam.com | Comments (0) | PermalinkGhost Education (Part 7)

Posted by Mark on February 26, 2015 at 07:46 | Last modified: May 11, 2015 13:19Terry Lane’s article certainly qualifies as ghost education. Should we have expected anything more?

“About the Author” reads:

> Terry Lane has been a journalist and writer since 1997.

Journalists and writers don’t necessarily know anything about trading.

> He has both covered, and worked for, members of

> Congress and has helped legislators and executives

> publish op-eds in the “Wall Street Journal,” “National

> Journal” and “Politico.”

Op-eds usually have nothing to do with trading: even (especially?) those in the WSJ.

> He earned a Bachelor of Science in journalism from the

> University of Florida.

I wonder if he had to take any finance classes as part of that concentration?

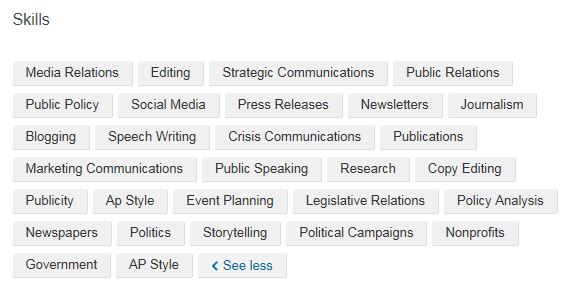

According to Lane’s LinkedIn page, his background includes nothing about trading or finance. He has listed as “Skills:”

Apparently, Lane has no investing background, no background at all in the financial industry, or even specifically the financial media. I wonder if he has ever traded a stock or option contract in his life? It might be bad enough for the average investment adviser with no trading experience to report on this. What the devil is someone completely outside the financial industry doing by trying to report on it?!

I mean nothing against Terry Lane. He seems like a solid writer. He could be a very nice guy, a wonderful family man, and he may be great at what he does: writing and communications.

Lane seems extremely unqualified to be writing any kind of article about trading, though, and that is exactly what his article reflects from a content standpoint. This is ghost education: a subset, in my opinion, of optionScam.com. Many people will read this article expecting to learn and learn they will not. Lane might get hits for Demand Media, which may be his job. To me and the rest of us traders, though, Lane’s content is absolutely meaningless and a waste of our time.

Categories: optionScam.com | Comments (0) | PermalinkGhost Education (Part 6)

Posted by Mark on February 23, 2015 at 07:24 | Last modified: May 11, 2015 13:00In the last installment I defined “ghost education:” an article that purports to provide instruction but actually provides nothing actionable at all. Both the Lane and Option Alpha articles are ghost education. Did you see the contradiction between the two?

The Option Alpha article concludes:

> We have found that the most consistent strategy

> is to SELL the options that are far out of the

> money and keep the premium as they expire

> worthless.

Lane’s article concludes:

> When these events can’t discount the volume, it

> may signal that investors have reasons to be

> optimistic about the options and could be a buying

> opportunity.

First, the Option Alpha article implies we must determine why the options are being traded in order to make money off the opportunity. Although that is impossible to do, Lane suggests we have an opportunity when we can’t determine a reason. These are contradictory.

Second, the Options Alpha article suggests selling high-volume options. Even though that fails because the options have zero bid, Lane suggests buying the options. Again, these are contradictory.

To recap, what we have here is ghost education by Terry Lane that is based on ghost education by Option Alpha. Terry Lane’s article is ghost education because he purports to tell us how to profit and he never does. He seems to be basing his approach on the Option Alpha article but he gets it backwards.

This is optionScam.com, folks.

I will make one further observation in the next post.

Categories: optionScam.com | Comments (1) | PermalinkGhost Education (Part 5)

Posted by Mark on February 19, 2015 at 05:08 | Last modified: May 13, 2015 11:23The Option Alpha article ends by saying once we determine why high volume options are being purchased, we can decide how to profit on them. This is ludicrous since we can never know the “why.” The absurdity doesn’t end there.

Maybe these options aren’t even being bought. Christine asked this question in the Comments section and Kirk (the author, I presume) responded:

> well you usually won't [sic] know who's [sic] doing what…

He admits the obvious! We can’t know. This makes me laugh. Volume and open interest just are. They don’t indicate what is bought and what is sold. He goes on:

> But you can usually assume that extremely high volume

> with out-of-the-money options is the work of buyers who

> are hedging.

Assume anything you want but ultimately, nobody can know since we can’t interview market participants. Period.

We’re pretty much left with nothing, here, since the article is telling us to decide how to profit based on why they are being traded, which we can never know.

This is the epitome of what I call “ghost education:” the title of this blog mini-series. Ghost education is an article, or other presentation, that purports to deliver something real but, in fact, delivers absolutely nothing.

The Option Alpha article concludes:

> We have found that the most consistent strategy

> is to SELL the options that are far out of the

> money and keep the premium as they expire

> worthless.

In the example of the Jan 11 500 put, how much could I make by selling the option? Look back at the option chain: the bid is zero. I would make nothing. There is nothing actionable here. Ghost education once again…

In my next post I will address another point.

Did you notice a contradiction between the two articles?

Categories: optionScam.com | Comments (3) | Permalink