Dissection of an Investment Presentation (Part 6)

Posted by Mark on June 22, 2018 at 06:54 | Last modified: January 3, 2018 07:44Today I will conclude analysis of the investment presentation referenced here.

The third-to-last slide discussed lists managed account formats and related information. Formats exist for “Market Series” and “Factor-Enhanced Series” accounts. This presentation has focused on the latter. Formats include “UMA Sleeve,” “SMA Beta,” “SMA Tax-Optimized,” and “SMA Custom.” Minimum investment ranges from $60,000 to $750,000.

The penultimate slide lists investment management fees. The factor-enhanced “quantitative portfolios” (QPs) range from 0.20-0.25%, which it states is 5-10 basis points above average. This is cheap compared to the standard 1% fee most financial advisors charge, which includes non-investing services. It’s not as cheap based on my incremental value calculations. I think a big difference exists between investment styles, though. This appears to be a passive, plain-vanilla investment offering that generates subpar performance yet still represents significant improvement. Mine is an active investment approach.

The summary slide says the factor-enhanced QPs “deliver the potential for excess return.” This may be the best line of the whole presentation. Many things have potential. This is no guarantee nor is it an exaggerated conclusion drawn from the content provided.

This line suggests everything in the presentation amounts to circumstantial evidence, which relies on inference to support a claim. Plenty of instances have been discussed where incomplete or flawed logic begs inference to overlook. In Part 1, I talked about potential data-mining bias. In Part 2, I talked about incomplete/empty phrases that work well for sales and marketing. In Part 3, I analyzed performance graphs potentially related to but not direct portrayals of the factor-enhanced QPs. In Part 4, I mentioned missing analyses of the very important drawdowns and flat times. In Part 5, I talked about a number of irrelevant labels sounding professional and persuasive.

Circumstantial evidence is one step below direct evidence. I mentioned a lack of supporting evidence several times throughout this dissection. A large emphasis of sales and marketing [advertising] is staging circumstantial evidence to persuade. I suspect many people fail to realize what is missing. People may also get distracted from the fact that the evidence is incomplete. The presenter (or presentation) can achieve this any number of ways such as with establishment of rapport, with emotional appeals or humor, with polished public-speaking skills, etc.

At the end of the day, this is another instance of performance omission by an investment manager. Eleven other such mentions were given in this blog series. At the very least, I think this investment offering is as good as any other. While professional and somewhat convincing, however, given the circumstantial nature I certainly would not bet on outperformance.

Categories: Financial Literacy, optionScam.com | Comments (0) | PermalinkDissection of an Investment Presentation (Part 5)

Posted by Mark on June 19, 2018 at 06:50 | Last modified: January 2, 2018 11:53The next slide continues with the process of portfolio selection.

Starting with a parent index such as the Russell 1000 or Russell 3000:

> PMC uses a proprietary methodology to rank the…

Companies often describe their methods as proprietary. I view “proprietary” as a fancy word that gives the adviser authorization to conceal details. Whether this is acceptable is a topic for later discussion.

> constituents according to momentum and value, well-known

> factors grounded financial [sic] economic theory.

As discussed in Part 1, “well-known,” “grounded,” and “economic theory” are meaningless terms without supporting evidence and/or further explanation.

> Constituents are reweighted according to the factors,

How is this done?

> resulting in the Envestnet Factor-Enhanced Index.

Note the professionally-sounding, marketable product name.

> PMC’s Quantitative Research Group (QRG) and…

“Quantitative Research Group” sounds very official in addition to getting its own abbreviation. I discussed “quantitative” in Part 1. My guideline is to only assign abbreviations when I am going to be using them later.* I see no other references to QRG in this presentation, which makes me think sales and marketing as it seems sophisticated, meaningful, and compelling.

“Research” is misleading because neither supporting evidence nor methodological description is given. In scientific research, investigators provide sufficient details to enable replication by others. Study replication with similar results can represent strong validation.

“Group” enhances credibility because people working together imply better accuracy.

> experienced portfolio managers review the portfolio…

Degree of skill (not discussed) at managing portfolios is more important than experience (not quantified) in doing so.

> to ensure target factor exposures, tracking error

> allowances, and liquidity constraints are satisfied.

What is the target number? How much tracking error is allowed? What are the liquidity constraints? If they don’t provide enough detail to replicate the study then they can claim anything. Realizing this diminishes their credibility.

> The resulting Factor-Enhanced Portfolio model

> is a concentrated portfolio of 75+ positions providing

> exposures to desired factor exposures [sic?].

The performance graphs discussed here were not for the Factor-Enhanced Portfolio. Those graphs were for momentum and value factors and indexes, which themselves are nebulous terms. In truth, they have described an elaborate-sounding investing strategy without providing any concrete [validated performance] reason to invest.

Other questions about the portfolio also come to mind. How often is it rebalanced? Is this the same as “reweighting?” What is the turnover? These are examples of meaningful [performance-related] information that has been overlooked.

The next slide discusses tracking error:

“Tracking error is higher when the strategy outperforms and is very low when the strategy performs in-line with the parent index,” the presentation claims.

I fail to see any pertinence to potential investors, which suggests its inclusion is probably for the purposes of sales and marketing. If I thought this to be important then I would ask how the numbers were calculated. Past performance is also no guarantee of future results and as retrospective analysis that may be curve-fit, tracking error may be meaningless anyway.

The portion reviewed today is heavy on sales and marketing techniques while being light in terms of relevant information.

* Apparently the Chicago Manual of Style advises against abbreviations unless used at least five times in a

manuscript (my posts rarely exceed 500 words, which make for some very short manuscripts).

Dissection of an Investment Presentation (Part 4)

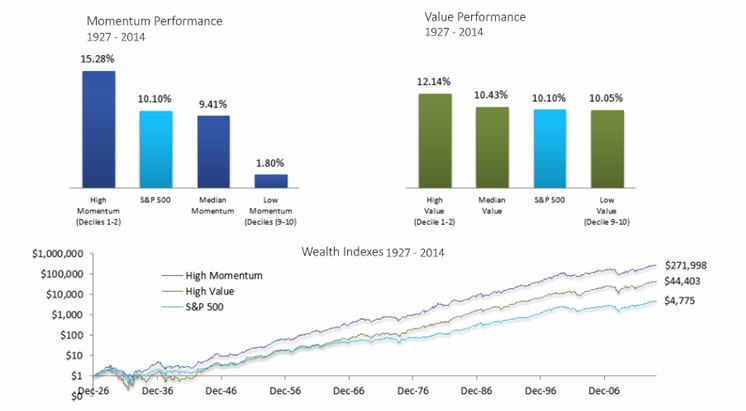

Posted by Mark on June 14, 2018 at 06:42 | Last modified: January 2, 2018 08:09Without doubt, the “Wealth Indexes 1927 – 2014” graph is impressive. The comparator (S&P 500) gets dwarfed by both high value and high momentum curves.

As with the Part 3 line graph before it, though, this graph raises lots of questions. Again, no drawdown (DD) analysis is shown. Graphing “growth of $1” on the y-axis makes it difficult to tell whether any DDs exceeded initial equity value. This is a no-no because merely changing the starting date could mean the difference between survival and Ruin. I think the proper way to backtest a strategy is to use constant position sizing and an initial equity value that exceeds maximum DD [perhaps with a margin of safety, too]. If they did this then supporting evidence should have been given.

Posting index returns raises questions about dividend yield inclusion and taking steps to avoid survivorship bias.

Index benchmarks imply buy and hold (B&H), which raises the tax issue. I asked Longs Peak* how GIPS handles taxes:

> Reporting performance net of tax is not very common so

> taxes themselves will not affect performance. If the strategy

> is different because the accounts are managed in a tax

> sensitive way then… [compare] accounts with similar tax

> situations… many firms create… taxable and non-taxable…

> composites because they implement their strategy in…

> different way[s]… You want to ensure you are making an

> apples-to-apples [comparison]… [via e-mail].

If I knew trades in the test and benchmark accounts involved different levels of capital gains then I might include an adjustment to err on the side of conservatism. For example, I could subtract the long-term capital gains rate from the highest tax rate and decrease equity curve growth by that amount.

Along with DD analysis, another phenomenon often excluded from comparison studies is flat time. Flat time is the [longest] time interval between equity highs (-water marks). Flat times are inversely proportional to new account highs.

While it’s hard to measure precisely given the wide axis scale, the high-momentum case shows at least a couple instances of 5-10-year flat times. It might be difficult for some people to stick with the strategy through these periods. I certainly would not recommend this to anyone looking to trade full-time as a business or for those seeking an optimal investing approach. I do believe people can benefit from a B&H strategy, however. I think this is characteristic of most garden-variety offerings that present significant improvement in the face of subpar returns.

Finally, the exponential y-axis suggests the graph reflects remaining 100% invested. This is either not realistic or carries a greater risk of Ruin (e.g. here or here). I believe optimal investing should allow for the possibility of locking in profits over time, which remaining fully invested does not.

* Sean Gilligan has been very helpful with GIPS compliance questions over the phone and through e-mail.

Dissection of an Investment Presentation (Part 3)

Posted by Mark on June 11, 2018 at 06:28 | Last modified: December 25, 2017 10:28Today I continue studying the investment presentation referenced here.

> …important characteristics of the momentum and value factors

> is their negative correlation… meaning value tends to work well

> when momentum is not… and momentum works well when value is

> idle. So each factor adds value on a standalone basis but

> their negative correlation makes them an excellent combination

> for potentially increasing risk-adjusted returns.

“Negative correlation,” which is arguably the “Holy Grail” of diversification, is a great marketing buzz phrase.

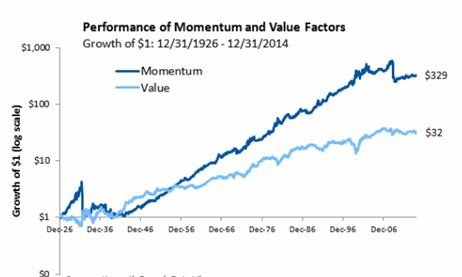

One problem is that correlation changes over time. During some of the most severe market declines, negative correlations have turned positive and approached +1.00. This means everything loses. The presentation says from 12/31/1926 – 12/31/2014, correlation of value and momentum was -0.40. This doesn’t tell us how things look at the extremes (when correlation becomes most positive) or what the overall distribution looks like (how often the negative correlation persists). An unstable parameter with large mean excursions coinciding with big losses is probably not a viable trading concept.

At worst, this could completely invalidate momentum and value factors as edge provided by their investing approach.

Here is their graph of factor performance:

Over 88 years, $1 grows to $329 and $32 for momentum and value factors, respectively. That sounds impressive!

This is a good time to review my general recommendations for viewing an investment presentation:

- Do not be blinded by the light: their job is to make things look good.

- Accept no comparison without assessing the comparator.

- Challenge everything.

- Do not accept any claims without supporting evidence (added after Part 3).

No available comparator violates #2. We cannot see how the investment performed when not tailored toward momentum or value. A terminal value of $350, for example, would be reason to reject both factors.

Drawdown (DD) analysis is important enough to render any presentation lacking it very limited in application. DDs determine whether we can remain invested in a strategy. I have written about the importance of DDs here, here, here, and here.

With regard to #3, I see the graph omits DD analysis by showing growth of $1. The account would never actually start with $1 and the maximum DD of both curves may even exceed the initial value. Any such equity curve would, in reality, be terminated early due to Ruin (account going to zero).

In other words, growth of $1 to $350 simply would never have happened. The initial account would need to be larger to trade this strategy over the entire 88 years. Adding initial equity dilutes returns. Instead of 35,000%, realistic growth could be 3,500%, 350%, or less. The bloom is off the rose.

The presentation continues with this slide:

For me, the line graph begs an immediate question: how does this line graph differ from the first one? Both graphs show value and momentum factors. Both show growth of $1. Both cover a similar time interval. Why does momentum in the latter graph only grow to $272 (rather than $329) while value grows to a whopping $44 (rather than $32)? Those are huge differences for a subtraction of one year (or less), which is only a 1.1% difference on 88.

I also wonder why the time intervals are different at all. The first graph is “12/31/1926 – 12/31/2014” and the second is “1927-2014.” Were they just sloppy in reporting the same time interval? If they used the same interval then what/why was the difference in how they defined factors? Did they do their own research or “borrow” data from others?

Consistency breeds credibility and [especially] when consistency is lacking, explanation should be given. None is given here, which violates #4. I question the accuracy of their calculations. I also question their underlying motives. Were they trying to artificially inflate certain numbers to serve their purpose? Remember #1, above.

Categories: Financial Literacy, optionScam.com | Comments (0) | PermalinkDissection of an Investment Presentation (Part 2)

Posted by Mark on June 8, 2018 at 07:13 | Last modified: December 23, 2017 11:50Today I will continue my exemplar of things to watch for when viewing a financial presentation.

Remember my general recommendations:

- Do not be blinded by the light: their job is to make things look good.

- Accept no comparison without assessing the comparator.

- Challenge everything.

The presentation continues:

> A significant amount of academic and industry research has focused…

Incomplete phrases like these are easy to challenge:

- Who determines significance?

- Who did the research?

- Who funded the research?

- What conflicts of interest were present?

- When was the research done?

- What was the research methodology?

All this information can help us to determine validity of the conclusions.

No responsible, advanced trader is going to accept empty claims just because they appear in a presentation. This can only serve marketing/advertising purposes in an attempt to persuade the gullible.*

This same lack of evidence is why I disregard other traders’ claims about their own personal investment success. I have written on this subject here and here. I write about my own performance every now and then to hold myself accountable. I do not expect you to take anything from those posts.

Remember, too, that finance and investing are all about the money. Somehow, I feel this puts us more at risk for fraud than other industries. As a public service announcement, go back and read some of my other posts on fraud to increase awareness and protect yourself (e.g. here, this whole mini-series, or any of my optionScam.com posts).

> …on the tendency for assets that have performed well over the past

> year to continue to perform well over the near term.

I need to know much more to evaluate these claims. Drawing conclusions from one and only one parameter value is shortsighted (e.g. here, here, and here). I would rather see discussion of a range and why they selected 12 months.

These comments regarding momentum also apply to the value factor.

This presentation is clearly intended to be more for marketing and advertising than it is research because the latter would not omit so much critical information. I try to avoid being sold by any presentation lacking critical information. I would highly recommend you do the same.

> Why have we selected momentum and value as the two factor

> exposures we attempt to maximize? Of the several hundred asset

> pricing factors researchers have identified over the past few of

> decades, there are only a few that stand the test of time and

> remain statistically significant through various market cycles.

> Of those few, momentum and value are among the most robust.

I discussed last time why the “several hundred” detail is irrelevant if not damning.

Hard data is needed to fulfill claims that momentum and value have “stood the test of time” and are “statistically significant.”

Again, do not accept hollow statements in a presentation without understanding the supporting (or lack thereof) evidence.

I will continue in the next post.

* This arguably includes many people. The financial industry likely gets away without reporting performance, in large part,

for this reason alone.

Dissection of an Investment Presentation (Part 1)

Posted by Mark on June 5, 2018 at 06:56 | Last modified: December 23, 2017 08:15Investment presentations often sound quite tantalizing. Critical thinking must be applied in order to assess what meat (if any) is actually there. The video referenced here is accessible over the internet. Today I will begin to discuss my thoughts as an exemplar of what to look for in such a presentation.

Here are a few general recommendations to keep in mind. First, do not be blinded by the light: their job is to make things look good. Second, accept no comparison without assessing the comparator. Finally, challenge everything. Anything that can withstand such scrutiny and still come out looking impressive is probably deserving of closer attention.

> Quantitative Portfolios combine the benefits of passive

> investing with the portfolio customization of managed

“Quantitative Portfolios” is a complex-sounding eight-syllable phrase. Capitalizing “portfolios” makes it seem like an advanced product. Quantitative just refers to numerical measurement rather than semantic description. Most portfolios are quantitative because some number is calculated somewhere. “Quantitative Portfolios” could therefore be much ado about nothing.

Passive investing usually misses the benchmark due to tracking error and expense fees. This falls under my category of subpar returns and right off the bat, I suspect this might be a garden-variety offering.*

> accounts… low cost access… with opportunities for

“Low cost” is also suggestive of a garden-variety offering because I don’t believe the intellectual capital (including dedicated quantitative analysts) needed to boost a garden-variety strategy to something more optimal comes cheap.

> personalization and tax management.

I think [portfolio] “customization” and “personalization” are best used as marketing buzzwords.*

Tax management can be useful but hard to measure.*

> Factors are the basic building blocks determining an asset’s

> risk and return… since [1990s], hundreds of… factors have

> been researched.

Researched by whom and to what extent? Some sort of reference would be useful.

The seeds for data-mining bias are planted here. By chance alone, an exhaustive (i.e. “hundreds”) study of historical data will usually turn up at least a couple highly-correlated relationships. Correlation does not imply causation, however. This is not the best way to identify relationships likely to be predictive of the future.

> Both the momentum and value factors have been heavily

> researched for at least 20 years by leading academics and

> industry practitioners and used extensively in practice by

> well-known quantitative investment managers.

I have read about the advantages of focusing on momentum and value over the years. Familiarity breeds credibility. This is important to recognize for the sake of objectivity.

The sentence sounds matter-of-fact and official, which can be very persuasive. Dig a bit deeper, though, and we can see that critical information is omitted:

- Who are these “leading academics?”

- Are they skilled investors (i.e. is there reason to think this might be actionable)?

- To assess quality of the research, what are meant by “extensively” and “well-known?”

- Have the investment strategies outperformed benchmarks and increased AUM for the firms involved?

- What do the drawdown distributions look like?

These unanswered questions can raise doubt about validity.

Finally, most investment categories (e.g. active, passive, hedge funds) represent significant improvement. I [optimistically] assume that at some level, all approaches are managed/developed with “heavily researched” factors and “leading academics” doing the work. This limits the positive impact of the whole statement to something less than optimal.*

I will continue next time.

* These are good topics for future blog posts.

Categories: Financial Literacy, optionScam.com | Comments (0) | PermalinkLack of Performance Reporting (Part 7)

Posted by Mark on April 19, 2018 at 07:07 | Last modified: November 30, 2017 14:00Today I want to talk about the lack of accurate performance reporting among IAs (or whatever you want to call them).

This information comes from a January 7, 2016, article in azcentral written by Eric Tyson (author of Investing for Dummies).

> Mutual-fund companies must have their performance records

> audited and reviewed by the… [SEC]. Most also provide an

> independent auditor’s report. Private money managers face no

> such SEC requirement. Few provide independent audits. Of

This is the “expensive accountant.”

> course, you really want to know the performance facts about

> the money manager who you’re considering for ongoing

> management of your funds. What [annual] rate of return has he

> earned… How has he done in up and down markets? How much risk

> has he taken, and how have his funds performed versus comparable

> benchmarks? These are important questions. Getting objective

> and meaningful answers from most investment advisers who

> manage money on an ongoing basis is difficult…

Emphasis mine.

> If all the money managers are telling the truth… 99% of them

> have beaten the market averages, avoided major market

> plunges over the years, and just happened to be in the best-

> performing funds last year. Money managers pump up their

> supposed past performance to seduce you into turning your

> money over to them through common marketing ploys:

>

> Select accounts: If you can get the money manager to give

Emphasis mine.

> you performance numbers and charts, too often an asterisk

> refers… [to] something like select or sample accounts. What this

> term means, and what the money manager should’ve said instead,

> is: “we picked the accounts where we did best, used the

> performance numbers from those, and ignored the rest…”

From the client point of view, this is all good reason to stick with GIPS compliant and verified firms.

> Advisory firms also may select the time periods when they look

> best. Finally, and most flagrantly, some firms simply make

> up the numbers (such as Bernie Madoff did).

> Free services: Some money managers will produce performance

> numbers that imply that they’re giving… services away… money

> managers charge a… percentage of assets… [and] are required

> to show… returns… [net of] fees… to clearly show the amount

> that, as an investor using their services, would’ve made…

Some will occasionally show “after tax” performance, too. At the very least, I think some adjustment should be made when short-term strategies are being compared to a longer-term benchmark (the latter may have a lower tax burden).

> Bogus benchmarks: …some also try to make themselves look good

> in relation to the overall market by comparing… performance numbers

> to inappropriate benchmarks. For example, money managers who invest…

> in international stocks) may compare their investment performance

> only to the lowest-returning U.S.-based indexes.

Sneaky, sneaky…

> Switching into (yesterday’s) stars: Money managers don’t want to send…

> updates that show… they’re sitting on yesterday’s losers and missed

> out on yesterday’s winners… they may sell the losers and buy into

> yesterday’s winners, creating the illusion that they’re more on top of the

> market than they are… known as window dressing, [this] is potentially

> dangerous because they may be making a bad situation worse by selling

> funds that have already declined and buying into others after they’ve

> soared (not to mention possibly increasing transaction and tax costs).

I included “optionScam.com” as a category for today’s post. “Unsavory” would also apply.

Categories: Money Management, optionScam.com | Comments (0) | PermalinkLack of Performance Reporting (Part 2)

Posted by Mark on March 5, 2018 at 06:43 | Last modified: November 20, 2017 11:30Last time I discussed failure to report reliable performance records as a phenomenon in the financial industry.

I will pick up today commenting on an excerpt from Kenneth Winans’ 2017 Forbes article. Instead of minding performance, Winans says clients are more interested in customer service attributes and how well connected the adviser is.

To me it’s a no-brainer that clients hiring advisers to invest their savings should care about performance above all else. Since they are aiming to grow their money (otherwise why seek an adviser in the first place?) rather than lose it (otherwise why invest as opposed to gamble on games of chance like the lottery or casino games?), how can they fail to hold the adviser accountable for this? I can understand congeniality or rapport as a close second but it boggles my mind to see performance considerations downplayed (or completely omitted) as a criterion for adviser satisfaction.

This helps to explain my recent deliberation about potential brainwashing by the financial industry as a by-product of persuasion (salesmanship). Perhaps deception specialist or magician like Apollo Robbins would be a better analogy.

And perhaps a better explanation for how this occurs is poor financial literacy and an inability to grasp the implications of out/underperformance. Much of this is mathematics (e.g. annual return of 7% versus 6% on $100,000 over 20 years will result in $386,000 versus $320,000: ~20% improvement).

Winans continues:

> A case in point was Barron’s September article “The Changing

> Indie Landscape.” The story failed to mention the most important

> metric that investors want to know — how much money

> they made their clients over the last three, five, or 10 years

I think educated investors want to know these metrics but the dictionary definition of “investor” presumes no such education. Based on the paragraphs above, I am not at all sure the average investor even thinks to inquire about performance.

> on average. Instead, money managers boast about assets under

> management (AUM), as if what our money needs is the company

> of other money. The media’s obsession over AUM comes because

The smokescreen is displacing the focus from investment performance to AUM. The illusion/fallacy is that because high-AUM advisers are so popular, they must be good at making money grow.

> many heavily promoted registered investment advisors don’t

> actually manage any investments at all. While a traditional

They outsource to TPAMs.

> investment manager keeps your funds in a discretionary account

> and can buy and sell a mix of stocks, bonds, ETFs or mutual

> funds, many “money managers” are just middlemen who funnel

> client money (for a fee) to a real investment management firm.

Hopefully the fee is for other necessary financial planning services rather than simply making the connection with a real investment management firm.

I will continue next time.

Categories: Money Management, optionScam.com | Comments (0) | PermalinkStansberry Research

Posted by Mark on February 8, 2018 at 06:18 | Last modified: November 1, 2017 21:01I received the following e-mail from a friend today:

> Hey Mark,

> What do you think of this guy’s predictions???

> Should one take him seriously?

> http://thecrux.com/dyncontent/millionaire-warns-to-get-out-of-cash-now/

The first thing I noticed was the byline “by Patrick Bove, Stansberry Research.” I associate Stansberry Research with long, persuasive [and nefarious] advertisements. This is probably because I’ve seen multiple writings from them in the past. At the very least, it was reason to investigate further.

I then noticed “Dr. Steve Sjuggerud,” a name that definitely raises red flags. Again, I’m not exactly sure why but I’ve been looking at these things for the last 10 years. I actually recall researching him somewhat recently and being surprised not to see blatant confirmation of his chicanery.

The Crux (top of page) is not something I recognize as a reputable news source. Like anything else, I can do an internet search that led me here. Not only does the review link it to the questionable “Stansberry Research,” it also concludes:

> There are many other online publications that share

> “informational” articles promoting products for sale

> or that offer newsletters whose ultimate goal is to

> sell their readers financial products…

This tells us all we need to know about the cataclysmic conflict of interest. Time to run away! Don’t waste another second.

Because I sought further confirmation, I ran an internet search on “Stansberry Research” to find this and this.

Oh by the way, printed above The Crux at the top is “advertorial.” What the hell is that? For me, such a word raises multiple red flags. Any advertisement (“advertorial” is presumably “advertisement” + “editorial”) is quite possibly fake news—especially if it proclaims a doomsday scenario.

Categories: optionScam.com | Comments (0) | PermalinkThe Relationship between Success and Credibility (Part 4)

Posted by Mark on November 16, 2017 at 07:48 | Last modified: September 27, 2017 08:28Today I want to conclude by further emphasizing the respect I give to those sharing losing trades.

Gloria Loring taught us that we cannot have the good without the bad so I see little point in trying to overlook the losers. I believe I have at least as much to learn from the losers as I do the winners because the former can deliver me to Ruin.

When people suffer catastrophic loss, they tend to go quietly into the night. Maybe this is in hopes of preserving a positive self-concept or minimizing damage to personal reputation. A sense of shame may also play a role. Sharing failure with others could prevent the rest of us from repeating similar mistakes but Schadenfreude is a coping mechanism too.

On a smaller scale, this phenomenon of “going quietly into the night” seems to happen with regard to any losing trade.

As discussed last time, a great way to improve as traders is to understand mistakes we are most likely to make. These include mistakes made by others. I would prefer to hear a presentation on losing rather than winning trades because the latter, in my opinion, is more likely to be contaminated with self-promoting conflicts of interest.

I have considered creating a seminar on “ways to save thousands in the financial markets.” In this program I would discuss financial frauds and shady practices that I have encountered during my years studying the financial/trading landscape. I definitely believe one key to long-term trading success is to avoid being derailed by the tempting offerings (e.g. black box systems, trading newsletters, trader education programs) professing mouthwatering performance numbers. These are more likely to rob you blind should you get suckered in.

Ironically, I decided not to move forward with this seminar idea is because I questioned whether the negative is marketable. People often don’t like to hear the negative. Even I prefer to focus on the positive but I had to grow up sometime and realize that it’s not all winning and roses out there. Losing is part of life and I believe I have much to learn from its lessons.

I have often thought that a string of early wins can be a curse for those new to trading. If they assume this early success to be representative of future win rate then they may increase position size too fast. This leaves them vulnerable to the possibility of catastrophic loss when Mr. Market decides to change his mind.

I once heard “that’s why it’s called trading, not winning.” Sometimes it takes time for the reality of losing to set in.

Categories: optionScam.com | Comments (1) | Permalink