Is Option Trading Too Expensive? (Part 2)

Posted by Mark on August 5, 2016 at 06:27 | Last modified: May 25, 2016 14:59I occasionally get the sense that option trading, specifically naked put (NP) selling, is quite expensive. Today I will provide a couple other snapshots explaining why this is not the case.

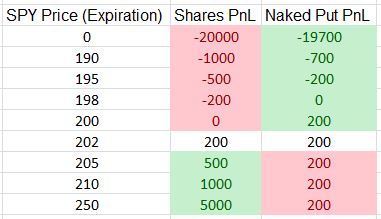

Consider the purchase of 100 SPY shares at $200/share. This will cost $20,000. Suppose I sell one SPY 200 put for $2.00. This will cost me $19,800 in a retirement account. The PnL of each trade at option expiration is:

Green (red) cells indicate the more (less) profitable position. The NP trade is 1% cheaper and the naked put never loses more than the long shares. The NP underperforms to the upside but not because it loses more money—only because it doesn’t make as much. With risk traditionally defined as how much I can lose, NPs are never more risky than shares (score a second point for trading options over stock).

Are NPs too expensive? Clearly not: if I have money to buy the shares then I have money to sell the put.

I can also dramatically cut the cost of the NP by purchasing a long option. For example, in last post’s SPX example, a 1500 long put would cost $0.45. This cuts my profit from $2.13 to $1.68, which is a decrease of 22%. This cuts the trade cost, however, from $178,787 to $29,000, which is a decrease of 83%. Put another way, the potential annual return has just increased from 1.4% to 6.9%.

In the last post I discussed the possibility of selling an SPX option for 1% of the strike price to target 1% per month. The option premium increased from $2.13 to $20.75: almost 10-fold. The strike price increased from 1790 to 2010: about 13%. The former is the numerator of the ROI calculation whereas the latter is the denominator. Ponder this in terms of how much cheaper (more profitable) the trade can potentially be. Trade-offs always exist and in this case the trade-off is a decreased frequency of winning (probability of profit).

So in the final analysis, how expensive is it to trade options? Perhaps the best answer is “as expensive [or cheap] as you want it to be” (score a third point for trading options over stock).

Categories: Option Trading | Comments (0) | PermalinkIs Option Trading Too Expensive? (Part 1)

Posted by Mark on August 2, 2016 at 06:50 | Last modified: May 25, 2016 14:12My belief in trading naked puts (NP) goes back to some early posts I wrote on the topic. Occasionally, however, I am blinded by an illusion that suggests the trade is too expensive.

Consider the following SPX (S&P cash index) example. On 5/9/2016, with SPX ~2060 I could sell a Jun 1790 put for $2.13. This is 39 DTE and has roughly a 100% probability of profit based on the current implied volatility, which means its expected return is $213. This trade would cost $178,787 in a retirement account. On the same date, with SPY ~206 I could sell a Jun 200 put for $2.05. This is 40 DTE and has a roughly 82% probability of profit. This trade costs $19,795. The first trade is nine times as expensive as the second trade and potential profit for both trades is about equal!

Making matters seemingly worse is the annualized return of the initial trade: only 1.4%. If I wanted to aim for 1% per month then I could sell an option worth 1% of its strike price like the Jun 2010 put for $20.75. This has an 81% probability of profit and an expected return of $604.

[As an aside, if it were possible then buying 100 shares of long SPX would have a lousy 52% probability of profit and an expected return of negative $892. Score one point in favor of options over stock.]

At first glance above, trading the naked put did seem quite expensive but it’s less expensive in the second example.

I believe option trading is better understood as a give-and-take across different parameters. The second trade makes more money but wins less frequently. The first trade will win almost every time but make less money per trade. When the former position does lose, it may indeed be catastrophic. This is not as much the case for the latter. More (less) consistency will be met with (less) more severe, albeit rare (and more frequent), drawdowns.

I will frame this in a slightly different light next time.

Categories: Option Trading | Comments (0) | PermalinkCatastrophic Loss (Part 4)

Posted by Mark on September 25, 2015 at 07:41 | Last modified: October 22, 2015 08:42For years I’ve felt that catastrophic loss is the worst thing possible but in the big picture, it’s not uncommon.

By the very nature of the word, “catastrophic” sounds like an outlier. The second definition is:

> extremely unfortunate or unsuccessful [italics mine].

“Outlier” and “extreme” are synonymous.

For something so extreme, though, catastrophic loss is all around us. This need not be loss of life although that certainly would qualify. I’m thinking more akin to Serena Williams’ loss to unseeded Roberta Vinci in the 2015 U.S. Open a couple weeks ago. That ended her bid for the Calendar Slam, which would have been one of the great tennis accomplishments of all time. Another example comes from Survivor: Second Chance: we heard some players talk about losing in previous seasons and how catastrophic it was because they were so close to winning $1M. I think anytime we put our heart and soul into something and then get blindsided and/or fail to accomplish, the result is catastrophic.

In psychological terms, maybe “devastating” is the word used more often. Like the loss of a loved one, it can be associated with grief. Those who are true champions will be able to deal with it and bounce back. These make for many of the inspirational stories the evening news loves to report.

Going forward, the best course of action would be to get my checklist in place to decrease the possibility of catastrophic loss from ever occurring again. Given that I’m now in financial drawdown and emotional recovery, though, I also need to focus on a bright future, positive things, and pulling myself up by the bootstraps.

For the time being, I’ve said quite enough about catastrophic loss. Let’s go out and make some money, shall we?

Categories: About Me, Option Trading | Comments (0) | PermalinkRUT Weekly Calendar Trade #13 (Part 2)

Posted by Mark on July 28, 2015 at 07:57 | Last modified: August 6, 2015 09:43Yesterday I reviewed weekly trade #13, which ended up losing money.

I reluctantly consider this trade a failure. With the market never under my control, the one thing I do control is adherence to my trading plan. I am not unique in tweaking my trading plan based on a news announcement. If this constitutes the majority of traders then I want to be different. I have no reason to think anybody is any better off because they listen to news. I think it’s just a matter of luck when such positions work out profitably.

I’m here to be serious and disciplined. I need to work harder at sticking to the plan.

I strayed from my plan by taking off risk earlier than usual. That doesn’t seem like such a horrible thing on the surface. I still left myself a good chance to hit the profit target were the market to move lower but I did leave it as a directional trade. Had I followed the plan, the trade would not have been directional and would have still been vulnerable (perhaps more so) to a big move either way.

Equally important but less frequently understood, I believe, is the fact that risk may come from missing out on potential profits as much as from taking big losses. If this trading plan wins 75% of the time then it may be a worthwhile endeavor despite a poor average win/loss ratio. If I do not adhere to the plan and I realize some periodic losses in place of winners then the overall average return may be much worse or even negative: not a strategy that makes good business sense.

Trade #13 would have lost whether I stuck to the plan or not. Should I stray again in the future, I may not be so fortunate.

One other note: this trade has wide breakevens and a positive horizontal skew at inception. Unlike last week’s trade, however, this one lost.

Categories: Option Trading | Comments (1) | PermalinkCalendar Calculations

Posted by Mark on June 9, 2015 at 07:03 | Last modified: June 10, 2015 10:01Trading can be challenging especially when trying to manage the heat of a moment. In reading lots of material and hearing even more discussion, I find people rarely discuss actual trading details. As opposed to “optional activities,” trading activities include: reading and manipulating charts, running stock/option screens, recording trades, modeling positions, entering orders, and keeping abreast of what needs to be executed when. Perhaps the most important trading activity is the application of simple arithmetic.

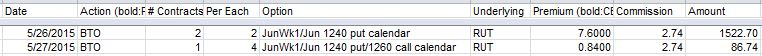

Here is my spreadsheet from my last calendar trade:

The “Premium” column shows prices. First, I bought two 1240 put calendars for $7.60 each. I then rolled one to the 1260 call strike for $0.84 resulting in a double calendar. If I want to exit for a 10% profit, what price do I require to close?

At first I thought this was simple: ($7.60 + $0.84) * 1.1 = $9.29 [1]

Wrong. As a combination of two calendars, the double calendar price should be much higher.

Perhaps the answer is ($7.60 + $0.84) * 1.1 * 2 = $18.57 [2]

Wrong again.

Let’s look at the “Amount” column to see if we can figure it that way.

$1,522.70 + $86.44 = $1,609.44 [3]

$1,609.44 * 1.1 = $1,771 [4]

$1,771 / 100 = $17.71

Check:

Profit = $1,771 – $1,609.44 = $161.56

$161.56 / ($1,522.70 + $86.44) = 0.10, or 10%.

Yay!

What was so hard about this? Didn’t I do the same thing with [3] / [4] as I did with [2]?

If I overlay [2] and [3]:

($7.60 + $0.84) * 1.1 * 2 = $18.57 [2]

$1,522.70 + $86.44 = $1,609.44 [3]

How are these different?

The two calendars [2] are $7.60 * 100 * 2 = $1,520, which is about $1,522.70 [3] without transaction fees.

Rolling one for $0.84 [2] should be $0.84 * 100 * 2 = $168, which is not $86.44 [3]. Why?

This is the mistake. The initial cost of $7.60 must be multiplied by two to account for both calendars. The subsequent cost of $0.84 is the entire roll of four contracts traded: no need to multiply by two.

In fact, if I take half of the roll debit and calculate:

($7.60 + ($0.84 / 2)) * 1.1 * 2 = $17.64

If I multiply that by $100/contract then I get $1,764, which is about equal to $1,771 [4] minus transaction fees.

Trading platforms usually do not track running profit/loss of positions. As traders, we must have a reliable means to do this simple arithmetic if we want to make money rather than lose it.

No experienced trader ever said this was easy; here is another House advantage the markets use to take our money.

Categories: Option Trading | Comments (0) | PermalinkCorrelation Confound (Part 3)

Posted by Mark on April 3, 2015 at 06:41 | Last modified: May 17, 2015 08:35Correlation confound #1 dealt with portfolio diversification. Today I will discuss correlation confound #2, which has to do with pairs trading.

To design a pairs trade, the first step is said to be finding stocks that are highly correlated. This could involve businesses in the same industry or sub-sector, index ETFs like QQQ and SPY, highly-correlated futures pairs, etc.

The next step is to monitor a chart showing price ratio between the two markets. When the price ratio diverges far enough, I want to go long (e.g. sell an OTM put spread) the relatively cheap market and go short (e.g. sell an OTM call spread) the relatively expensive market. Since the two markets generally move together (i.e. highly correlated), when they move apart I should expect mean reversion where they come together again.

Correlation confound #1 also applies to pairs trading. Just because markets have been correlated in the past does not mean they will be correlated in the future. That could cause problems for pairs trades.

Correlation confound #2 is something called cointegration. Correlation measures the tendency of two variables to move together but it’s not guaranteed that they’ll stay close to each other. Look at the following charts of the gold and silver markets:

Believe it or not, in both charts these markets have the same statistical correlation of +0.75! If you took on a traditional pairs trade when these markets were far apart with the expectation that they would get closer together, you might be sorely disappointed with the graph on the right but happy with the graph on the left.

Cointegration is a measure of how well assets are tied together. Two correlated variables are allowed to wander arbitrarily far apart but a cointegrated variable is not. Cointegrated variables are expected to stay parallel to one another since the difference between the two will be corrected over time.

Categories: Option Trading | Comments (0) | PermalinkCorrelation Confound (Part 2)

Posted by Mark on March 31, 2015 at 06:49 | Last modified: May 15, 2015 09:20In the last post, I defined both words in the title. Today I continue by describing the correlation confound of portfolio diversification.

Combining assets with low correlations in a portfolio may allow me to get more return while taking on the same level of risk. It may also allow me to get the same return with less risk. This is diversification.

Risk, or variability of returns, is what causes people to close positions for the worst possible losses. Averaging +10% per year is great for a portfolio but if, at some point during the year, you were down 80% then would you still be in the market? In 2012 I described this scenario in terms of maximum adverse excursion. Diversification helps to lower risk and while that may lower returns as well, if it can keep me in the trade mentally then time has repeatedly been shown to work its magic and allow the market to rebound.

To build a diversified portfolio, we are advised to look for assets whose returns have not historically moved in the same direction. What I do not see in most of these discussions is the fact that correlation can change. Jim Fink addressed this in a 2013 article:

> A large portion of the disappointment can be traced to

> the severe bear markets… when correlations among asset

> classes increased markedly at the worst possible time,

> resulting in all declining in price at the same time.

> [Mebane] Faber uses 2008 as a prime example:

>

> "The normal benefits of diversification > disappeared as many non-correlated asset > classes experienced large declines > simultaneously. Commodities, REITs, and > foreign stock indices all suffered > drawdowns over 50%."

>

> If only there were a way to avoid exposure to risk assets

> during the most severe bear markets, the problem of

> converging correlations could be avoided and the

> diversification benefits of different asset classes with

> normally low correlations could be fully realized . . .

Correlation confound #1 is changing correlations. If this happens then your best efforts to diversify and minimize losses may not be effective.

Categories: Option Trading | Comments (3) | PermalinkCorrelation Confound (Part 1)

Posted by Mark on March 26, 2015 at 05:19 | Last modified: May 15, 2015 09:07Correlation is mentioned as a key factor in two different trading/investing contexts. In this mini-series, I’m going to describe correlation, how traders can make use of it, and a couple missing pieces (confounds) to avoid unexpected failures.

I will begin by explaining both words in the title.

Correlation is a measure of how often two variables change together. A correlation of +1 between two stocks means historically, when one stock was up 5% the other was also up 5%. A correlation of -1 means historically, when one stock was up 5% the other was down 5%. A correlation of zero means historically, no relationship between the stocks’ price changes occurred. Correlation can range from -1 to +1.

In science, a confounding variable is “an extraneous variable in an experimental design that correlates with both the dependent and independent variables.”

Ice cream [example] can better help me illustrate this. Suppose a correlation between murder rates and ice cream sales is observed. If murder rates go up (down) when ice cream sales increase (decrease) then ice cream sales drive murder rates, right? This is less likely if some other variable is also found to be correlated with murder rates. That variable would then confound our initial model. Suppose it is also observed that as seasonal temperature increases (decreases), people buy more (less) ice cream and spend more (less) time outdoors where criminals run the streets. It makes logical sense for seasonal temperatures, not ice cream sales, to affect murder rates. Seasonal temperature is a confounding variable.

In the next post I will start to explain confounding variables that prevent correlation from doing its job.

Categories: Option Trading | Comments (1) | PermalinkProtect Your Nakeds!

Posted by Mark on March 9, 2015 at 07:46 | Last modified: May 13, 2015 11:49I subscribe to a mailing list that focuses on covered call writing. I often see people fail to acknowledge risk and it makes me a bit uneasy.

This was taken from a 2014 post:

> I will be happy to buy QCOR at 65 if it is put to me.

> Based on reading many of the QCOR reviews I believe

> QCOR is fundamentally very strong… If put to me I

> appreciate Citron’s work that adds to volatility and

> will reward me if and when I sell a CC for a high

> premium.

People short puts on Enron or any other stock that ultimately went bankrupt said the same thing before it went to zero. When the stock is well on its way to zero, no stockholder, naked put trader, or covered call writer will be happy.

Some people use explicit wording instead of a smug “I’ll be fine because I feel comfortable owning the shares” attitude. An example is often given by people advertising covered call services or option educators who say “sell the put at a strike price at which you would be happy to purchase the stock.”

I think either of the above clouds the real issue: risk management.

The bottom line is if I take assignment on a naked put then I’m probably losing money. If I don’t have an exit strategy then I better hope to high heaven the stock doesn’t go to zero! Regardless of how “happy” I say I’ll be if assigned, I’ll feel more and more heat if the stock continues to slide further. If the stock tanks substantially and then trades sideways then I will be highly frustrated sitting on what feels like dead money because I won’t be able to collect meaningful premium on the [now] deep OTM calls.

Categories: Option Trading | Comments (0) | PermalinkThe Myth of “Unusual Option Activity” (Part 1)

Posted by Mark on March 3, 2015 at 07:58 | Last modified: May 12, 2015 12:05The financial media often treats unusual option activity as a predictor of how large institutions are trading. This may or may not be very misleading, which in my view casts doubt over the entire strategic approach.

Traders will sometimes study the option flow for a stock because they believe this helps them to understand sentiment. Particularly when a stock is extended, some believe option activity can offer predictive signals. For example, if one large block is going against the trend, it can mean the institutions are starting to think trend reversal. On the other hand, increased small-lot activity in the direction of the trend conveys a message that can fool the beginning trader.

What options are predictive of trend persistence versus trend reversal is not at all obvious. For example, heavy put volume on a beaten down stock could be a trader(s) shorting puts in expectation of mean reversion: either reversal to the upside or at least a temporary reprieve before the downtrend resumes. If this trader(s) is also shorting stock against the put sale then the overall position is actually bearish rather than bullish. The trader(s) took advantage of the high implied volatility to collect some extra premium in the hedge but the primary profit generator is downward stock movement (upside has unlimited risk).

Married puts and covered calls are two other examples of misleading option activity. Buying puts in the former suggests a bearish position but having purchased the stock, this is really a bullish position with downside protection. Selling calls in the latter suggests a bearish position but having purchased the stock, this is also a bullish position with [limited] downside protection. In fact, if the stock is purchased before the option is traded then the stock price may be higher to allow for a cheaper put purchase or more expensive call sale: both advantageous to the combined position.

I will conclude with the next post.

Categories: Option Trading | Comments (0) | Permalink