Fear and Greed: an Interlude

Posted by Mark on November 10, 2016 at 06:18 | Last modified: August 25, 2016 11:32At the root of my last post but never explicitly stated were those darned emotions of fear and greed.

Talking about drawdown (DD) analysis took me back to the idea that options are better than stock. DDs trigger the fear inherent within. This threatens catastrophic loss when I have to close positions at the worst time to maintain sanity. I have argued that long stock can always lose more than the naked put (NP) and is more risky for that reason.

Upside profit is capped with NPs while remaining unlimited for long stock. On the whole, I don’t believe upside movement outpaces NP profit potential very often. This is why I consider long stock more of a gamble as opposed to the more consistent returns generated by NPs.

For those who conceptualize trading as a zero-sum game, the upside is where differences may be recovered. The few times the market goes up strongly and [far] outpaces NP gains makes up for the many times the market goes up a little bit, sideways, or down and the NP trade wins.

I think psychological comfort should be considered when comparing NPs with long stock. As mentioned above, I favor lower DD approaches because fear lurks on the downside. On the upside, greed can take over if I fail to keep pace. A market that remains strong for an extended period of time may cause NP traders to become increasingly frustrated. In a worst case scenario greed takes over, the NP is closed in favor of long stock, and the market proceeds to tank causing larger losses.

Remember the adage “you can’t go broke taking a profit.” I may not profit as much to the upside but I won’t go broke and I will continue to make consistent profits. Anybody who gets so restless and agitated because they aren’t making as much should think about what happens when times flip and the market heads lower. Don’t get caught up in the greed because nothing goes up forever.

Categories: Financial Literacy | Comments (0) | PermalinkDon’t Believe the Hype! (Part 2)

Posted by Mark on October 14, 2016 at 06:28 | Last modified: September 22, 2016 16:42Today I conclude with a few more posts from GB, one other post to GB, and my ultimate response after I had seen enough.

On April 13, 2015, GB wrote:

> NLNK is my next possible trade this week. I

> believe the $430 Call will provide over $33.00+ (my

> goal is $1.00 profit per share per week) so this is

> a triple grand slam with insurance. I can

> only afford 2 contracts but will still make more

> than my weekly profit goal. Thx. [italics mine]

In another post, GB wrote:

> Hello… I’m not too familiar with the different

> names like collars, spreads, etc. But my goal is to

> create a near zero Delta, hence zero risk. I’m

> thinking that it limits my upside but protects my

> downside because the Put is already ATM or ITM,

> again, a higher quality Delta… [italics mine]

Here was an insightful post by another member in response to one of GB’s posts:

> …your suggestion to add long puts to a covered

> call makes little sense. You are creating what is

> known as conversion. Long stock + short call + long

> puts. It is a flat position, which can only be used

> to lock in profit/loss. If I understood your trade

> you are adding puts after the stock has moved against

> you. Hence you are locking in a loss. IV variations

> might diminish your loss or even create a very small

> profit but again conversion is a lock.

To that, GB responded:

> Sound [sic] like profit to me all day long and all

> the way to the bank!!

After some hearty laughs, I felt compelled to offer GB one response to all his posts:

> If there’s potential reward then there is no such

> thing as zero risk.

>

> If you don’t know the different names then learn

> them. Ignorance is no excuse for being oblivious

> to risk. Don’t put on any trades unless you fully

> understand what your exposure truly is.

>

> Your posts have been entertaining with phrases like:

>

> –consistent weekly profits

> –‘gravy’ forever into the next generation

> –the coast is clear to keep it and make premiums

> until it is ran up again

> –those who stayed are rich and retiring out this

> year and next

> –sound [sic] like profit to me all day long and

> all the way to the bank

> –so this is a triple grand slam with insurance

>

> Where’s the one about trading being an ATM machine?

>

> Nothing about trading or investing is free, nothing

> is guaranteed, and nothing here is ever worth the

> kind of exuberance you seem to project with your

> posts. There’s risk inherent with everything and

> if you trade too large aiming to be too greedy then

> you will one day learn the hard way by getting blown

> out of the game for good.

>

> Just my two cents: be careful and watch your back!

I feel that pretty much said it all.

Categories: Financial Literacy | Comments (0) | PermalinkDon’t Believe the Hype! (Part 1)

Posted by Mark on October 11, 2016 at 06:49 | Last modified: September 22, 2016 16:41Almost two years ago, a new guy started posting in an e-mail list I read. Today I am going to paste some of his posts. The moral of the story here is don’t believe the hype: any trade has risk and can always lose!

On April 12, 2015, GB wrote:

> Hello Mark… Did you use quality Delta Puts for

> the coal stocks? I work with a guy who lost tens

> of thousands…now he is in the dog house with the

> wife who is… threatening divorce if he trades

> again. I had him backtest a couple his major losers.

> He came back really upset because he could have

> used Puts to offset the loss. He had heard about

> Puts but never used them. I’m all for taking the

> middle ground using Puts for consistent weekly

> profits. Matter of fact, the lower the stock drop

> the more the Put increases. Then, you might be able

> to buy higher Puts to get out of the dropped stock

> to recoup even more cash. Hmmm! I’m going to run

> numbers on that last idea.Thx. [italics mine]

On April 12, 2015, GB wrote:

> …think of it like this: You keep getting premiums

> and dividends you will recoup all of your money and

> the rest will be “gravy” forever into the next

> generation. Also, look back to see if ITM Puts

> by 1 or 2 strikes would have made you money on the

> initial position. I do not care to own stock for the

> long term. I use my employment retirement account

> for funds. I will use index funds for my IRAs going

> forward. I use stocks as a financial tool…like a

> hammer or saw. I use to get stuck in a stock when

> it dropped…but usually way back on top after 2

> weekly trades. I believe the “hype” is out of a

> stock when it drops…so the coast is clear to keep

> it and make premiums until it is ran up, again…

> like an upcoming dividend.Thx [italics mine]

In another post, GB wrote:

> Mike, I’m not an analyst but I’m sure your right…

> coal will save the country. I agree not to be afraid

> of a paper loss. Too many of my co-workers dumped

> their retirement shares in 2008. They lost, big.

> Those who stayed and kept putting into their

> retirement accounts are rich and retiring out this

> year and next!! Do you mind if I check out those

> stocks? [italics mine]

Yes he minds because he likes to control all the shares?!?

No, incidentally, Mike did not praise coal stocks nor did he say paper losses do not matter.

Until I conclude next time, recognize that any trade can always lose and that without risk there are no profits!

Categories: Financial Literacy | Comments (0) | PermalinkAgainst Target Date Funds (Part 4)

Posted by Mark on October 6, 2016 at 06:37 | Last modified: August 16, 2016 11:27I want to

I found the following on a robo-advisor website in the comments section of a blog post:

> So, back to the subject at hand. I love the article,

> and the ideas are great, but the closet quant would

> like to see some numbers…

The author’s response:

> Thank you for your comment… the key here isn’t

> focusing on returns, per se – both [your TDF] and

> [our product] invest passively. We are both trying

> to track the index, not create active alpha.

Indeed, each TDF component aims to track its index, which is what so many financial products strive to do. The industry conditions us to be happy with this by making a strong case that it is difficult to achieve.

Articles deprecating actively managed funds are easy to find. I did an internet search for “what percentage of money managers beat the market.” I found one article citing S&P Dow Jones as reporting 86% of active large-cap fund managers did not beat their benchmarks in the previous year. Another article, also citing S&P Dow Jones, says out of 715 mutual funds that performed in the top 25% over 12 months ending in 2010, only TWO remained in the top 25% for each of the four succeeding 12-month periods.

Passively managed funds also fail to match the benchmark because of the fees. Think about it. These funds aim to track the indices or overall market. They advertise low fees (“expense ratios”) compared to actively managed funds. If the best they do without fees is match the benchmark, though, then they always lose to the index after fees regardless of how small those fees are.

Given how difficult it seems to match the market (not to mention beat it), I think people who do feel they have stumbled upon some sort of “Holy Grail.”

I believe this is all a distraction. My goal is not to beat the market, which wins some years and loses [big] in others. My goal is to pay the bills. I want consistency and I think when we strip away the ego that surrounds issues of money for so many people, they would also admit to dreaming of a linear positive-sloping equity curve.

I would argue the best way to achieve this all-important goal of consistency is with options rather than stock: something the financial industry spends too little time discussing.

Categories: Financial Literacy | Comments (0) | PermalinkAgainst Target Date Funds (Part 2)

Posted by Mark on September 29, 2016 at 07:33 | Last modified: August 9, 2016 11:56I previously discussed two articles in the June 2016 AAII Journal arguing against target date funds (TDFs). Charles Rotblut, CFA, (AAII vice president and editor) wrote a third article in the same issue that takes aim at TDFs.

In the article, Rotblut samples six different TDFs. He discusses the importance of speed to final allocation:

> The Vanguard fund will reach its final allocation

> by 2027, versus 2030 to 2039 for the Fidelity

> fund. A shorter glide path and a larger

> allocation to bonds… may be a plus for

> someone with a shorter expected life span and/or

> greater cash needs in retirement… The ideal

> strategy provides a person the right amount of

> money to fully fund retirement and no more

> beyond what is desired to be bequeathed.

Rotblut says target date depends on expectations for other retirement income that may ease the burden on your nest egg:

> For example, say you plan to retire in 2020… if

> you do not expect to be reliant on your portfolio

> for retirement income—thanks to a pension or

> other sources of income—you could choose to go

> with a 2025 or later-dated fund instead. A

> later-dated fund will give you a greater

> allocation to stocks at retirement and thereby

> more long-term growth. On the flipside, if you

> don’t think you will be able to withstand a bear

> market near your retirement date, you should

> consider a shorter-dated fund.

Rotblut concludes by suggesting creation and management of one’s own portfolios:

> Setting aside questions about whether TDFs use

> the most optimal allocation strategies… the

> biggest downside to them is the lack of

> customization. Shareholders in these funds

> are locked into specific fund families. They

> are also locked into allocation ranges based

> on planned retirement ages.

I think his most damning critique of TDFs comes near the beginning of the article where Rotblut shows a lack of clear consensus on capital allocation. Six funds with a target date of 2020 have a current allocation of stocks and bonds ranging from 38-65% and 30-59%, respectively. Final fund allocations for stock and bonds range from 20-30% and 46-80%, respectively.

How much of a leap is it to suggest I might as well put on a blindfold and take aim at a dartboard?

Categories: Financial Literacy | Comments (0) | PermalinkAgainst Target Date Funds (Part 1)

Posted by Mark on September 27, 2016 at 06:40 | Last modified: August 9, 2016 11:13At the second local Fintech Meetup a couple months ago, we had a presentation by a startup company (name omitted to protect the professionals) selling target date funds (TDF). The entire presentation begged the question: why bother?

Wikipedia describes a TDF as a collective (e.g. mutual fund or collective trust fund) investment scheme offering a simple solution by gradually shifting the portfolio to a more conservative asset allocation by the target date (usually retirement).

Intended as constructive criticism, I suggested the presenter do some backtesting to demonstrate that TDFs are better than conventional vehicles.

The very next day, I read my June 2016 American Association of Individual Investors (AAII) Journal and found three discouraging references to TDFs. The first reference was an interview with Jane Bryant Quinn: a nationally known personal finance writer/commentator. She concluded the interview with:

> I think the research shows that if you reduce

> the amount you hold in stock—you reduce the

> stock amount and increase the bond amount

> every year starting at 65—that is the least

> optimal way to make your money last for 30

> years. At least hold steady.

I viewed this as the weakest challenge to TDFs, which decrease equity allocation over time starting from a much younger age. Quinn cautions doing this from the age of 65 onward.

James Cloonan, however, suggests in a second article that Quinn’s comments are relevant to TDFs. Cloonan is the founder and chairman of AAII. He said:

> I hope there’s been more emphasis on keeping

> more in stock even at older ages or closer

> to retirement. In a recent interview in

> the AAII Journal… Quinn amazingly started

> to show the importance of doing this, and

> she’s a very conservative person. She

> pointed out that you just have an awful lot

> of your life ahead at retirement. You have

> to be a long-term investor if you’re going to

> make enough to keep up with inflation.

Indeed, Cloonan is largely against the idea of TDFs. He argues the conventional belief of increasing exposure to bonds as one gets older is completely flawed:

> One rule of thumb has been that the amount

> you should have in stock is 100 minus your

> age. Well, people retire at 70 these days.

> That means only 30% of their portfolios

> should be in stock. And they’ve got 30

> years to go. Bonds and cash may not even

> keep up with inflation. I think that is

> real risk.

I will continue with the next post.

Categories: Financial Literacy | Comments (1) | PermalinkOptions are Better than Stock (Part 4)

Posted by Mark on September 13, 2016 at 06:48 | Last modified: July 28, 2016 15:40I feel I have done a pretty good job of establishing that options are better than stocks for most investors. One exception might be bullish speculators.

I previously demonstrated option outperformance when the stock moves lower, sideways, or moderately higher. I also made a strong case that options provide more consistent returns.

I previously suggested that options are inferior with regard to bullish speculation but I actually believe the opposite. If someone tells me up-front her goal is speculation then I would make the case for option leverage. “Swinging for the fences” is pretty much synonymous with buying options!

While no one option strategy is better in all market environments, given any market environment one can come up with an option strategy that should outperform.

For the average investor trying to build a nest egg for retirement, I have made a strong case for options as the superior way to go. One may worry naked puts/covered calls are limited-profit vehicles but I would ask how often it happens that the market runs away to the upside? This could be backtested. Even if this happens enough to result in lower annualized returns, the greater consistency of option performance likely makes up the difference. Besides, speculation (i.e. gambling) has no place in building a nest egg.

I did an internet search for “why don’t financial advisers use options” and found one enlightening response:

> You’re right to ask what the average financial

> adviser (FA) knows about investing… But, I

> think you’re underplaying a few additional points.

> First, that most FAs don’t have options

> registrations — so options aren’t even in their

> world view…

Advisers as fiduciaries are bound to act in the clients’ best interests. In my opinion, if they cannot do this because they lack “registrations” then they simply should not be in the business. If advisers cannot do this because they lack proper option education then that is even worse.

> Second, in this era of “low cost advisory” many

> clients are on active missions to cut their

> costs — expense ratios, trading fees — and make

> no mistake, but any active option overlays are

> going to have associated, non-trivial costs.

I would argue stocks and options to be comparable with regard to transaction costs. Given the proper know-how, any adviser can do either without significant material cost.

Bottom line: options options options, folks! This may be just what the industry needs to cure itself of the subpar returns people have been conditioned to expect and accept.

Categories: Financial Literacy | Comments (0) | PermalinkOptions are Better than Stock (Part 3)

Posted by Mark on September 9, 2016 at 06:42 | Last modified: August 4, 2017 08:20I believe I am already done if I were simply trying to argue that options are less risky than stock.

I have shown the naked put position to outperform long stock if the underlying trades down, sideways, or up “a little.” In the previous example, AAPL stock could trade up over 10% in one year and still lose to the naked put. I also argued for higher consistency of returns with naked puts over long stock. This means lower standard deviation of returns and lower volatility of returns. In this case, it also meant lower maximum drawdown for the option position.

All this suggests option strategies are a better choice for a large segment of stock investors. Options are more suitable for growth investors. Options are also more suitable for income investors given the non-refundable premium collected up-front.

I would say neither options nor stocks are suitable for “safety investors” who are most concerned with capital preservation. This may include the elderly and people in retirement. This does include the extremely risk-averse. For this group, Treasuries, highly rated corporate bonds, or certificates of deposit would probably be a better fit. I think the option position can lose less than the stock position but when the market gets really ugly both can lose significantly.

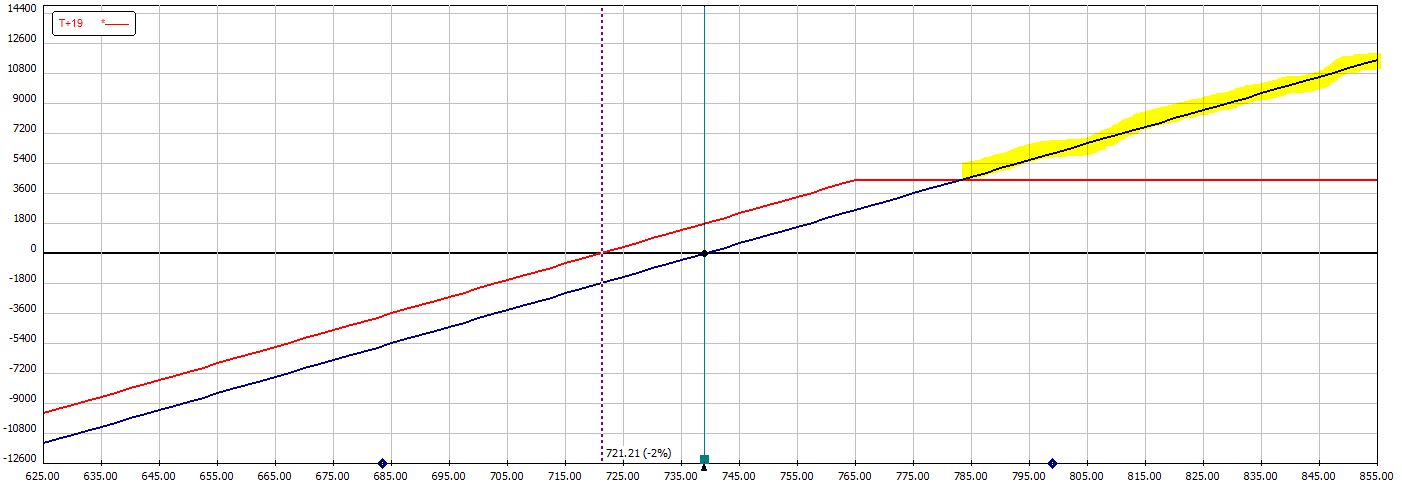

The one category more suitable for stock than options would seem to be speculation. This involves stock selection with the hope of hitting a home run rather than singles and the occasional double. In the following graph, the blue line represents long stock and the red line represents a covered call position:

The yellow highlighting indicates that when the market races higher, the stock can outperform. The option position has limited upside potential whereas the stock has unlimited upside potential. This is a reason why many people like to buy stocks. For some it is like the lottery: people hope to see their shares double, triple in price—or more.

I could argue that options (e.g. long calls) also outperform stocks to the upside. Unfortunately, though, I cannot implement options in such a way to outperform in bearish, sideways, and mildly bullish conditions and also outperform in strongly bullish ones. And if I implement options to outperform in strongly bullish conditions then I would underperform were the market to trade slightly higher or sideways (although I would outperform were the market to move significantly lower).

I will wrap all this up in the next post.

Categories: Financial Literacy | Comments (0) | PermalinkOptions are Better than Stock (Part 2)

Posted by Mark on September 8, 2016 at 05:06 | Last modified: July 26, 2016 11:16As discussed in Part 1, I have taken a defensive posture on the stock versus options debate in the past. As seen in recent articles by Perry Kaufman and Craig Israelsen, today I am going to implement a more anecdotal approach. When studied this way, options very much seem like a better trading and investment vehicle than stock.

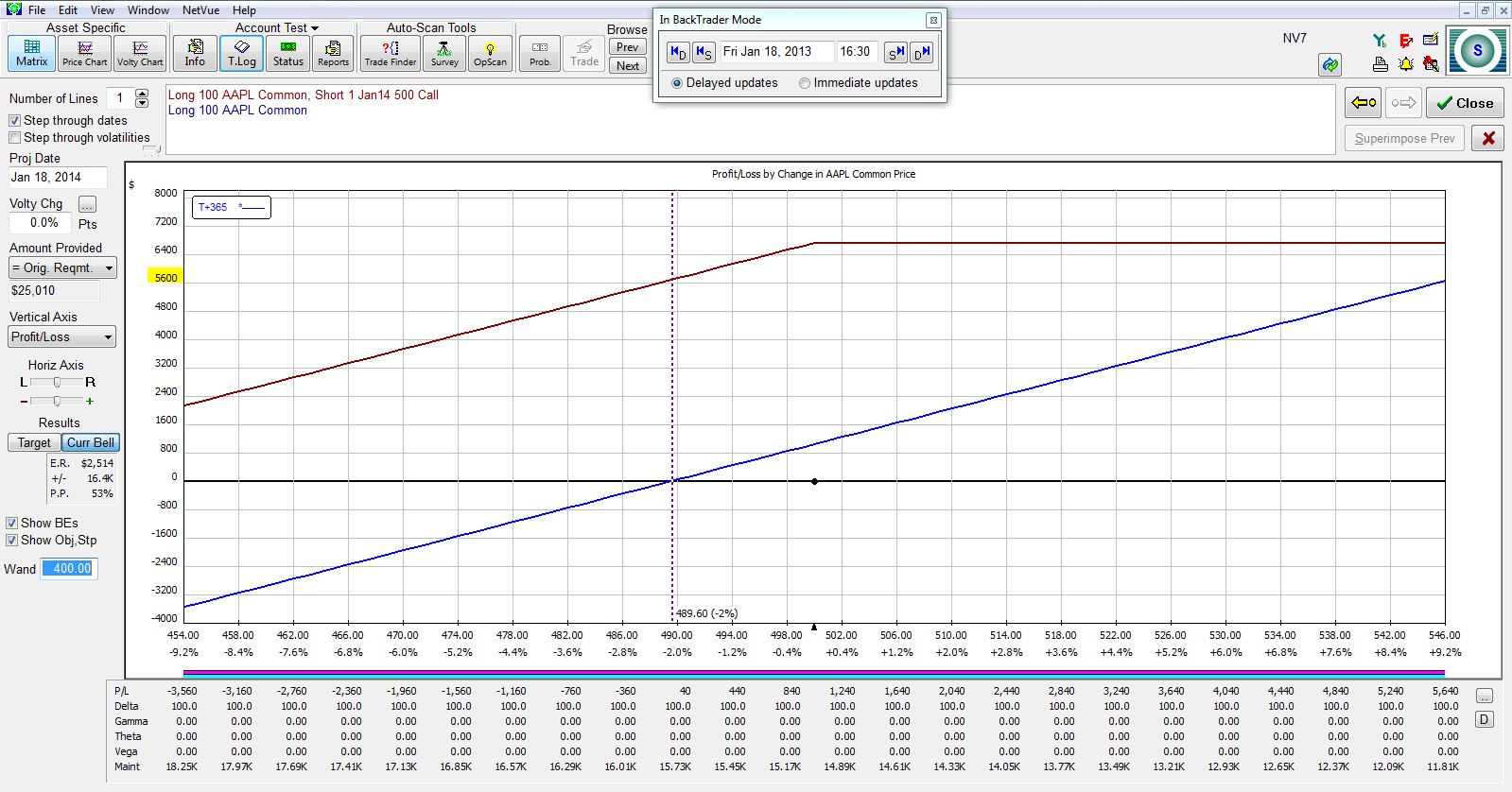

First, let’s revisit my comparison of long shares versus a covered call (CC) position from a 2013 blog post. The following graph plots the PnL of AAPL stock (blue line) and a CC position (purple line) 365 days after trade inception when the option expires. Stock dividends ($1,040) are included:

The vertical, dotted line shows breakeven for the stock position after 365 days if the stock price falls. At this zero profit level, the CC shows a profit of $5,600, which is the profit from selling the call at trade inception. The CC also outperforms farther to the downside and to the upside through an underlying price increase of over 10%.

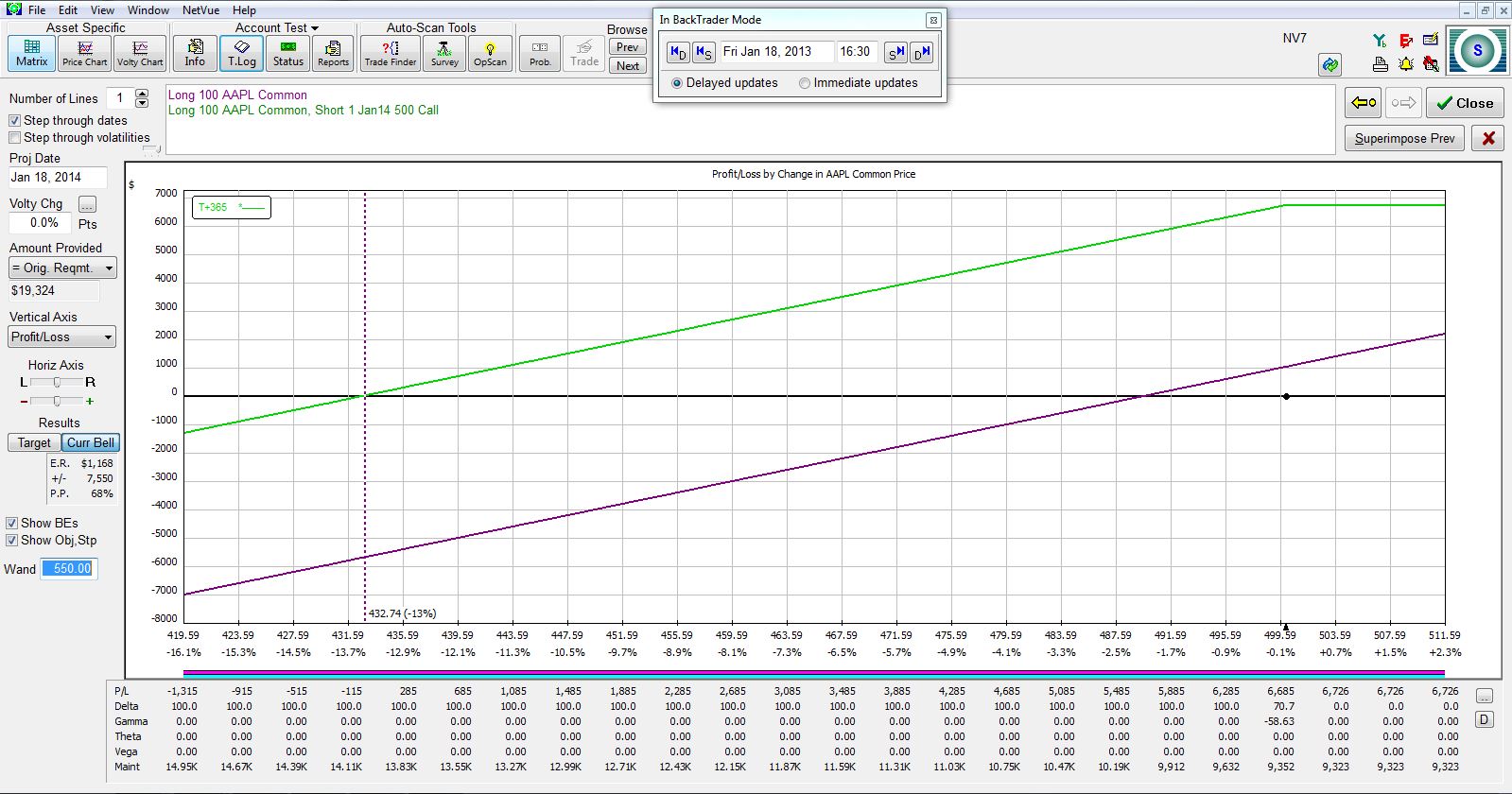

Second, I refer to the common interpretation of risk as potential maximum loss. To compare these positions when the market falls, we can shift the graph to the right:

The CC outperforms by the $5,600 mentioned above and this difference persists to a stock price of zero because the CC owner collects that non-refundable premium at trade inception.

Third, although a CC includes long stock, derivatives theory dictates that a CC is synthetically equivalent to a naked put. I illustrated this with graphs shown here. This is not anecdotal: this is universal.

Taken together, the first three points above argue for option superiority over long stock when the latter trades up a little, sideways, or down.

My fourth piece of evidence is anecdotal study of risk as volatility of returns. I cited studies here and here suggesting that returns are similar between stock and option positions with volatility 33% lower using the latter. Furthermore, my preliminary backtesting has shown lower maximum drawdowns for the naked put positions relative to long stock.

I will continue discussion in the next post.

Categories: Financial Literacy | Comments (2) | PermalinkOptions are Better than Stock (Part 1)

Posted by Mark on September 6, 2016 at 06:09 | Last modified: July 24, 2016 12:22Options folk enjoy debate about things like which trading strategy is best and which adjustment is best. Almost unilaterally when I hear a discussion like this setting up, an immediate answer pops to mind: neither is better or worse—they each have their pros and cons. I feel options are a better vehicle to trade than underlying stock but because of my reluctance to proclaim superiority, I rarely communicate this to others.

In 2014, I made the case for options with a six-part blog series. In Part 1, I wrote:

> I actually believe that trading options is better than

> trading stocks or futures. This would be very, very

> difficult to prove, though. When it gets down to the

> trading system, whether discretionary or systematic,

> it would be extremely difficult to convince anyone

> that options are unequivocally better.

For this reason I took a defensive posture with option trading. I suggested the financial industry represents option trading as making a “deal with the devil.” I then attempted to inject reasonable doubt to weaken that claim. I explained why options are not “too risky” and I went on to offer some advantages of trading options.

In this blog series, I am taking a more aggressive approach: options are a superior investment/trading vehicle to stock. I will make the argument with covered calls/naked puts, which I have blogged about at length.

Pay close attention because the implications of option superiority are significant and wide-ranging. For starters, it may rarely be in one’s best interest to own long stock shares without a hedge. To the extreme, perhaps the vast majority of the financial industry as we know it (e.g. financial/investment advisers) is completely wrong.

Let’s take this one step at a time.

Categories: Financial Literacy | Comments (0) | Permalink