Questions about CMLViz Trade Machine (Part 2)

Posted by Mark on August 27, 2021 at 07:21 | Last modified: May 30, 2021 10:16Continuing from last time, this is a laundry list of questions, suggestions, and discussion ultimately aimed toward getting clarification about what the CMLViz Trade Machine PRO (TM) offers and what its limitations are.

In the 2019 presentation mentioned in Part 1, Ophir Gottlieb’s response to a question about forward testing is a curve-fitting alert. Someone asked if forward testing could be done and he responded:

> What is forward testing? If I knew the future then I’d certainly trade it (followed by laughter).

Forward testing is a form of OOS validation I described in paragraphs 2-3 here. One of my concerns about Gottlieb’s examples is the possibility of curve fitting to generate overly optimistic results. Remember: this is still a sales presentation.

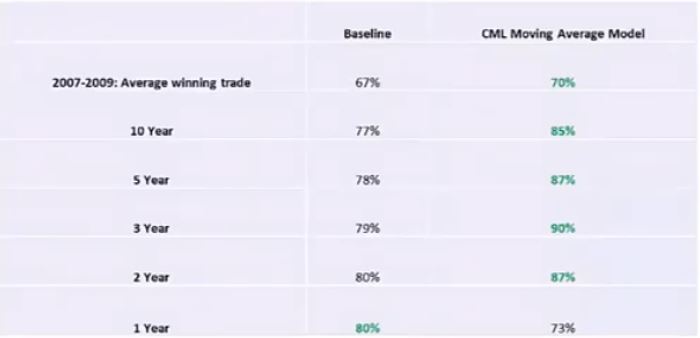

At one point, Gottlieb presents the table to follow. Is it susceptible to curve fitting?

Cherry picking this model over many others that did not show good performance would be duplicitous. I would like to know how many moving average (MA) models did not perform well. To screen out a spike in favor of plateau region (see last two paragraphs here, I would also like to know how MA models with similar parameter values perform.

Curve-fitting caution aside, the table suggests this model works better than baseline in most periods except recent history, which itself was still better than average baseline. I would like to see numbers of trades and, ideally, inferential statistics with correction for multiple comparisons (sixth paragraph here).

The ability to backtest strategies on S&P 500 stocks and to count how many meet customizable performance criteria would be interesting. This might be data mining, though, and unlikely to reveal persistent edges (it usually doesn’t).

Getting back to TM, I would like to be able to customize the trade statistics from a wider variety of potential calculations. What I saw in terms of output is not impressive:

Thinking off the top of my head, I would like to be able to include/exclude:

- Distribution of losses

- Maximum drawdown (MDD)

- Biggest/smallest winner/loser

- Max consecutive winners/losers

- Average days in trade

- Standard deviation (SD) for all, winning, and losing trades

- Average trade

- Average win : average loss ratio

- Profit factor

- Compound annualized growth rate

- PnL/contract-day

- Exposure %

- Risk-adjusted return (perhaps by MDD, SD, or exposure)

A complete listing of potential trade statistics is given in Part 1 and Part 2 of my Automated Backtester Research Plan.

I don’t think it should take a whole lot of programming to make a plethora of trade statistics available. Make us happy and let us play. Too much can never be offered in this area. I would say the same for “export to .csv” buttons: put them anywhere TM generates output because you never know when someone will want to do further processing (e.g. with spreadsheets).

I will finish up next time.

Categories: Backtesting | Comments (0) | PermalinkQuestions about CMLViz Trade Machine (Part 1)

Posted by Mark on August 19, 2021 at 06:54 | Last modified: May 30, 2021 09:50I recently saw a 2019 presentation on CMLViz Trade Machine PRO (TM) given by Ophir Gottlieb. The presentation is compelling, but I am not yet sold on this as my first automated backtester. Please excuse me in advance for the laundry list of questions, suggestions, and discussion that is to follow. More than anything else, I just want clarification about what the product offers and what its limitations are.

The presentation is ~75 minutes long and filled with examples that answer many questions. The backtest results are impressive, but I know better by now than to take impressive results at face value without establishing proper validation.

TM comes with a few technical analysis (TA) filters built-in. One viewer asked if this would be expanded. Gottlieb said the reason more TA indicators have not been added is because additional edge has not been found. While he will be looking to add, his criteria to do so are stringent. I found this answer to be very consistent with some of my writing on the subject.

As Gottlieb presents one technical setup I find very encouraging, I wondered whether customization is possible as discussed in the fifth paragraph here. A later screenshot shows this to be the case. Unfortunately, I don’t see that TA can be used for exits.

I wondered whether slippage and commissions are customizable. Slippage has three settings [none, market (natural pricing), or halfway between the two], which is acceptable. Ideally, I would like to also be able to customize slippage as a percentage and/or have dynamic slippage that increases with market speed. Commissions are customizable.

Although some examples showed impressive results, it’s unclear what the monthly fee includes. TM and CML Stock Research PRO are two separate products. The former includes some scans and write-ups, but the latter offers much more research. Gottlieb seems to have taken ideas from the latter as backtesting examples for this presentation, which deceptively makes TM seem more powerful than it actually is. I personally think Research PRO should be included for as much as TM costs.

Small sample sizes in the presentation limit generalizability of results that would otherwise be more meaningful. Many backtests were single stocks with few trades. No backtest of a single stock earnings trade over the last 2-3 years will ever qualify as a large sample size. Filtering entries to further cut down the number of trades is less than impressive.

Whether I can backtest the same strategy on a basket of stocks to increase sample size is discussed here. Part of me believes different people trade different stocks and drivers of one stock will not be drivers of another. Then again, perhaps the biggest money managers trade them all. Alternatively, if all stocks are in the S&P 500, then perhaps all overriding stock movements are dictated by traders of the index in the form of /ES or other tracking ETFs. Avoiding assumption is probably best practice.

I will continue next time.

Categories: Backtesting | Comments (0) | Permalink0 DTE Iron Condors (Part 3)

Posted by Mark on August 16, 2021 at 06:56 | Last modified: May 14, 2021 13:26I want to spend some time reviewing the second-to-last bullet point from Part 2.

As a future direction for research, I suggested comparing mean realized loss in excess of stop-loss trigger on either side to study directional edge on a more granular level. What exactly do I mean by that?

I wrote a blog post in 2017 that spells out many of the points I wish to make here.

When done properly, I believe backtesting can provide a good idea how a strategy will perform in real-time. Particular attention must be paid to ensure the plan can be backtested accurately (this blog mini-series explores such facets). A big limitation is data granularity. OptionNet Explorer (ONE) is good to offer 5-minute intraday market data for the last several years, but in live trading stop orders are monitored much more frequently (e.g. every three seconds).

The 0 DTE trade presentation suggested buy stop-market or buy stop-limit orders to mange risk. Once the stop is triggered, the stop-market order will be filled at the next available price. Since I may not like the fill if the market gaps big at that point, a buy stop-limit order may be used to avoid high prices. This becomes a limit order when triggered but will not fill if price gaps beyond the limit value. For example, “buy at 3.00 stop limit 3.30” will be triggered when price hits or exceeds 3.00 but will not offer more than 3.30. If the price sequence is “2.90, 2.95, 2.98, 3.50,” then this stop-limit order will not fill.

ONE does not provide intrabar data, which would be necessary to determine if/when during the period a stop order would get filled. We can see the open, high, low, and close for each period, but we don’t know the sequence of prices in between. We must therefore look at the open or close (be consistent) to make that determination. As five minutes is 100x longer than three seconds, results from backtesting may differ significantly from live trading where stops are used because the market has much more time to run past the stop.

Whether such deviation is good or bad is discussed in the blog post linked above. Today I just highlight the difference.

If I am developing a strategy through backtesting, then I must trade like I backtest to get similar results: 5-minute monitoring of opens/closes and no stop-market/stop-limit orders.

From the top I mentioned the suggestion to compare summed excess losses between put and call sides. Over six months, I found a roughly equal number of losses on each side. If one side therefore generates a much larger excess loss than the other, then perhaps that side would make for a better trade in real-time since stops would mitigate the excess losses.

I now retract this suggestion for two reasons. First, I do not have a PnL comparison between call/put credit spreads since I backtested both together as IC’s. Second, if I don’t trade like I backtest then even comparing excess loss in a credit-spread backtest will not be meaningful because additional trades stopped out in live trading will not be reflected.

Categories: Backtesting | Comments (0) | Permalink0 DTE Iron Condors (Part 2)

Posted by Mark on August 13, 2021 at 04:55 | Last modified: May 12, 2021 14:21Last time, I detailed backtesting for an intraday option strategy I recently viewed online. Today I will discuss results.

The initial backtest covers every trading day from 12/30/2020 through 5/10/2021: 89 trades total. This is a relatively small sample size studied over a limited time interval.

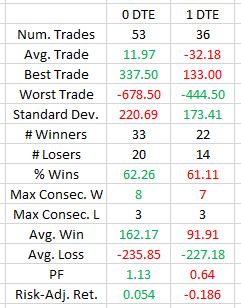

Over this period, the average trade is -$5.90 with a standard deviation of $203. The largest winner (loser) is $338 (-$679). 62% of trades are winners, but the average win (loss) is $134 (-$232). The maximum number of consecutive wins (losses) is 7 (5). Profit factor (PF) clocks in at 0.93.

An inauspicious beginning…

Remember from Part 1 that 0 DTE trades are different from 1 DTE trades. 1 DTE trades take place on Tuesdays and Thursdays. Despite the theoretical consideration given last time, one thing we know for sure is they cannot experience near-100% decay as intraday trades. Comparing the two:

With three days per week instead of two, the number of trades is expectedly larger for 0 DTE. While winning percentage is about the same, average trade and PF both show 0 DTE trades to be profitable whereas 1 DTE trades are not. With a larger sample size, I would perform hypothesis testing to verify statistical significance.

While 0 DTE trades seem to be better than 1 DTE, a PF of 1.13 implies only the slightest of edge. Kudos to me for including (some would say liberally) transaction fees (see third-to-last paragraph here), but average trade (just slightly ahead of commissions + exchange fees) is still close to a serious debacle being barely positive over a short period.

Although this is an IC backtest, I can still extract some information about vertical spreads.

Vertical spreads have a greater probability of profit than iron condors (IC). Theoretically at expiration, a 10-delta IC has ~80% probability of profit while a 10-delta put or call credit spread has ~90% probability of profit. As a potential tradeoff, the credit received for constant-delta verticals will be less because only one side is sold. Risk will be roughly equal since spread width is determined the same way for verticals and ICs.

I would expect more trades to be stopped out on the call than put side for two reasons. First, the market generally has an upward bias. Second, same-delta options are NTM in terms of points (or percentage of underlying) on the call versus put side as a result of vertical skew. Altogether, 16 (18) trades are stopped out on the put (call) sides. For 0 DTE, nine (11) trades are stopped out on the put (call) sides. For 1 DTE, seven trades each are stopped out on either side.

Despite a small sample size, these are balanced distributions offering no hint that trading just the puts or calls should be more advantageous than the other.

And based on PF, it’s hard for me to be overly encouraged by any of these short-term trades.

Potential directions for further study include:

- Selling farther OTM (e.g. NTM option with delta 5 or less) to decrease frequency of stop-loss (SL)

- Selling farthest OTM over threshold premium to normalize influence of any single trade on the average trade

- Selling naked shorts rather than spreads, which limit margin exposure at the cost of long-option premium

- Varying the SL trigger from 3x to 4x, 5x, 2x, or 1.5x

- Comparing mean realized loss in excess of SL trigger on either side to study directional edge on a more granular level

- Backtesting a longer time interval and/or different market environments Categories: Backtesting | Comments (0) | Permalink

0 DTE Iron Condors (Part 1)

Posted by Mark on August 10, 2021 at 07:43 | Last modified: May 11, 2021 13:38I recently viewed a webinar on 0 DTE credit spreads and iron condors (IC) that I found quite enticing. Today I will present my backtesting approach to studying this strategy.

Why did the presentation pique my interest?

- 75-85% winners

- Available discretion with regard to stop-loss and exit (mechanical or mental)

- Tradeable mechanically from the [near] open or using discretion to determine market direction before selecting side(s)

- Subscription software available for $250/month providing built-in indicators capable of improving success rate to 90-95%

Promises of your run-of-the-mill Holy Grail, pretty much: gently disguised, perhaps.

I conducted the backtest in OptionNet Explorer (ONE) as follows:

- At 9:40 AM, open one contract IC in front expiration (monthly expiration on Th with 1 DTE else Weeklys 0-1 DTE).

- Sell short put at 5-10 delta to receive at least $0.75 – $0.90 (opt for closer to 10 delta on Tu/Th).

- Sell short call at 5-10 delta to receive at least $0.60 (opt for closer to 10 delta on Tu/Th).

- Buy long put and long call at the NTM strike available for $0.05 or 50 points away from short strike (use NTM strike when multiple options are displayed with identical premium).

- For opening trade, assess transaction fee of $11 for premium approaching/exceeding $1.00 or $6 otherwise.

- If intraday distribution of PnL (graphically displayed in ONE!) mostly in the center then allow to expire worthless unless check of intraday high or low (pne click each in ONE) reveals breach of max loss threshold.

- Max loss for a vertical spread is 2x initial credit received for the short option: short option premium * 3.

- At the earliest 5-minute increment when premium exceeds net loss, close the distressed vertical spread leaving long option only if priced at $0.05 or less.

- For closing trades, assess transaction fee as follows: $21 for losers priced over $5.00 in a fast-moving market, $11 when priced between $0.80 – $5.00, or $6 otherwise.

- Any remaining options DOTM at 3:55 PM may be allowed to expire worthless by closing for zero cost.*

- BTC any remaining options at 3:55 PM per transaction fee guidelines described.

I try to follow presented guidelines presented, but some details are left vague. 5-10 delta is vague (the presentation mentioned “under 5 delta” or “under 10 delta”). Defining transaction cost to account for slippage is vague (but present, which I don’t believe was the case in the presentation. See second paragraph here). 0-1 DTE is vague compared to only 0 DTE. If the trade is robust and not just good marketing, then these specifics should not matter over a large sample size of trades.

The biggest deviation from presented guidelines is inclusion of Tu/Th trades. The presentation focused on 0 DTE. 100% decay is only possible for these. The Tu/Th trades decay up to ~50-70% even when DOTM with 1 DTE. I therefore tried to get a bit more premium by opening these trades closer to 10 delta. The risk to selling NTM is a lower winning percentage, but shouldn’t that be offset by the additional DTE to keep shorts farther OTM? All trades lasted exactly one day, which in theory should normalize magnitude of market movement. Whether a better control exists may be an empirical question, but always remember past performance is no guarantee of future results.

I will continue next time.

* — An Expire Options button to do so with two clicks (including confirmation) would be a nice software addition.

Debunking the Williams Hedge (Part 3)

Posted by Mark on July 30, 2021 at 07:01 | Last modified: June 7, 2021 14:39Today I will continue discussion of the Williams Hedge (WH), which I introduced here.

I mentioned in Part 2 that I would check with OptionNet Explorer (ONE) Support about the IV calculation. He called it a proprietary approximation using option prices “similar but not identical to the VIX style calculation.” That’s all I need to know.

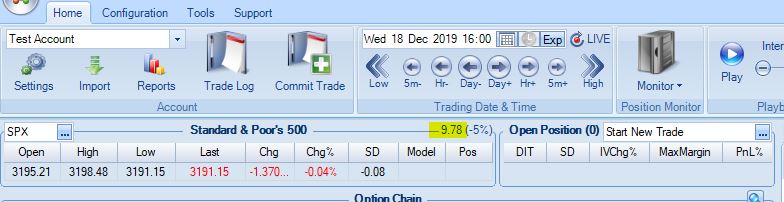

IV % Chg, surprisingly, seems to be a bigger puzzle. ONE Support says this is calculated off the official closing price. As an example, here is a closing screenshot:

Here is the next day at 3:55 PM:

9.78 to 6.39 is a 34.7% decrease yet ONE shows -39%. In case it takes a few minutes for prices to settle to get the official close, I can calculate based on the previous day’s 4:05 PM (9.76) and 4:10 PM (9.79) values. These correspond to IV decreases of 34.5% and 34.7% decreases, respectively. Where does the -39% come from?

I am fine with vendors citing “proprietary methods” in lieu of answering my questions as long as I know what the metric means and that it is consistently calculated. As a basic math fact, percent change is not proprietary and defines one particular correct answer that is not seen above. We still need some clarification.

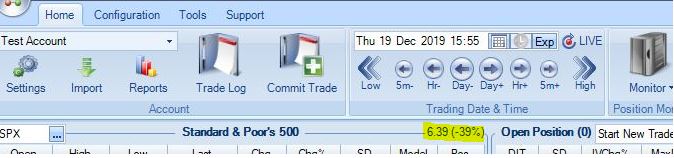

Speaking of inconsistency, I came back after lunch, powered up the computer, and launched ONE again only to see this displayed for the next day at 3:55 PM:

The 9.32 here is much different than the 6.39 seen above. The percent change is also wrong (should be -5%). I still need clarification.

Let’s get back to talking about the WH itself.

Remember the PCS is long-dated while the long puts are short-dated. When the long puts expire, the PCS will remain uncovered. For example, if the PCS average 90 DTE and the long puts average 48 DTE, then vertical spread risk will remain for six weeks (42 days) after the long puts expire. Strategy guidelines dictate closing the verticals for $0.10 when available. Suppose the spreads may be closed for $0.10 with three weeks to expiration. This leaves us uncovered for 90 – (48 + 21) = 21 days or three weeks. During that time, we will have three uncovered PCS tranches. With 10 contracts, this is a potential gross risk of $300K for 100-point vertical spreads.*

The strategy makes no provisions for PCS that go ITM and potentially expire ITM. Theoretically, this is okay assuming the long puts have exploded in value. I did not see this occur in the backtest, though. Why?

The WH video points out that when the market crashes, horizontal term structure can go from contango to backwardation. Aside from negative delta, this contributes to an explosion in long put premium. What is good for puts already purchased in the campaign is bad for puts still to be purchased as a campaign. In order to continue finding high IV puts for $0.45 or less, we will need to go closer and closer to expiration.

I will continue the discussion next time.

* — This was my width for the backtest. I could have gone 75 points wide, which would have

forced selling PCS NTM to recoup the extra cost.

Debunking the Williams Hedge (Part 2)

Posted by Mark on July 27, 2021 at 07:04 | Last modified: June 4, 2021 11:52Today I continue discussion of the Williams Hedge (WH) and my backtesting.

Let me address one technicality with regard to SPX IV. When people think about implied volatility for SPX, they usually think of VIX. Look at the screenshot below from OptionNet Explorer (ONE):

As seen in the Part 1 table, this number is 97.33 and 102.89 on 3/12/20 and 3/16/20, respectively. This website says the highest closing VIX ever recorded was 82.69 on 3/16/20, which therefore means the highlighted number can’t be VIX. Granted, I use data from 3:55 PM rather than the close for this backtest, but I find it hard to believe VIX could come down 20 points in five minutes. Until told otherwise, I am therefore calling the highlighted number “SPX IV” (probably calculated via proprietary ONE algorithm) rather than “VIX.” I will contact ONE Support to get a more complete explanation (also on what the percent change is based because 4:00 PM the previous day is not correct).

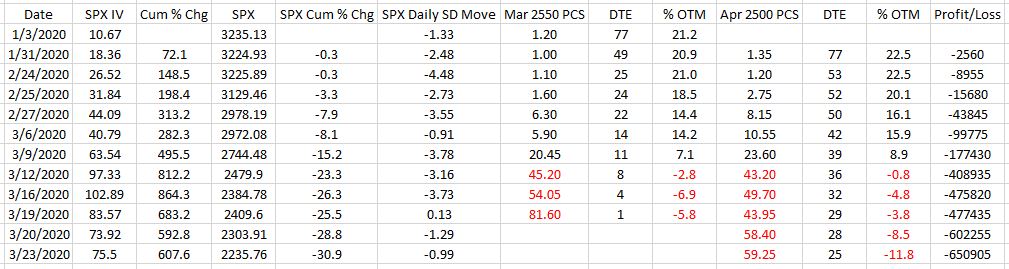

The Part 1 table says the WH performed miserably through the March 2020 market crash. Backtrading 10 contracts weekly of this strategy lands us down $650K on 3/23/20!

Per usual, I tried to backtest realistically by using values only 20% of the range from natural to midprice. While most backtesting chooses to ignore it, slippage is a reality of trading. We do not want to be the camp described in this second paragraph, else we’re probably better off finding a different strategy altogether. As you can imagine, when the market speeds up the spreads widen and I sometimes had to go nearer to the money to make sure I got requisite PCS net credit. As a single, inexpensive ($0.45) leg, buying the extra long is not affected by this so much.

We know when the market crashes, the PCS are going to “get killed.” This is explained in the WH video series and can certainly be seen in the table. The PCS studied started 20.9% and 22.5% OTM, which was not enough distance to keep them safe.

The video says when the PCS gets killed, the long puts will explode to cover them; this is where I run into problems. I sell a PCS every week (risk) and I buy two additional long puts (insurance) as well. This makes the position seem safe. One put is a 7 DTE teeny that serves only to keep T+0 elevated (saving portfolio margin). Even without the teeny, the second put leaves us net long contracts. What could possibly go wrong?

You sleep on that, and I will continue the discussion next time.

Categories: Backtesting | Comments (0) | PermalinkDebunking the Williams Hedge (Part 1)

Posted by Mark on July 22, 2021 at 06:41 | Last modified: June 10, 2021 14:21One does not have to look far to find trading courses (or systems) for sale. The advertising pitches are as long as the Mississippi River (or a CVS receipt, at least). I have written about this here and in the second-to-last paragraph here. Today I am going to give a real example of why you might want to avoid purchase of vendor strategies without testing them yourself.*

Submitted for your approval: the case of one Williams Hedge (WH). With name changed to protect the innocent, this is an option hedging strategy sold for ~$300 by a company formed in 2016. The description reads:

> The WH is designed to be a costless way to add crash protection…

> this trade will not help in mild corrective markets… this trade

> will kick in hard in a crash and offer profit to offset losses as

> well as significant margin boost to counteract exploding margin

> requirements and forced liquidations at inopportune times.

>

> [Our company is] an alternative to the hundreds of websites offering…

> index [ICs advertising] 5-10% every month without mention of the

> occasional 80% loss… [the WH is] different… adaptable, robust,

> tested… [we] backtest the idea and rules, then vet the trade plan

> through a small team to tear it apart, then backtest it some more,

> and then create a course for it while we trade it live, and then we

> launch. If it doesn’t perform to spec, we scrap it.

Sounds pretty solid, right?

The WH strategy includes:

- Long-dated put credit spread (PCS) sold for around $0.60

- Short-dated long put (LP) at short PCS strike for $0.45 or less

- 7 DTE teenie for $0.05 as margin control

- Rinse and repeat every week

The video says the far-dated PCS is going to get killed in a market crash while the near-dated LP will explode to offset losses and then some. Gains on the PCS won’t be realized until it closes. During market declines, the overall position will drawdown due to unrealized PCS losses but will recover by expiration assuming the PCS remains OTM.

Parental discretion is advised for the following:

This is an ~32% loss in the S&P 500 (SPX) index in one month. We have isolated a true Black Swan in its natural habitat.

What you are about to see is nothing short of phenomenal:

The second row of the table corresponds to the red arrow and highlighting on the chart. The Cum(ulative) % Chg columns use this row as base values for SPX IV and SPX. The three columns of PCS data are spread price, days to expiration, and moneyness. Red values indicate ITM spreads.

I really needed to immerse myself in these numbers for a while to get a good sense of what I’m looking at. SPX falls 30.9% while IV increases ~608%. SPX down 59 points (-1.79%) on 1/31/20 is a 2.48 SD selloff while the 106-point selloff (-4.38%) on 3/20/20 is only 1.29 SD. Realize we’re dealing with IV ~11 in the former case and IV ~74 in the latter.

I will continue next time.

* — See what I did there? Even after payment, many vendors will not be transparent with the

strategy (or coding) much less let you test all the rules yourself. You certainly won’t be

able to fully backtest a strategy before paying for it.

Call Me Crazy (Part 9)

Posted by Mark on July 13, 2021 at 07:33 | Last modified: May 27, 2021 14:05Today I finish up tying together loose ends with regard to the long call (LC) backtest.

In the bulleted list here, I suggest we might vary the DTE/DIT ratio. The current backtest holds two-year LEAPS for one year. What if I hold for 18 months? What if I buy 18 months out and hold for one year (plus one day)? Holding longer keeps the number of transactions as well as taxes down (LTCG but please consult a tax advisor as I am not a CPA and do not know your individual situation). One tradeoff is time decay, which increases as the LC gets closer to expiration.

One way to get more data points in the backtest is to buy a shorter-dated LC and hold closer to expiration. The original backtest has only 15 data points using two-year LEAPS. Alternatively, I could buy the LC one (two) month(s) to expiration and roll after three (six) weeks, for example. Many permutations are possible and what I would ideally like to see for a robust strategy is most to be profitable with superior risk-adjusted returns (especially in lieu of accelerated time decay).

Holding the LC longer when the market has declined can improve risk-adjusted return. LCs would be held for varying durations depending on underlying share performance. For a multi-year down market, this idea really seems attractive because a max loss could only be realized every two years rather than every year. Thinking about 2008-9 in the original backtest, maximum drawdown (MDD) would have been closer to 20% than the 32% seen in the enhanced data set.

When doing this “mental stress testing,” always think about the pros and cons of different tweaks. Holding the LC for longer lowers MDD in an extended downturn at the cost of slower profit after upside reversal. The unrolled LC expires worthless if the underlying fails to reclaim the strike price by expiration whereas the rolled LC profits earlier despite a larger MDD.

Also when doing “mental stress testing,” be aware that small sample sizes are very susceptible to curve fitting. We can imagine specific historical periods and forecast hypothetical performance, but when broken down into metrics (e.g. severity, duration, volatility change), each DD period is unique and small sample sizes are not to be generalized (see second-to-last paragraph here for fallacy of the well-chosen example). In the end, the best answer may be to skip the backtesting altogether and do what feels right because aborting a trading plan midstream is a good way to lose money and make us not want to look back.

Is rolling the LC up a low-probability trade and therefore something to avoid? This is effectively a bear call credit spread. Stocks have an upward bias while a call credit spread is bearish/neutral. Failure to roll would result in a more expensive LC over time. Perhaps fewer contracts could eventually be implemented to [somewhat] smooth out asset allocation.

Sticking with the same theme, rolling the LC down—effectively a bull call spread—should be a high-probability trade. This suggests we roll down when the market tanks and hold the strike as it soars. I tend to agree that when rallying, we want the LC to mimic stock. If we don’t roll, though, then we can’t get downside protection. I’m not sure how to rectify that.

The challenge with investing may not be figuring out the right or wrong strategy as much as determining the pros and cons of each and making educated choices from there.

Despite the benefits, one disadvantage to the LC is losing money if the underlying is flattish to down. This sounds like good reason to try lowering its cost basis, which is where I will head going forward.

Categories: Backtesting | Comments (0) | PermalinkCall Me Crazy (Part 6)

Posted by Mark on June 21, 2021 at 06:58 | Last modified: May 24, 2021 09:55I left off talking about RAR by PMDD. As impressive as this is in favor of the long call (LC) over stock shares, let’s consider the possibility that exposure isn’t everything.

Although a big difference exists between what is probable and what is possible, suitability standards for wealth management are based on the latter. The S&P 500 has never gone to zero* and I can hardly imagine a scenario where this happens in a sustainable society (I have seen fearmongers, omnipresent in the financial media, include Purge-like dystopias as part of their portrayal). Nevertheless, the possibility exists and risk models must respect it. We would otherwise be left to debate reasonable levels for maximum loss. Opinions on this differ and should we be wrong [likely, since “your worst drawdown is always ahead of you” (see third-to-last paragraph here)], the result could be tantamount to a true financial apocalypse.

[Deleveraged] Investing with insurance means we survive the worst. I’ve been in the trading trenches for the last 12+ years. Most of the time, things go smoothly. When markets get rocky, fear and stress mount fast. To have the confidence my portfolio will remain [healthy] even in the face of a total stock market collapse represents an enormous sense of security. Most substantial investors would feel the same way.

Backtesting the LC through the Great Recession appears quite encouraging.

Can we imagine a case where the strategy falters?

Consider how the LC fares in down markets. On the upside, the LC faces a performance drag in terms of upfront cost. An ATM (slightly OTM, actually) LC will expire worthless if the market does not go up. In the backtest, I purchased LEAPS two years to expiration and rolled after one. The market is marginally higher in two of the 14+ backtested years and only down in three. Is it true that overall, the LC fares better because most down years are small and/or because the LC retains most of its premium being closed with a full year left until expiration?

The second and fourth columns show % ROI for SPX share and LC accounts, respectively. The third column shows % ROI for the LC itself. Here are some observations:

- LC is battered and bruised in 2008 despite performing much better than the shares.

- LC underperformance during other four years averages 2.99% (not insignificant).

- LC average cost across all 15 periods (last being a partial year) is 16.10% (of account value).

- LC loses substantial value over first year in trade although hit to the entire account is less.

That final point has a lot to do with leverage. I have been enchanted by the limited exposure—how much firepowder remains dry—when investing with LCs. For a $100,000 account, every year offers the tempting opportunity to purchase up to 4 – 5 contracts. The last column increases proportionally to number of contracts, though. This is an ever-present threat.

I will continue next time.

* — SPX pulled back 57% from its all-time 2007 high by March 2009: the worst bear market

many of us have ever experienced, but a far cry from total 100% loss.