2012 Performance Evaluation (Part 5)

Posted by Mark on February 15, 2013 at 06:13 | Last modified: February 8, 2013 06:32As my own boss, I am conducting an annual review in this series of blog posts. In http://www.optionfanatic.com/2013/02/14/2012-performance-evaluation-part-4/, I continued with evaluation of 2010 and 2011. I now want to spend some additional time focusing on 2011.

As mentioned, 2011 was the fourth time I had been forced to exit positions turned against me because of excessively large position sizing. In previous years, I escaped with relatively modest losses. In 2011, however, my maximum drawdown (MDD) exceeded 50%. That is entirely unacceptable when trading other people’s money, which is one reason why I don’t, but also unacceptable when trading my own. I’m running a business here and losing that much money is the fast track to going “belly up.”

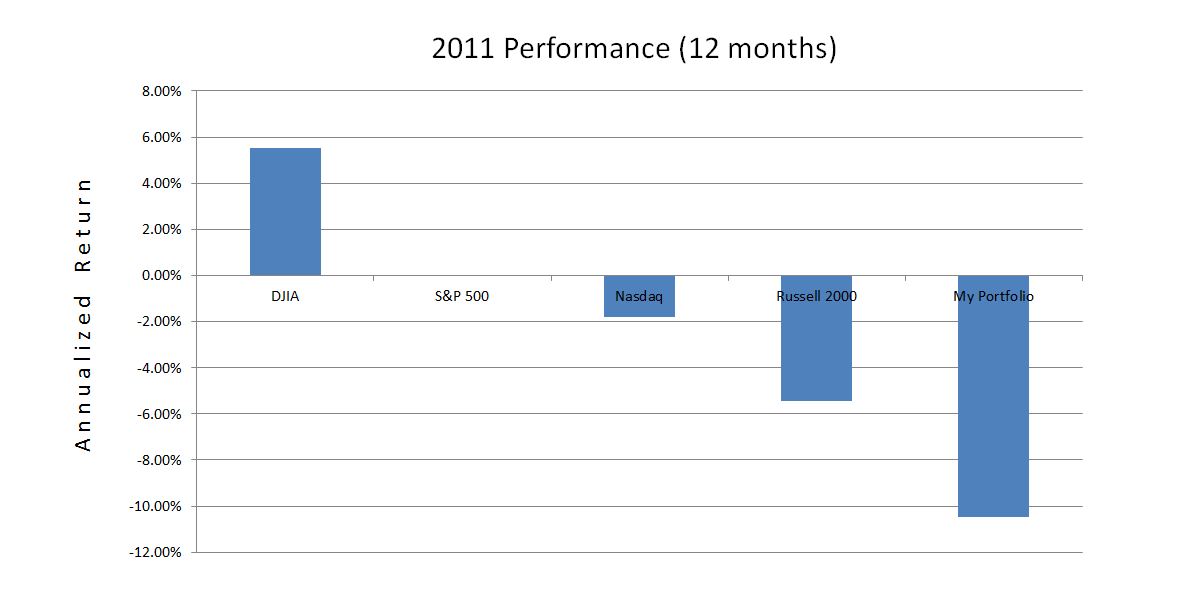

2011 was the third consecutive year of underperformance relative to the major indices. Despite the ugly MDD, I managed a 42.5% rebound from the year’s low, which landed me down “only” 10.5% for the year. I’m probably still standing for this reason alone.

In an attempt to turn things around, I have attempted to implement two major changes. First, I have resolved to avoid trading until after 3:30 PM. On too many days, I got scared by seeing strong market moves in one direction early only to see those moves reverse by day’s end. Usually when I made a trade earlier in the day I was smacking myself at the close wondering why I wasn’t more patient. This is overtrading and it may be labeled as such only in retrospect.

To facilitate this end-of-day approach, on many trading days since summer 2011 I have not even looked at the market until 3:30 PM. Over the next 15 minutes I typically catch up with the market’s intraday movement and then place trades (if necessary) at 3:50 PM or later. This has helped me be less reactive to random noise responsible for so much market activity.

I will continue this analysis in my next post.

Categories: Accountability | Comments (1) | Permalink2012 Performance Evaluation (Part 4)

Posted by Mark on February 14, 2013 at 05:34 | Last modified: February 7, 2013 13:12In the last few posts, I have been conducting my 2012 annual review. In the future, this will take only a day or two. Since I have never blogged about it before, however, this time I am reviewing back to inception. I reviewed 2008 and 2009 in http://www.optionfanatic.com/2013/02/13/2012-performance-evaluation-part-3/. Today I will continue with 2010-11.

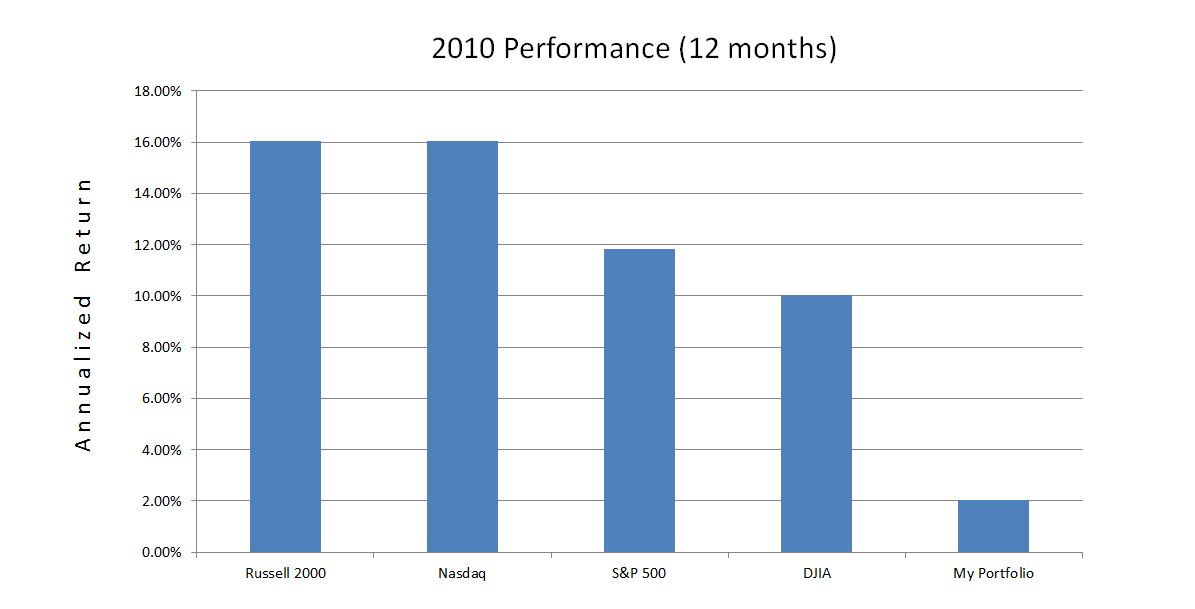

By the numbers, 2010 went like this:

May 6, 2010, was the infamous Flash Crash where the DJIA dropped over 1000 points in one hour. May capped my MDD for the year of 20.5%. In the last post, I said this would be an acceptable annual MDD if it never got any worse. The largest MDD seen in the major indices for 2010 was 13.9% (Russell 2000), though. That makes my MDD seem a bit less heartening.

As market volatility soared from April to May of 2010, my portfolio hemorrhaged cash. The psychic pain became too much to bear on May 6, when I closed the last of my long positions. This may sound familiar because it is: a third time being caught trading too large. As is often the case when trading too large, I was forced out at the absolute worst time (MDD).

2011 was very similar to 2010:

Again, this year brought a more severe mid-year market crash (Russell 2000 down 24.3% in 2011 vs. 17.1% in 2010 over roughly a 1-month time period), albeit without the magnitude of volatility increase seen during the Flash Crash (volatility spiked 65.2% in 2011 vs. 172% in 2010 over roughly a 1-month time period). I was camping at the time (with my laptop), and was caught with my pants down carrying too large a position for–what time is this? 2007, 2009, 2010… oh yeah, the FOURTH time. In prior posts, I have said that a 20% maximum drawdown (MDD) from one year to the next would be acceptable to me. In 2011, my MDD was 50.1%. Contrast this with the largest broad based index MDD of 25.6% and you have a recipe for disaster.

The analysis will continue with my next post.

Categories: Accountability | Comments (1) | Permalink2012 Performance Evaluation (Part 3)

Posted by Mark on February 13, 2013 at 04:30 | Last modified: February 7, 2013 05:24This blog series represents my 2012 annual review. In http://www.optionfanatic.com/2013/02/12/2012-performance-evaluation-part-2/, I discussed my performance through 2007.

2008 was my introduction to full-time trading. Faced with a market in correction, I traded much of the year with reduced position size:

This was not a cakewalk as my maximum drawdown (MDD) hit 20.9% in March. While discomforting, if this were the worst MDD ever encountered on a year-to-year basis then I would be content.

My MDD was only about half that seen in the major indices. I capitalized on much of the October-November tumble by purchasing put spreads. I remember spending hours in front of the screen with my mouth propped open as I watched the horror of a market in free fall. I felt bad for those who could only watch big retirement savings fly out the window from one day to the next because “buy and hold” was the mantra espoused by the financial industry for years and years.

My good fortune reversed in 2009:

What killed me in 2009 was a 27.7% MDD, which occurred in the span of two months. This was another case of trading too large and being caught with my pants down when the market made its third and final thrust lower. I traded small for the remainder of the year as I reassessed my trading plan.

In retrospect, what frustrates me is the need to experience this lesson multiple times before I learn it. My first lesson was in 2007 when a couple sharp selloffs turned my huge, long positions against me. In 2009, I saw this happen once again.

I will continue the analysis in my next post.

Categories: Accountability | Comments (1) | Permalink2012 Performance Evaluation (Part 2)

Posted by Mark on February 12, 2013 at 06:50 | Last modified: February 6, 2013 16:25In the absence of co-workers and a boss, the biggest reason I maintain this blog is to keep myself accountable. To that end, I presented equity curves of my performance since inception (2001) in http://www.optionfanatic.com/2013/02/11/2012-performance-evaluation-part-1/. The current blog series represents my annual performance review and a tool to tweak my trading plan, if necessary, to stay on track with long-term goals.

Because my time commitment and overall approach have been highly variable over the last 11+ years, I will not try to make generalizations about the whole. This would be like comparing apples to oranges.

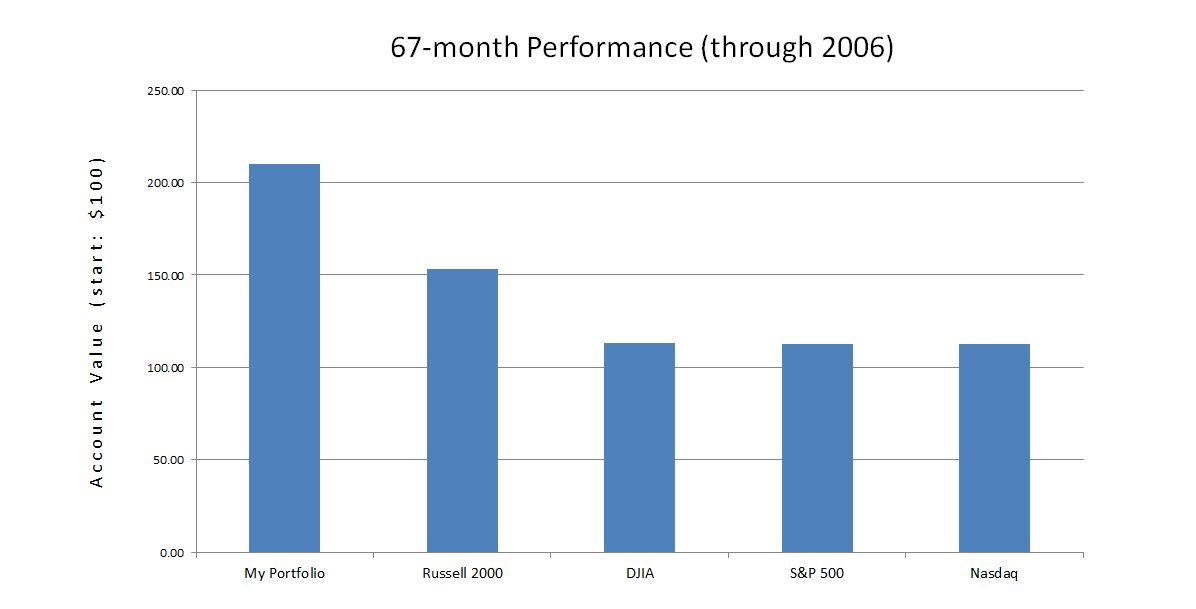

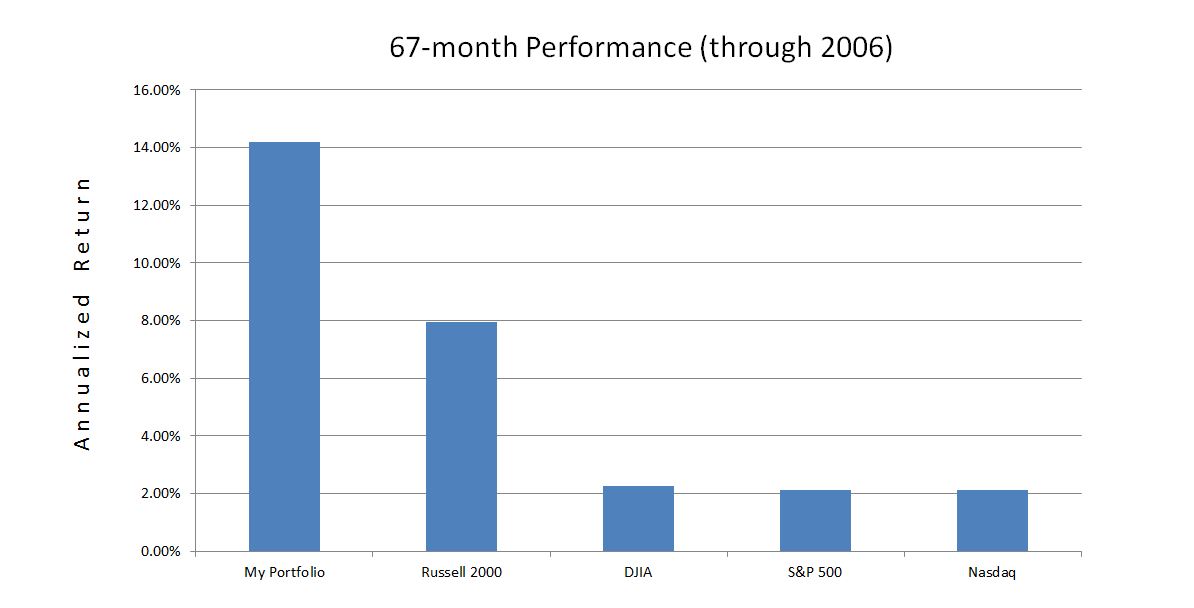

From June 2001 through the end of 2006, I worked full-time in pharmacy. My investment plan included a set of stock screens that I ran on a monthly basis. My net return during these years is shown below:

These years included sharp selloffs during 9/11 (2001) and 2002 along with bull market conditions in 2003 and 2004-2006. The maximum drawdown, faced only five months into my investing career, was 32%: larger than that seen by the Russell 2000 and DJIA indices. In the end, I did manage to outperform the Russell 2000 by 6.2% per year and the other three indices by about 12% annually.

In 2007, I started trading options in earnest. I was up 36% for the first five months of the year vs. the leading index (Russell 2000), which was up only 6%. By year’s end, I gave back all these profits and more. In the process, I learned an important lesson about luck. Because good luck may sour, being in a position to limit losses when the market turns against me is more important than being able to make money when the market goes my way. This is good risk management that is essential for success because the degree of loss will usually outpace the degree of gain when all other factors remain equal.

I will continue this analysis in my next post.

Categories: Accountability | Comments (1) | Permalink2012 Performance Evaluation (Part 1)

Posted by Mark on February 11, 2013 at 09:44 | Last modified: February 4, 2013 12:31The main reason I maintain this web site is to keep myself on task with what I want to do. Starting from the “ground up,” system development has been very difficult for me. Without co-workers, it would be easy to give it up and do something else. The web site keeps me accountable.

Along these lines, I want to spend some time focusing on performance to make sure I remain on course in pursuit of personal goals. Getting focused on small details and losing sight of the big picture is very easy to do when you don’t have to check in with bosses and supervisors. I will report here.

As a brief review, I took over the investing for my personal account in mid-2001. In 2008 I resigned from Pharmacy and began life as a full-time trader. My investing/trading approach has changed much over the years and that is important for the here-and-now. With the performance statistics now updated through January 2013, though, I wish to first spend some time looking at the entire history.

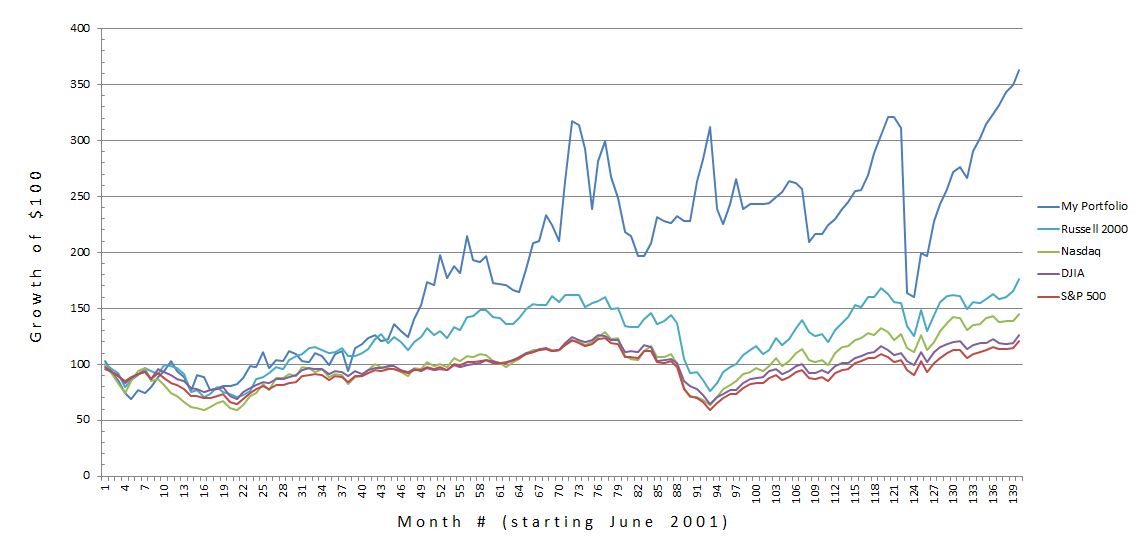

Below is a graph of my total performance to date. I have set the starting account value to be $100. The first graph is plotted with linear scaling:

Since linear scaling can sometimes be misleading, below I show the same data with logarithmic scaling. Note here that identical percent changes traverse the same distance along the y-axis:

In my next post, I will begin to analyze and to discuss these data.

Categories: Accountability | Comments (3) | PermalinkBlog Reset (Part 1)

Posted by Mark on September 12, 2012 at 06:27 | Last modified: February 13, 2013 05:16The goal for trading is consistent profitability over time. I don’t feel I can stress that enough.

My last post is dated July 1. I actually deleted my last post on an NDX butterfly backtest because it ended up being unprofitable for the first few years and was not worth pursuing further. That leaves me 29 posts behind through September 8 (last week).

Let’s try to get that back, shall we?

Going forward, I’m going to spend a great deal of time talking about backtesting directional trading systems. This is currently my main focus. The aim is to find strategies that were profitable in the past to formulate into systems to trade with shares or options (liquidity providing). System #1 will be relatively simple but will illustrate critical elements of the process.

Categories: Accountability | Comments (1) | PermalinkTrading System Development Group

Posted by Mark on April 3, 2012 at 22:19 | Last modified: April 12, 2012 10:00I’m looking to form a small group of traders working together to develop trading systems. This group is for a very specific type of trader. You should:

–Be knowledgeable about trading strategies.

–Understand why a trading strategy does not necessarily make for a trading system.

–Be practiced at critical thinking.

–Have experience working in groups.

–Be willing to purchase AmiBroker (www.amibroker.com) and data as desired.

–Have AFL programming expertise and/or be willing to spend time learning the language.

–Have multiple trading strategies available to be systematically tested by the group.

–Have hours available every trading day for project-related phone calls and e-mails.

–Not think this will be a place to steal profitable ideas without contributing your own.

–Not be looking to enroll our members in your educational company or investing service.

–Have a general understanding of what system development entails.

Interested? Please send e-mail to: mark@optionfanatic.com .

Tags: mastermind trading group | Categories: Accountability | Comments (0) | PermalinkCurtis Faith on Accountability

Posted by Mark on March 11, 2012 at 06:46 | Last modified: March 10, 2012 08:28As mentioned yesterday in my post “Words to Profit By” (http://www.optionfanatic.com/2012/03/10/words-to-profit-by/), just because this may sound good does not make it relevant. Give it some thought to see if it might apply to you:

“The idea that Rich had left out some key ideas was the easiest way for our paranoid Turtle to explain his inability to trade successfully during the program. This is a common problem in trading and in life. Many people blame their failure on others or on circumstances outside their control. They fail and then blame everyone but themselves. Inability to take responsibility for one’s own actions and their consequences is probably the single most significant factor leading to failure…

Trading is a good way to break that habit. In the end, it is only you and the markets. You cannot hide from the markets. If you trade well, over the long run you will see good results. If you trade poorly, over the long run you will lose money…

The bottom line is that you make the trades and you are responsible for the outcome. Don’t blame anyone else for giving you bad advice or withholding secrets from you. If you screw up and do something stupid, learn from that mistake, don’t pretend you didn’t make it. Then go figure out a way to avoid making that same mistake in the future…

Blaming others for your mistakes is a sure way to lose.”

–From Way of the Turtle (McGraw-Hill, 2007)

Tags: critical thinking | Categories: Accountability, Wisdom | Comments (0) | PermalinkHow to Learn Trading’s Best Kept Secret

Posted by Mark on March 8, 2012 at 08:56 | Last modified: March 8, 2012 08:58Consistent profits through trading may be facilitated by a good piece of [backtesting] software. Last week, I posted about a free on-line trading group I’m trying to form targeted toward learning the basics of AmiBroker (please see http://www.optionfanatic.com/2012/03/01/tradings-best-kept-secret/ ).

I feel strongly about participation with this group. Except for the programmers and people with a heavy quant background, you’re not going to learn AmiBroker (AB) by casually opening the program once or twice a week and fiddling around for 10-15 minutes at a time (I speak from unfortunate experience). Going forward, what I really want to do is take some time every single trading day to work with AB. I’m better able to do this alongside others seeking to achieve similar goals.

I expect those of us in the group to post regularly and to really make it clear that we are doing the work to learn the program, develop our skills, and become better system developers and/or traders.

I don’t think it necessary to be a full-time trader to make this commitment. If you have a day job, kids, and family, then I understand life can get quite busy. I do believe that if you’re going to learn AB then you need to set aside some time on a very regular basis. If you can’t do that then perhaps something more user-friendly like Metastock or TC2000 would be a better fit.

Lurkers can hang out in the AmiBroker User’s List where plenty of experts already contribute their time at a level far too advanced for most newbies.

Lurking is not the way to proficiency. I don’t want lurkers in the beginners’ group.

Tags: AmiBroker | Categories: Accountability, Trading Software | Comments (0) | PermalinkGlobal Disclaimer

Posted by Mark on March 5, 2012 at 15:57 | Last modified: March 15, 2012 11:46From options trading to futures trading to stocks and hypothetical results of proposed trading systems, I intend to show many things on this blog.

Everything presented on this web site is intended for educational purposes only. I am neither licensed nor registered as a financial adviser; nothing here should be construed as personalized financial advice. I have also added a Page accessible from the sidebar to reinforce this.

Options, futures, commodities, equity, and foreign exchange trading involves substantial risk that all traders should fully understand before committing real capital to the markets through live trading.

With regard to any backtesting results I will present in this blog, please understand that no representation is being made that any account will or is likely to achieve profits or losses similar to those presented here. For numerous reasons, actual trading results can differ substantially from those seen in backtesting. Please understand that hypothetical backtesting performance results are generally prepared with the benefit of hindsight and without financial risk. No backtesting record can completely account for the impact of financial risk on actual trading activity. As an example, emotional pain due to intratrade drawdown often forces traders to deviate from their planned trading strategy.

Categories: Accountability | Comments (0) | Permalink