RUT Weekly Calendar Trade #2

Posted by Mark on April 25, 2015 at 13:56 | Last modified: May 14, 2015 10:27On Tuesday morning, April 21, I got filled at 7.25 in about 30 minutes. I caved 0.15 over that time and got filled 0.05 off the the mark. Breakeven points at expiration were 1248 and 1283.

The trade was never challenged. I had a contingent GTC order working to close for 8.09.

I watched the trade all day yesterday. At 3:50 PM, the market was 7.9 / 9.0, which is a mark of 8.45. My order was therefore 36 cents off the midprice and still not filled! I was a bit surprised.

At 3:58 PM, the market was 7.4 / 8.8, which is a mark of 8.1. I figured I surely wouldn’t be filled since my order would need to be at least 20 cents under the midprice if not more than 36 cents to be hit!

Then at 4:02 PM, What do I hear at 4:02 PM, after the regular session had ended: Ding! Ding!

Indeed, my order for 8.09 was filled! The market at that time showed 7.0 / 8.9, which is a mark of 7.95. My order got filled 14 cents better than the midprice! That is a shocker but, of course, I’ll take it any day.

Nothing should surprise me yet since I’m still observing and learning how these things work. This was only my second trade, after all. Once I have a larger sample size of experience then I can look back to determine what is unusual and what is not. Maybe I’ll see a handful of trades executed after the close like this. Who knows?

For this week though, 8.09 – 7.25 minus a few dollars for transaction fees gives me a return of 10.4% in four trading days.

I look forward to the next one!

Categories: Accountability | Comments (0) | PermalinkRUT Weekly Calendar Trade #1 (Part 3)

Posted by Mark on April 19, 2015 at 10:42 | Last modified: April 17, 2015 14:03Today I will continue and complete the postmortem on my first live weekly time spread.

In the last post I illustrated the differences in risk graphs. That’s huge and something I need to eventually figure out.

The final point is retrospective: should I have closed this trade at the first adjustment point? My profit target is 10% with a 15% max loss. In the backtesting I tried to do, if I was anywhere close to max loss at the adjustment point then I wanted to exit the trade. After slippage, I’d likely be at or beyond max loss after adjustment and it can only get [much] worse from there should the market continue moving against me.

The problem here was that I had no idea I was so close to max loss. It came fast (within one day) and the market did not seem to move a great deal to get there! Between OptionVue and my TOS account, I just did not have it modeled acceptably. I probably need to get this into my DDE spreadsheet and then maybe I can create an “after adjustment P/L” cell to project where I would be after 0.10 slippage is applied per leg (for example).

On this trade, I lost 21.2%!

However, in legendary terms, “I’LL BE BAHK” [phonetics mine].

This is why we trade small: to learn the nuances and how the trades work. I think this was a case of whipsaw; the market ran up forcing an adjustment and then ran down even harder. I was going to check before I went out this morning and had I been at the helm, I probably could have saved some of the loss. Market activity like this is just not going to work for this trade, however.

So was this a fluke occurrence or does it happen on a semi-regular basis?

Only time will tell.

Categories: Accountability | Comments (1) | PermalinkRUT Weekly Calendar Trade #1 (Part 2)

Posted by Mark on April 18, 2015 at 05:35 | Last modified: April 17, 2015 14:02I previously gave an overview of my first live weekly time spread. Today I want to run through a few more details.

Compare and contrast:

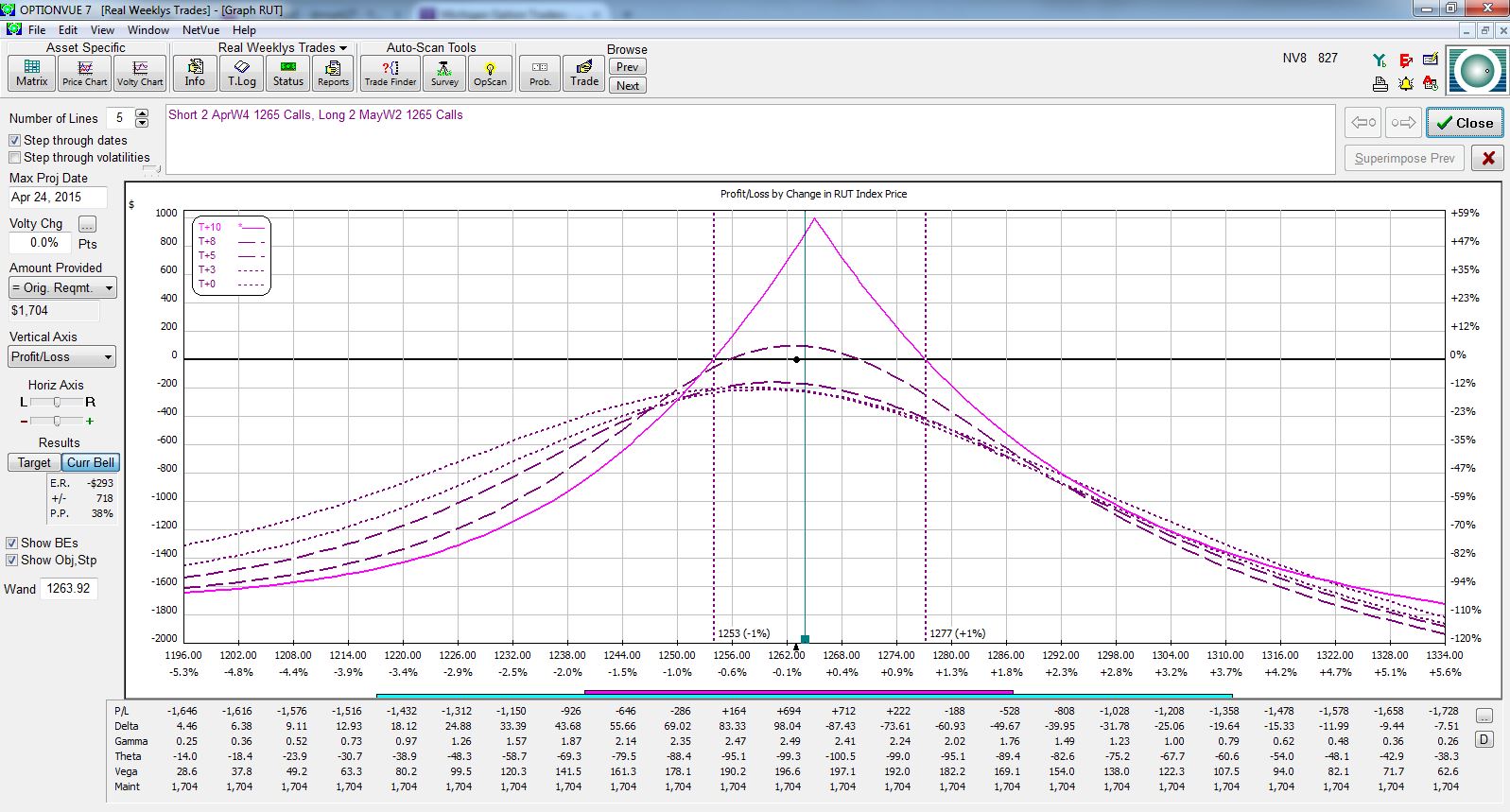

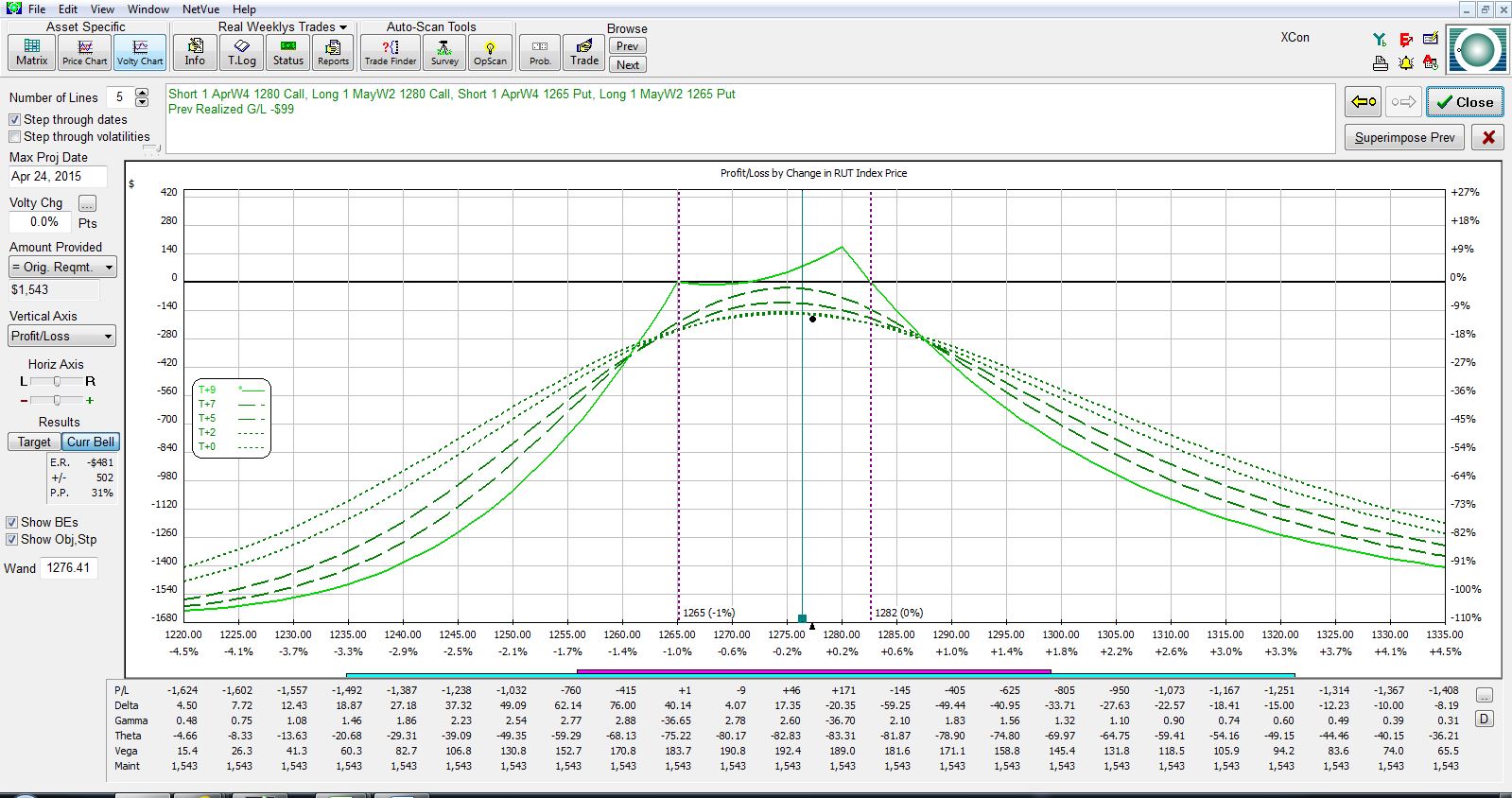

Which pictures portray the correct representation?! Figure 1 has breakevens of 1253/1277 whereas Figure 2 has breakevens of 1249/1281. Figure 3 has breakevens of 1265/1282 whereas Figure 4 has breakevens of 1262/1283. These differing breakevens can significantly affect when to adjust. In addition, the Figure 3 expiration graph is downright ugly! That’s a trade I might not even want to keep. Figure 4? That trade looks to have much more potential.

The only way to truly understand which risk graph is more likely to be accurate is to get a number of these trades under my belt. As the days go by, I’ll be able to see my live P/L and compare that to what the risk graphs tell me. The risk graphs might change over time too and morph into something better aligned with my P/L. Again, only by trading these and learning will I gain the necessary experience to understand.

It’s hard enough to figure this stuff out by trading it live. It might have been foolhardy to ever think I could backtest these with OptionVue, at least, given data in 30-minute increments. Maybe another tool offering finer data (like 5-minute increments) could give me a fighting chance to accurately represent.

I’ll “stick a fork in it” with my next post.

Categories: Accountability | Comments (1) | PermalinkRUT Weekly Calendar Trade #1 (Part 1)

Posted by Mark on April 17, 2015 at 12:45 | Last modified: April 17, 2015 12:45This is the week I decided to junk the backtesting and try a real one live!

On Tuesday, RUT opened down on the day. I entered an order to buy 2 @ 7.40, which would have been around the mark or a little better. RUT rallied to 1265 and I did not get filled over the next few hours.

I canceled that order and did get filled on a 1265 spread for 8.14. The order was placed at the midprice and sat for two hours before I caved 0.10 and got filled about nine cents off the mark.

The market rallied on Wednesday and around midday, I rolled one of the 1265 spreads to 1280. I did this for six cents but I was down nearly 15% on the trade when it was done. I caved about 0.20 off the midprice to do this: one dime off each spread.

Today, the market tanked out of the gate. I ran some errands and came back 30 minutes into the session to see the market around 1256. I entered an order to close the DC at the midprice around 10:01. The market fell over one point in a minute and I ended up caving 0.95 over two minutes. I got filled 0.08 off the then mark, which ended up being 0.43 off my original limit price and 0.52 better than the modified order I had submitted to close. My total loss on the trade was an ugly 21.2%.

Think about that slippage for a moment: 0.43! I suppose that’s not horrible. That is roughly 0.11 per leg, which is usually the worst I would include in backtesting. The long options here were pretty expensive too and those spreads are pretty wide. One of my short options was 1.50/2.50. That seems a bit absurd. In fast-moving markets those spreads will widen and I guess given that, it’s not horrible to lose only this much in slippage.

I’ll cover a few more details about this trade in my next post.

Categories: Accountability | Comments (2) | PermalinkBlog Reset (Part 2)

Posted by Mark on February 26, 2013 at 05:24 | Last modified: July 25, 2013 11:40As mentioned here, I was 29 posts behind my twice-weekly goal on September 8 of last year. With the exception of a couple weeks at the beginning of January, I have pretty much posted every trading day since. As of today, I am roughly 14 posts ahead of schedule.

With a target length of 300 words per post, I will aim to post twice weekly going forward. This blog keeps me on track with my goals and is a way to keep me accountable in lieu of a manager or supervisor that I used to have in my corporate days as a pharmacist.

Categories: Accountability | Comments (0) | Permalink2012 Performance Evaluation (Part 9)

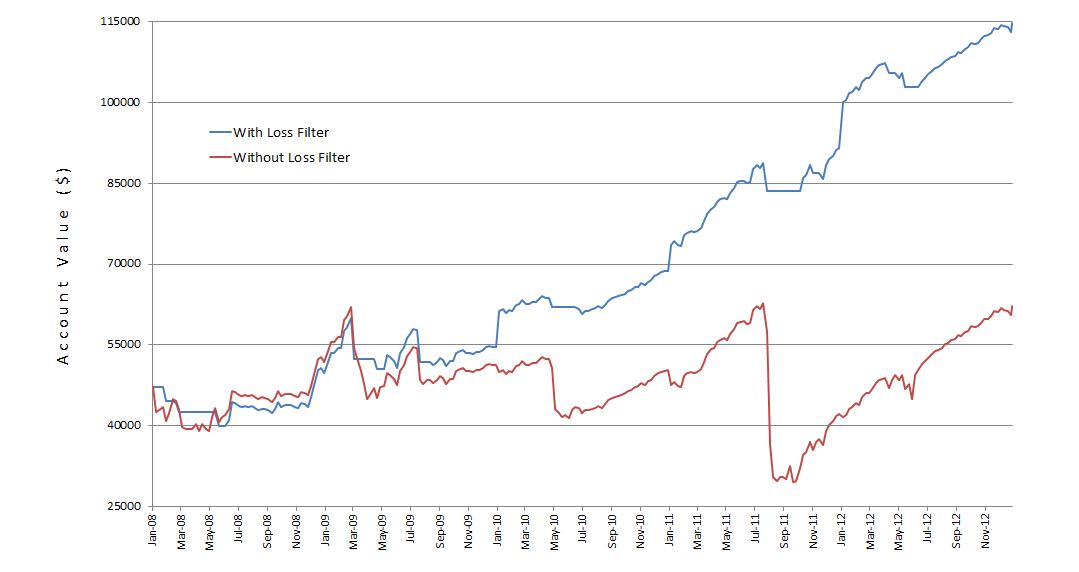

Posted by Mark on February 22, 2013 at 05:29 | Last modified: February 13, 2013 05:20In http://www.optionfanatic.com/2013/02/20/2012-performance-evaluation-part-8/, I detailed the loss filter (LF) concept and showed performance results with and without the LF. I then went on to describe two potential flaws with the analysis.

As mentioned previously, when I see shockingly impressive results I tend to scrutinize closely to see if mistakes, either deliberate or inadvertent, have been made. Did you look closely at the graph in the previous post? If so then you might have seen what I did:

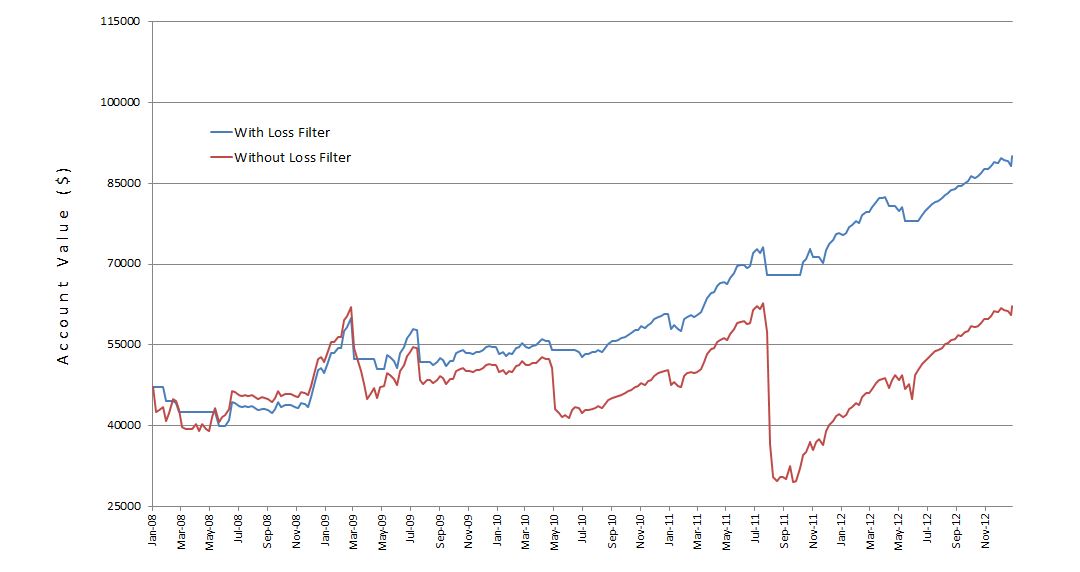

When activated, the LF keeps me out of the market, which results in a flat equity curve. The red line should always be gaining when the blue line is gaining because the red line is always in the market (no LF). Highlighted in yellow above are three occurrences where the blue line was gaining and the red line either gained much less or lost.

As it turns out, I made a mistake in the spreadsheet at year-end 2009, 2010, and 2011!

I will continue this analysis in my next post.

Categories: Accountability | Comments (1) | Permalink2012 Performance Evaluation (Part 8)

Posted by Mark on February 21, 2013 at 06:41 | Last modified: February 13, 2013 05:21In http://www.optionfanatic.com/2013/02/19/2012-performance-evaluation-part-7/, I discussed using the equity curve as a signal to stop trading when it crosses below its own moving average. Another concept I have been considering is to exit the market in favor of paper trading when I have an unusually large weekly drawdown and to resume live trading once consecutive weekly paper gains are posted.

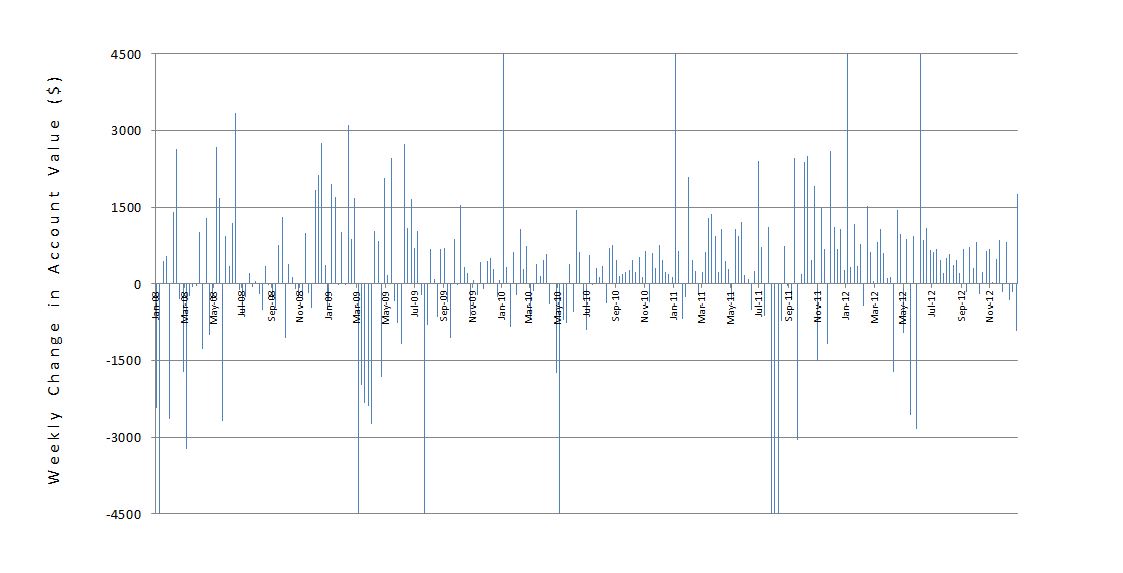

Here is a graph of account value weekly change:

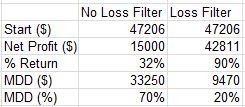

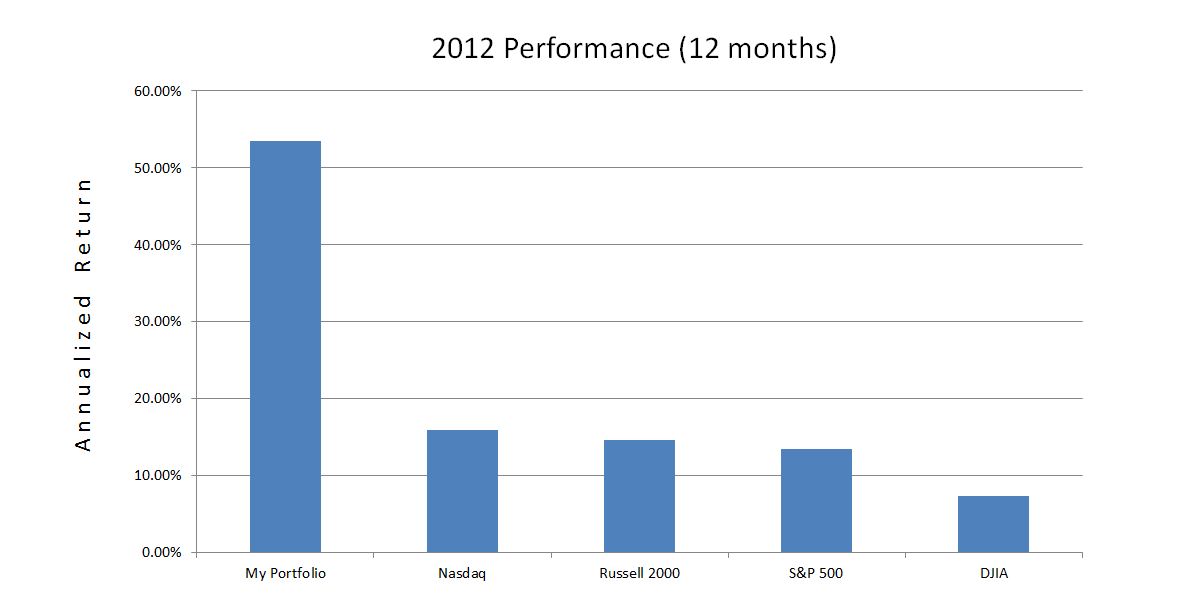

Since 2008, I have made money in about 64% of all weeks. The largest losses seem to be somewhat clustered, though. Suppose I switch to paper after a weekly loss over $3,000 and resume live trading after back-to-back weeks of paper profit The following graph shows the equity curves with and without this “loss filter” (LF):

Note the significantly reduced drawdowns–especially March 2009, the Flash Crash, and August 2011. With that ball and chain cut, the profits were really able to run:

Whenever I see shockingly impressive results like these, I want to scrutinize the methodology for potential flaws. I see two such flaws with this analysis. First, I am analyzing a sample of discretionary rather than systematic trading. Position size has varied in an unpredictable fashion and the bigger weekly changes may have occurred when position size was extremely large. With a systematic approach where position size is more controlled, this may not have occurred and the LF may not have been triggered. On the flip side, the hypothetical account did not outperform in all instances where the LF was triggered. I should backtest the strategy in a more systematic fashion and then assess the impact of the LF.

A second potential flaw is arbitrary selection (-$3000 for the LF and two consecutive weeks of profitability) per my post http://www.optionfanatic.com/2012/12/12/flushing-out-the-arbitrary/. I should study the parameter space for plateaus rather than spikes by backtesting different values of the LF and number of consecutive profitable weeks required to resume live trading.

Categories: Accountability | Comments (0) | Permalink2012 Performance Evaluation (Part 7)

Posted by Mark on February 20, 2013 at 06:57 | Last modified: February 13, 2013 05:22As discussed in my last post (http://www.optionfanatic.com/2013/02/18/2012-performance-evaluation-part-6/), 2012 was calm for stocks as compared to any of the preceding four years. Give me any tame market and my account should flourish. Indeed, last year I returned over 53% when the best-performing index returned under 16%. What a windfall! Don’t you just wish I managed your money? Do you want to be like me?

Not just yet.

As for the other two questions, no and no.

I cannot depend on quiescence in order to succeed. I will only be a good trader when I can make money in calm markets and avoid losing big in violent ones. With the exception of 2008, I have yet to demonstrate success with the latter.

I now want to adjust my focus from monthly to weekly performance numbers. The basis for this discussion involves tracking account value alongside its moving average (MA). The MA serves as a “loss filter” by signaling to stop trading real money in favor of paper trading when the equity curve crosses below the MA. When the hypothetical account value crosses above the MA then trading may resume with real money.

While I think this concept has merit, I worry about the potential for curve fitting. I would not want to optimize and pick the best MA period without surveying the parameter space to make sure good results are seen with neighboring values. I also worry about sample size. I have less than five years of weekly account values available and in that time, I may only have a handful of instances where account value has crossed its MA. If I don’t have enough cases to form a valid sample then the door is left open to curve-fit results and decreased probability of future profit with real trading.

In the next post I will discuss a variation on this theme.

Categories: Accountability | Comments (0) | Permalink2012 Performance Evaluation (Part 6)

Posted by Mark on February 19, 2013 at 06:38 | Last modified: February 13, 2013 05:23For the first time in this blog, I am reviewing my performance from 2001 to the present. In http://www.optionfanatic.com/2013/02/15/2012-performance-evaluation-part-5/, I reviewed 2011 and began discussion of two changes made in my trading following the summer market crash.

Aside from not trading until after 3:30 PM, the second change I have adopted is a stricter limit on position sizing. Although it is difficult to nail this down with certainty, the largest long position size (by number of contracts) I would carry today is about 40% of that carried in 2010 and about 70% (about 60% in dollar terms) of that carried in 2011. I have a maximum monthly long contract limit in mind and I prefer to start out trading 33-67% of that limit. In most months I do not even reach the limit.

Position sizing has been restricted on the short side as well. I would estimate my acceptable short contract limit to be 60% or less than what I carried in 2010-11.

One thing that still concerns me is a tendency to see position size creep higher from one month to the next. This reflects difficulty accepting loss. Rather than close out positions and realize loss, I look to roll positions for equal or greater credit. This will boost profitability in a tame market but lead to suffering when the bull or bear really gets angry.

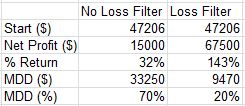

In 2012, the Russell 2000 experienced two corrections over 10% but still moved higher by year-end. For the first year in four, I outperformed:

With a 53% return and MDD of only 3.6%, this was a dream year for my portfolio. This was a relatively tame year for the markets, however, as the largest MDD of any major index was only 8.2% (Nasdaq). I give much more credit to the tame market than to my own skill for the exhilarating performance. While I feel the updated trade guidelines have helped to stabilize my portfolio, it will take the next significant market correction to truly make an apples-to-apples comparison with what happened in 2010 and 2011.

Categories: Accountability | Comments (0) | Permalink