2018 Incident Report (Part 1)

Posted by Mark on May 19, 2020 at 07:08 | Last modified: May 12, 2020 15:17I have been getting more organized this year by converting incomplete drafts into finished blog posts. Completing this draft made me realize I was overdue for a performance report.

As it turns out, I had a never-completed mini-series from July 2019 about my 2018 performance.

—————————

Originally, this was supposed to be an incident report of major losses suffered the week of October 8, 2018. Now, it’s going to be an incident report for all of 2018.

After having my best year ever in 2017, 2018 was decisively my worst (including 2008 when I actually made money). I took big losses in February, October, and into December.

One of the biggest sources of both frustration and optimism is that whenever I experience big losses, I always seem to be able to look back to a point where I can easily say “I should have gotten out” and avoided the worst. The big question is whether these points are visible prospectively. Anything knowable only in hindsight is mirage and not a useful indicator.

I feel like I need to do a few different things every day to maintain trading preparedness.

First and foremost, I need to develop a checklist with daily monitoring parameters. I will take pre-planned action when triggers get hit. The main focus of my trading will then be to follow the checklist: no questions asked.

I had a monitoring spreadsheet created this year for naked puts. I stopped using it once I closed partial positions. My discipline waned throughout the remainder of the year. This needs to be iron clad throughout. Discipline, in the trading business, may be said to be everything.

One repetitive theme I have noticed about myself is that when I stop the bleeding, I rarely stop the bleeding. If I use some sort of equity stop-loss or [set of] indicators to determine whether I am in [for at least a percentage of my standard size] or out of the market [entirely], then that needs to be it. I always seem to fear the whipsaw. I fear being out when the market suddenly reverses thereby leaving me on the sidelines. This fear has not helped because time and time again, I have maintained a partial position that proceeded to aggravate my losses.

Here are three things to work on for the coming year:

- I need to feel comfortable in the markets.

- I need to look at the markets more.

- I need to have an approach to trading when I actually trade.

I will discuss these further next time.

In Need of Performance Update

Posted by Mark on March 10, 2020 at 09:05 | Last modified: January 12, 2022 09:15One of my blog projects for the year is to get more organized by converting drafts to completed posts.

With a bit more work, incomplete drafts can become completed posts. Entering this year, I had over 30 entries in the “drafts” folder—some in excess of 450 words, which is my usual target. Completing these long drafts is a major coup because for less than the time it takes me to finish one from scratch, I can easily generate two, three, or even four complete posts.

With regard to these drafts, I typically write something like:

> In the longshot case that someone out there could possibly benefit

> from any of this, what follows is this post from August 2018.

Some of the drafts are well thought out, but I honestly have no idea where they fit. Some are without reference links to guide me. Some (like this one) are excessively complex and hard for me to decipher. I have no excuse for the latter except poor writing, quite honestly. Because they are just drafts I’m looking to complete, I include them and leave the decryption to you.

What follows is especially “in case someone out there could possibly benefit” content. Although it reminds me that a performance update is overdue, I am not sure what six-year period is being described. Perhaps when I go back and calculate performance, I will be able to resolve what follows. This post is therefore a call to action as stated in the title.

—————————

Keep in mind that my performance during said six year window, as discussed last time, was disappointing. However, showing performance since I started trading full-time provides evidence that I have done well overall. I believe the approach I have used recently is more disciplined, systematic, and therefore better than what I did in the early years of 2010 – 2014.

Then again, my stated 2010 – 2014 performance is not exactly bad. The high standard deviation (SD) hurts but that SD is to the upside. Upside SD will not cause sleepless nights, which is why a separate statistic differentiates upside from downside variance (Sortino Ratio). My 2012 return in excess of 50% is a major contributor to the high SD, which leaves risk-adjusted return much to be desired. Realistically speaking, though, clients would never complain about that.

Also with regard to multiplicative versus additive, what shocked me was to see a 10% improvement on the RAR ratio amounting to only 79 basis points. The problem with RAR is that it is unitless. 79 basis points is not 79 basis points, either. From 10% to 10.79% is only a 7.9% improvement whereas from 5% to 5.79% is a 15.8% improvement. When thinking in terms of management fee and overall compounded returns, we think about the additive difference.

Categories: Accountability | Comments (0) | PermalinkThe Case for Withholding Performance Reports (Part 2)

Posted by Mark on October 5, 2018 at 06:07 | Last modified: September 23, 2018 08:22Today I continue discussion of an argument in favor of opacity surrounding performance reporting.

I recently spoke with a trader “E” who cited a performance claim he believed to be credible from an investor he had been speaking with over a long period of time. In E’s mind, the long time interval was sufficient to establish the investor’s credibility. E remembered an earlier date when the investor made a buy call for an [allegedly] substantial position. The stock went on to do extremely well.

I think E is probably right about this specific example but in my experience, the example is unusual. I meet people in forums, Meetups, or investor shows, and they boast about performance or big wins. These aren’t people I have known for a long time nor are they people who have given me specific market calls (which I would never ask for, anyway). Stories aplenty exist about social media profiles of “investors” who make various buy/sell calls over time. Most of these do poorly. Every now and then—if only by chance alone—one does well and that profile gets all the press.

I will point out one important caveat with regard to E’s example: without brokerage statements and/or tax returns, E really has no idea how “substantial” the position is. Position size is important with regard to performance because the smaller the position, the more willing one may be to gamble on a trade. From a marketing perspective, I should tell many strangers about new positions: if wrong then I look human and if right then I look like a hero. E may be experiencing the latter.

I will conclude by addressing a potential contradiction mentioned in the footnote to my previous post. I said I would feel more comfortable reporting performance to people with whom I have an “advance degree of trust.” At the same time, I go ahead and report performance here. This blog is primarily to keep me on track with projects. I do not advertise this blog. I do not market this blog. I occasionally view the analytics and I know very few people read this blog. It’s therefore not the case that I share performance with large numbers of strangers (and certainly not in a timely manner).

It would appear that my previous dilemma over whether to organize a free and transparent Meetup has run into another dilemma over performance reporting. Sir Walter Scott’s quote is quite fitting here: “oh what a tangled web we weave when we first practice to deceive.”

Categories: Accountability | Comments (0) | PermalinkThe Case for Withholding Performance Reports (Part 1)

Posted by Mark on October 2, 2018 at 06:05 | Last modified: September 18, 2018 07:02I am surprised to see myself defending opacity in the financial industry.

One of the things the industry routinely avoids is accurate performance reporting. I did an extensive review on the subject earlier this year. The upshot is that most potential clients fail to demand accountability by demanding such reports, that the opacity is likely self-serving for the industry, and that transparency might lead to compliance issues.

Unlike my shock and awe when doing the research, I found myself at least neutral if not favoring opacity when writing this recent post. More is to be said about performance than just the numbers alone. No matter how my results look, for example, the additional context would be downright scary. Consequently, I would feel more comfortable sharing with those I trust than with complete strangers.*

This concept is indirectly affirmed by S12 E15 of CNBC’s “American Greed.” As part of his fraudulent pitch, Ephren Taylor promised one plaintiff an annual return of 66% on a “riskless investment.” Taylor fits under the “worst-case scenario” umbrella along with Madoff and others profiled on the show. But even on much smaller orders of magnitude, I question whether performance claims are ever trustworthy when compliance is not onboard to ensure accuracy.

Performance is one of the most powerful tools con-artists use to defraud people. Promises of unrealistic returns hit the uneducated in arguably their most vulnerable spot. Fraud runs rampant in this industry where people are literally handing over money [with the hopes of investing but all too often with the result of getting robbed].

Because I never know who I’m dealing with when making new connections, I prefer to keep performance out of the discussion. It might be relevant if presented correctly, but the numbers are misleading often enough to necessitate scrutiny as a means to establish validity. I therefore don’t feel comfortable believing performance claims I hear from others and I don’t think they should either. It’s a cautious and maybe even pessimistic approach but I honestly credit an ability to avoid the lofty sales pitch as one of the keys to surviving 10+ years as a full-time trader.

In contrast to baseless claims, I would believe performance numbers generated from GIPS compliance and verification. This is precisely the sort of expense retail investors do not undertake.

* I will resolve a related contradiction next time.

2017 Performance Evaluation

Posted by Mark on August 31, 2018 at 06:50 | Last modified: September 4, 2018 11:53As I am a proponent of performance reporting, today I discuss my 2017 trading performance (also see here, here, and here).

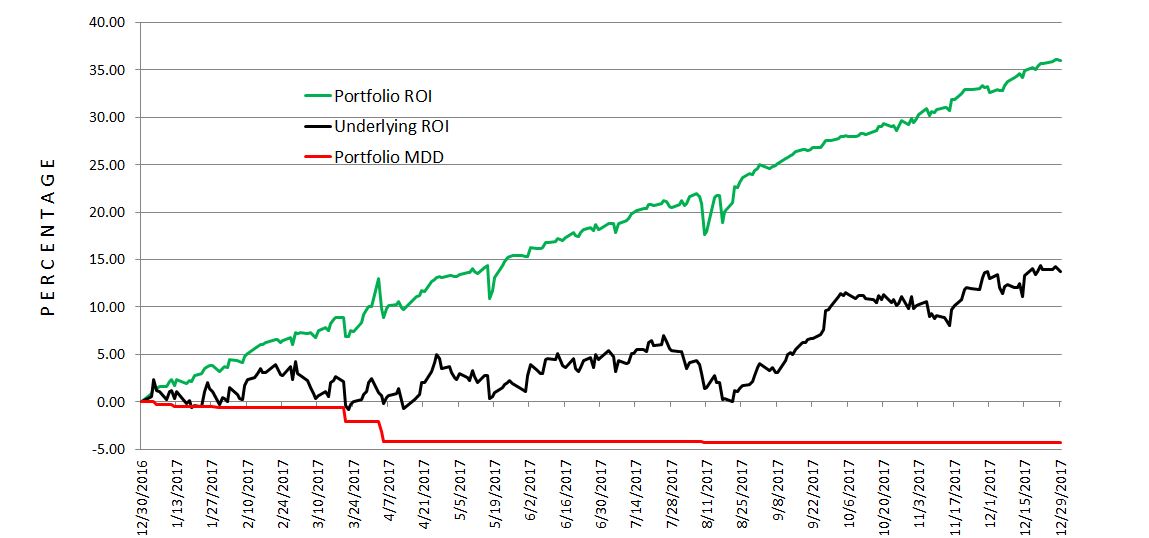

The green and black lines represent performance of my portfolio and the underlying, respectively. The latter is similar to a benchmark for comparison purposes without implementation of constant notional risk. MDD (red line) is maximum drawdown.

I generated +36% versus +14% for the underlying (dividend yield < 2% not included). My MDD was 4.3% versus 6.9% for the underlying, which gives me a risk-adjusted return (DD) 4.2x better. That is smashing. I also like to look at standard deviation (SD) of returns as a measure of risk. My portfolio posted a SD of 0.57, which is about 22% smaller than 0.73 for the underlying. This does not support my conclusion here, which I will soon update for a longer time frame. In the spirit of Sortino vs. Sharpe ratios, I looked at SD of negative returns (losing days) and found my portfolio with 0.60 to be 28% larger than 0.47 for the underlying.

I calculated a Sharpe-style (Sortino-style) ratio of 0.219 (0.208) for my portfolio versus 0.0738 (0.115). These calculations are based on daily returns rather than annualized but I think degree of outperformance is more important.

I also find it noteworthy that my portfolio had 83 losing days, which is ~26% fewer than 113 for the underlying.

Onward and upward, hopefully, for 2018!

Categories: Accountability | Comments (0) | PermalinkWelcome to the Ann Arbor Algos

Posted by Mark on November 2, 2017 at 06:26 | Last modified: August 15, 2017 06:37I wrote this back in April 2012 but it never got finalized. I did post it on Meetup.com without any success. This group concept is different from those discussed here or here because trading system development is the primary focus.

—————————————–

I have seen a number of Michigan investing/trading meetups over the last few years and inevitably, most of them ultimately fail. In some cases, the organizers just gave up. In other cases, the organizers were for-profit entities electing to move in new directions to market their wares.

I am an independent trader in search of other independent traders without any commercial interests. My hope is to form a small group of traders working together to develop trading systems.

This group is for a very specific type of trader. You should:

–Be knowledgeable about trading strategies.

–Understand why a trading strategy does not necessarily make for a trading system.

–Be practiced at critical thinking.

–Have experience working in groups.

–Be willing to purchase AmiBroker (www.amibroker.com) and data as desired.

–Have AFL programming expertise and/or be willing to spend time learning the language.

–Have trading strategies available to be systematically tested by the group.

–Have hours available every trading day for project-related phone calls and e-mails.

–Not think this will be a place to steal profitable ideas without contributing anything of your own.

–Not be looking to enroll our members in your educational company or investing service.

–Have a general understanding of what system development entails.

My hope is to find 3-10 investors/traders to work together on this project. Please contact me if interested or sign up at http://www.meetup.com/Ann-Arbor-Algos/.

Tags: mastermind trading group | Categories: Accountability | Comments (0) | PermalinkRUT Weekly Calendar Trade #15

Posted by Mark on August 4, 2015 at 07:39 | Last modified: August 6, 2015 11:24On July 21, I bought a JulWk5 1255 calendar for $7.37.

With the market trading lower near the expiration breakeven, I rolled half to 1230 on July 24 for a $0.50 debit. This cut NPD from 18 to 3-4.

Less than four hours later, the market was at 1227 so I rolled the other 1255 calendar down to 1235. This was a mistake: I should have rolled to 1230 but it really did not make a difference. I now had a 1235/1230 double calendar to be closed either at 15% loss or if an expiration breakeven was hit.

Shortly after the open on expiration Monday, the market traded under 1213. I closed the double calendar for a max loss of 19.4%.

They say in trading, one has to be able to accept losses. This is now three in a row.

From a few who are now supposedly in their second year doing this trade, I hear it’s not out of the ordinary to have three consecutive losses once or twice per year. I’m trying to give this trade a fair shot so while now bordering on apathetic (not good) with regard to my outlook for this trade, I will keep plugging away.

Categories: Accountability | Comments (0) | PermalinkRUT Weekly Calendar Trade #14 (Part 2)

Posted by Mark on August 3, 2015 at 06:13 | Last modified: August 6, 2015 11:24Today I conclude discussion of weekly trade #14.

Around 11:05 AM ET on expiration Tuesday, the market dropped quickly from 1255.80 to just under 1255. I did not really want to roll the second 1270 calendar to 1255. Because the trade had only 2+ more days and because I might be down over $100 on expiration Tuesday with a max potential profit at expiration of $400 or less (usually closer to $1000 at trade inception), I did not want to roll the other 1270 to 1255. I was guestimating on post-adjustment max potential profit. I find it difficult to model these positions and track the PnL. It was the heat of the moment too.

A couple minutes later, RUT sank below 1253 and I placed an order to close (not roll) the 1270 for $6.70. By 11:10 I had caved $0.50 and still was not filled. I wondered whether I should even be trying to chase at this point because: RUT had breached the lower BB (I’ve really learned this is a bad time to trade but it’s when my emotions run hottest compelling me to trade). Also, I noticed the bid/ask on the calendar was close to $3.60. If I waited then the market would calm down, bid/ask spreads would narrow, and I’d get a better fill. I therefore canceled the trade.

As the market drifted a bit lower, I felt I just had to get the damn thing off. I put in a 4-legged order for the remaining double calendar and caved $0.40 over 2+ minutes. I got filled 0.10 off the then mark for a loss of $74 (4.71%) with the market at 1252.37.

At 10:00 ET on expiration Thursday, the JulWk4 1255 put calendar was trading at 8.40/9.60 at 10:00 ET. By 11:30, it was 9.36/10.27 as of 11:30 ET. I would have gotten the full 10% profit had I rolled the second 1270 calendar to 1255.

Once again, I failed to follow the trading plan. The trading plan says nothing about how I feel about a trade, where the BBs are, how wide the bid/ask is, etc. This time, as previously discussed, what should have been a winner was closed at a loss.

This trade was a big confidence zapper.

Categories: Accountability | Comments (0) | PermalinkRUT Weekly Calendar Trade #14 (Part 1)

Posted by Mark on July 30, 2015 at 07:12 | Last modified: August 6, 2015 10:17On July 14 with the market at 1269.25, I bought a 1270 calendar for $7.35. I got filled $0.10 off the mark.

Adjustment points were 1258 and 1283. While I felt it was not fun being back to narrower breakevens, last week’s trade with wider breakevens lost!

The market traded sideways for a few days but trading down to 1260 on July 20, I had to roll to 1255. I did not like only getting an additional five points but modeling the 1250 showed significant sag that would make the trade implausible. In retrospect, now with only a 15-point range, this trade itself may have been too narrow and implausible. A slight breeze is all it would have taken to force a second adjustment.

When I looked at the risk graph before market open on Tuesday (July 21), the expiration curve was much lower. That held after the open, too. I think this was more a subjective perception than anything else, though. I had a bad attitude about this trade from the very beginning because of the relatively narrow breakevens. TOS also makes it hard to determine exactly where the red [expiration] curve is at times on the risk graphs because they can vary from moment to moment. In retrospect, I noticed the 10:30 graph looked more pumped up than those earlier in the day. Unfortunately, I feel this negative attitude factored into my trade management.

I’ll conclude discussion of this trade in my next post.

Categories: Accountability | Comments (1) | PermalinkRUT Weekly Calendar Trade #13 (Part 1)

Posted by Mark on July 27, 2015 at 05:37 | Last modified: August 5, 2015 15:07This trade was placed on July 7 around 11:10 ET for $8.40 with the market around 1230. This is the most expensive calendar I had bought to date. That could be viewed as a sign to keep out of the trade in case elevated IV were to subsequently mean revert. A positive horizontal skew was poised to benefit this trade, though, as was seen with trade #12.

I found myself in a quandary on Friday with the market four points from the upside BE at 1254.

According to plan, on a continued move higher I should have adjusted to a double calendar. With real money on the line and facing the reality that a big upside move could land this trade down $250 or more at Monday’s open, I ended up closing half the trade.

This is why trading is difficult. Given the Greece referendum/vote on their financial crisis, I felt I had to act defensively. I figured if the market pulled back in such a way that I could have taken full profit but then couldn’t because I already closed half the trade at a big loss, I would be frustrated. It almost seemed irresponsible to leave on the entire risk or even to try centering the trade as a double calendar given a “market-related earnings announcement” being due over the weekend.

The market did indeed move higher on Monday and I closed the rest of the position at 9:45 with the market around 1261. This trade lost 16.2% in seven days.

Categories: Accountability | Comments (2) | Permalink