Am I Worthy of Self-Promotion? (Part 1)

Posted by Mark on September 16, 2016 at 06:30 | Last modified: February 3, 2017 09:36Much of the background for today’s post was written here and here. Perhaps because my Dad dislikes attribution of my current professional status to luck or everyday trading strategies, casual reflection had me reviewing this idea once again. For the first time, I am starting to entertain the possibility that I am a success story worthy of self-promotion.

I have traditionally shied away from advertising or marketing my triumphs. More than shy away, even, I typically run away. I’m a believer in karma and I think arrogance is a trap to which we humans often fall prey. The moment we get too overconfident or arrogant is the moment we get stricken down—often solely a result of our own sheer folly. I may be exaggerating a bit but I do believe it happens quite often.

I believe Nassim Taleb’s Fooled by Randomness teaches some important lessons about trading. People often get lucky and have transient success. I would hate to start advertising such success at a time when harsh reality was just about to set in. I would only be able to look in the mirror and say “you got what you deserved” if I were to misjudge temporary, random success for a long period of developing skill through hard work.

Having acknowledged my caution toward arrogance and the possibility of fluke, I do believe I deserve an objective assessment just like anyone else. As I step back and take a broad perspective, what do I see?

The most significant observation is that I am currently in the ninth year of operating a successful trading business. I started out working 60+ weeks for the first few years and so far that hard work has paid off. I do all the trading and devise my own trading strategies. I supervise myself. I work from home. I have a flexible schedule. I can trade on the road while hardly missing a beat.

Perhaps anyone working as a successful entrepreneur has a story worth telling because it is such a rare occurrence. I only know a couple people who are running their own successful businesses. Many people have jobs they dislike. Many people live paycheck to paycheck. Many people are chronically burdened by job-related emotional and physical stress. None of these, thankfully, apply to me.

I will continue this in the next post.

Categories: About Me | Comments (2) | PermalinkIs There a Better Way?

Posted by Mark on May 20, 2016 at 07:14 | Last modified: July 16, 2020 11:35This morning I take a macroscopic view wondering what I’m trying to do here and why I seem to disagree with so many others in the financial industry. It’s not just that I’m trying to find a better approach: I’m trying to determine whether a better approach even exists.

I am not exaggerating when I say almost everywhere I look, I see marketing of a better trading/investing approach (substitute “Holy Grail” to make for slight exaggeration). Many seemingly innocent, matter-of-fact claims are actually the Holy Grail in disguise but that’s beyond the scope of this post.

Just as I questioned whether successful traders exist, I question whether a better trading/investing approach exists.

Consider the following observations:

–The disappearance of popular/outspoken traders over time

–Frequent flaws in advertising/marketing claims (e.g. affirming the

consequent, hasty generalization, fallacy of the well-chosen example)

–Rampant confirmation bias

–General ignorance about trading system development and inferential

statistics: tools capable of installing meaningful objectivity into an

environment of variable moving targets

–Multiple “professionals” telling me that generation of consistent, modest

annual returns [in comparison to what many investment newsletters and

trader education programs advertise] would have the big money storming

down my door to invest if I were to start a hedge fund

–Repetitive articles in financial planning and investment periodicals about

slight outperformance relative to benchmarks translating to large AUM

—American Greed on CNBC

–Financial industry’s overall ignorance about and misrepresentation of options

to the general public

–Attraction of discretionary trading as the Holy Grail for many profit seekers

If the concept of “a better investing approach” were on trial then perhaps none of these observations taken individually would be sufficient for debunking. Taken together, however, I see a boatload of reasonable doubt.

Sometimes I feel like X-Files. On the TV program, Mulder feels compelled to continue searching to ultimately discover “the truth is out there.” With regard to finance, I wonder if there is no particular truth to be found (i.e. a better way) even though everywhere I look I see advertising suggesting there is.

Categories: About Me | Comments (0) | PermalinkState of Mind (Part 2)

Posted by Mark on March 12, 2016 at 06:18 | Last modified: June 7, 2017 09:00I am the only successful trader I know and the second thing this brings to mind is humility.

If my trading endeavor has been “successful” then I am anything but arrogant about it. My trading strategies are hardly unique. I am uncertain whether my profits are more attributable to skill or to random luck. The next eight years may reveal how poor my trading abilities really are. If that doesn’t happen then the eight years after that might wreak havoc on any positive self-concept I have in this domain. Until the day I stop trading I am threatened by Mr. Market and for this reason I find it incredibly difficult to be overconfident.

In a nutshell, the most successful trader I know is virtually shaking in his boots every single day over the unknown of what will come next. Despite that latent concern, I press on intrepidly with my systematic approach and repeat it day after day with continuous monitoring.

Among a backdrop of other traders, my humble, fearful attitude seems to stand out. I could understand why every other trader would feel this way but I simply don’t hear anyone else expressing it. The tone I hear behind most trader talk is an arrogant voice of certainty and ego. I often hear “if the market goes up, down, or sideways then I can do X, Y, or Z.” No matter what happens they got this! It is a voice of infallibility and a stance of immortality.

Across a trader landscape I hear the scattered yell “I know nothing,” but I feel this is artificial exaggeration. I do know that we cannot know a great many things. For example, traders frequently engage in polarizing arguments about future market direction. I believe we cannot foresee the future. Discretionary traders sometimes present strategies with many degrees of freedom. I believe we cannot assess such effectiveness as a result of excess complexity.

I think much time could be saved if traders would take a step back start by considering whether potential answers to particular questions would even be actionable but this is a topic for another day.

Categories: About Me | Comments (2) | PermalinkState of Mind (Part 1)

Posted by Mark on March 11, 2016 at 05:52 | Last modified: February 3, 2016 06:57I have talked to many traders over the years, e-mailed even more, and met some in person. Aside from being the most successful trader I know, I am the only successful trader I know.

Upon further reflection, this really is not surprising. Others may disclose results of specific trades or less commonly overall PnL but these are unverified claims since people always have potential reasons to deceive. I do my own trades and keep the spreadsheets. I get my own brokerage statements. I see my annual tax returns. I pay the taxes. I get unsolicited feedback from my accountant. I know how much I have made.

Because trading tends to be a solitary pursuit, I doubt my situation is unique. I try to network with others and I have even found others, intermittently, with whom to talk trading on a regular basis. These are acquaintances who may become friends but they are not people with whom I share intimate financial details like total net worth, annual income, etc. I think for many, such details are even hidden from close family members.

So I am the most successful trader that I know and this realization brings two things come to mind.

First, I do not feel wildly successful. By no stretch of the imagination am I any sort of “mogul.” I am not “rich,” I don’t have money to burn, and I still need work to pay the bills. I have accomplished one goal of leaving my corporate job and more than replacing the annual income. I would say my financial position is solid and has improved over the last several years but I still have a ways to go.

I cannot really say whether my overall performance is good or bad. As suggested above, I don’t know these intimate financial details about anyone else. I don’t even know anyone who trades full-time as a business like I do. I therefore have no yardstick with which to measure and this is probably another reason why I feel like anything but a prodigy.

I will conclude with the next post.

Categories: About Me | Comments (2) | PermalinkOption Trading Meetup (Part 3)

Posted by Mark on February 6, 2016 at 06:01 | Last modified: December 8, 2015 04:50As I was writing the last post I got the sense I was being too hard on this group. Today I will reality check myself.

I criticized DY for claiming to have been trading for 30 years and over seven figures per week. This is not verifiable and therefore not something I believe should be brought into the discussion. All it can do is serve as a faulty basis for trust. For this reason, I don’t share such information with others and this is probably why the organizer treated me as a newbie when answering my question.

But experience is often stated in other fields. Pharmacists will say they’ve been practicing for X number of years. Surgeons will say they have done Y number of surgeries. Lawyers will say they have litigated Z related cases [and won, which is also not verifiable]. As a society we accept these claims. Why should one not accept a similar claim from a trader?

I feel like fraud and deceit are more prevalent in Finance because it is all about the money. Pharmacy, medicine, and law may indirectly come down to money but there can also be other things involved (e.g. medical treatment, legal rights, and wanting to help others). Finance is the direct conduit to money and is therefore at risk for stronger exposure to greed: one of the seven deadly sins. While this sounds good, I have no data to support it. I should therefore recognize it as a personal bias but not act on it.

I sometimes disagree with other traders because I focus on data science while they employ “conventional wisdom.” I can continue to follow the data. If disagreement leads someone to say “I have been trading for 30 years and I trade seven figures per week” then I can respond “I have extensive live trading experience too” and move on. I don’t need to disqualify them just because they stated unverifiable experience. I also don’t need to accuse them of fraud.

Hopefully my second visit to this Meetup will be more fulfilling.

Categories: About Me, Networking | Comments (0) | PermalinkGet a Hold of Me

Posted by Mark on February 2, 2016 at 07:03 | Last modified: February 2, 2016 07:03I don’t often hear from readers out there especially because I do not promote this blog. However, I am interested in finding a research partner. If anyone out there has a good understanding of trading system development and/or coding then please e-mail me: mark at optionfanatic.com. I’d love to hear from you!

Categories: About Me | Comments (0) | PermalinkCatastrophic Loss (Part 4)

Posted by Mark on September 25, 2015 at 07:41 | Last modified: October 22, 2015 08:42For years I’ve felt that catastrophic loss is the worst thing possible but in the big picture, it’s not uncommon.

By the very nature of the word, “catastrophic” sounds like an outlier. The second definition is:

> extremely unfortunate or unsuccessful [italics mine].

“Outlier” and “extreme” are synonymous.

For something so extreme, though, catastrophic loss is all around us. This need not be loss of life although that certainly would qualify. I’m thinking more akin to Serena Williams’ loss to unseeded Roberta Vinci in the 2015 U.S. Open a couple weeks ago. That ended her bid for the Calendar Slam, which would have been one of the great tennis accomplishments of all time. Another example comes from Survivor: Second Chance: we heard some players talk about losing in previous seasons and how catastrophic it was because they were so close to winning $1M. I think anytime we put our heart and soul into something and then get blindsided and/or fail to accomplish, the result is catastrophic.

In psychological terms, maybe “devastating” is the word used more often. Like the loss of a loved one, it can be associated with grief. Those who are true champions will be able to deal with it and bounce back. These make for many of the inspirational stories the evening news loves to report.

Going forward, the best course of action would be to get my checklist in place to decrease the possibility of catastrophic loss from ever occurring again. Given that I’m now in financial drawdown and emotional recovery, though, I also need to focus on a bright future, positive things, and pulling myself up by the bootstraps.

For the time being, I’ve said quite enough about catastrophic loss. Let’s go out and make some money, shall we?

Categories: About Me, Option Trading | Comments (0) | PermalinkCatastrophic Loss (Part 2)

Posted by Mark on September 18, 2015 at 08:02 | Last modified: October 17, 2015 10:31Last time I discussed more positives than negatives about my trading business. Today I want to inch closer to this concept of catastrophic loss.

When catastrophic loss happens I try to do a postmortem to better understand exactly what happened. I try to find pearls that will prevent it from happening again. I often come up with a checklist: things to watch for each and every day to make sure I am avoiding potential landmines.

Unfortunately, I believe even the best laid plans sometimes cannot avoid catastrophic loss. When histograms of trade returns are plotted, most results end up somewhere in the middle but a few will locate far to the left (i.e. Black Swan). Maybe it’s a cost of doing business? Perhaps it’s just a necessary evil of trading. As luck (randomness) often giveth, (bad) luck may also taketh away. At the end of the day, if Green > Red then it might be “winner winner chicken dinner.”

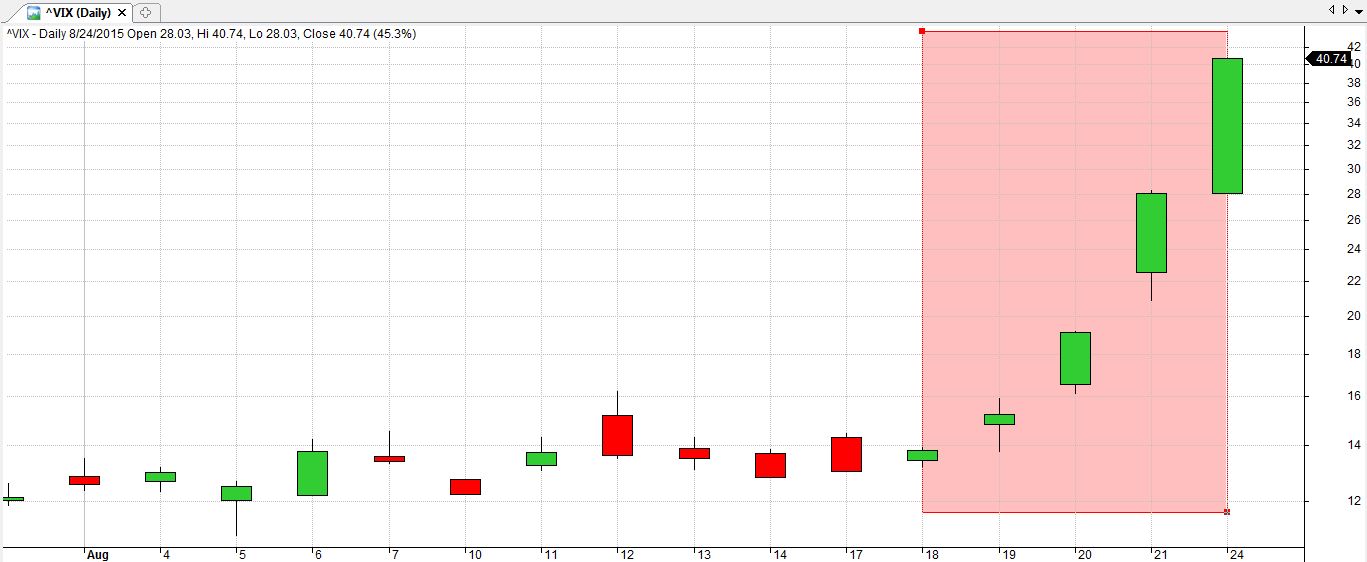

One thing I find tricky about the trading business is that catastrophic loss can happen at any time. I find my head must always be on a swivel because in retrospect, the rough times always came out of nowhere and occasionally to a staggering extent. Sometime I should tell the GC story. The whole motivation for writing on this subject now is because of what happened last month with stocks. From August 18 to August 24, the market fell 9.3%. While that is surprising, what happened to volatility is utterly earth-shattering: up 212% in five trading days!!!

That’s enough to destroy many option traders who are trying to play the odds.

Hell, that was the first time I ever used red text in this blog! If that doesn’t say it all…

Not a typo: up 212% in five trading days! I need a break.

Categories: About Me | Comments (2) | Permalink