Strategies vs. Systems (Part VI)

Posted by Mark on July 1, 2012 at 10:26 | Last modified: July 1, 2012 10:26In Part V of this series (http://www.optionfanatic.com/2012/06/05/strategies-vs-systems-part-v/), I concluded some commentary on discretionary trading. Today I want to provide some argument for algorithmic (also known as “rules-based” or “systematic”) trading.

Rules-based trading systems may be tested for statistical reliability. Robust systems have proven themselves over extended periods of time and different market environments. This leaves us confident about trading them into an unknown future.

Systematic trading eliminates decision making. An oft-cited quote is “prepare for war in a time of peace.” In the heat of battle, adrenaline kicks in. Decisions are then motivated by survival rather than profit. These are the times when psychic pain causes us to realize huge losses if only to sleep restfully at night. This is not the road to consistent profits over time.

Systematic trading ensures consistent application of trading rules. Rules without enforcement are trades without rules. No longer are we then trading systematically and no longer does our historical backtesting apply. Based on nothing concrete we are now gambling, not trading.

Systematic trading eliminates emotion. We program entries and exits to ensure they occur reliably and according to plan. One of the largest uncertainties of discretionary trading is our emotional reactions to pleasant or unpleasant situations. Systematic trading removes this.

Finally, systematic trading provides continuous risk control. Profit targets and stop-losses were determined through the rigorous system development process yielding potential results with which we feel comfortable. Gone will be the days of “I’ll hold on just a little longer because I think this market is about to reverse.” The trading platform will exit our trades automatically.

In my next post, I will address some potential downside to systematic trading.

Tags: critical thinking | Categories: System Development | Comments (1) | PermalinkThe Naked Put (Part III)

Posted by Mark on March 25, 2012 at 12:12 | Last modified: March 29, 2012 13:56Option income trading purports to generate consistent profits on a daily basis. As defined in my post on March 20 (http://www.optionfanatic.com/2012/03/20/the-naked-put-part-i/), an option income trade is a positive theta position. The exemplar I have been studying is an April 510 naked put on AAPL (see http://www.optionfanatic.com/2012/03/22/the-naked-put-part-ii/). The profit potential for this trade is $240/contract.

To better understand this trade, we need to know the risk. If AAPL sinks below $510 then the naked put could be assigned. The max risk of this trade is therefore $510/share * 100 shares = $51,000. While your stock would most probably have significant market value, in the worst-case scenario with AAPL stock crashing to zero, you would be out $51,000. The max potential return on this trade is therefore $240 / $51,000 = 0.47%.

Repeating this sort of trade every month would roughly generate an annualized return of 0.47% * 12 = 5.6%, right? Not exactly. With the trade being placed with 33 days to expiration, the possibility is great for two overlapping positions to be on at once. The max risk therefore has to be 2 * $51,000 or $102,000. This now yields a max annualized return of 2.8%.

While 2.8% is a very small return, realize how conservative this trade is. AAPL would have to fall 15% within 33 days in order for the profit not to be made on this trade. If you look back on a price chart, you’ll find it has been years since AAPL has fallen 15% in 33 days. Anything is possible, but because this would be such a rarity, many market observers would consider this trade to be reliable like an ATM machine.

Is this an accurate portrayal? I’ll cover some further insights in my next post.

Tags: critical thinking, income trading, trader education | Categories: Option Trading | Comments (3) | PermalinkTo Optimize or Not to Optimize?

Posted by Mark on March 15, 2012 at 11:44 | Last modified: March 15, 2012 11:54In the quest for consistent trading profits, backtesting is generally regarded as useful but optimization is viewed by some as a four-letter word.

If a system captures profits from consistent human behavioral characteristics reflected in the market then the past should reasonably approximate the future. This will never be perfect but it may be profitable.

Optimization is the determination of what trading parameters applied to past market action would have resulted in maximal returns. After all, if it worked well in the past then shouldn’t be likely to work in the future if the past is at least some small reflection of the future due to those consistent behavioral characteristics? This is called curve-fitting.

One of the biggest scams on Wall Street is to present a system with brilliant historical returns (anyone can run an optimization procedure on backtested data to do this) and sell it as a system to be used in live trading. Trading an optimized system into the future is almost guaranteed to underperform the past. Selling an optimized system can be like selling snake oil, and charlatans abound in financial circles who aim to do just that.

To avoid excessive curve-fitting, some think that if you don’t optimize then you can’t fall prey to the illusion. Choose only one parameter value and backtest it; if you come up with impressive results then they’re likely to persist into the future, right?

Not necessarily!

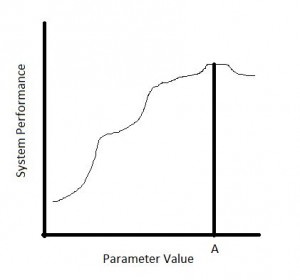

Suppose a system has one parameter (e.g. period for a moving average). Imagine backtesting the system repeatedly over the historical time period while changing the period each time. When you plot performance, does it look like this…

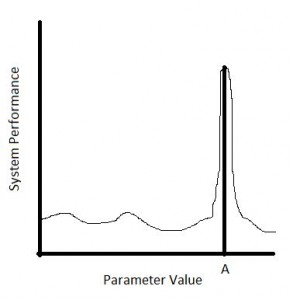

…or like this?

In both cases, using a period of A would have resulted in the best historical performance. However, in the latter case, if the period varied just a tad higher or lower then system performance was devastated. In the former case, trading with a period higher or lower than A would still have generated solid performance. Since the past is never identical to the future, which do you think has a better chance of generating profits going forward?

The bottom line is that “curve-fitting” and “optimization” are not four-letter words if used to know what you do not know. Optimize not with the intent of finding the perfect parameter to trade going forward. Optimize with the intent to determine whether encouraging past results are likely to persist into the future.

Tags: critical thinking, survival, trader education | Categories: System Development | Comments (0) | Permalink

Curtis Faith on Accountability

Posted by Mark on March 11, 2012 at 06:46 | Last modified: March 10, 2012 08:28As mentioned yesterday in my post “Words to Profit By” (http://www.optionfanatic.com/2012/03/10/words-to-profit-by/), just because this may sound good does not make it relevant. Give it some thought to see if it might apply to you:

“The idea that Rich had left out some key ideas was the easiest way for our paranoid Turtle to explain his inability to trade successfully during the program. This is a common problem in trading and in life. Many people blame their failure on others or on circumstances outside their control. They fail and then blame everyone but themselves. Inability to take responsibility for one’s own actions and their consequences is probably the single most significant factor leading to failure…

Trading is a good way to break that habit. In the end, it is only you and the markets. You cannot hide from the markets. If you trade well, over the long run you will see good results. If you trade poorly, over the long run you will lose money…

The bottom line is that you make the trades and you are responsible for the outcome. Don’t blame anyone else for giving you bad advice or withholding secrets from you. If you screw up and do something stupid, learn from that mistake, don’t pretend you didn’t make it. Then go figure out a way to avoid making that same mistake in the future…

Blaming others for your mistakes is a sure way to lose.”

–From Way of the Turtle (McGraw-Hill, 2007)

Tags: critical thinking | Categories: Accountability, Wisdom | Comments (0) | PermalinkWords to Profit By

Posted by Mark on March 10, 2012 at 08:13 | Last modified: March 10, 2012 08:13With today’s post, I am going to introduce a new category: “Wisdom.” I do a lot of reading and occasionally I come across a quote or passage that really rings true with me or seems to be of great significance.

Just because something sounds good does not mean it has any necessary relevance at all. This is my grand disclaimer. Some people make a habit of collecting “great quotes,” posting them, and including them in e-mail signatures. Some people think just reflecting these “great quotes” makes them look all educated and brilliant. I believe what makes you brilliant is not the “great quotes” themselves but critical evaluation to determine whether they can be applied to you or anyone else.

This echoes an interesting concept in the world of trading systems. Upon first glance, many ideas for trading systems make good technical or fundamental sense. When you backtest them, though, you’ll find their performance to be in the toilet.

Just because something sounds good does not mean it is actionable or will lead to consistent profitability. We need to differentiate between the two in order to be successful traders.

Tags: critical thinking | Categories: Wisdom | Comments (2) | Permalink