2012 Performance Evaluation (Part 10)

Posted by Mark on February 25, 2013 at 06:01 | Last modified: February 13, 2013 05:19In http://www.optionfanatic.com/2013/02/21/2012-performance-evaluation-part-9/, I disclosed a third flaw in my preceding analysis showing potential utility for a LF.

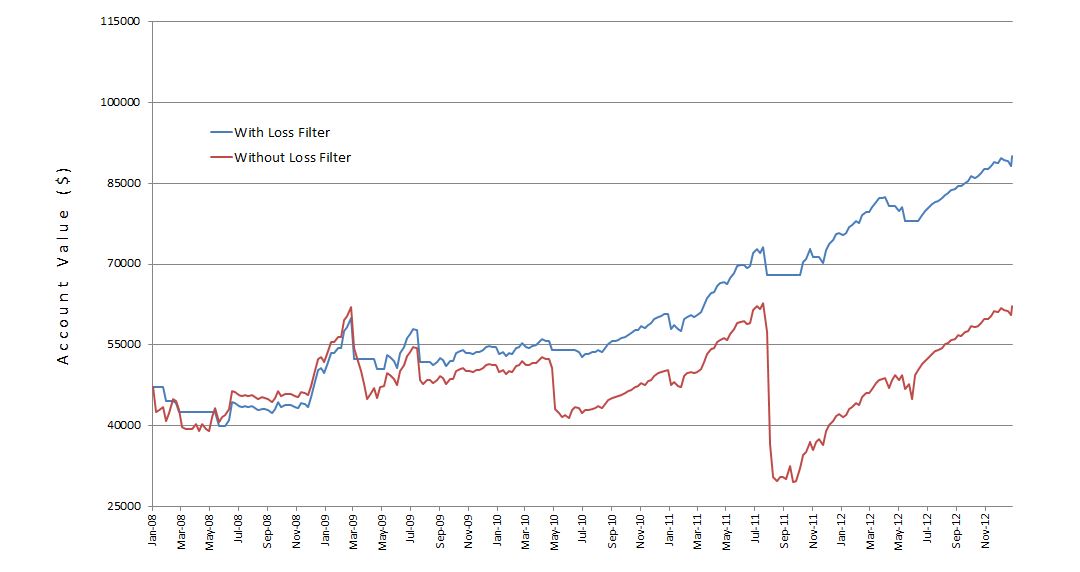

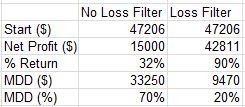

The corrected equity curves and performance results are shown below:

The methodology is still worth researching but a 90% profit is nowhere close to 143%.

I am categorizing this post as optionScam.com (http://www.optionfanatic.com/2012/04/21/optionscam-com/) because I have found deception to be commonplace among newsletter and trader education/mentorship offerings. You should understand the theory behind a proposed system and review the results to see if they are consistent with general tenets of the theory. Furthermore, you should not fall for the “one good example” that might be cherry picked from a population of losers. You should always be thinking about other possible combinations, market environments, and trade situations to evaluate whether an exemplar successful in one situation is likely to be successful in others.

I outperformed with this analysis by going beyond human nature to detect an honest mistake and I believe this is exactly what we need to do as traders to be successful. I really cannot emphasize that enough. Human nature is falling prey to the confirmation bias, as written here:

> The reason confirmation bias can be so deadly to a human is because… we tend to look only

> for information that supports our pre-held beliefs… not only could we be biased about the

> information we do get a hold of, we may completely sidestep vital information in the first

> place, just because we are subconsciously ignoring everything that doesn’t fit in with our

> beliefs.

For the most part, traders maintain hope that a “Holy Grail” exists. Once we get wind of a potential contender, we become captivated. We confirm evidence in support and discard, overlook, or refuse to scrutinize evidence to the contrary. Confirmation bias must be one of the biggest culprits of flawed system development methodology. If left undetected then traders will fall victim (i.e. lose money) to the “scam” perpetrated by another or, even worse, inadvertently by themselves.

Categories: Accountability, optionScam.com, System Development | Comments (0) | PermalinkTrading System #3–Naked Puts (Part 2)

Posted by Mark on December 7, 2012 at 05:23 | Last modified: November 24, 2012 09:10In http://www.optionfanatic.com/2012/12/06/trading-system-3-naked-puts-part-1/, I presented some initial results for the naked puts (NP) trading system. Five years ago when I began to backtest option strategies, my first step was to assess the profitability of a trading system.

The current system aims to sell puts every month. If I lose over $30K in any one week then I exit the market and stay out until I see two consecutive weeks of market gains. The profit of 604% results from my selection of $200K as the initial account equity. I arrived at this figure by setting a stop-loss at a max weekly drawdown of $30K. I therefore aimed to exit upon losing $30K / $200K = 15% in one week.

In the backtest, the NP system gained 604% over nearly 12 years, which is about 17.6% per annum. That is a pretty impressive number especially considering that it is a constant contracts trading system. This means the position size remains constant throughout (60 contracts). Constant risk in the face of increasing account value means overall exposure decreases. This will leave room to either increase position size over time or incorporate other trading systems to my portfolio.

These are the sorts of numbers that are often presented in advertisements and infomercials, but unfortunately they literally do not even begin to tell the story.

In this case, the max DD was $234K, which is more than the initial account value. The position size remains constant throughout, which means this DD could have occurred very early on in the trade. In that case, the account would have gone bust!

You never hear/see that in an advertisement or infomercial for trading strategies, newsletters, or educational programs. optionScam.com, anyone ( http://www.optionfanatic.com/2012/04/21/optionscam-com/)?

I will continue this analysis in my next post.

Categories: optionScam.com, System Development | Comments (0) | PermalinkStrategies vs. Systems (Part V)

Posted by Mark on June 5, 2012 at 09:29 | Last modified: June 5, 2012 09:30I’m in the process of breaking down quite the mouthful from Part III of this series (http://www.optionfanatic.com/2012/05/23/strategies-vs-systems-part-iii/):

“If you are a discretionary trader then you have trading strategies with guidelines… [this] relies somewhat on common sense and gut instinct.”

Today I will finish by discussing the latter.

“Gut instinct” is a type of knowledge that may be difficult or impossible to describe as binary statements or programmable criteria. The guidelines are meant to be generalities subject to change depending on what discretionary traders believe to have typically occurred in the past when these observations were made.

Since this does not reduce to programmable criteria, the biggest problem with gut instinct is the inability to backtest trading strategies. Maybe your gut would have proven correct one or two times. Would it have proven correct most times out of a large number of instances, though? These may be hard to determine without using software to scan the universe of markets over long periods of time.

Because it cannot be objectified, gut instinct lends itself to biased thinking. Confirmation bias is the tendency for people to favor information that confirms their beliefs. This leads to overconfidence because it’s not necessarily true that gut instinct has proven itself correct time and time again–it simply has yet to fail.

Gut instinct also falls prey to the availability heuristic, which is when you mistakenly believe something at the forefront of your mind is something that has occurred often. For example, if you recently saw a moving average crossover generate a profitable trade then you may be more likely to trade similar crossovers in the future. One instance does not make for a robust phenomenon; it may simply be good luck.

In the next post, I will break down characteristics and qualities of algorithmic trading.

Tags: critical thinking | Categories: optionScam.com | Comments (1) | PermalinkStrategies vs. Systems (Part IV)

Posted by Mark on June 4, 2012 at 15:47 | Last modified: June 4, 2012 16:36In my last post (http://www.optionfanatic.com/2012/05/23/strategies-vs-systems-part-iii/), I said quite a mouthful.

Let’s break it down.

“If you are a discretionary trader then you have trading strategies with guidelines… [this] relies somewhat on common sense and gut instinct.”

Discretionary traders claim to know their market through lengthy study and/or live trading experience. They claim to have a feel for how the market moves–slow or fast, volatile or nonvolatile, cyclical ranges, etc. They claim to have a feel for common price patterns, tendencies, and fake outs. Based on this assumed understanding, discretionary traders develop trading strategies with guidelines.

“Common sense” includes tendencies that sound logical. For example, it sounds logical to reduce exposure to the market ahead of big news announcements or known events when you don’t know how the market might react. Discretionary traders often include logically sounding guidelines in their trading approach regardless of whether these boost or detract from profitability.

The unfortunate fact is that common sense trading guidelines often end up producing unprofitable trades. This is evident in the thousands of trading systems based on common sense criteria that have generated unimpressive results. The only way to know if inclusion of common sense guidelines is beneficial would be to define some trading rules and backtest them. This is more work than most [discretionary traders] are willing or able to do.

In my next post, I will wax eloquent for a while about “gut instinct.”

Tags: critical thinking | Categories: optionScam.com | Comments (0) | PermalinkStrategies vs. Systems (Part III)

Posted by Mark on May 23, 2012 at 09:29 | Last modified: May 23, 2012 09:32In Part II of this series (http://www.optionfanatic.com/2012/05/16/strategies-vs-systems-part-ii/), I continued to argue that trading strategies are optionScam.com. Let’s continue this analysis from another angle.

In the quest for consistent trading profits, traders are commonly discretionary or algorithmic in their approach.

Much ado has been made about the differences between these two. If you are a discretionary trader then you have trading strategies with guidelines. If you are an algorithmic trader then you have trading systems with rules. The former relies somewhat on common sense and gut instinct. The latter depends on programmable criteria that can be evaluated and executed by a computer.

At this point in my trading career, I strongly suspect that through a complex interplay of logic and human psychology including but not limited to the effect of wins and losses on emotions and memory, Maslow’s hierarchy, and ego fulfillment, discretionary trading may be optionScam.com at its finest.

That’s nothing short of a mouthful. In future posts, I will break down each and every one of these elements.

Tags: critical thinking | Categories: optionScam.com | Comments (2) | PermalinkThe More Things Change…

Posted by Mark on May 21, 2012 at 09:51 | Last modified: May 21, 2012 09:51…the more they stay the same? This excerpt is from Gary Smith’s book Live the Dream by Profitably Trading Stock Futures, which was published 17 years ago:

“There are a handful of vendors that sell hyped and overpriced systems, seminars and trading manuals that purport to teach the public how to day trade the S&P successfully. They recommend trading not only on a daily basis, but even several times during the day. Off the floor it is an almost impossible task to trade profitably this way… I find it interesting that absolutely NONE of these vendors can prove that they are winning traders via multiple-year, real-time brokerage statements. Their trading courses are total illusions. They dazzle you with an array of historical charts and other past data to illustrate the purported validity of their methodology.”

Categories: optionScam.com | Comments (0) | PermalinkStrategies vs. Systems (Part II)

Posted by Mark on May 16, 2012 at 14:20 | Last modified: May 16, 2012 14:20In Part I (http://www.optionfanatic.com/2012/05/07/strategies-vs-systems-part-i/) I argued that trading strategies are optionScam.com. A second reason for this claim is because trading strategies often assume you can predict the future.

Many option education programs teach you how to place trades to optimize the current trend of the market. I have subscribed to two of these programs in my trading career at a cost of over $6,000 each. One program teaches “form a market opinion and place a trade to optimize that market trend.” The second program teaches “don’t try to predict market direction” and advises placement of non-directional “income trades” that make money if the market trades up a little, down a little, or sideways.

Although both programs spend hours teaching you how to place the “correct” trades, what actually determines profitability is whether your market expectation is correct. Neither program spends more than a couple hours on this! With regard to placing the trades correctly, I can save you $6,000 by listing a number of books under $30 or free web sites providing this content. The only way to know if your process will sufficiently determine future market direction (sideways included) is to perform a valid backtest.

System development is the real work to be done and these “educational programs” teach nothing about it.

Because your market expectation may be wrong, both programs teach you to trade small to limit risk. Trading small also limits gains, though. The key question is whether these approaches even have positive expectancy. This is a complicated question still up for debate and if the answer is no then at $6,000-a-pop you will be learning nothing more than how to lose all your money slower rather than faster.

Save your retirement account. Give me a couple grand and call it good.

Tags: trader education | Categories: optionScam.com, System Development | Comments (1) | PermalinkStrategies vs Systems (Part I)

Posted by Mark on May 7, 2012 at 23:54 | Last modified: May 8, 2012 10:30Trading systems are capable of generating consistent profits while trading strategies are optionScam.com (see http://www.optionfanatic.com/2012/04/21/optionscam-com/).

Trading strategies are available everywhere you look. You can find trading strategies in books, through webinars, on internet sites–this list goes on and on. Strategies are often marketed through long advertisements that promise huge ROIs and large compounded returns.

Trading strategies appeal to human greed. They are sought after and commonly sold for hundreds to thousands of dollars. Expensive trader education programs generally teach strategies. If the market is bullish (bearish) then do X (Y) trade. If the market is stagnant then do Z trade. You can spend lots of money learning what kinds of trades will optimize what trends. At the very least, this makes you dangerous although it may not make you profitable.

Trading strategies are well illustrated by single trades in isolation, which is hardly the reality of live trading. By applying the strategy guidelines to a particular trade, you can learn its strengths and weaknesses. Annualize that ROI (as if!) and human nature has already taken over. “Imagine what X%/year can become over the course of decades!” Human nature needs a reality check. The only way to generate consistent income and meaningful growth is to trade as a business, which single trades in isolation are not.

A trading strategy is not a trading system because it lacks detail about money management. Money management addresses Risk of Ruin for the entire portfolio. Making money without studying this is luck at its finest–luck that will eventually run out.

For these reasons, trading strategies are generally not actionable. This makes trading strategies optionScam.com. In future posts I will go into more detail about this important concept.

Tags: critical thinking | Categories: Money Management, optionScam.com | Comments (2) | PermalinkoptionScam.com

Posted by Mark on April 21, 2012 at 10:43 | Last modified: April 19, 2012 10:45How can I trade in order to generate consistent profitability over time? That is the $6M question most any trading mentorship program, educational program, or investing service is trying to answer. None of them have the answer but all of them purport to have an answer. Since my focus is mainly on options, I’m going to call this misnomer “optionScam.com.”

A scam is a fraudulent or deceptive act or operation. A scam is when you pay for something promised that you don’t end up getting.

Most all retail traders dream of making consistent profits over time. Out of fear and greed, the two emotions most commonly attributed to traders, we tend to be pulled toward outlets that promise this consistent profitability.

No program or service can truly provide us with such consistent profitability, however. Regardless of whether we pay a couple hundred dollars or several thousand dollars, nobody can deliver on this promise. Paying money to not receive the service promised is optionScam.com.

Proof of optionScam.com is like proof of arbitrage bounds. A higher strike put must always cost more than a lower strike put. A longer dated put (call) must always cost more than a shorter dated put (call) at the same strike. A call must always cost less than or equal to the underlying price. If any of these are violated then you could place a trade for guaranteed profit. Similarly, if someone absolutely knew how to generate consistent profit over time then they could do the trade for guaranteed profit. What would happen with arbitrage bound violations or the profitability promise is that others would execute the trade until the profit was no longer [guaranteed].

This is what makes any such promises optionScam.com.

Let me be absolutely clear: IN ORDER TO BE A SUCCESSFUL TRADER YOU MUST AVOID optionScam.com.

Tags: critical thinking, survival | Categories: optionScam.com | Comments (3) | Permalink