Words to Live By? (Part 4)

Posted by Mark on September 17, 2013 at 14:04 | Last modified: January 24, 2014 08:42Having lain the foundation for critical thinking, I will now begin to analyze the trader “wisdom” as presented in part 1.

The trader begins:

“I think one of the most important things X teaches is trading the same market over and over and over again.”

This suggests I should not trade multiple markets sporadically. I find this interesting because I have often debated whether I should have a watch list approach to trading where I limit myself to a specific group of markets to be analyzed and traded all the time or whether I should use a scanning approach to trade any markets that meet a specified set of criteria. People line both sides of the aisle on this issue. There is no right answer.

“You get to the point where you don’t need any indicators. You really understand how the market breathes.”

That sounds encouraging! This also sounds very meaningful and even, dare I say, intimate. Good persuasive technique.

“You get really comfortable [and really start to think] ‘okay, I know what I’m doing today.’ It’s not that you can predict the future with it but you get comfortable with how [the market] reacts.”

The unspoken premise here is if I consistently make money trading it. Surely if I am losing then I will not feel comfortable or very knowledgeable. If my losses are great enough then I won’t think I know a damn thing and I might even decide to throw in the towel altogether! In other words, by phrasing the advice in this way, he suggests you will make money consistently because that is the only way his statement will be true. This is good persuasive technique as well.

Are you getting the gist of where I’m going with all this? I will continue with my next post.

Categories: optionScam.com, Wisdom | Comments (1) | PermalinkWords to Live By? (Part 3)

Posted by Mark on September 12, 2013 at 07:22 | Last modified: January 24, 2014 08:41In my last post I began to lay some foundation for critical thinking. This is useful to evaluate others’ claims in the financial industry or otherwise.

Television has dramatized countless times over the decades how you often cannot believe what people say. Summed together, CSI: Crime Scene Investigation, CSI: Miami, and CSI: New York have entertained audiences to over 740 television episodes and not a single episode has failed to feature a suspect who did not lie. The same may be said for patients of Gregory House in 177 episodes of House, M.D. Pretty Little Liars features continuous deceit as does [probably] any and every soap opera ever to appear on TV. If people in general can’t be trusted then claims about success (read: marketing) certainly cannot be accepted without intense scrutiny.

This is valid reason why you probably should not heed others’ advice in financial matters. “Others’ advice” may include premium investment advisories, investment/trading education packages or “mentorships,” and for-profit trading rooms (if you are paying then they are profiting). The ultimate arbiter is the PnL and regardless of how well they organize a presentation, you can never verify its true authenticity. Visiting face-to-face with the person and holding in your hand monthly brokerage statements with account numbers displayed tempts true belief but in the financial industry this never, ever happens. More often, you talk to people over the phone, e-mail via the Internet, and see or hear alleged performance numbers. Never do you personally witness a signed tax return complete with SSN.

This simple observation about human nature gives me tremendous latitude to say things that sound very logical on the surface. If I present these words with confidence and appear to have a following of others then I may even have great persuasive power. An apparent following may include positive reviews on Amazon.com, virtual participants appearing to be attending my webinars, students I claim to be enrolled in my education program, or my face frequenting financial media such as theStreet.com articles or CNBC segments. When you believe me then you will pay me because you hope I can make you rich.

In too many cases, all you will end up doing is allowing me to live criminally.

Categories: optionScam.com, Wisdom | Comments (1) | PermalinkWords to Live By? (Part 2)

Posted by Mark on September 9, 2013 at 07:40 | Last modified: January 24, 2014 08:41A few days ago, I heard a trader addressing a group. By the tone of his voice and the superficial meaning of his words, this was certainly sage advice. Today I will begin to lay the framework of critical thinking that should always be employed to evaluate what people say in financial circles [or anywhere else, perhaps].

The ultimate arbiter on all things right or wrong about financial markets is the profit/loss (PnL). I can say whatever I want about this stock or that market, this pattern or that valuation, this metric or that performance statistic. If I make money for myself or for others then I will stay in the game. If I lose money then I will eventually go bust and you will hear me no more.

Unfortunately for those listening, you can never know what my true PnL is. I can tell you that I’ve made hundreds of millions of dollars in stocks. Will you believe me? In an industry sometimes suspected of snake oil, chicanery, and egregious fraud driven by human greed, should you believe me?

If there’s any possible way that I might profit now or later from your belief then you probably should not believe me.

Mull that over for a couple days and I will continue to develop this thesis in my next post.

Categories: optionScam.com, Wisdom | Comments (1) | PermalinkWords to Live By? (Part 1)

Posted by Mark on September 6, 2013 at 02:47 | Last modified: January 24, 2014 08:41The last couple of posts elucidated my general belief that the financial industry is a comprehensive scam. I mentioned chipping away at a foundation suggesting that once the evidence accumulates, the totality of deception will be overwhelming beyond any reasonable doubt.

Today I heard something that had the veneer of trading wisdom. You know, the old adages that seemingly light the way to the Holy Grail… common mistakes that I am always guilty of making when I lose significant money…

Here is what I heard:

“I think one of the most important things X teaches is trading the same market over and over and over again. You get to the point where you don’t need any indicators. You really understand how the market breathes. You get really comfortable [and really start to think] ‘okay, I know what I’m doing today.’ It’s not that you can predict the future with it but you get comfortable with how [the market] reacts. I sit here in front of the screens all the time watching the 5-minute bars on all the futures and I’ve gotten very comfortable with my trades because I kinda know… I get decent entry points because I know how the market is moving around when I’m getting my trades on and I know when to just… hold off… doing my adjustment for 5, 10, or 15 minutes to see—you know, typically it’ll reverse here so I’ll wait and see and maybe get a better price. On this trade, I think it’s important to really understand how [the market] works so you can see the graph and see how these candles affect the trade. You’ll see patterns among the stocks.”

Does that sound like good, reasonable advice coming from a professional trader? Words to live by?

I’ll begin my analysis in the next post.

Categories: optionScam.com, Wisdom | Comments (5) | PermalinkThe Scam is Everything (Part 2)

Posted by Mark on August 30, 2013 at 05:22 | Last modified: December 11, 2013 14:04In my last post I began a slow ramble about how the financial industry strikes me as a scam.

Maybe it doesn’t matter much that financial advisors and fund managers are crooked given that I can trade and invest my own money but few people actually do. A cursory Google search found this article from 2011, which indicates only 11% of trading volume to be retail. In some way, shape, or form, this implies that 89% of all trading is done by firms managing other people’s money.

If the financial industry is a scam then it’s a big deal.

My view is not going to be a popular one.

The money and the influence belongs to Wall Street, which has power to direct the media, influence publications, etc.

My words would probably be laughed at, debated, labeled as absurd, and rejected. My reputation would quickly be tarnished.

Thankfully, I’m not out to win a war of propaganda. My goal is only to better understand for myself and in so doing, to have greater awareness of what it will take to succeed as a retail trader.

To repeat: I care about my performance and my results.

Follow me and comment as you wish.

Categories: optionScam.com | Comments (0) | PermalinkThe Scam is Everything (Part 1)

Posted by Mark on August 27, 2013 at 04:15 | Last modified: December 11, 2013 13:35One thesis I explore in this blog continues to be supported with few exceptions: the financial industry is a scam.

I cannot prove this.

I sometimes have trouble explaining exactly what this means.

But the more you read my posts and think about how the general themes fit together, the more you will see me chipping away at a foundation assumed by many to be, at some level, sacrosanct.

Make no mistake: respect for the financial industry is hardly held up on a pedestal or even, in general terms, spoken about with healthy respect. The Occupy Movement (“we are the 99%”) drew a line separating “Wall Street”–the few people with great wealth–from “Main Street”–the vast majority of the population comprising a small percentage of total wealth. Banks and investment advisory services are often spoken about with disdain. The stock market is often said to be manipulated.

People do seem to have an easier time hating the financial industry in general than the specific people or entities with whom they interact. As an example, you may have a good relationship with a banker or manager at your local branch. You may have a financial advisor who you trust. Cognitive dissonance theory helps to explain this (http://en.wikipedia.org/wiki/Cognitive_dissonance). Most people need to have a local bank and most people with money believe they need a financial advisor. If you truly dislike your banker and your financial advisor then why are you sticking with them? If I am with a bank I hate and a financial advisor I don’t trust then maybe I am the dummy for not getting off my couch and exploring to find new ones. People don’t want to admit this so they [unconsciously] form a more favorable opinion of their bank and their financial advisor, instead. Your own mind may contribute to your being sold.

And while people hate the industry as a whole, they’re less likely to suspect or realize the ones they have direct interactions with are also cut from the same, untrustworthy cloth.

I will continue this discussion with my next post.

Categories: optionScam.com | Comments (5) | PermalinkThe “Fitz” of Retrospect (Part 2)

Posted by Mark on June 11, 2013 at 04:12 | Last modified: July 25, 2013 12:31In my last post, I discussed an MTZ trade that Dan Fitzpatrick explained could have easily made you 10% in a short period of time. Upon closer scrutiny this trade seems to be more difficult than promised, no thanks to the illusion of Retrospect.

Fitzpatrick said you could buy on a move above the thick black line and ride the stock to victory:

A closer look reveals that MTZ definitely traded higher the next day:

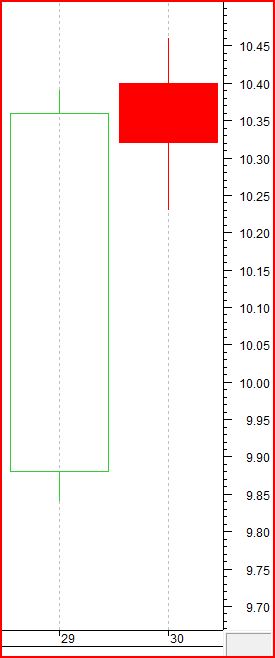

MTZ closed at $10.36 on the 29th and opened at $10.40 on the 30th. MTZ then traded up to $10.46: a full 1% above the previous close. While Fitz suggests this day to be weak and not reason to buy, nothing weak is evident in the first 30 minutes when the stock opened higher and continued higher.

If I were to truly follow Fitz’s directions then I would have had a more difficult trade than Fitz represents. The easy way to follow Fitz’s lead would be to set a buy-stop to enter long above $10.36. Two days later, MTZ traded down to $10.04 intraday: a loss of 3.1%. This would have undercut the 50-day moving average (seen on the top chart) and caused some people to exit at a loss. If I would enter on a buy-stop intraday then why wouldn’t I exit on an intraday stop-loss?

Retrospect is the illusion that masks the difference between what Dan Fitzpatrick says would happen with this trade and what really would have happened. Getting on-board and riding the stock up 10%+ is the fairy tale we want to believe. The difference between that and the reality of buying, losing 3.1%, and then riding onto victory was significant for those who didn’t stick around to be rewarded with the profits!

Application of Retrospect means trading away from a chart’s hard right edge, which is not reality. The illusion of Retrospect therefore allows one to gloss over particular details that involve a great deal of endless debate, instruction, and theory. This is what makes trading so difficult to learn and to master.

Categories: optionScam.com | Comments (0) | PermalinkThe “Fitz” of Retrospect (Part 1)

Posted by Mark on June 3, 2013 at 04:01 | Last modified: July 25, 2013 11:50Dan Fitzpatrick (a.k.a. “Fitz”) is a talking head who has been featured on CNBC’s “The Call,” Jim Cramer’s “Mad Money,” and theStreet.com where he posts “3 Stocks I Saw on TV.” Not surprisingly, he also has his own premium trading service called Stock Market Mentor. In his free chart of the day from October 16, 2010, he did something that I have seen virtually every “educated” stock market commentator do: try and get us to fall for the illusion of Retrospect.

In this video, Fitz discussed a breakout trade on Mastec Inc. (MTZ). The chart is shown below:

On the chart, you can see the black line Fitz drew to coincide with the top of the large green candle in September. This is the breakout level. Fitz then explains:

> “When the stock gets above the initial breakout level is when you want to

> participate… this is a textbook volatility squeeze. I see this so much where

> you get the initial move one day—BAM—that draws your attention to the

> stock, only the next day—yeah it went up a little bit but it was kind of

> weak. It came back down and then finally you get this blowout above the

> initial breakout level… now you’re in at, say, $10.50 and you ride it clear

> up to $11.50 and you’ve made 10%.”

How easy does that sound as a way to print money?

The premise of this trade is to enter long when MTZ trades above the black line. MTZ did just that the very next day (yellow highlighting). Fitz notes this even though “it was kind of weak.” He glosses over it as if you would not take this trade. His chart pretty much hides it, and unless you were watching with a critical eye, you might not really see it, either. The dramatic breakout, after all, is a few days later.

I will conclude with my next post.

Categories: optionScam.com | Comments (1) | PermalinkIs Independent Trading Success Possible? (Part 4)

Posted by Mark on May 30, 2013 at 06:40 | Last modified: July 25, 2013 12:30This blog mini-series initially aimed to discuss whether independent trading success is actually possible.

I have observed many people who claim to be successful traders and most have something to sell. Some people start off with blogs and a web site and others progress to a subscription newsletter, a mentorship service, or an “educational program.”

As Gregory House says, “everybody lies.” People may lie for many reasons. This realization forces me to accept only authentic account statements and tax returns rather than completed questionnaires.

Since these documents are regarded as intensely personal in our society, I have a research problem. I might be able to collect such data in exchange for significant compensation but I don’t have that kind of budget. I am therefore left with no investigative means for a practical research question.

Is independent trading success possible vs. can we demonstrate the existence of statistically significant independent trading success? The latter seems to be “no,” which leaves me to be content with a sample size of one: myself. Human greed is what keeps us all searching for the “holy grail” and this hope will sustain trader interest and activity even when proven success stories are nonexistent.

“We believe what we want to believe.”

As for those looking for a new line of work, I might encourage a profession where demonstrated efficacy (i.e. a regular pay check) exists rather than one that might be sustained only by urban legend or anecdotal reports of success.

Categories: optionScam.com | Comments (0) | PermalinkIs Independent Trading Success Possible? (Part 3)

Posted by Mark on May 22, 2013 at 06:10 | Last modified: July 25, 2013 12:28In this mini-series, I may have raised more than reasonable doubt as to whether verification of independent trading success is even possible.

One thing I cannot do is gather data by survey or questionnaire. As mentioned previously, people will exaggerate and lie especially when it comes to matters of performance. Someone believed to be successful can develop a tremendous amount of respect and admiration from others. At the very least, this can fulfill Maslow’s needs for affiliation and esteem. This can also serve as sales and marketing for products or services–especially trading newsletters or “educational” programs. Can you say “conflict of interest?”

Since word of mouth cannot be trusted, I must focus exclusively on authentic documentation. Some people may show me a trade confirmation or two, but this is far from satisfactory. I need to see account statements and tax returns over a lengthy period of time to establish consistent profitability. As discussed in my last post, I would also need to see them from a large number of people.

Fahgettaboudit, right? In our society, people just don’t share such information with strangers.

While brokerages have access to the requisite documentation, I don’t believe they can be trusted. No brokerage could serve as an objective investigator when promotion of trading stands to increase its profits. To publish findings that independent traders are doomed to fail would be a conflict of interest with the brokerage’s bottom line.

The IRS also has access to the requisite documentation but from a practical standpoint, I see no justification for the research expense. The IRS cares about collecting taxes, not demonstrating independent traders’ ability to succeed. If they cared about success rates then they would certainly study numerous other professions as well, which would drive costs to an enormous sum.

Supposing independent trading success is indeed possible, now I question whether this is something we could possibly know.

If a tree falls in a forest and no one is around to hear it, does it make a sound?

Categories: optionScam.com | Comments (1) | Permalink