Weekly Iron Butterfly Backtest (Part 4)

Posted by Mark on June 24, 2013 at 07:42 | Last modified: August 1, 2013 07:57In this blog series, I’m backtesting a weekly option trade described here.

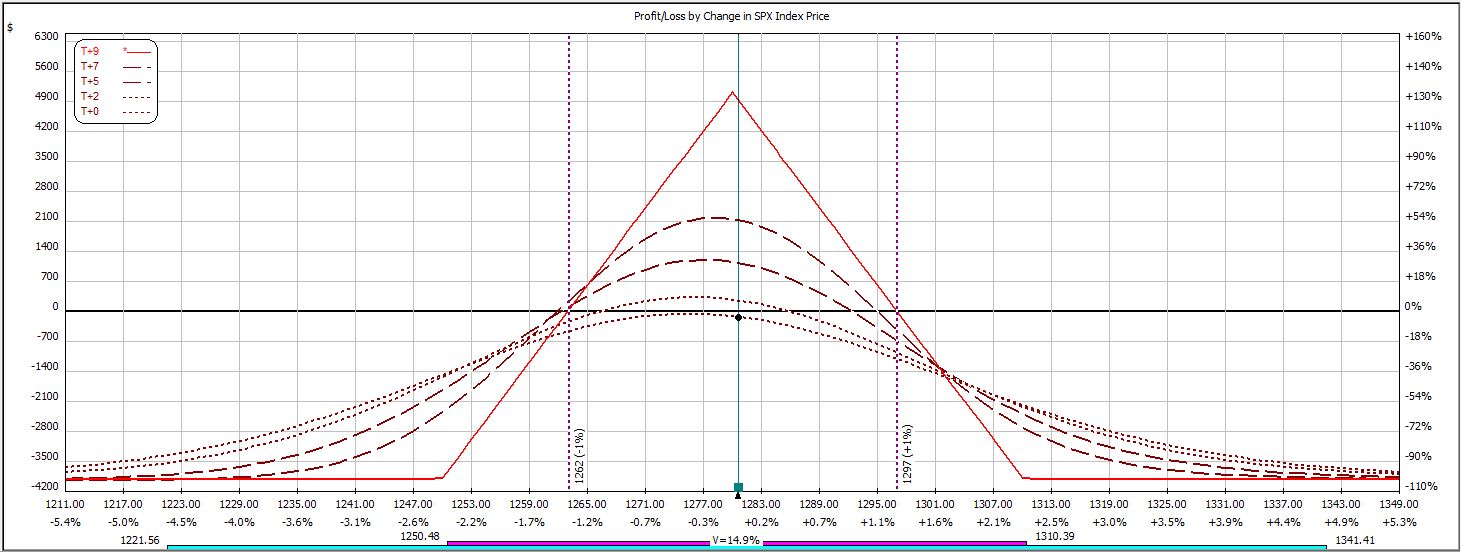

The third week required an adjustment. At inception, the trade looked like this:

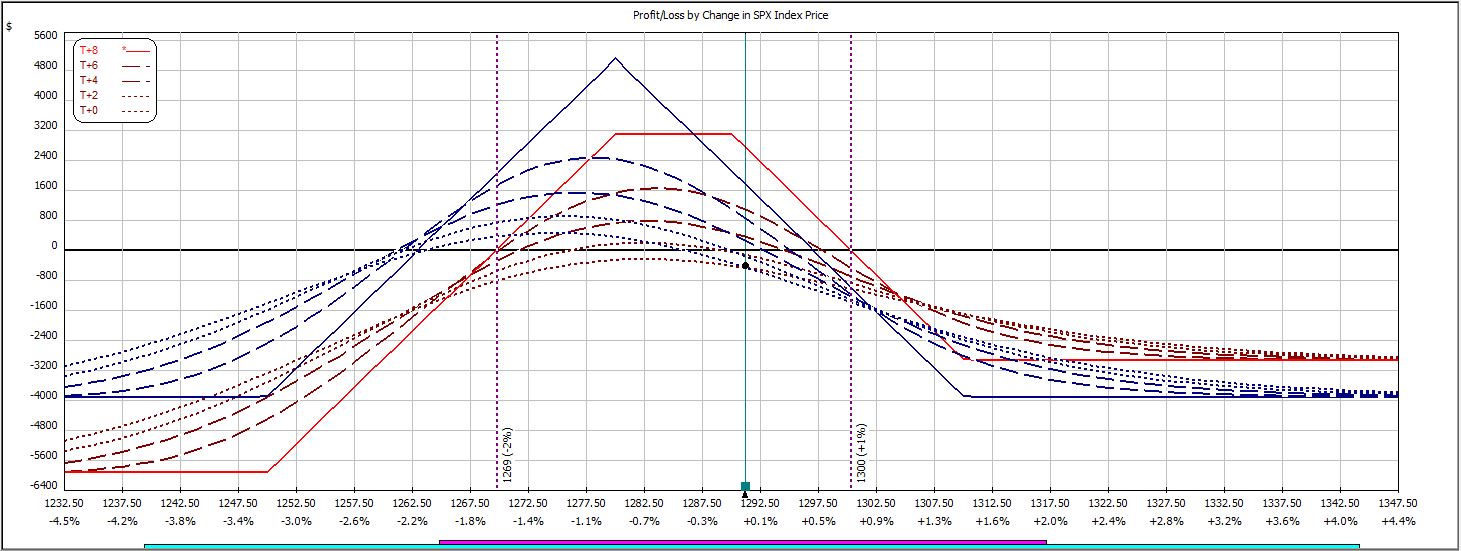

The market was 10 points higher on Day 2, which required me to roll up the short call:

A discussion may be had whether to roll up the short call or the short call vertical spread. The former cuts net position delta while the latter does not increase risk as much. Although the former increase risk (margin requirement) more, that risk is on the profitable side of the trade. If the market continues to trend then the risk is actually less. This may be seen in the above graph that shows the adjusted trade superimposed on the original trade.

Which adjustment is better? That is a very difficult question to answer that would require extensive backtesting. I may be able to do that eventually for now I continue one week at a time.

P/L on Day 1 ranged from -$144 to +$39.

P/L on Day 2 ranged from -$426 to +$189 and the margin requirement increased from $3,915 to $5,931 on three contracts.

P/L on Day 5 (nothing happened over the weekend) ranged from +$72 to +$216.

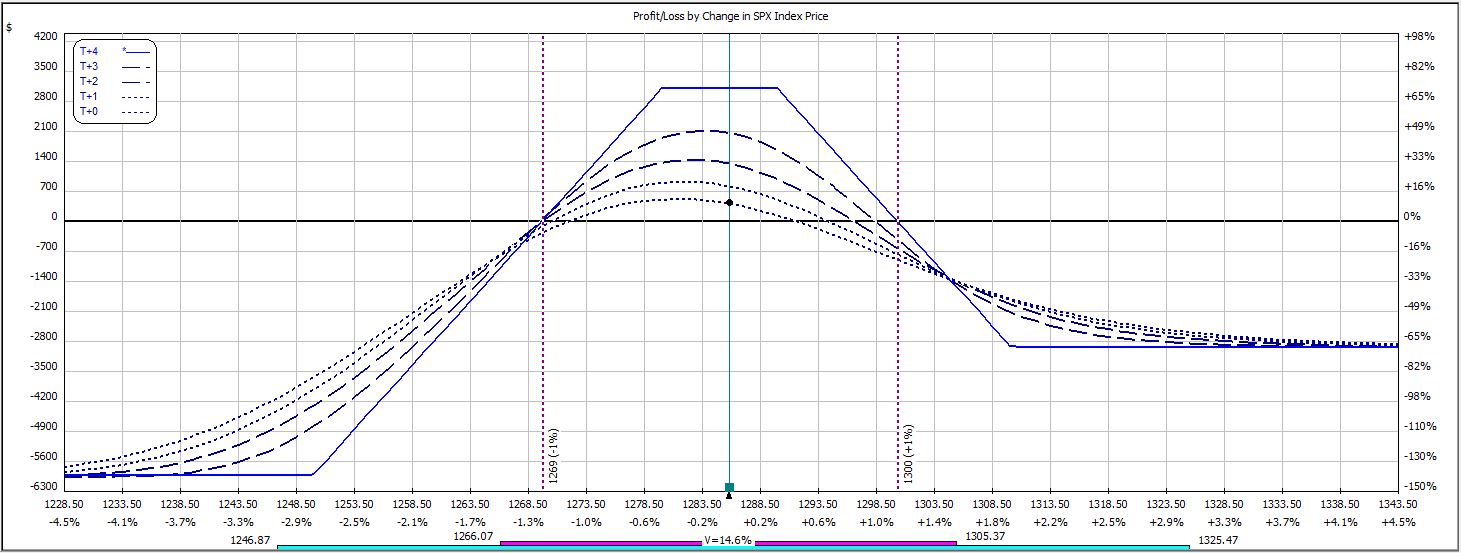

P/L on Day 6 ranged from $237 to $447, which is when I closed the trade:

On the increased margin, return on investment was 7.5% on this trade.

Another question for debate is what to do if the market returns to its original price after rising or falling 10 points and forcing an adjustment: undo the adjustment or let it ride? This is another question that cannot be answered yet. The current trade does suggest, however, that adjustment requires staying in the trade longer to reach profit target. That makes theoretical sense.

Thus far, this trade has three wins and zero losses.