The “Fitz” of Retrospect (Part 2)

Posted by Mark on June 11, 2013 at 04:12 | Last modified: July 25, 2013 12:31In my last post, I discussed an MTZ trade that Dan Fitzpatrick explained could have easily made you 10% in a short period of time. Upon closer scrutiny this trade seems to be more difficult than promised, no thanks to the illusion of Retrospect.

Fitzpatrick said you could buy on a move above the thick black line and ride the stock to victory:

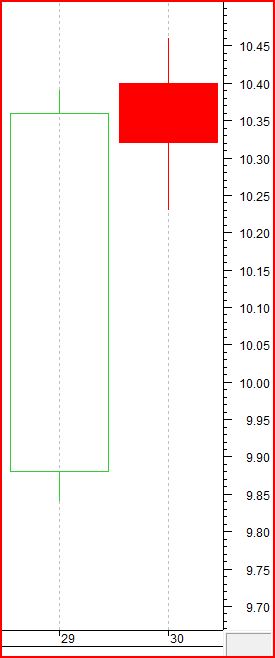

A closer look reveals that MTZ definitely traded higher the next day:

MTZ closed at $10.36 on the 29th and opened at $10.40 on the 30th. MTZ then traded up to $10.46: a full 1% above the previous close. While Fitz suggests this day to be weak and not reason to buy, nothing weak is evident in the first 30 minutes when the stock opened higher and continued higher.

If I were to truly follow Fitz’s directions then I would have had a more difficult trade than Fitz represents. The easy way to follow Fitz’s lead would be to set a buy-stop to enter long above $10.36. Two days later, MTZ traded down to $10.04 intraday: a loss of 3.1%. This would have undercut the 50-day moving average (seen on the top chart) and caused some people to exit at a loss. If I would enter on a buy-stop intraday then why wouldn’t I exit on an intraday stop-loss?

Retrospect is the illusion that masks the difference between what Dan Fitzpatrick says would happen with this trade and what really would have happened. Getting on-board and riding the stock up 10%+ is the fairy tale we want to believe. The difference between that and the reality of buying, losing 3.1%, and then riding onto victory was significant for those who didn’t stick around to be rewarded with the profits!

Application of Retrospect means trading away from a chart’s hard right edge, which is not reality. The illusion of Retrospect therefore allows one to gloss over particular details that involve a great deal of endless debate, instruction, and theory. This is what makes trading so difficult to learn and to master.