Practice Trades BWB+Cal 1.3 (Part 1)

Posted by Mark on January 27, 2022 at 07:02 | Last modified: December 13, 2021 17:00This trade begins 10/12/20 (14 DTE) down $840. MR is $7,140 (five contracts) and PT is $7,140 * 0.05 = $357. At inception, TD = 128, IV 17.9, NPD = -0.65, and NPV = -140.

PnL is -$940 at 1 DIT.

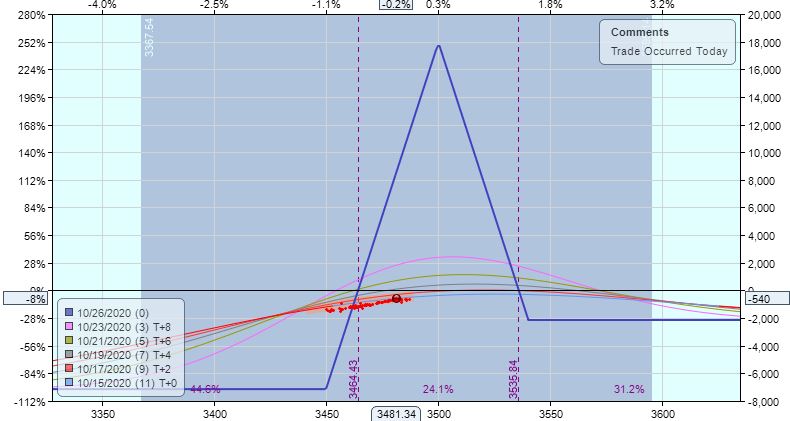

Three trading days later, I hit the first adjustment point with trade down $540 (7.6%):

This is 17 points into a 70-point width (between breakevens), which is just inside the 25-yard-line. Adjusting puts the calendar inside the BWB structure, which for some reason doesn’t feel right to me. Other options would be to place farther OTM (40 points) or to do nothing at all. The latter would be vulnerable to a big downside opening gap and/or being far beyond an adjustment point at next monitoring in 24 hours.

Since this isn’t even MDD and TD = 8, I’m going to be a rebel and do nothing at all.

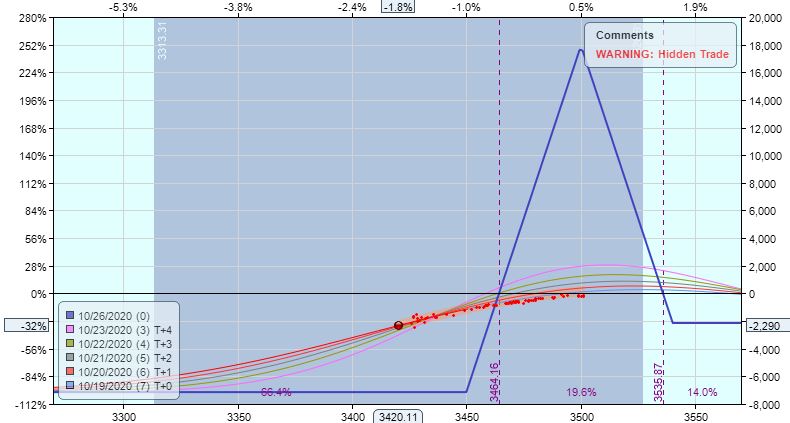

Two trading days later, we get a -1.5 SD move:

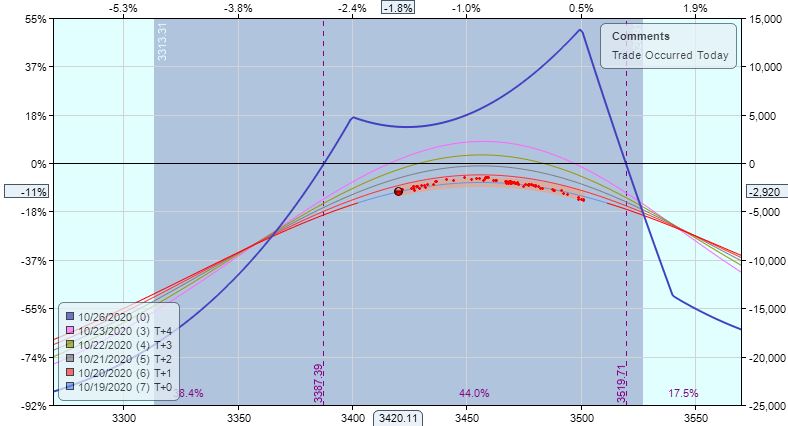

I am now down $2,290 (-32%) and the prescribed adjustment (with lower wing calendarization) looks like this:

Three of five T+x lines are underwater, but facing a big loss I find it difficult to exit. The adjustment increases my loss to $2,920, which is [only] -10.8% of the [dramatically increased] $27,155 resultant margin requirement.

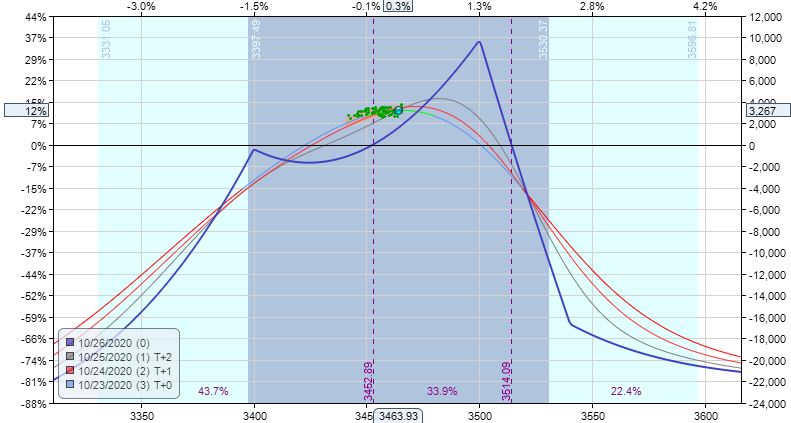

Blue skies lie ahead. Two trading days later I have a $130 profit. One trading day after that, I’m up $1,380 (5.1%). One trading day after that, I’m up $3,267 (12%):

If I didn’t exit for +$1,380, which was at the profit target, then this is certainly a must-exit being Friday and 3 DTE.

Things work out well by doing the trade “wrong.”

What if do the trade “right?” I will pick up here next time.