Naked Call Backtest (Part 1)

Posted by Mark on October 19, 2021 at 07:38 | Last modified: July 5, 2021 09:53For the last several years, I have not been a proponent of selling naked calls. However, “necessity is the mother of invention.” Volatility does not explode to the upside; how bad can they actually be?

Here are my backtesting guidelines:

- Use OptionNet Explorer (ONE) between 3/23/2020 – 7/1/2021.

- Sell 10 naked calls in monthly expiration closest to 30 DTE for ~$7/contract.

- Use 25-point strikes only.

- Assess transaction fee of $16/contract (slippage and commission).

- Monitor market once daily at 3:50 PM ET.

- If ITM, roll to following month as far OTM as possible for credit and double size.

- Otherwise, rinse and repeat on expiration day.

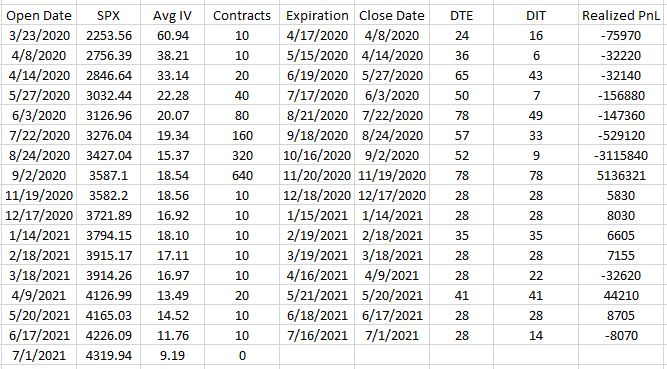

This is the backtesting period:

To understand how bad naked calls can possibly be, this seems to be a pretty good place to start. SPX 2254 to 4316 is an increase of ~91% in just over 15 months: a staggering [recovery and] ascent! I expect to see losses under these conditions.

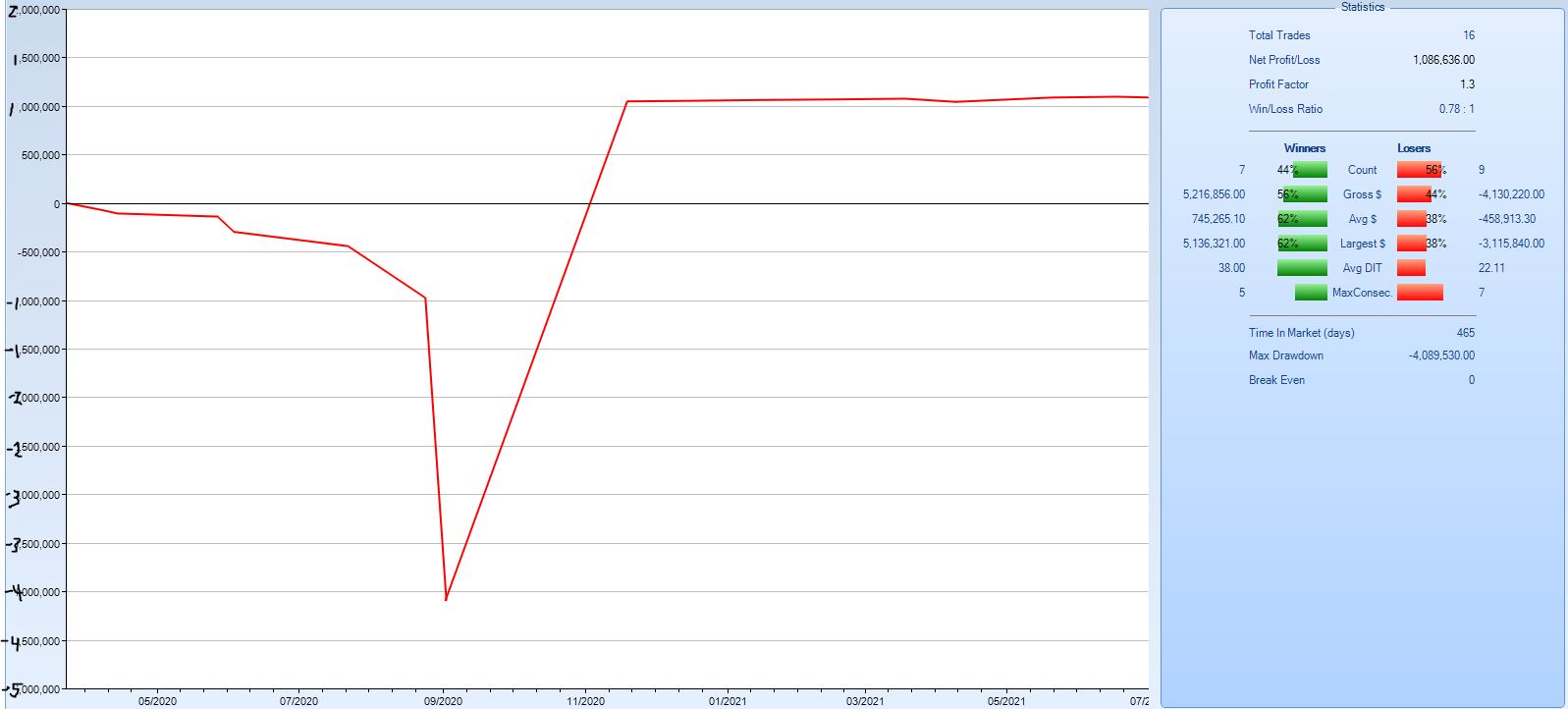

Here are the overall results:

This is a strange looking equity curve. It certainly does not match my ideal, which would be upward sloping at 45 degrees. From inception through Sep 2020, this strategy does a wonderful job losing money. From Nov 2020 on, it looks flat. In between the two periods, it makes a ton of money.

Trade statistics indicate this strategy loses more often than it wins and that the average winner is bigger than the average loser. Overall, this shakes out to a profit factor of 1.3.

Take it or leave it?

Let’s look closer to the individual trade results:

The first seven trades are all losses and position size doubles each time. No wonder the numbers on the equity curve get huge. A win finally recoups all losses and then some. Position size remains comparatively low for the remainder of the backtest (10-20 contracts compared to the high of 640), which is why the curve is flat on the right side.

One trade out of 16 saves our bacon.

Actually, what saves our bacon is not the particular trade but rather the position size. Any of the winning trades sized at 640 contracts would generate enough profit to overcome the losses.

We must not forget about risk. Portfolio margin (PM) for naked calls is 12%. With SPX at 2254, this amounts to 2254 * 100 * 0.12 = $27,048/contract. With SPX at 4316, this amounts to 4316 * 100 * 0.12 = $51,792/contract. The initial position size carries a PM requirement between ~$270K – $518K. 640 contracts carries a PM requirement between ~$17M – $33M where

M = million. This backtest includes a 64-fold increase in position size!

At this point, I have to say leave it. Even with one contract, PM requirements are too large and the MDD ($406K) is too big.

I will continue next time.