Investing in T-bills (Part 5)

Posted by Mark on February 20, 2024 at 11:37 | Last modified: March 20, 2024 21:37Having now completed the comparison between long calls and short puts, we’re now ready to consider both at once.

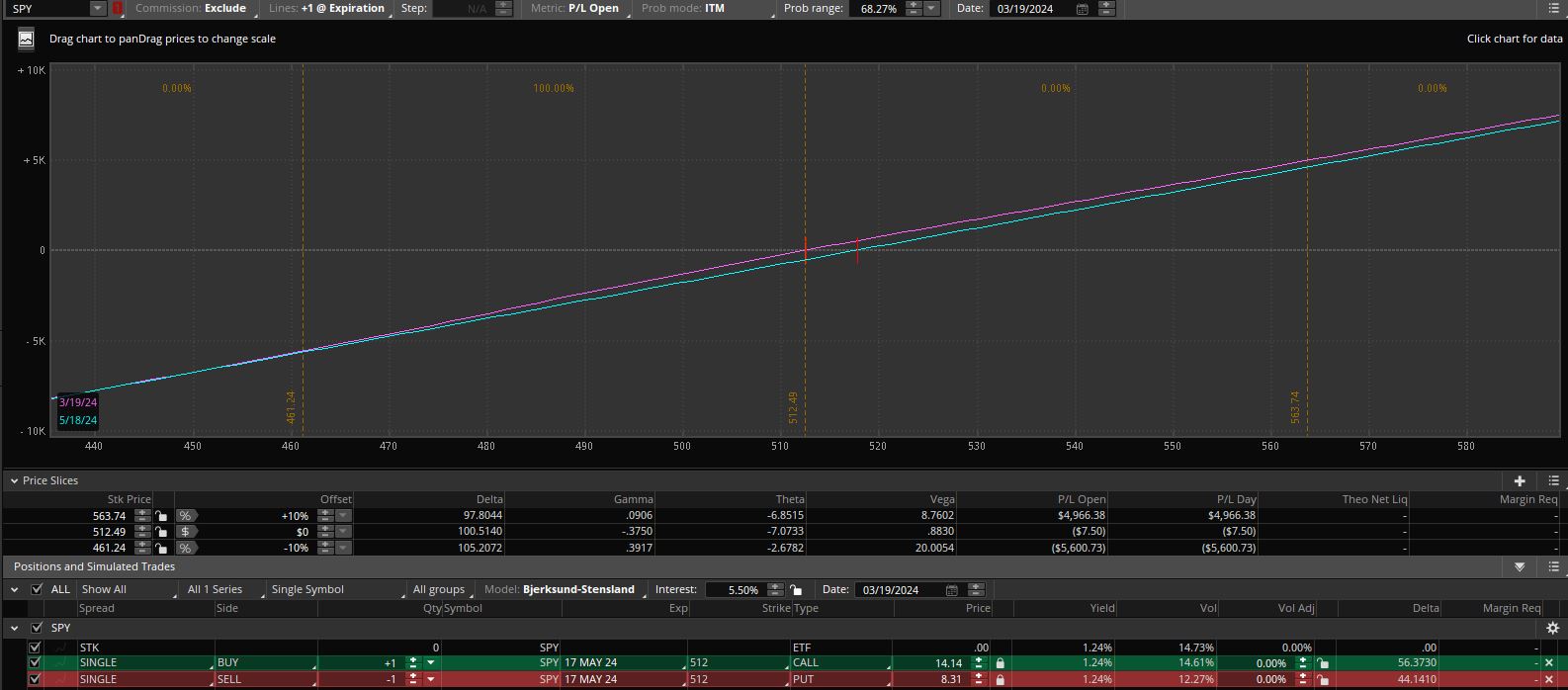

A long call and short put opened at the same strike price produce a risk graph that may look familiar:

This is known as synthetic long stock. One contract of each option will be virtually identical to 100 shares of the underlying stock (SPY ETF in this example) with regard to profit/loss.

Here are the vitals:

- The cost to open this position is $14.14 – $8.31 = $5.83/contract (or $583 compared to $51,220 to buy the stock).

- The purple (cyan) curve shows profit and loss today (in 59 days at May expiration) based on a range of prices for SPY.

- Like stock, this has unlimited profit potential and maximum loss to be realized if SPY goes to zero at expiration.

For purposes of T-bill investment, the cost savings is paramount: $51,220 – $583 = $50,637 saved via synthetic stock can buy T-bills for a guaranteed [by the full faith and credit of the United States government] return of [currently] over 5.0% per year.

This blog mini-series has led to exploration of synthetic long stock as a higher-performance alternative to stock shares. Most people who invest in mutual funds or ETFs are committing the full $51,220 mentioned above without any T-bill exposure. What about trading options for a fraction of the cost and getting 5%/year on the difference?

I can’t find any supporting statistics, but I would venture to say investment in S&P 500 index mutual funds and/or S&P 500 ETFs are the most popular equity investments in existence (coming in a close second may be total stock market funds/ETFs). S&P 500 vehicles are offered in every retirement plan I have ever seen, heard of, or read about. Most articles I study in financial journals use these index mutual funds or ETFs (e.g. SPY, IVV, VOO) as a proxy for equity investment performance. They also have among the lowest expense ratios and narrowest bid/ask spreads of any issues traded on Earth.

The first of several considerations to be made when comparing long stock to synthetic long stock / T-bills is option trading permissions. Option trading levels range from beginner to advanced and different brokers have different categories. TD Ameritrade has three “tiers” while Interactive Brokers has four levels of “option trading permissions.” Most novice traders and IRA accounts receive basic authorization that enables use of covered calls and long call or put contracts. This requires some basic options knowledge and a cash or IRA account with enough funding. More advanced authorization usually requires a margin account. Since the broker risks losing money by lending funds, these levels require some options trading experience and sufficient funds or assets in the account to cover any losses.

The short put places synthetic long stock into a more advanced option trading category. Not being applicable to everyone is a disadvantage because it would therefore require added cost for an authorized trader (investment advisor) to manage.

I will continue next time.

Categories: Option Trading | Comments (0) | Permalink