Time Spread Backtesting 2022 Q1 (Part 7)

Posted by Mark on August 12, 2022 at 07:14 | Last modified: May 2, 2022 13:49I left off backtesting trade #12 from 3/14/22 with the base strategy shown here.

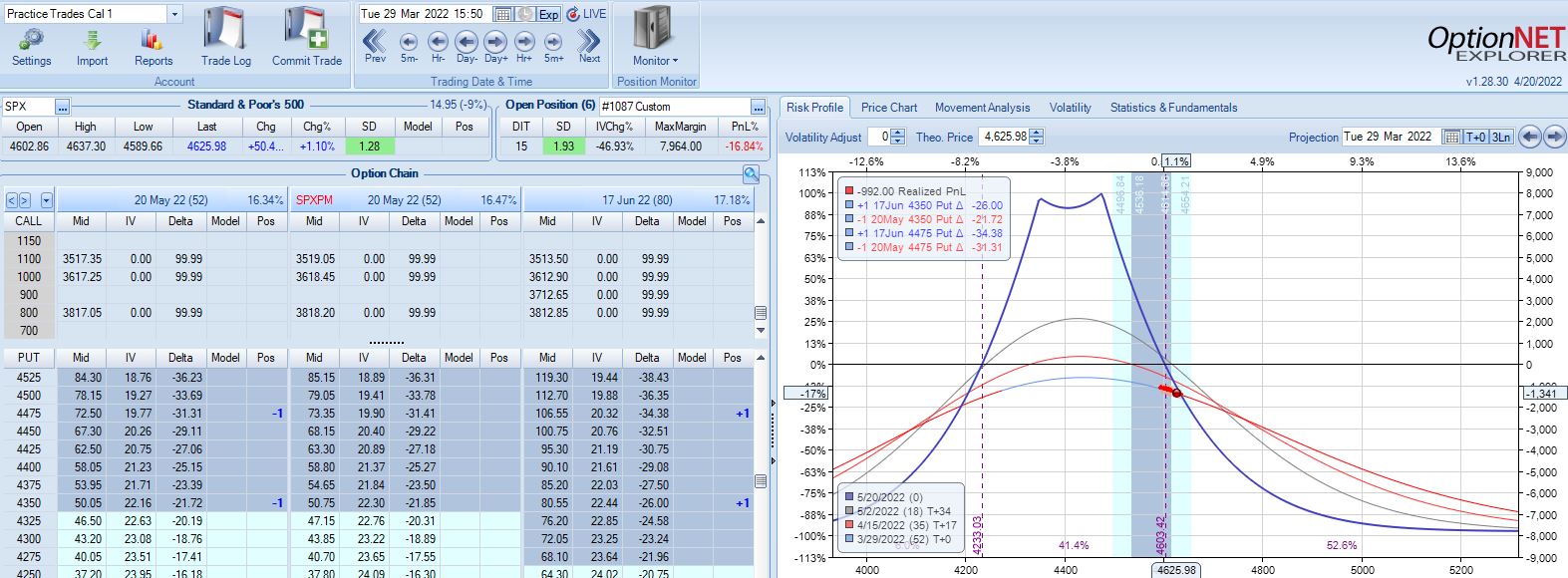

After the second adjustment, SPX peaks 11 days later at 4626 with position looking like this:

SPX is up 1.93 SD in 15 days and the trade is down 16.9%. The risk graph looks scary, but TD is still 4. Furthermore, having already adjusted twice I have nothing left to do according to the base strategy except wait another day.

On 28 DIT, SPX is in the middle of the expiration tent with trade up 1%.

On 38 DIT, SPX is again near the middle of the expiration tent with trade up 8%.

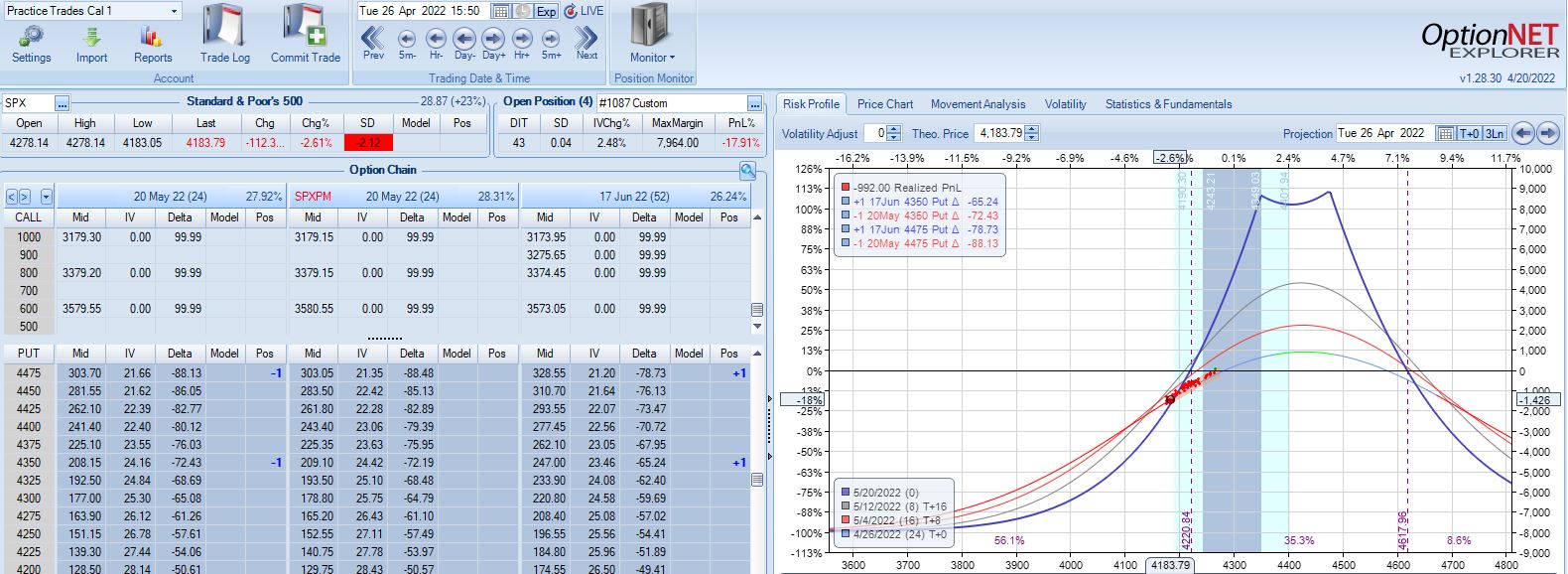

Three trading days plus a weekend later (24 DTE), the market has collapsed with Avg IV soaring from 19.3% to 28.9%:

This is an adjustment point since the trade had recovered to profitability since the last adjustment.

In live trading, I’d have a tough time adjusting here knowing my exit is three days away. This is a good example of the second deadline discussed in Part 6. I could exit without adjusting and take the big loss, which would still be better than the market going against me [big] again sticking me with an even larger loss.

Anytime I’m staring a big loss in the face, I need to realize it’s just one trade. This is also a big whipsaw (adjusted twice on the way up and then a third time on the way back down). Such whipsaws do not seem to happen often.* Accepting a big loss may be easier when realizing how unusual the situation is to cause it.

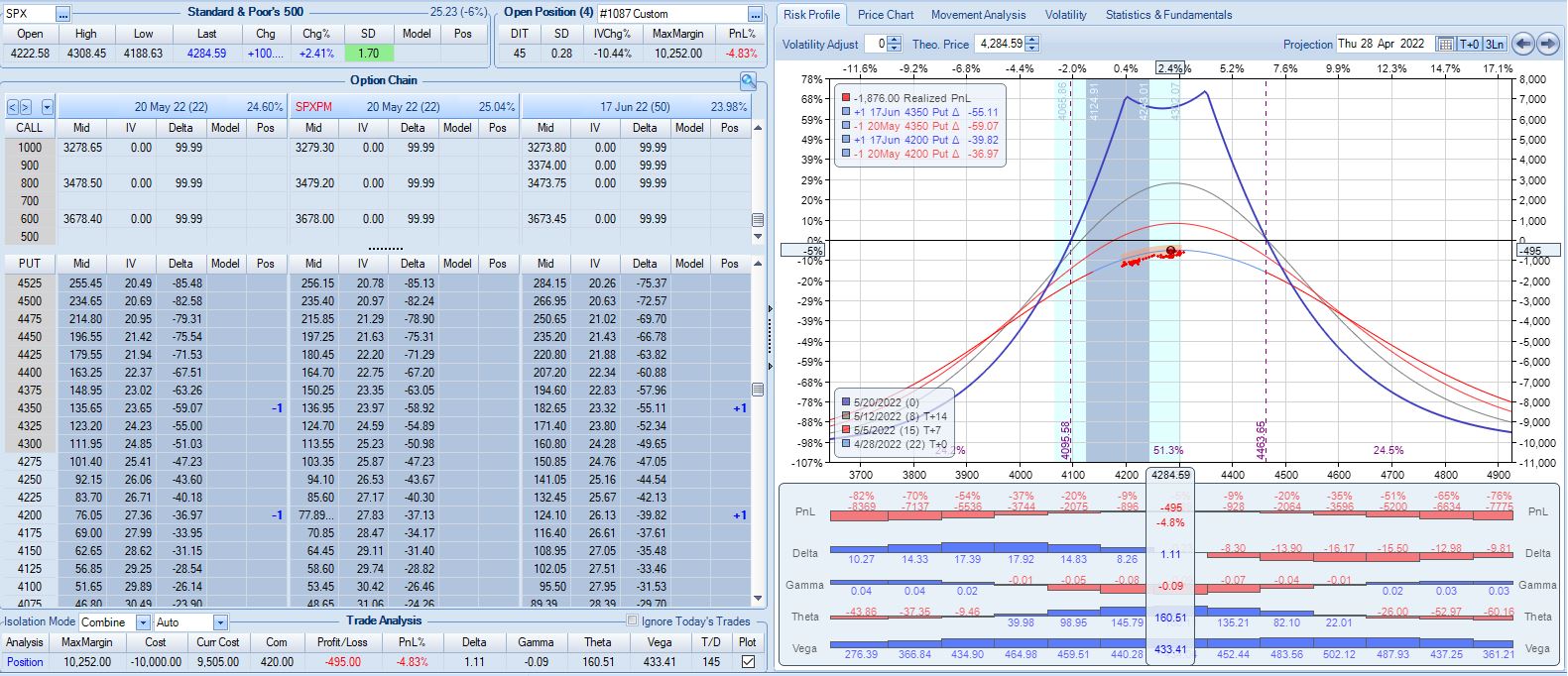

Two trading days later at 22 DTE, I find myself in another challenging spot:

Nothing in the base strategy tells me to exit now, but should I consider it given the way this trade has progressed? It’s hard to say without any data. I am fortunate to be down only 5% with one day remaining after being down 15% twice.** If trading systematically based on a large sample size then I should stick with the guidelines. In all my Q1 2022 backtesting, this is the only trade that has been adjusted three times so finding a large sample size of similar cases may prove difficult.

This particular trade has given me lots to consider! I will finish discussing it next time.

*—If I wanted to add a whipsaw-preventing guideline (or test to see how often this occurs), I could plan

to exit at the center or opposite end of the expiration tent after an adjustment is made.

**—The relevant exit criterion to be tested would be something like “if down more than X% at any point,

lower profit target from 10% to Y%.” Another could be “if under 28 DTE, lower profit target to Z%.”