Backtester Logic (Part 2)

Posted by Mark on August 9, 2022 at 07:11 | Last modified: June 22, 2022 08:34Last time, I discussed a plan to iterate through data files in [what I think is] an efficient manner by encoding elements only when proper criteria are met. Today I will continue discussing general mechanics of the backtesting program.

While the logic for trade selection depends on strategy details, the overall approach is dictated by the data files. The program should ideally go through the data files just once. Since the files are primarily sorted by historical date and secondarily by DTE, in going from top to bottom the backtester needs to progress through trades from beginning to end and through positions from highest to lowest DTE. This means addressing the long leg of a time spread first as it has a higher DTE.

Finding the long and short options are separate tasks from updating long and short options once selected. When finding, the backtester needs to follow trade entry guidelines. When updating, the backtester needs to locate previously-selected options and evaluate exit criteria to determine whether the trade will continue. I therefore have four branches of program flow: find_long, find_short, update_long, and update_short.

Going back to my post on modular programming, I could conceivably create functions out of the four branches of program flow. Two out of these four code snippets are executed on each historical date because opening and updating a trade are mutually exclusive. I do not see a reason to make functions for this since the program lacks repetitive code.*

Whether finding or updating, once the short option has been addressed the backtester can move forward with calculating position parameters and printing to the results file. For example, in order to calculate P_price = L_price – S_price (see key here), the program needs to complete the find_long / find_short or update_long / update_short branches since the position is a sum of two parts. One row will then be printed to the results file showing trade_status (reviewed in previous link), parameters, and trade statistics.

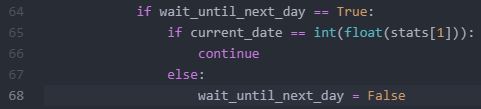

Since every trading day involves either finding or updating, once the short option has been addressed any remaining rows in the data file with the same historical date may be skipped. For that purpose, I added the wait_until_next_day flag. This is initially set to False and gets toggled to True as needed. Near the beginning of the program, I have:

If the flag is True, then the continue statement will return the program to the top where the next iteration (row of the .csv file) begins. This will repeat until the date has advanced at which point the flag will be reset to False.

To complete our understanding of this matter, I need to analyze where current_date is assigned.

I will continue with that next time.

*—Resetting variables is the one exception I still need to discuss.