Practice Trades Cal 1.13

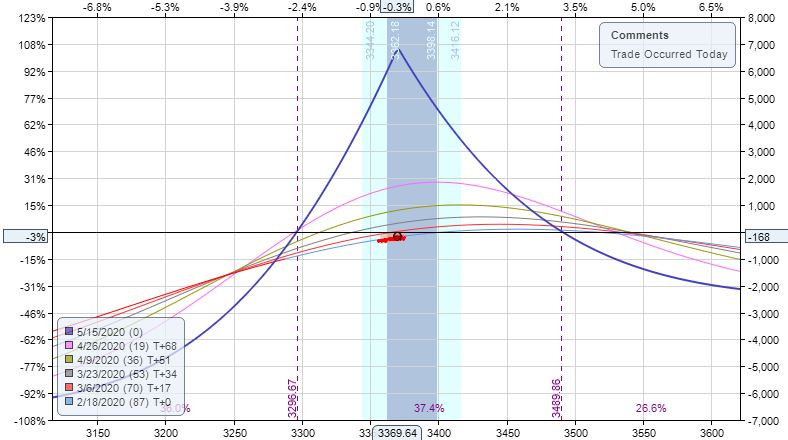

Posted by Mark on March 10, 2022 at 06:21 | Last modified: December 24, 2021 12:28Cal 1.13 (guidelines here) begins 2/18/20 (87 DTE) with SPX 3370 and trade -$168 (-2.6%). TD = 1, MR $6,498 (two contracts), IV 11.9%, horizontal skew -0.85%, NPD 6.8, and NPV 231.

What jumps out at you when looking at the initial risk graph?

This is the second Cal example where the same strike is unavailable in the back month (see Cal 1.4 here). Placing the long leg lower gives the trade a bullish bias, which is something discussed in the fifth paragraph here.

Notice that a bullish bias is achieved whether I diagonalize the long leg (lower) or whether I raise the calendar strike. The former preserves profit potential at current underlying price at the cost of raising MR. Each has pros and cons.

As mentioned in the third paragraph here, I may want to come up with some alternative downside management since TD = 1 at inception unless I plan to let it go to ML.

On 84 DTE, trade -4.4% with market down 0.85 SD in three days.

Exit 81 DTE for loss of $1,478 (-22.8%). This is the 4.33 SD down day, which comes without warning. Over 6 days, SPX down 2.73 SD with IV up 83%. Horizontal skew has increased slightly to -0.62%. TD = 0 (rounded).

Unlike Cal 1.2, SOH to see how the market “shakes out” would be a terrible decision here:

Highlighted is my first opportunity to exit at max loss (with market far outside profit tent and TD 0 unlike third paragraph here where Cal 1.12 is still well-positioned with TD strong). I have to take the loss immediately: no reason not to.

HEED WARNING DISCRETIONARY TRADERS!

I think one of the biggest risks of discretionary trading is the tendency to see something that seems to work while conveniently forgetting other instances where it does not. You may be confident in something that, on the whole, adds no benefit (or worse). A large-sample-sized systematic backtest to assess strategy guidelines can prevent this from happening.

Categories: Option Trading | Comments (0) | Permalink