Practice Trades IC 1.2 – 1.6

Posted by Mark on February 4, 2022 at 07:16 | Last modified: December 14, 2021 15:28More of the same, today: backtested trades per guidelines discussed here. All I’m trying to do is build muscle memory.

IC 1.2 begins 1/11/21 (67 DTE) down $336. MR is $18,136 (two contracts), PT is $1,864 * 0.8 = $1,492, and ML = $2,984. At trade inception, TD = 32, IV 17.7, NPD = -1.1, and NPV = -234.7.

MDD = -$596 (-3%) at 51 DTE.

On 3/2/21 (50 DIT), exit trade for 8.7% ROI ($1,569 profit) with market up 0.31 SD. IV increased 7.6% while in the trade. Not much going on here:

Let’s shift the start date one week (actually eight days because of MLK holiday) later to 1/19/21, which is 87 DTE. Again, trade starts down $336. MR is $17,876 (two contracts), PT is $2,124 * 0.8 = $1,700, and ML = $3,400. TD = 23, IV = 17.6, NPD = -1.2, and NPV = -263.9.

MDD = -$1,196 (-6.7%) at 79 DTE.

On 3/22/21 (62 DIT, 25 DTE), exit trade for 9.5% ROI ($1,704 profit) with market up 0.51 SD. IV decreased 21% while in the trade. Once again, not much drama here.

Let’s shift the start date six days later to 1/25/21 (81 DTE). Again, trade starts down $336. MR is $17,846 (two contracts), PT is $2,154 * 0.8 = $1,724, and ML = $3,448. TD = 23, IV = 16.8, NPD = -1.3, and NPV = -259.1.

MDD = -$1,096 (-6.1%) at 79 DTE.

On 3/22/21 (52 DIT, 29 DTE), exit trade for 9.7% ROI ($1,739 profit) with market up 0.25 SD. IV decreased 21% while in the trade. Not much to see here.

Let’s shift the start date two weeks later to 2/8/21 (67 DTE). Again, trade starts down $336. MR is $18,016 (two contracts), PT is $1,984 * 0.8 = $1,588, and ML = $3,176. TD = 25, IV = 12.6, NPD = -1.4, and NPV = -265.7.

MDD = -$346 (-1.9%) at 66 DTE.

On 3/22/21 (42 DIT, 25 DTE), exit trade for 9.5% ROI ($1,704 profit) with market up 0.18 SD. IV increased ~10% while in the trade. Again, not much to see here:

The market sold off a bit then recovered—all for net sideways trading, pretty much.

For my final example of the day (IC 1.6), let’s shift the start date three weeks later to 2/28/21 (67 DTE). Again, trade starts down $336. MR is $18,146 (two contracts), PT is $1,954 * 0.8 = $1,484, and ML = $2,968. TD = 41, IV = 17.7, NPD = -0.7, and NPV = -241.4.

MDD = -$746 (-1.9%) at 78 DTE.

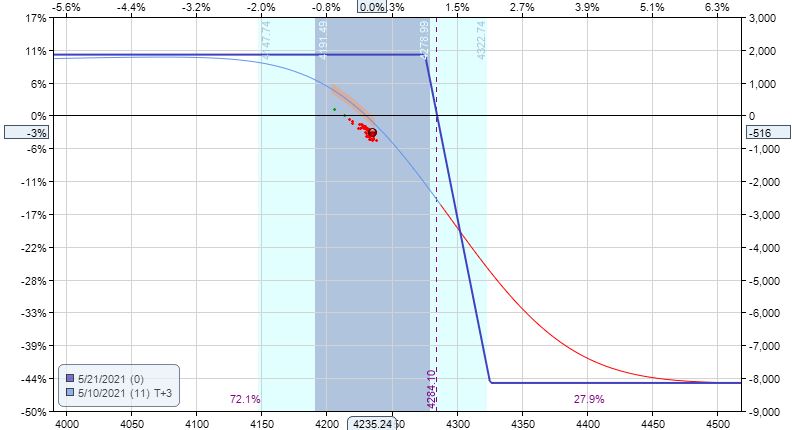

On 5/12/21 (72 DIT, 9 DTE), exit trade for 8.9% ROI ($1,609 profit) with market up 0.5 SD. IV increased ~42% while in the trade. Interestingly, trade exit occurred on a 2.5-SD down day. Three trading days earlier, the position looked somewhat precarious with the market up 1.1 SD over the first 62 DIT:

PnL was only -$516 at this point, but TD = 3 and T+0 upside slope is scary. Also note the blue shaded region, which corresponds to a 1 SD move over the next three days. Such a move would put the trade down over $2,000 (although it may be exaggerated if ONE computes this as a 3-day SD due to the weekend when it actually represents a single trading day).

If numbers work out over a large sample size, though, then I would deem such temporary pain to be worth the effort.

Categories: Option Trading | Comments (0) | Permalink