Practice Trades BWB+Cal 1.2 (Part 3)

Posted by Mark on January 24, 2022 at 07:41 | Last modified: December 14, 2021 11:07Today I wrap up some ideas for—well, let’s call it what it is: curve fitting!

Backing up, instead of closing BWB + downside calendar and rolling 9 points above the money, I could roll farther above the money akin to the guidelines discussed here:

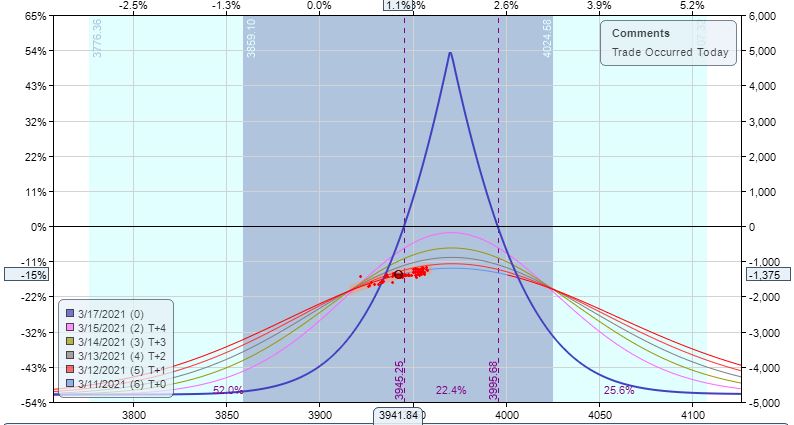

One day later, the market has gone against me even though the trade is now down a bit less ($1,275):

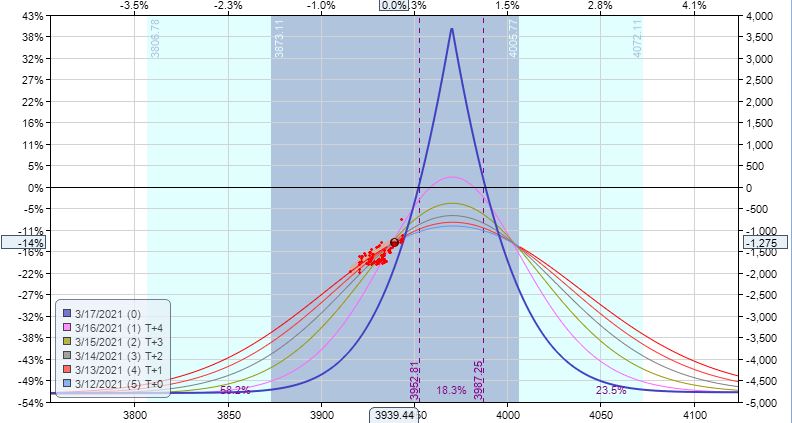

Although the directionality may appear risky, I had the same thing in place one day earlier.

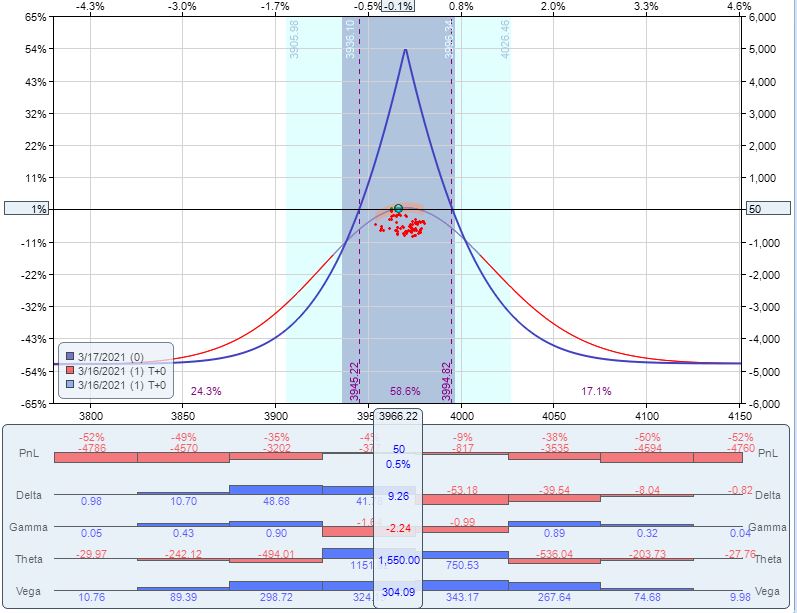

MR is $9,235 here, and this version is profitable one day to expiration with a profit of 1% ($50):

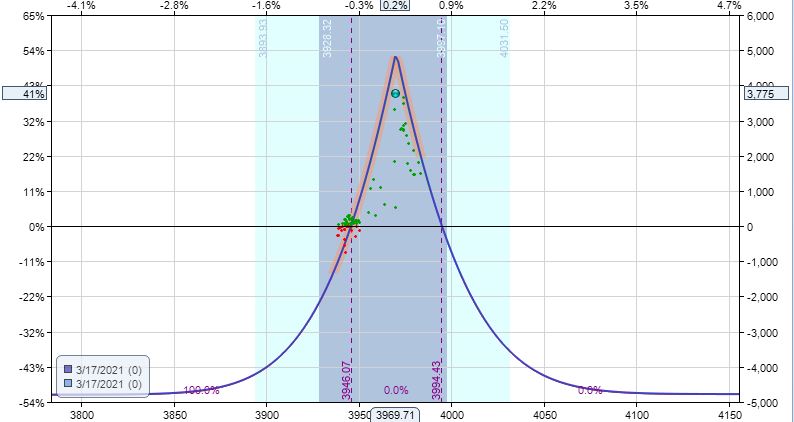

If I were really gutsy and held to expiration, I could end up with the motherlode:

That’s a profit of 41% ($3,775).

Back to reality, though: in the absence of other validated variants, this trade meets unfortunate demise at 2 DIT with a hefty loss of 15.3% ($1,410).

Since each of these variants begin by closing the original BWB and added calendar, they are essentially new trades altogether. By linking them to the previous transactions, I ensure an overall exit for something ranging from small loss to windfall profit. To maintain consistency and repeat the same strategy every week, though, I should keep things separate: BWB + Cal on one hand and, if so desired, bullish calendar on another.

Categories: Option Trading | Comments (0) | Permalink