Practice Trades BWB+Cal 1.2 (Part 2)

Posted by Mark on January 21, 2022 at 07:36 | Last modified: December 12, 2021 13:04Per the suggested guidelines, this trade was a loser. Surely we can always come up with tweaks to improve the outcome.

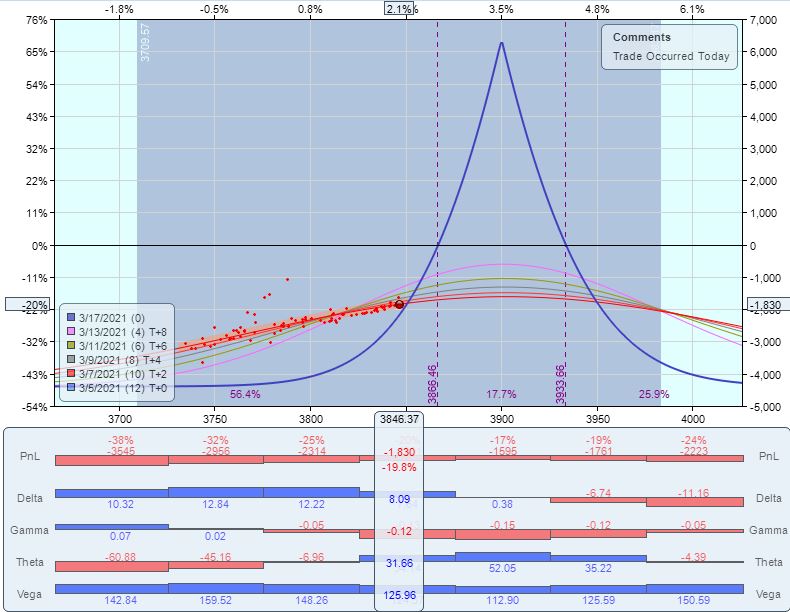

One alternative would be to close current positions and enter a calendar above the money at 2 DIT. This is making a blatant directional bet albeit one that coincides with the general tendency of stocks to go up more often than they go down:

This adjustment would put trade down $1,830 on $9,235 margin with TD = 4. Despite a subsequent down day, we see a nice recovery through 3/11/21:

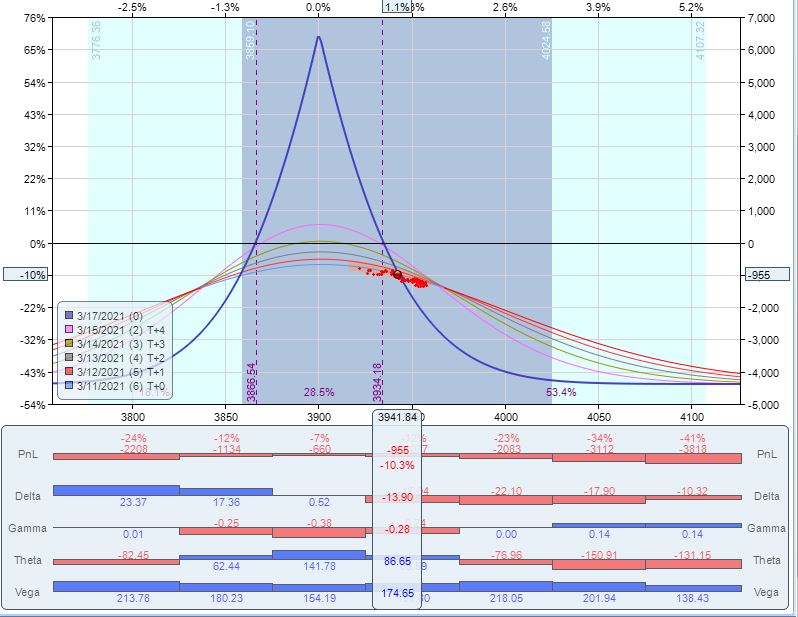

Trade is now completely directional to the downside, which blatantly taunts the general tendency. We could exit for a loss of $955, which is lower than the 2 DIT loss of $1,410.

If we choose to press onward, then we could roll to first above-the-money [10-point] strike. This would take PnL back to -$1,375 since the adjustment involves 20 contracts. Be aware that each adjustment takes days from which to recover (unless I’m being far too aggressive in my TF assumptions).

One day before expiration, this trade is down $375. Given what we’ve been through, we should take this and consider it a huge moral victory.

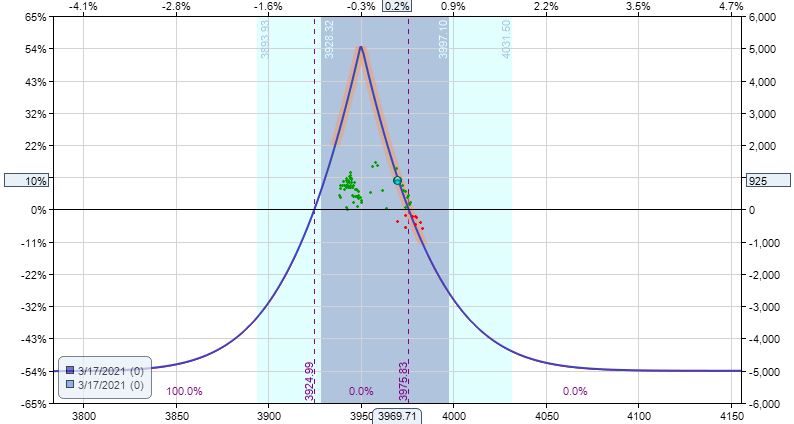

Rolling the dice to expiration:

That’s a 10% return of $925. Lucky Charms!

But wait… there’s more?! Watch for it next time.

Categories: Option Trading | Comments (0) | Permalink