Getting Back to Basics

Posted by Mark on September 2, 2021 at 07:11 | Last modified: June 1, 2021 08:27Today’s post is about getting back to basics, which is something I periodically find myself forgetting to do.

I have no complaints about my trading this year. I’m sticking with the plan, which is my primary goal.

For a few different reasons, though, I want more. First, I may need a different plan when the market environment sours (a constant threat as seen in the tables here). Second, I can accommodate a few more small-sized trades in the portfolio. Third, I always want to be on the road to self-improvement. I don’t always accomplish this, but I certainly want to be trying.

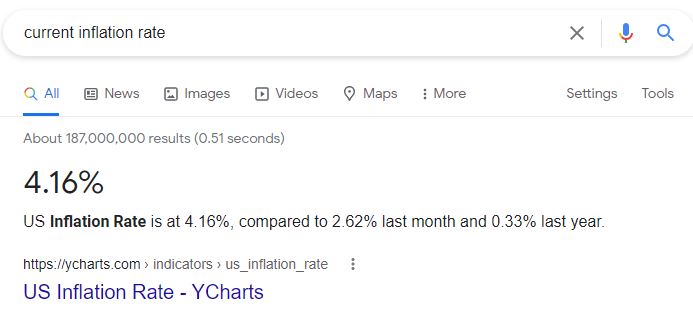

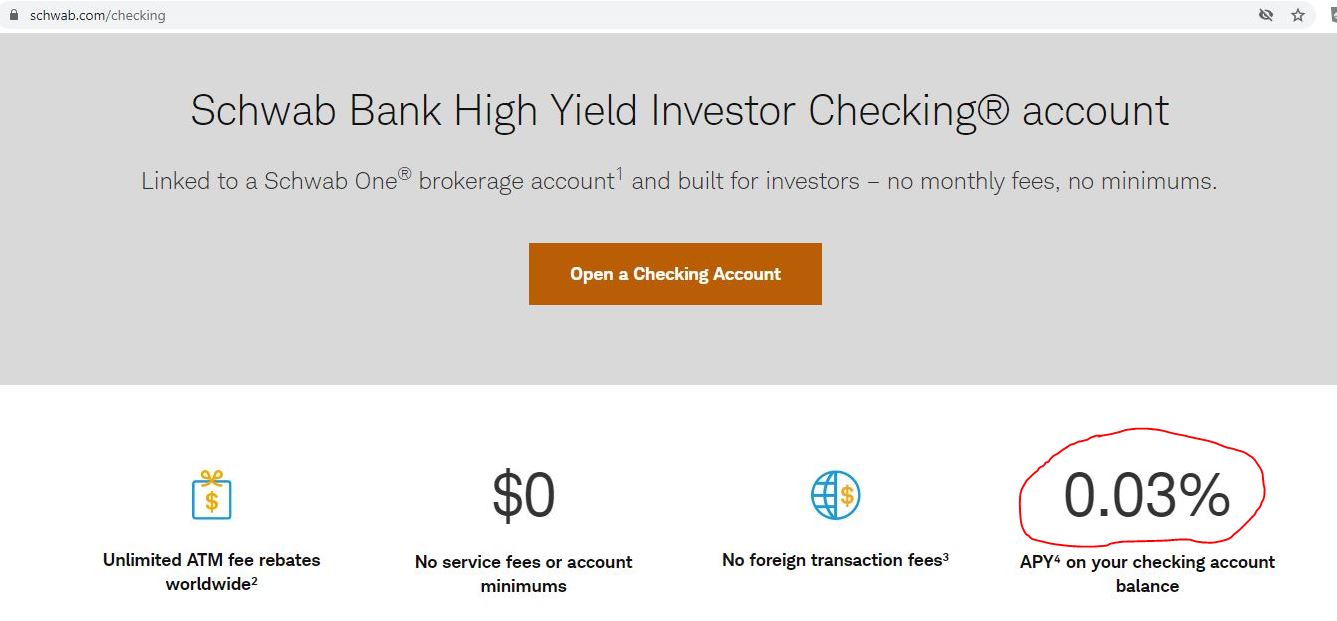

One further reason to want more: interest rates. I feel the need to make up for this deficit:

For all these reasons I want more, but I also have a lot on my plate right now:

- I’m trying to network with traders to establish new connections. This is a big ask (see third-to-last paragraph here, fifth paragraph here, and fourth-to-last paragraph here): probably itself equivalent to a part-time job.

- I’m mulling over potential job interviews (see here).

- I’m on the hunt for an automated backtester (see here).

- I’m doing some manual backtesting (see here).

- I’m studying one particular trading philosophy that is a paradigm shift away from what I currently implement. It takes a lot to wrap my head around this and to understand all the moving parts.

I occasionally hear about a relatively simple trading strategy that makes me think “I should have been doing this all along.” While I now recognize the periodic pattern, I never cease to be amazed when it repeats.

Maybe now is the time to do something to make sure the pattern repeats less. How can I make this happen?

- Write down the trading strategy in a straightforward, objective manner.

- Backtest the strategy enough to become comfortable with how the position moves and what I can expect with regard to relevant items like greeks, PnL, etc.

- Start trading live with the smallest position size available (one contract will suffice for many).

- As I feel comfortable, increase size slowly after trading through enough drawdowns and losses.

- Rinse and repeat (may also be done in parallel with multiple strategies).

I may get stopped out from #2 due to performance concerns. If the strategy is not viable in backtesting, then I need to junk it and make a note that development was unsuccessful. I am likely to stumble upon this strategy at some future date and I can save myself a lot of time and effort if I remember that I’ve “been there, done that.”

My discipline, to which the 900+ posts in this blog can attest, is beyond reproach.

My challenge is now to take that discipline and apply it to something new—something that, in this case, can potentially lead to multiple streams of income.

I have always liked the [quite marketable] sound of that!