Debunking the Williams Hedge (Part 3)

Posted by Mark on July 30, 2021 at 07:01 | Last modified: June 7, 2021 14:39Today I will continue discussion of the Williams Hedge (WH), which I introduced here.

I mentioned in Part 2 that I would check with OptionNet Explorer (ONE) Support about the IV calculation. He called it a proprietary approximation using option prices “similar but not identical to the VIX style calculation.” That’s all I need to know.

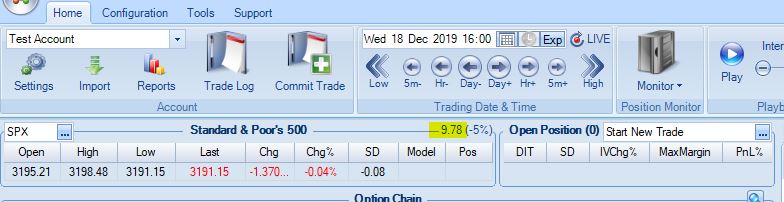

IV % Chg, surprisingly, seems to be a bigger puzzle. ONE Support says this is calculated off the official closing price. As an example, here is a closing screenshot:

Here is the next day at 3:55 PM:

9.78 to 6.39 is a 34.7% decrease yet ONE shows -39%. In case it takes a few minutes for prices to settle to get the official close, I can calculate based on the previous day’s 4:05 PM (9.76) and 4:10 PM (9.79) values. These correspond to IV decreases of 34.5% and 34.7% decreases, respectively. Where does the -39% come from?

I am fine with vendors citing “proprietary methods” in lieu of answering my questions as long as I know what the metric means and that it is consistently calculated. As a basic math fact, percent change is not proprietary and defines one particular correct answer that is not seen above. We still need some clarification.

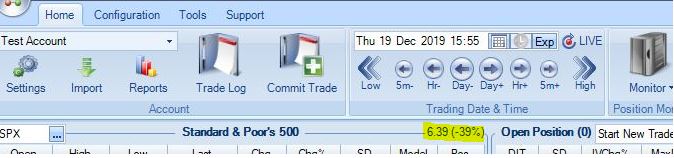

Speaking of inconsistency, I came back after lunch, powered up the computer, and launched ONE again only to see this displayed for the next day at 3:55 PM:

The 9.32 here is much different than the 6.39 seen above. The percent change is also wrong (should be -5%). I still need clarification.

Let’s get back to talking about the WH itself.

Remember the PCS is long-dated while the long puts are short-dated. When the long puts expire, the PCS will remain uncovered. For example, if the PCS average 90 DTE and the long puts average 48 DTE, then vertical spread risk will remain for six weeks (42 days) after the long puts expire. Strategy guidelines dictate closing the verticals for $0.10 when available. Suppose the spreads may be closed for $0.10 with three weeks to expiration. This leaves us uncovered for 90 – (48 + 21) = 21 days or three weeks. During that time, we will have three uncovered PCS tranches. With 10 contracts, this is a potential gross risk of $300K for 100-point vertical spreads.*

The strategy makes no provisions for PCS that go ITM and potentially expire ITM. Theoretically, this is okay assuming the long puts have exploded in value. I did not see this occur in the backtest, though. Why?

The WH video points out that when the market crashes, horizontal term structure can go from contango to backwardation. Aside from negative delta, this contributes to an explosion in long put premium. What is good for puts already purchased in the campaign is bad for puts still to be purchased as a campaign. In order to continue finding high IV puts for $0.45 or less, we will need to go closer and closer to expiration.

I will continue the discussion next time.

* — This was my width for the backtest. I could have gone 75 points wide, which would have

forced selling PCS NTM to recoup the extra cost.

Debunking the Williams Hedge (Part 2)

Posted by Mark on July 27, 2021 at 07:04 | Last modified: June 4, 2021 11:52Today I continue discussion of the Williams Hedge (WH) and my backtesting.

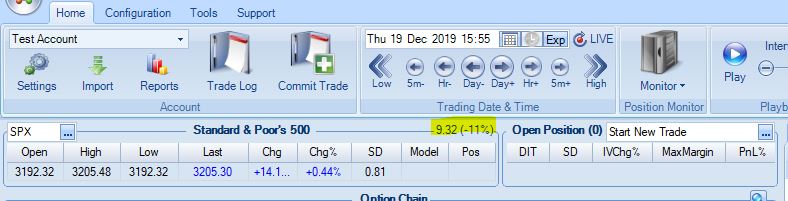

Let me address one technicality with regard to SPX IV. When people think about implied volatility for SPX, they usually think of VIX. Look at the screenshot below from OptionNet Explorer (ONE):

As seen in the Part 1 table, this number is 97.33 and 102.89 on 3/12/20 and 3/16/20, respectively. This website says the highest closing VIX ever recorded was 82.69 on 3/16/20, which therefore means the highlighted number can’t be VIX. Granted, I use data from 3:55 PM rather than the close for this backtest, but I find it hard to believe VIX could come down 20 points in five minutes. Until told otherwise, I am therefore calling the highlighted number “SPX IV” (probably calculated via proprietary ONE algorithm) rather than “VIX.” I will contact ONE Support to get a more complete explanation (also on what the percent change is based because 4:00 PM the previous day is not correct).

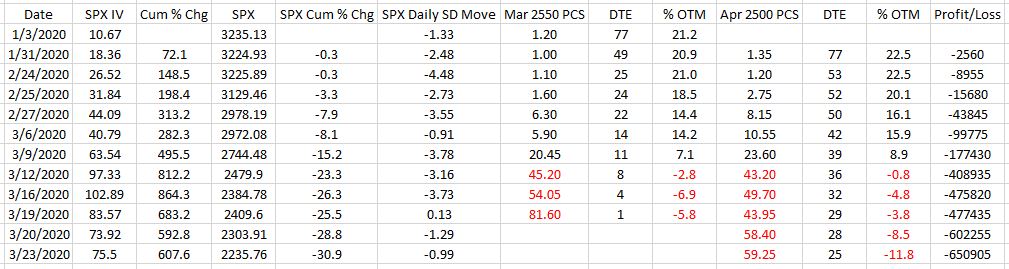

The Part 1 table says the WH performed miserably through the March 2020 market crash. Backtrading 10 contracts weekly of this strategy lands us down $650K on 3/23/20!

Per usual, I tried to backtest realistically by using values only 20% of the range from natural to midprice. While most backtesting chooses to ignore it, slippage is a reality of trading. We do not want to be the camp described in this second paragraph, else we’re probably better off finding a different strategy altogether. As you can imagine, when the market speeds up the spreads widen and I sometimes had to go nearer to the money to make sure I got requisite PCS net credit. As a single, inexpensive ($0.45) leg, buying the extra long is not affected by this so much.

We know when the market crashes, the PCS are going to “get killed.” This is explained in the WH video series and can certainly be seen in the table. The PCS studied started 20.9% and 22.5% OTM, which was not enough distance to keep them safe.

The video says when the PCS gets killed, the long puts will explode to cover them; this is where I run into problems. I sell a PCS every week (risk) and I buy two additional long puts (insurance) as well. This makes the position seem safe. One put is a 7 DTE teeny that serves only to keep T+0 elevated (saving portfolio margin). Even without the teeny, the second put leaves us net long contracts. What could possibly go wrong?

You sleep on that, and I will continue the discussion next time.

Categories: Backtesting | Comments (0) | PermalinkDebunking the Williams Hedge (Part 1)

Posted by Mark on July 22, 2021 at 06:41 | Last modified: June 10, 2021 14:21One does not have to look far to find trading courses (or systems) for sale. The advertising pitches are as long as the Mississippi River (or a CVS receipt, at least). I have written about this here and in the second-to-last paragraph here. Today I am going to give a real example of why you might want to avoid purchase of vendor strategies without testing them yourself.*

Submitted for your approval: the case of one Williams Hedge (WH). With name changed to protect the innocent, this is an option hedging strategy sold for ~$300 by a company formed in 2016. The description reads:

> The WH is designed to be a costless way to add crash protection…

> this trade will not help in mild corrective markets… this trade

> will kick in hard in a crash and offer profit to offset losses as

> well as significant margin boost to counteract exploding margin

> requirements and forced liquidations at inopportune times.

>

> [Our company is] an alternative to the hundreds of websites offering…

> index [ICs advertising] 5-10% every month without mention of the

> occasional 80% loss… [the WH is] different… adaptable, robust,

> tested… [we] backtest the idea and rules, then vet the trade plan

> through a small team to tear it apart, then backtest it some more,

> and then create a course for it while we trade it live, and then we

> launch. If it doesn’t perform to spec, we scrap it.

Sounds pretty solid, right?

The WH strategy includes:

- Long-dated put credit spread (PCS) sold for around $0.60

- Short-dated long put (LP) at short PCS strike for $0.45 or less

- 7 DTE teenie for $0.05 as margin control

- Rinse and repeat every week

The video says the far-dated PCS is going to get killed in a market crash while the near-dated LP will explode to offset losses and then some. Gains on the PCS won’t be realized until it closes. During market declines, the overall position will drawdown due to unrealized PCS losses but will recover by expiration assuming the PCS remains OTM.

Parental discretion is advised for the following:

This is an ~32% loss in the S&P 500 (SPX) index in one month. We have isolated a true Black Swan in its natural habitat.

What you are about to see is nothing short of phenomenal:

The second row of the table corresponds to the red arrow and highlighting on the chart. The Cum(ulative) % Chg columns use this row as base values for SPX IV and SPX. The three columns of PCS data are spread price, days to expiration, and moneyness. Red values indicate ITM spreads.

I really needed to immerse myself in these numbers for a while to get a good sense of what I’m looking at. SPX falls 30.9% while IV increases ~608%. SPX down 59 points (-1.79%) on 1/31/20 is a 2.48 SD selloff while the 106-point selloff (-4.38%) on 3/20/20 is only 1.29 SD. Realize we’re dealing with IV ~11 in the former case and IV ~74 in the latter.

I will continue next time.

* — See what I did there? Even after payment, many vendors will not be transparent with the

strategy (or coding) much less let you test all the rules yourself. You certainly won’t be

able to fully backtest a strategy before paying for it.

Updated Meetup Hopes (Part 2)

Posted by Mark on July 19, 2021 at 07:16 | Last modified: June 2, 2021 10:49In an effort to network with other traders in my new state, I have been messaging people from a few pertinent [dormant] Meetup groups. I recently got a response from one claiming to know a handful of interested traders who asked me to compose an e-mail describing in more detail what I am looking for. I continue the e-mail from Part 1:

———————–

This is another place where compatibility fits in. I believe becoming a good trader means building number of occurrences, repetition, and discipline. Not everyone lives by these virtues and I probably won’t work well with those who don’t.

Either of the previously-described group formats could be a destination. In a structured manner, we would be pursuing serious, consistent trading with the potential for solid profit potential. This might make driving to a central location more feasible. I can also see much of the work being done online through Skype, Zoom, or Slack. In going that route, I would still like to at least have periodic social gatherings.

The previously described formats are highly-selective structures that beg for substantial individual commitment. I got one reply from a Meetup member saying he applies a fundamental approach to stock selection that he complements with a few technicals. I see nothing wrong with this and yet, it’s not something I would do. First and foremost, he trades stocks—not options. Second, it’s unlikely he would be interested in an option group if, in his mind, he’s onto something that works (why would he continue to do it otherwise?). I would not be in one of the previously-described groups with him.

As an aside, the [humility to] detect and abandon flawed methods for something better stands in juxtaposition to the host of people who tweet on social media about trading accounts going “to the moon,” making money hand over fist, and trading services that advertise outrageous performance. I’m not sure what the trash talk and braggadocio is all about, but I want to improve regardless of how well I may have done thus far. I would prefer to discuss my current strategy development rather than actual trades because I hope to morph the latter into something more comfortable and secure.

I hope one of the benefits of my experience is knowing where I need to improve.

Stepping down in sophistication, we could have a group of diversified traders who informally share trades and strategies, discussion about the economy, market predictions, etc. Personally, this would allow me to meet people although it may not result in [much] professional enhancement. I think people would be less willing to drive distance for this since it doesn’t offer the payout potential of the more sophisticated formats. This format would be more suited to beginners. I wouldn’t want people who think they will take without giving, though. I would suggest a mandatory contribution of either money or content.

The dream, as written about in so many investment/trading books, is to leave the employer and trade for oneself on a more flexible schedule from any desired locale. The conundrum for many, I think, is that the dream can only be accomplished with full-time effort that most people cannot afford (i.e. quitting their job).

I hope we can make something happen!

Sincerely,

Mark

Updated Meetup Hopes (Part 1)

Posted by Mark on July 16, 2021 at 06:54 | Last modified: June 2, 2021 09:44In an effort to network with other traders in my new state, I have been messaging people from some [dormant] trading-related Meetup groups. I recently got a response from one claiming to know a handful of potential members who asked me to compose an e-mail describing in more detail what I am looking for.

———————–

Hi BD,

Nice talking with you yesterday.

This message got lengthy! Please don’t forward the whole thing to anyone you think might get overwhelmed. Feel free to pare it down or I can write something altogether different. I would like to hear what potential members might be looking for, what kind of trading they do, what they might be able to contribute, etc. When I organized that small group 5-6 years ago, I started with a short assessment questionnaire designed to help me tailor the group accordingly (and decide whether it was even something of which I wanted to be a part).

Explaining what I seek in a group is difficult. What I’m ideally looking for is probably a pipe dream so I’ll start with that.

As a full-time option trader, my aspiration would be to find people with whom to collaborate on trading strategy development. This is simply stated yet extremely complex because it requires people who are advanced traders, who have studied, who have already put in extensive time and effort, who know some statistics/quant methods/coding, who have unbridled passion…

I’m here to tell you that aside from our discussion about the challenges of organizing a successful trade-related meetup, I have looked high and low over the years for other full-time traders. On the rare occasion I stumble upon one, I usually find incompatibility because I can’t get behind the philosophy (for a reason, which sometimes makes me question whether they’re even being honest with me), the vehicle, the time frame, the limited sample size, the level of discretion, etc.

It’s no joke when they say the trading strategy must fit one’s personality.

Aside from such a collaborative effort, I would be interested to form a trading team where each member specializes in a particular strategy. This will be a strategy they track and follow every single day. If they don’t trade it live, then they will paper trade it. If they have the tools then they can backtest for a broader perspective. At every group meeting, time will be allocated for each member to present updates, education, and/or discussion about their assigned strategy. If this requires too much time then perhaps members present every x meetings; we just need to be meeting enough for this to make sense. Learning new strategies is very difficult with infrequent exposure—we’ll repeatedly forget before hearing about them again.

———————–

I will continue next time.

Categories: About Me | Comments (0) | PermalinkCall Me Crazy (Part 9)

Posted by Mark on July 13, 2021 at 07:33 | Last modified: May 27, 2021 14:05Today I finish up tying together loose ends with regard to the long call (LC) backtest.

In the bulleted list here, I suggest we might vary the DTE/DIT ratio. The current backtest holds two-year LEAPS for one year. What if I hold for 18 months? What if I buy 18 months out and hold for one year (plus one day)? Holding longer keeps the number of transactions as well as taxes down (LTCG but please consult a tax advisor as I am not a CPA and do not know your individual situation). One tradeoff is time decay, which increases as the LC gets closer to expiration.

One way to get more data points in the backtest is to buy a shorter-dated LC and hold closer to expiration. The original backtest has only 15 data points using two-year LEAPS. Alternatively, I could buy the LC one (two) month(s) to expiration and roll after three (six) weeks, for example. Many permutations are possible and what I would ideally like to see for a robust strategy is most to be profitable with superior risk-adjusted returns (especially in lieu of accelerated time decay).

Holding the LC longer when the market has declined can improve risk-adjusted return. LCs would be held for varying durations depending on underlying share performance. For a multi-year down market, this idea really seems attractive because a max loss could only be realized every two years rather than every year. Thinking about 2008-9 in the original backtest, maximum drawdown (MDD) would have been closer to 20% than the 32% seen in the enhanced data set.

When doing this “mental stress testing,” always think about the pros and cons of different tweaks. Holding the LC for longer lowers MDD in an extended downturn at the cost of slower profit after upside reversal. The unrolled LC expires worthless if the underlying fails to reclaim the strike price by expiration whereas the rolled LC profits earlier despite a larger MDD.

Also when doing “mental stress testing,” be aware that small sample sizes are very susceptible to curve fitting. We can imagine specific historical periods and forecast hypothetical performance, but when broken down into metrics (e.g. severity, duration, volatility change), each DD period is unique and small sample sizes are not to be generalized (see second-to-last paragraph here for fallacy of the well-chosen example). In the end, the best answer may be to skip the backtesting altogether and do what feels right because aborting a trading plan midstream is a good way to lose money and make us not want to look back.

Is rolling the LC up a low-probability trade and therefore something to avoid? This is effectively a bear call credit spread. Stocks have an upward bias while a call credit spread is bearish/neutral. Failure to roll would result in a more expensive LC over time. Perhaps fewer contracts could eventually be implemented to [somewhat] smooth out asset allocation.

Sticking with the same theme, rolling the LC down—effectively a bull call spread—should be a high-probability trade. This suggests we roll down when the market tanks and hold the strike as it soars. I tend to agree that when rallying, we want the LC to mimic stock. If we don’t roll, though, then we can’t get downside protection. I’m not sure how to rectify that.

The challenge with investing may not be figuring out the right or wrong strategy as much as determining the pros and cons of each and making educated choices from there.

Despite the benefits, one disadvantage to the LC is losing money if the underlying is flattish to down. This sounds like good reason to try lowering its cost basis, which is where I will head going forward.

Categories: Backtesting | Comments (0) | PermalinkCall Me Crazy (Part 8)

Posted by Mark on July 8, 2021 at 07:36 | Last modified: May 27, 2021 10:50Last time, I discussed the risks of a multi-year down or flattish market on the long call (LC) strategy. Today I want to start wrapping up some loose ends in preparation to move on.

Many variants can be made to what is just one of many LC backtest permutations:

- Vary DTE from two years

- Vary DIT from one year

- Apply price-based (i.e. market up/down X%) rather than time-based roll

- Vary strike from ATM (i.e. ITM, OTM)

In Part 7, I discussed how the LC can realize serial losses by rolling down to the current ATM strike in a multi-period down/flattish market. Holding the strike avoids replenishment of juicy extrinsic value that dissipates quickly on a continued move lower. Some people would say the stock market’s long-term upward bias makes this a lower-probability trade. My gut reminds me this upward bias is not written in stone or guaranteed by law. The Nikkei has gone over 30 years since hitting all-time highs. Can you imagine this happening to US stocks? I feel the need to consider it in order to be prepared.

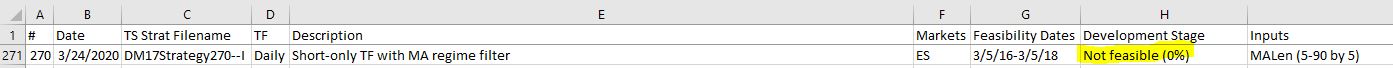

A trend-following (TF) technique could take advantage of a sustained move lower. Maybe I hold the strike and do not roll down when price is below the 200-MA. Although this seems logical, keep in mind we have no data to suggest it actually works. In fact, I have data to the contrary from testing a variant of this as a short entry for /ES:

As much as it twists my innards, sticking with the long bias and is probably best until and unless I have reason to someday think otherwise (and if this happens, then hopefully I’ll have capital left when I finally make the decision to switch). Did someone say hope is not a strategy?

Thinking about the damage from a long-term bear market is to say the LC strategy has no built-in TF downside component. Oh well. One of two resilient [expectancy, not necessarily risk-adjusted] edges I have found is the upside for equities.

A volatility filter to add or substitute more downside protection sounds logical to monetize a down market. In this case, maybe something OTM would work better because despite the built-in insurance, the LC cost can really hurt. Maybe even selling the stock and going put-only would help—or some sort of put spread to offset the higher volatility and time decay.

Similar to the TF filter explored above, the problem with this idea is that going long on VIX spikes historically performs well. While a volatility filter might keep me alive should equities not bounce back, I think (versus my gut) I’d rather play the percentages than bet on something never-before experienced. Much of investing seems to come down to this.

I will continue next time.

Categories: Option Trading | Comments (0) | PermalinkKD or the Retail Trader? (Part 3)

Posted by Mark on July 5, 2021 at 06:02 | Last modified: May 25, 2021 08:19I left off with mention of NS. Time to wrap up his story.

After I asked where he got my name, he responded:

> Hi Mark,

>

> I found your contact information on the… [collaboration spreadsheet]

> from KD.

>

> I have decided to continue to trade stocks only for now. I think this

> adventure and undertaking is premature at this moment in my life, the

> time commitment and capital needed to succeed is not there. Will

> revisit this in the future. Thank you for your understanding.

>

> NS

In 24 hours, NS apparently went from enthusiastically seeking collaboration on futures trading strategies to not trading futures at all. He doesn’t have the time commitment: did he just learn what kind of commitment it would take? He doesn’t have the capital: did he just learn about capital requirements? Did he research these critical details before spending thousands of dollars on the course? He seems like a responsible adult: a family man and a CEO of a company with 20 employees. Sudden reversal and complete oversight are not what I would expect from a guy with his head on straight.

This escapade with NS strikes me as the epitome of fickle. You know, fickle: capricious, changeable, variable, volatile, vacillating, mercurial, irregular, inconstant, undependable, unsteady, etc.

This also reminds me of trader reluctance to discuss losers (see second paragraph here and bullet points 6 – 7 here).

Since NS and the 12 e-mail contacts I wrote about are all associated with KD, I wonder if this behavior is a reflection of a lousy approach. Paying for a failing system is an ego-challenging experience when we feel ripped off, taken advantage of, or violated. I wrote earlier about my failure. I gave 3+ months of full-time effort. I was disciplined. I documented. I exchanged 50 – 100 e-mails with KD asking questions, discussing details, and reviewing examples. My time committed is more than I would would expect from most. If it didn’t work for me, then I would not be surprised to learn it didn’t work for others either. KD warns it may require even greater effort, but it could be a complete farce. I have my suspicion.

On another hand, statistics about the high failure rates among traders as a whole circulate often. Maybe the same sort of commitment and patience required to succeed with KD is required to succeed with trading and most people just don’t have it. Trading itself could be a farce, but I have to admit that I have succeeded with my overall efforts until now. This makes me less likely to reject the entire trading enterprise.

Categories: Accountability | Comments (0) | PermalinkKD or the Retail Trader? (Part 2)

Posted by Mark on July 2, 2021 at 07:29 | Last modified: May 24, 2021 15:29Is the takeaway from this blog mini-series more a reflection of KD or of retail traders in general?

I left off discussing my outreach to 12 people from the Y collaboration worksheet. Here are the results:

- One said he had moved on from KD’s approach and was now trying something else.

- One said he had not yet started to apply KD’s approach and would not be any help (despite the fact that he added himself to the spreadsheet months earlier).

- One said he hadn’t gotten anywhere with KD’s approach because he was struggling with the programming.

- Two responded enthusiastically about working together but did not respond to a subsequent e-mail.

- Seven did not respond at all.

I am shocked by the overall response. I stated in the third paragraph here that I could not recommend KD because I had yet to find any success. This is supported by the total reception to my e-mails. Most people having success would be happy to share stories, meet others who are like-minded, hear other potentially helpful suggestions, etc. Over half my e-mails went without any response, two gave no substantive response, and the rest expressed failure and/or remarkably weak excuses.

I cannot exclude the spam filter as reason for why so many e-mails went unacknowledged. Two of the nine were second e-mails following an initial response, which makes the spam filter doubtful. I don’t know about the other seven. Keep in mind, though, that all messages went to people who voluntarily put themselves on a list to be contacted. I am somewhat computer literate and know to check my spam folder periodically for non-spam messages. I would like to think that intelligent people spending thousands of dollars for strategy development education would also know, but I can’t be sure.

Six months later, a newbie contacted me. He wrote:

> Hello,

>

> How are you? I just took KD’s Y workshop and saw that you are

> open to collaboration.

>

> I’ve been recently liberated from a high-tech job as a product

> manager/business development in Silicon Valley. I’m trying to build

> a steady income stream by trading futures. I’ve submitted one

> strategy to the club so far and I’m trying to build up a diversified

> portfolio.

>

> Let me know if you are open to corresponding through email.

>

> Thanks,

>

> DO

I think the message I sent to others was a proper introduction and done with enough awareness to avoid alarm. DO’s message to me most assuredly accomplished the same. NS’s initial contact that I included in the last post: not so much.

Speaking of NS, I will get back to his surprising ending next time.

Categories: Accountability | Comments (0) | Permalink