Bullish Iron Butterflies (Appendix)

Posted by Mark on September 28, 2020 at 06:54 | Last modified: May 8, 2020 10:19I’ve been going through my “drafts” folder this year trying to finish partially-written blog posts and get more organized. This post began an eight-part mini-series on bullish iron butterflies (IBF). My drafts folder contained one additional post containing miscellaneous thoughts about the trade and development. In the longshot case that someone out there could possibly benefit from any of this, here is that post from Sep 2017.

—————————

With the bullish IBF, I have found profit factor to be much lower and complicated backtesting with OptionVue. What about profit per commission?

Intuitively, I feel the market moves around in gross points more than proportionately to the underlying value. Does ATR truly capture this? If not, then perhaps fixed width rather than a dynamic butterfly is the way to go. In that case, I should just repeat my backtesting with different widths and see what works best. That would also allow for easier MAE analysis, which I might be finding right now is impossible due to varying widths.

I thought the bullish butterfly would perform better because of the general upward bias to equities over the last decade. I’d like to compare this to an ATM butterfly.

Other future directions include:

- Break down PnL by width

- MAE distribution

- Slippage analysis

- Break down PnL by Osc

- Categorize by Average IV

- Study effect of time stop

- Histogram of days in trade for winners (earlier exit, lower

potential loss since T+0 maintains height over max loss)

The preliminary trade statistics did not record trade price, which I’m guessing is lower for the symmetric than the bullish IBF.

I haven’t dealt much with the differential margin requirement on each trade. What about widening the narrow structures in case that’s just leftover margin anyway?

Is there an issue with profit contribution when trading width-adjusted butterflies? The wider structures contribute more profit than the narrow ones. The narrow ones lose less because they are more diluted but they also return less in terms of ROI (in addition to gross).

Categories: Backtesting | Comments (0) | PermalinkAttacking the Python

Posted by Mark on September 25, 2020 at 07:18 | Last modified: January 5, 2021 14:29In 2019, I spent about four months taking some introductory online courses in Python, Excel VBA, and TradeStation EasyLanguage. This year, I’ve made a somewhat larger commitment to learn Python by subscribing to DataCamp (DC).

DC offers hundreds of online courses in Python, R, and other subjects pertaining to data science and programming. Classes include roughly 15 videos with each averaging around four minutes in length. The videos are punctuated with multiple-choice questions and fill-in-the-blank programming exercises. If I don’t know the answer then I can click to get a hint and, if necessary, click to get the answer. At any point, I can submit my answer to be checked. If correct, I gain points and move onto the next exercise or video (watched videos also accrue points).

One thing I found lacking at DC was a detailed explanation of solutions. I usually found provided solutions to be self-explanatory (especially in combination with the videos), but occasionally I was left scratching my head. To this end, DC has a Slack platform with multiple channels where questions can be asked or comments made. I have found this community to be of significant benefit thanks to a number of people eager to help.

DC bundles together classes into career tracks and skill tracks. The former encompass more classes and a broader education. I completed the “Data Science with Python” career track while going through 100+ classes. I was only a few courses away from completing a few other career tracks, but I took all the classes that captured my interest. I feel like I definitely gained a solid, introductory foundation for what programming in Python is all about.

In addition to the classes, DC offers additional practice exercises, assessments, and some open-ended (not fill-in-the-blank) projects. I plan to do some of these, but I have not yet started.

I have been doing supplemental practice exercises at w3resource.com. This is not the only website that offers such practice exercises, but it has a lot of them along with working solutions.

To aid with my review, I have also started my first bigger project: a futures backtester. This will take a lot of time (and require extra help since I have such limited programming experience) but should be very educational. I will write about this soon.

Categories: Python | Comments (0) | PermalinkWooing My Dream Job (Part 2)

Posted by Mark on September 22, 2020 at 07:08 | Last modified: January 9, 2021 11:01Continuing on with a recent job listing for my potential dream job:

The Jr. Investment Analyst will be responsible for collecting and managing performance and market data used for reporting on portfolio performance.

In this role, the Jr. Investment Analyst is expected to:

- Work collaboratively the Board of Directors, the Investment Committee, the Executive Director, and Director of Finance

- Work collaboratively with the Chief Investment Officer… investment managers, service providers and custodial banks

- Compile investment materials for quarterly board meetings with investment committee

- Manage programs based on scope of work for new initiatives

- Gather and analyze data, facilitate meetings, and produce reports as required

- Conduct quantitative analysis to support efforts

- Manage Key Performance Indicators by capturing data and reporting on a timely basis

- Identify opportunities to improve quality of reporting and metrics

Required Knowledge, Skills, and Abilities

The candidate will be early in their career and will have served as a junior investment or finance analyst with experience in managing investment portfolios, evaluating strategies, assessing portfolio performance, coordinating resources, and reporting. The candidate should be very familiar with investment concepts, asset allocations, and have experience using a variety of tools and data sources with experience in a foundation, pension, or endowment.

Critical competencies and experiences:

- A College or University degree

- Strong analytical skills and ability to deal with large amounts of data with attention to detail

- Strong quantitative skills with expertise in financial modeling and statistical analysis

- Knowledge of investments and completion or pursuit of CFA certification

- No more than 3-5 years of experience in finance

- Team player: collaborative and flexible

- Very high proficiency with Office and expertise with Excel and PowerPoint

- Knowledge and experience in computational modeling, programming, statistics, and state of the art reporting tools

- Ability to learn new systems and databases

I can fast forward and tell you that I did not get a call back for this position. To be sure, I was overreaching in some areas:

- Although I started preparing for CFA Level 1 in 2012, I did not complete the process nor take the exam

- I am still very early in my Python journey, which may or may not be considered sufficient programming experience

- I have no experience with reporting tools

Finally, I have worked as a full-time option trader for over 12 years, which exceeds their desire for no more than 3-5 years in finance. I have trouble understanding why this would be a deterrent, though. I would imagine this—perhaps more than anything else—is what made me unique compared to most other applicants.

This was my first job application in over 19 years. It was not meant to be.

On to the next one!

Categories: About Me | Comments (0) | PermalinkWooing My Dream Job (Part 1)

Posted by Mark on September 17, 2020 at 07:41 | Last modified: September 19, 2020 15:33I recently stumbled upon a job listing that captured my attention.

Well… more than “captured my attention.”

Fine: it was virtually love at first sight, okay?!?

Minus some particular details to protect the innocent, the listing reads as follows:

“[We are] a private, non-profit research foundation… formed in 1973 [to help] achieve… objectives around economic development through the commercialization of intellectual property…

[We] manage a… [multi-] million [dollar] endowment, built from decades of licensing revenue derived from… intellectual property. In addition to providing… [millions] in research funding… annually… [we] operate four subsidiary organizations…

[We are looking] to hire a Jr. Investment Analyst to work closely with the Executive Director, Director of Finance, and Chair of the… Foundation’s Investment Committee to assist with the management of the investment portfolio…

The… Foundation’s portfolio is created from decades of licensing revenue derived from licensed intellectual property. It is… a flexible and sustainable resource that creates the margin of excellence for… [us] as a research organization.

As a flexible resource, [we] must be prepared to provide financial support at higher than sustainable expenditure levels in response to extraordinary circumstances… As a sustainable resource… [we carry] an obligation to invest and grow… assets to ensure benefits to this and future generations…

The Board of Directors… is responsible for making decisions that govern all aspects of the… Foundation and its investments are overseen by the… Foundation Investment Committee…

The Investment Committee sets investment objectives and performance measurement standards and has the responsibility to oversee the investment management of the Fund, Endowment, and Restricted Funds on its behalf. The Investment Committee has the responsibility to ensure that the assets of the… Foundation are managed in a manner that is consistent with the policies and objectives of each respective pool of capital.

The portfolio is generally segmented into four main categories including Global Public Equities, Hedge Funds and Fixed Income, Private Equity and Venture Capital and Program Investments. Together, the Investment Committee and… Foundation leadership manage several service providers to assist within the main categories and direct relationships with investment managers to perform diligence, asset allocation, manager selection and reporting.

Job Brief

This role is ideally suited for an individual early in their career. The Jr. Investment Analyst will work closely with the Executive Director, Director of Finance and Chair of the Investment Committee in all aspects of the investment portfolio management and reporting. From monitoring the portfolio positions, preparing, and presenting performance reports, reviewing contracts and fees for managers, capital calls, and performing analysis, the Jr. Investment Analyst will have hands on exposure to helping oversee this important resource.”

I will continue next time.

Categories: About Me | Comments (0) | PermalinkThe Mixed-Up Files of SEMI Collective (Part 4)

Posted by Mark on September 14, 2020 at 07:23 | Last modified: May 7, 2020 16:04I’ve been going through my “drafts” folder this year trying to finish partially-written blog posts and get more organized. This is another series of unfinished posts.

From October 2016, I have a post about the SEMI group concept. I also had four other incomplete drafts. I have cursorily looked over these drafts along with the actual post. The content is different.

I resurrected Part 3 here. In the longshot case that someone out there could possibly benefit from any of this, here is what I believe to be Part 4.

—————————

In a sense, I want to outlaw from this group what Planet Fitness outlaws from their facilities. Like Planet Fitness allows no “Gymtimidation,” I want no “Fin[ance]timidation.” Like Planet Fitness has a lunk alarm, will we have an alarm for excessive egos. If you believe strongly about something and have verifiable data to support it, then perhaps we can work together to evaluate the results and the conclusions. If you bring only baseless claims (including undocumented personal trading performance), then I don’t really want to hear about it.

I want this group to be different.

I want to gradually move discussion toward the topic of trading as a business. This is what I do. I believe trading full-time is certainly possible with a different mentality/outlook than that commonly discussed. I hope every session includes actionable information that brings us closer to our trading goals. I also aim to discuss and develop the skills required to manage our own money. I don’t rely on outside “financial professionals” to manage my money and I strongly believe you shouldn’t either.*

I want this group to be different.

We will talk a lot about marketing, advertising, and fraud. I believe the experience of being conned offers a solid head start to failure in the financial space. I have communicated with many who have lost money to bad brokers, to investment newsletters, and to expensive trader education companies. We will talk about classic fraud and the role of heuristic thinking in making us believe things are better than they actually are. This increases probability of becoming the next sucker.

I want this group to be different.

Most everything we discuss in this group should relate to financial literacy. I want to help you develop and learn. What you do with that knowledge in your efforts to profit is up to you. I believe you are ultimately the best person to manage your own finances—not a professional adviser, not a canned trading system, and not a newsletter—and our discussion will periodically revisit this point.

* — For the great many, I have since changed my mind on this matter (see paragraphs 3-4).

Crude Oil Strategy Mining Study (Part 6)

Posted by Mark on September 10, 2020 at 07:11 | Last modified: September 19, 2020 14:41Today I will wrap up with criticism and conclusions from my latest study on crude oil.

Hypothesis[3] is flawed because it contains a future leak. Only in retrospect will I know how the market moves, but the hypothesis must be defined beforehand. Indeed, whether the hypothesis bears out depends on whether the market goes up/down. I clearly have it backwards.

I think the key to avoiding hindsight bias and future leaks is to put myself in the moment of uncertainty and to figure out how I will make the decision. I can easily look back and say “we were in a bull/bear market,” but in the moment all I have are operational definitions that may or may not be effective. Backtesting will determine this.

This is all to say that while the second sentence in paragraph three of Part 4 is easy to say, in the moment I may or may not be able to deliver. In my testing thus far, I have found all lookback periods to face significant challenges.

Perhaps the harshest criticism of this study is that I may have done the statistical analysis incorrectly. I got a #NUM! error in Excel and e-mailed the plug-in developer. His answer—something he admittedly may have failed to mention—made me question the entire battery of tests. The documentation looks tantamount to an entire statistics course. I will review this before analyzing further to make sure I don’t miss anything else. If necessary, I will revisit this post to correct any mistakes.

I didn’t apply the Holm method and I used alpha = 0.05. Hopefully after studying the documentation, I will have a better answer as to whether the former is necessary and/or whether the latter is too high for multiple comparisons.

Turning my final focus to overall conclusions, while many of the differences I presented are statistically significant, they are close to being wrapped around zero. Most performance numbers average out to be slight losers.

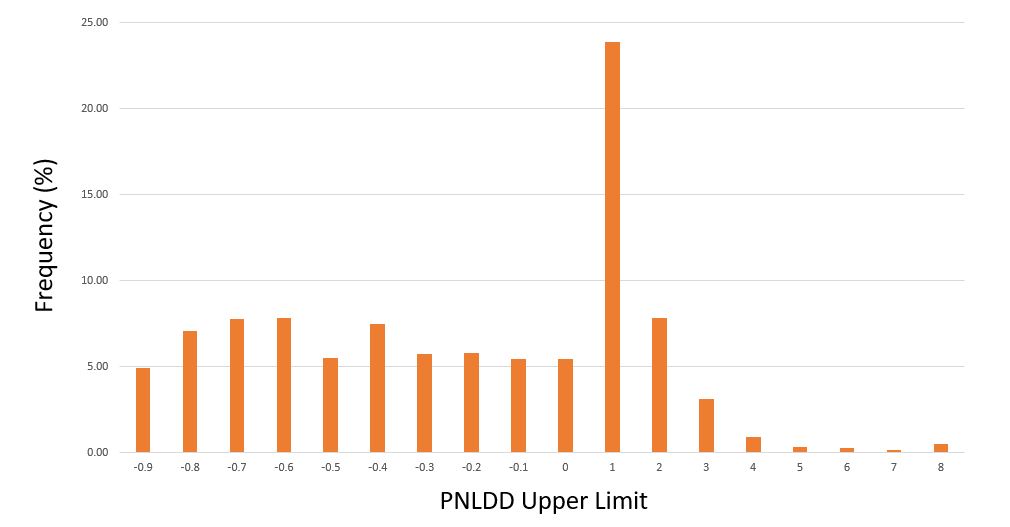

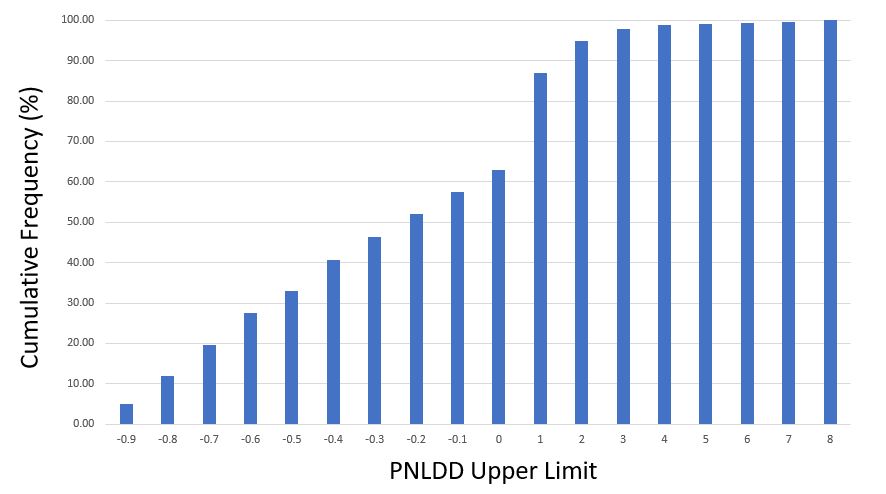

Here are [cumulative] frequency histograms for all 1,632 strategies (i.e. Upper Limit of 1.0 means 0 < PNLDD < 1) :

Strategies clock in with dynamite PNLDD numbers (over 2-3)—but it’s only 5% of the total while other strategies are complete meltdowns (see third-to-last paragraph here). I would discard the horrible ones, but this begs the question how the best strategies generally perform going forward. For the next study, perhaps I will shorten up the time intervals and test an OOS3.

This is only my second mining study, but so far I don’t see a whole lot to be excited about. For me, that does not bode well for algorithmic trading.

Categories: System Development | Comments (0) | Permalink2020 Career Counseling Update (Part 2)

Posted by Mark on September 8, 2020 at 07:06 | Last modified: September 19, 2020 14:40Picking up where I left off, here are my current thoughts about becoming an investment advisor representative (IAR).

I don’t feel like I can really talk to friends or family about investing because I am not registered to give financial advice. Strictly, a three-prong test exists for what constitutes an IA:

- The person gives advice on securities.

- The advice is given as part of a regular business.

- The person receives compensation for the advice.

In talking to others, I would be regarded as doing the first. I may be regarded as doing the second if I give advice along with trading, which is now my regular business. While I would never accept compensation without being registered, two out of three is too close for comfort. I therefore choose to say nothing at all.

And since I haven’t written this in a while:

> Nothing in this blog constitutes investment advice or any recommendation

> that any [portfolio of] security[s], investment product, transaction, or

> investment strategy is suitable for any specific person. As a blogger, I

> cannot assess anything about your personal circumstances, your finances, or

> your goals and objectives, all of which are unique to you. Any opinions or

> information contained in this blog remain just that: opinions or information.

> You should not use my blog to make financial decisions. You should seek

> investment advice from someone authorized to provide it.

Returning to the topic at hand, while part of me resents not being able to communicate with friends/family about the topics I love, another part is at peace. Quite honestly, I still have reasonable doubt as to whether anything I have studied is significantly better than long-term passive investing despite trading full-time for a living over the last 12+ years.

While I maintain hope that some strategies I implement do offer alpha, I am not qualified to evaluate the suitability standard (see here) in recommending them. As an IAR, I would be well-versed in suitability from training to everyday application.

I still have great interest in backtesting and developing trading systems. I would like to learn more about programming and statistics to acquire powerful tools to answer my research questions. I may or may not be able to continue this work as a full-time IAR working 40+ hours/week. I certainly don’t see this work fitting in with my target clients—most of whom will probably be laypeople when it comes to financial literacy.

I miss working with others. Other traders with whom I can communicate have been like a proverbial “flash in the pan” on a variety of different wavelengths. Many of them have been quick to believe what they get from books or the internet as opposed to doing the hardcore testing to confirm or deny hollow claims (so many of which are not true or actionable). For these reasons and others, I have been unsuccessful in cementing long-term collaborative relationships.

As an IAR, I would be able to collaborate with colleagues on the advising; could I also find other professionals committed to quantitative work? Or is the only place I could really hope to find such like-minded folk among the hedge fund and other performance-chasing firms that look to hire MSFEs and PhDs? One thing I don’t want to pursue at this juncture is a whole other degree field* unless I can merge it with IAR training (and tuition reimbursement?) to ultimately benefit my firm.

As a final thought, I definitely want to continue trading options even if I go the IAR route. I’ve never been a day trader and I do not require being glued to a screen to watch every tick. I would want to check the market 1-2 times per day and place trades/adjustments accordingly, though. This would have to be approved by my firm’s compliance department.

* — For what it’s worth, I did pass the Series 65 exam [for the second time] in fall 2019.

Crude Oil Strategy Mining Study (Part 5)

Posted by Mark on September 3, 2020 at 07:32 | Last modified: July 20, 2020 16:37Today I want to continue discussing results from my latest crude oil study.

Monte Carlo drawdown (MC DD) relative to actual DD (fifth-to-last paragraph here) does not seem to be useful. 813 out of 1633 strategies had a MC DD less than the actual DD. These strategies performed significantly worse over incubation than strategies with actual DD less than MC DD (PNLDD -0.11 vs. 0.24, Avg Trade -$59 vs -$15, and PF 0.93 vs. 1.02). While this is somewhat of a surprise, over 81% of these were from the worst group. Best strategies significantly outperformed worst.

Randomized OOS had a significant effect on performance in favor of strategies that pass. In this study, 280 strategies passed Randomized OOS while 1382 failed. Passing strategies averaged 0.13 PNLDD, -$22 Avg Trade, and 0.99 PF versus 0.06, -$40, and 0.97 for failing strategies, respectively.

With regard to worst strategies, none passed Randomized OOS and a vast majority met the MC DD criterion. Best strategies included only a few that passed Randomized OOS and a few that met the MC DD criterion.

Like any study, this study is not without its limitations and/or criticism.

I should have required one Randomized OOS to pass rather than two. On a few occasions, I saw strategies pass and then not pass (or vice versa) upon retest. This made me think the test lacked sensitivity. Because I did not study this over a large sample size, I don’t know how often it actually takes place. In case this makes anybody uncomfortable, one software suggestion would be to make number of Randomized OOS simulations a customizable setting. I would prefer 2,000 simulations to running the test twice in hopes of saving time, but 2,000 curves on the spaghetti graph might be too messy.

I should have programmed the spreadsheet to compute Avg Trade since I recorded Net PNL and number of trades. Automating this would save time and decrease the probability of transcription errors.

I will continue next time.

Categories: System Development | Comments (0) | Permalink