Stepping Back to Walking Forward (Part 1)

Posted by Mark on July 20, 2020 at 07:08 | Last modified: June 30, 2020 14:41Reflecting on recent studies, I’m starting to see a bridge between data mining and walk-forward (WF) optimization.

Let me begin by discussing the assumption that all trading systems break. I will not be able to verify this myself until I have developed a respectable sample size of viable strategies [I have zero thus far] with further data on strategy lifetimes. Nevertheless, many gurus talk about continuous system monitoring in case of breakage. Many traders mention it, too.

One explanation for the poor performance I have seen in recent studies (see third-to-last paragraph here) could be that the incubation period is too long. I’ve been testing good-looking strategies over a subsequent four-year period. What if the average lifetime of a profitable strategy is six months? Averaging over four years when real outperformance may be limited to six months could result in overall mediocrity.

Recall my discussion in this second- and third-to-last paragraph where I suggested the most important feature of strategy performance might be a maximal number of profitable runs over the complete backtesting period. This echoes WF with the exception of reoptimizing parameter values: here I want to stick with one constant strategy all the way through.

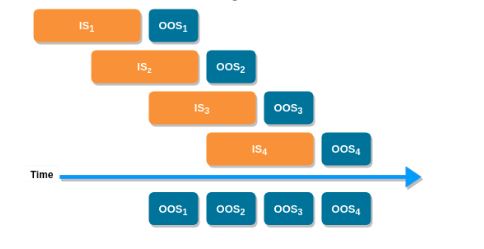

A shorter average strategy lifetime means validation or incubation should be tested over shorter time intervals. The WF process seems perfectly suited for this: test over relatively brief OOS periods, slide the IS + OS window forward by those brief increments, and concatenate OOS performance from each run to get a longer OOS equity curve. I like the following image to illustrate the concept:

I started to describe the data-mining approach to trading system development with regard to how it diverges from the WF process here. I feel I may now have come full circle albeit with the one slight modification.

As I struggle to rationalize the Part 7 results (first link from above), I can shorten the incubation period or leave it unchanged in subsequent studies.

Perhaps I am suggesting a new fitness function altogether: percentage of OOS runs profitable.

Backtracking a bit, I think much of this evolved because I have yet to see validation data for the different stress tests. Such data is not forthcoming from the product developer who says in a training video, “at the end of the day, we are still competitors and I have to keep some things to myself.” This is data I will have to generate on my own.

Categories: System Development | Comments (0) | Permalink