Short Premium Research Dissection (Part 40)

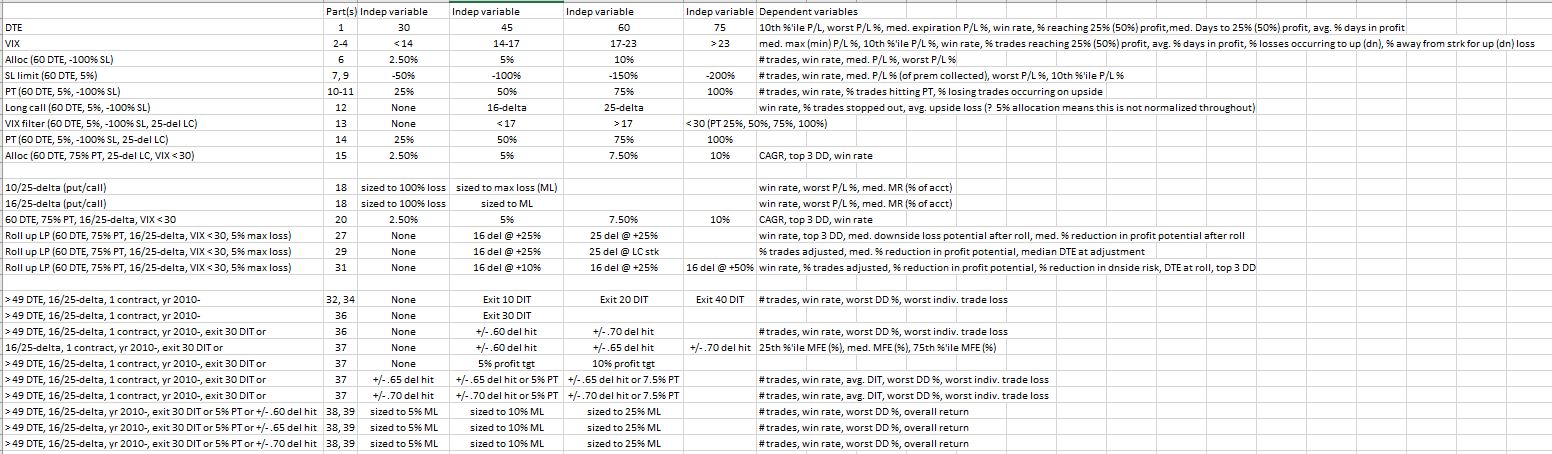

Posted by Mark on July 8, 2019 at 07:14 | Last modified: January 11, 2019 09:18By way of recap, let’s begin by doing an updated parameter check (see second paragraph here). Get your reading glasses:

The second column shows in what part of this blog mini-series each study is discussed.

This is too complex to be a definitive exercise in trading system development. Numerous independent variables, dependent variables, and criteria of all sorts have been covered. With all the degrees of freedom represented, only a fraction of the total number of permutations are actually explored.

I discussed my concept of trading system development in the paragraphs #2 and #3 below the excerpt here. As mentioned in the second and third paragraphs of Part 11, thousands of different permutations is too complex. The scary thing is that in some instances (e.g. paragraph after graph here and paragraph #2 here where I discussed failure to explore range extremes), I have actually been clamoring for more parameter values to be studied.

I believe each independent variable should be studied separately to understand its impact on performance.* “Independent variable” is easily confused with words like entry/exit criteria, profit target, filters, stops—when in fact they all probably represent degrees of freedom. The total number of permutations is multiplicative across the number of potential values for each independent variable. I tracked this earlier (final sentence of Part 11) before the research went in too many directions with too many inconsistencies and too much sloppiness.

Some of the tested variables are more about position sizing than trade setup. I’m talking about delta selection for long options. Narrower spreads carry lower margin requirements and allow for greater leverage (see discussion beginning here). This makes delta a factor in position sizing, which goes hand-in-hand with allocation: something she does study.

An entire knowledge domain exists to solve the problem of optimization. I have yet to write about this subject.

For now, it will suffice to say that although I think our author has failed to undertake a valid system development process, I do not have the solution to right her ship. The approach seems too multi-dimensional. In my gut, I sometimes feel that not everything needs to be thoroughly explored. For example, why not just stick with 60 DTE rather than having to look at 30, 45, and 75 DTE? This is precisely the rationale for studying daily trades (second-to-last paragraph here), though, as a check to ensure results aren’t fluke. It’s really all about cutting through the laziness.

I will conclude next time.

* This is easier said than done as interaction effects (see this footnote) should also be identified.