Short Premium Research Dissection (Part 21)

Posted by Mark on May 2, 2019 at 07:25 | Last modified: December 19, 2018 08:54I pick up today with comparison between the data provided last time and that shown in Part 15.

Tables are clearer than graphs and thankfully, albeit not the standard battery, our author provides one template for both.

She writes:

> You’ve likely noticed that the returns of the strategy above

> are less substantial than the returns of the high-risk

> strategy discussed in the previous section of the course

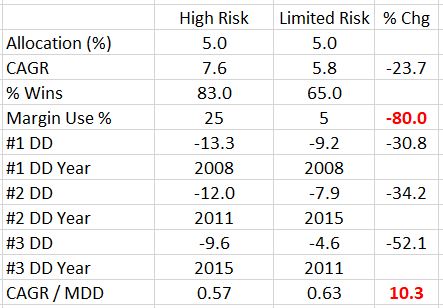

With all the inconsistent reporting of statistics and general sloppiness, I actually hadn’t realized until this mention. What effort she did not put forth to make this clear, I did:

I’m not sure why the second- and third-worst drawdown years are different between the two strategies. This didn’t quite cause me to raise an eyebrow although it didn’t escape my notice.

She omits inferential statistics, which means I cannot definitively talk about comparative differences. I last mentioned this in the paragraph below the table here, but the flaw is applicable throughout the report.

Looking past this critical oversight, my general takeaway is that limited risk sacrifices total return for a greater decrease in drawdowns. The limited-risk strategy has a lower winning percentage, which begs me to ask for distribution of losers (omitted). The 0.57 perplexes me since the other high-risk allocations posted 0.63, 0.628, and 0.625. If this is in error and 7.6% should be higher (corresponding to a similar CAGR/MDD), then this whole paragraph goes out the window.

The author distinguishes high- and limited-risk strategies in many ways:

> 1. Risk is known before entering trades.

This really makes all the difference. Defined risk provides a level of comfort. Everything below is corollary.

> 2. Losses cannot exceed limits.

Only a stop-loss can limit losses in a high-risk trade, but a big gap opening is always possible (see last excerpt here).

> 3. No need to watch market intraday

This is huge and follows straight from the first two. It means one could execute this strategy while still working a full-time job; it means one need not be tied to a computer screen or portable device.

> 4. Losing trades may be held longer.

This also follows straight from the first two and means trades have more time to recover (at the cost of PnL per day, perhaps, which gets overlooked per my discussion in the third paragraph here).

I will complete the list next time.