Short Premium Research Dissection (Part 29)

Posted by Mark on May 30, 2019 at 07:40 | Last modified: December 25, 2018 08:14Picking up where we left off, our author writes:

> The previous study tested rolling up the… long put options when

> a 25% profit target was reached. What about rolling up the long

> puts when the stock price rises to a price equal to or greater

> than the long call’s strike price?

Her stated methodology has two differences from the Part 27 study:

- Rolling is only done to 16-delta put

- “Stock price > long call strike” added as second adjustment trigger

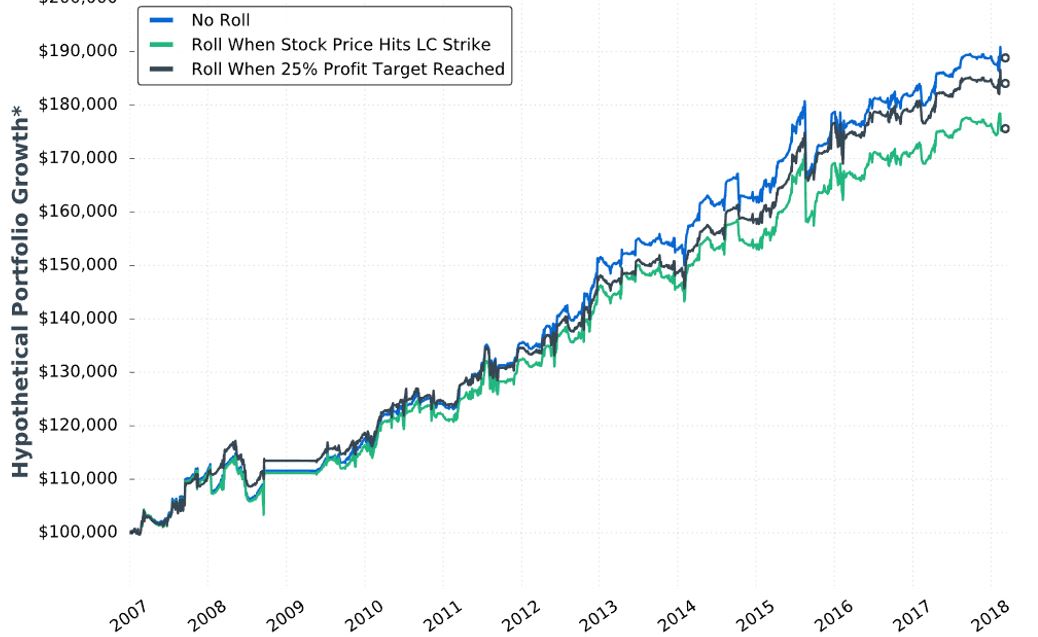

She gives us hypothetical portfolio growth graph #12:

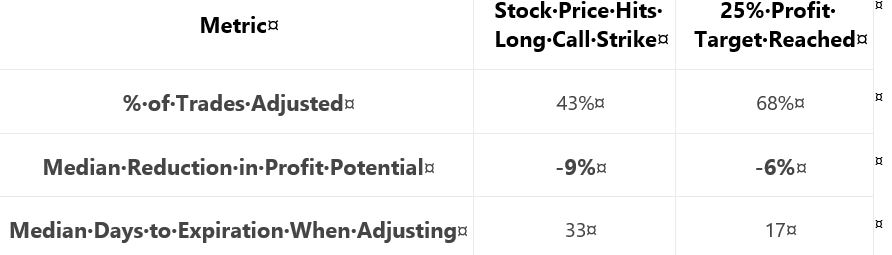

She gives us these statistics:

She writes:

> …results can be explained by the fact that… adjustment

> was usually made earlier when adjusting if the stock price

> exceeded… long call strike… With more time until

> expiration, the put-rolling adjustment was more expensive…

> when adjusting at… 25% profit… there was usually less

> time until expiration, which resulted in a cheaper roll.

My criticism of this sub-section will probably sound familiar by now.

The graph is inconclusive: No Roll finishes on top with little difference [throughout the backtesting interval] between curves, lack of inferential statistics to diagnose real differences, and likelihood of any apparent differences being due to 1-2 trades.

Once again, she offers a table with sporadic statistics never before seen.* She does not present the standard battery. I cannot even determine how many trades were adjusted because she does not tell us the sample size and/or distribution (temporally or by PnL) of trades.

As discussed in the paragraph below second excerpt here, I think caution should be applied when explaining results. I have gotten the impression throughout that her studies employ a relatively small sample size. Assuming that to be the case, it would only take a couple trades in the opposite direction to get a reorganization of top performers. This would suddenly make any good explanation look quite foolish. Besides, all her effort may be to explain differences that wouldn’t even classify as real were the [omitted] inferential statistics to fail in rejecting the null hypothesis.

Put another way, why results are what they are really doesn’t matter. We tend to feel better when we have reasons because human nature is to seek out causal relationships even when none may exist. The financial media thrives on this daily (separate topic for a dedicated post).

I will continue next time.

* I like % trades adjusted” and “median DTE when adjusting,” but [doing best Leonard McCoy

impression] for G-d’s sake man either present them consistently for global comparison or

don’t present them at all.

Short Premium Research Dissection (Part 28)

Posted by Mark on May 27, 2019 at 06:48 | Last modified: December 24, 2018 08:10Concluding this subsection on taking cheaper opportunity to reduce downside risk, our author writes:

> …by paying more, the profit potential decreases by a larger margin…

> [A trade-off exists between] risk reduction and profit reduction.

Paying more means rolling to a higher-delta put.

> Personally, I don’t mind keeping some risk on the table in exchange

> for a lower reduction in profit potential. As a result, I like rolling up

> to the 16- [rather than 25-delta] puts as an adjustment strategy.

Once again (see paragraph below the first excerpt here), she makes a subjective decision about system development rather than making use of comparative performance data. I believe system development should be data-driven and objective wherever possible.* In this case, the decision could come from the data if she were to analyze it properly.

As a final critique on this matter, I think she is too indirect about rolling implications. A few times, she mentions that the long put decreases profit potential. She writes, “the primary concern is the cost of the adjustment.” Rolling is a form of insurance. The insurance comes at the cost of theta, which is reflected as PnL per day. As mentioned at the end here, our author doesn’t address this concept. I think it important, though, because a lower PnL per day means more days in trade, a lower probability of hitting the profit target, a higher probability of big market moves while in the trade, probability of more losses, etc.

I think “lower profit potential” candy coats the reality because these direct consequences are more serious.

And once again, use of the standard battery might better illuminate these direct consequences. Her inconsistent reporting of sporadic statistics has resulted in a fuzzy sense about what strategy variants are truly better (if any).

* If this gives her the confidence to implement it (see last paragraph here) then great, but

basing such decisions on a whim isn’t good enough for me and I don’t think it should be

good enough for you either.

Short Premium Research Dissection (Part 27)

Posted by Mark on May 24, 2019 at 07:12 | Last modified: December 24, 2018 10:09I can now continue with our author’s next topic: rolling up the long put (limited-risk strategy).

In effect, this is closing the PCS mentioned here to reduce asymmetrical downside risk. Her goal is to do it for a lower cost. To this end, she discusses rolling after options have decayed and the trade is up 25%.

Like Part 21, she gives us a fuller study methodology. She does not give us exact backtesting dates, number of trades, or [inferential] statistical analysis, however, which limits our ability to discern significant differences.

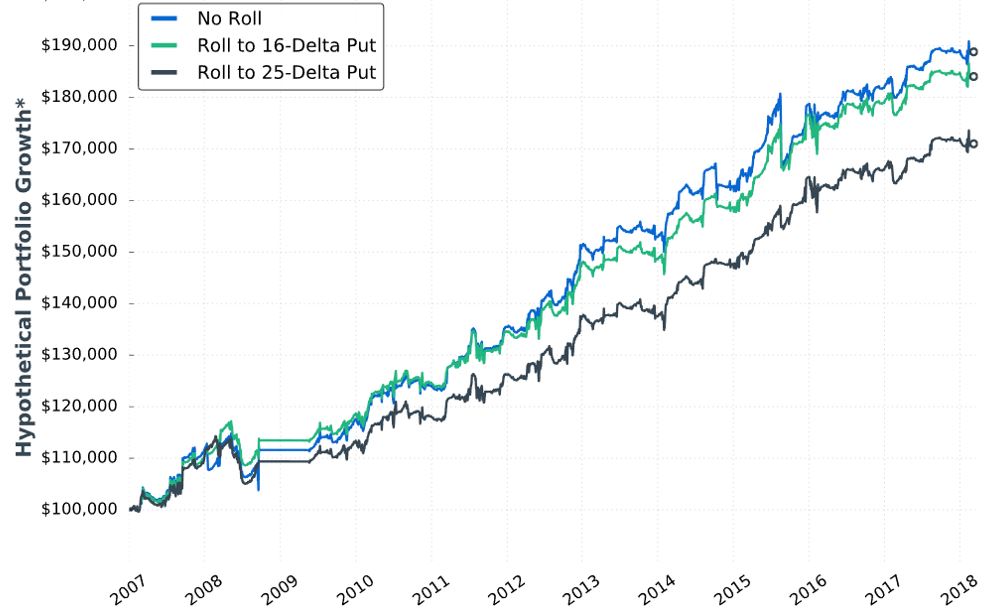

Here is hypothetical performance graph #11:

She writes:

> …rolling up the put options resulted in less overall

> profitability compared to not rolling at all. It makes

> sense, as we have to pay to roll up the long put option,

> which decreases the maximum profit potential on the trade.

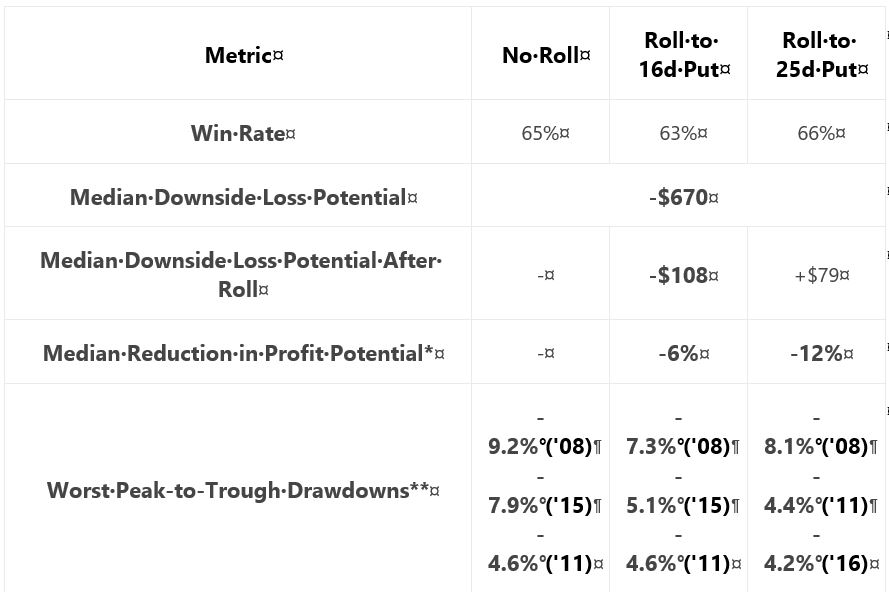

She then gives us:

She claims “the adjustment reduced the worst portfolio drawdowns (DD) by notable margins.”

Unfortunately, I’m not sure how notable this is. I would expect DDs to follow the order of No Roll > 16-delta > 25-delta. Seven of nine comparisons (e.g. for three different years, comparing No Roll to 16- and 25-delta along with 16- to 25-delta) follow this order. Why is there no 2011 difference between 16- and 25-delta? Why is DD greater for 25- than 16-delta in 2008? Furthermore, I think DD differences are likely due to 1-2 trades. Recall my repeated concern with curve fitting (last mentioned below the excerpt here). I want to base strategy on what happens with a large sample size of trades.

Aside from omitting inferential statistics, lack of the standard battery (see second paragraph of Part 19) muddles “notable.” We can see from the graph that rolling hurts profitability [a little], the table states rolling decreases DD, but she fails to present CAGR to calculate CAGR/MDD (see third-to-last paragraph here). If DD differences are due to 1-2 trades, then I would like to compare more inclusive statistics like average win/loss, average DIT (should be longer due to adjustment cost), and standard deviation (see third paragraph here).

Another useful comparison might be between just those trades where the roll gets triggered. The roll doesn’t always get done and including identical trades in both groups may mask adjustment differences.

I am happy to see her backtest a rolling adjustment, but this specific choice concerns me. Rolling later in the trade and/or when the market has gone the other way is protecting against a short-term move and/or a large whipsaw—both of which are rare circumstances. I think of it like this:

- In only a limited number of cases does the market fall enough to cause this trade to lose.

- If the market rallies, then the market must fall more in order to cause this trade to lose; this represents a limited number of limited cases.

- If the market trades sideways (or even slightly down) for long enough to trigger the roll, then the market has less time to fall enough to cause this trade to lose; this represents a limited number of limited cases.

I worry this adjustment is like the Band Aid discussed in third paragraph below the graph here: a sign of curve fitting.

I will continue next time.

Categories: System Development | Comments (0) | PermalinkShort Premium Research Dissection (Part 26)

Posted by Mark on May 21, 2019 at 06:36 | Last modified: December 22, 2018 08:14Today I want to wrap up the last six blog posts.

Curve fitting and all, the current version of the limited-risk strategy is described in the second paragraph here. Just below that, our author gives us the graph and table of the strategy.

In Part 21, we get:

> You’ve likely noticed that the returns of the strategy

> above are less substantial than the returns of the

> high-risk strategy discussed in the previous section…

I have been studying this comparison intensely over the last five posts. Contrary to her suggestion, I had not noticed the difference. The only reason I even realized such a comparison was to be made is because one section is entitled “high-risk options strategy” and the next section “limited-risk options strategy.” Aside from that, she could hardly have been less clear.

Being spared the need to trade intraday is, as discussed in her third point (Part 21), a huge potential benefit that does have consequences for execution. Without being around the computer intraday, I may not be able to close trades at EOD when exit criteria are met. Contingent orders have benefits but can be rough on slippage necessary to maintain a high probability of fills. More likely is the possibility that I review trades at night and enter closing orders for the next day: a logistical difference.

After further review, I have no reason to suspect a meaningful impact between trading EOD or next morning. I certainly may see gap moves up/down that take the market NTM/OTM and affect trade profitability. Over a large sample size of trades, I would expect no net effect, though.* I may actually get a slight bump in theta between market close and next morning’s open especially closer to expiration. Since I like to be conservative in drawing conclusions, I am fine with her use of the EOD trades (although less fine with omission of transaction fees as mentioned in this third paragraph).

My last paragraph includes suggestions about improving total return that would probably apply to both limited- and high-risk strategies. Trading that way may come at the cost of having to be home or capable of logging in to make intraday trades.

* If 1-2 trades experience a huge gap sufficient to skew the overall average, then they should

probably be excluded from the data set since this is nothing meaningful about the strategy

itself (with equal likelihood in the future of seeing a gap that offsets the difference).

Short Premium Research Dissection (Part 25)

Posted by Mark on May 16, 2019 at 07:55 | Last modified: December 20, 2018 15:19I left off with the most intense scrutiny of this research report yet.

I undertake this scrutiny as best as I can in lieu of sketchy methodology details (last two paragraphs here) and failure to disclose the standard battery—both issues I have mentioned several times throughout this mini-series.

I am trying to determine whether the worst loss cited in the study described here for a similar high-risk strategy is likely to be part of our author’s data set as well. If this is the case, then why does it subsequently take so little time to rebound to new equity highs [in this graph]?

At the end of the last post, I decided the October 2008 trade should be in the analysis while the November trade should not (volatility filter). By estimating open/close dates for both, I was able to estimate the market moves:

The November drop is slightly larger in terms of price move (percentage). The October drop is worse in terms of volatility. Taken together, I think there’s a really good chance the October trade would be a bigger loser than November and consequently the worst loss overall. This leaves me wondering how it could take less than one year to recoup the losses.

If the largest loss were November, then the VIX filter helps and my concerns are assuaged. If 2008 included consecutive losses, however, then my concerns are magnified. And again, less than one year to recoup losses in a 2009 period when volatility was easing only gradually…

I can’t know anything for certain. Putting together the analysis from the last three posts, all I have is suspicion, doubt, and skepticism: none of which are encouraging for research that cost me good money.

Zooming back out to the end of Part 22, something marketable must come from the lower margin use percentage (MUP) of limited-risk trading. Maybe with the lower MUP, I feel more comfortable to deploy other [non-correlated] strategies in combination. With high risk, MUP must be viewed as something that could easily multiply after a sudden, large market move. None of that matters for limited risk because the largest possible MUP is always staring me in the face.

If nothing else then perhaps a limited-risk strategy saves me from the worst sales pitch ever. This could mean everything.

We need not end with the 10% improvement of CAGR/MDD for limited-risk over high-risk strategies (Part 21 table). Time stops are a good next step for exploration (see second paragraph here ). I suspect X% of maximum potential profit comes sooner whereas the biggest losers come later (exploding gamma). Indeed, a 75% profit target can only be hit with waning days to expiration if and only if the market trades in the vicinity of the short strike (with a -100% max loss lying in wait to greet an outsized market move). As an alternative to time stops, smaller profit targets (e.g. 5-20%) and stop losses (e.g. 10-30%) are more common among similar approaches discussed by other traders.

Categories: System Development | Comments (0) | PermalinkShort Premium Research Dissection (Part 24)

Posted by Mark on May 13, 2019 at 06:51 | Last modified: December 20, 2018 09:03I left off under suspicion of a major data flaw in the short premium research report. Today I take this one step further.

I am really trying to make sense of the fivefold MUP difference and its implications as discussed here. A direct consequence is the possibility of multiplying position size for the lesser, which would give the limited-risk strategy a much better total return. Multiplicative drawdowns (DD) could render this approach unfeasible.

Something still bothers me about the 2008 DD and why it’s only a few percentage points more for high risk. Maybe the small allocation (mentioned last time) and/or VIX filter are sufficient to explain this.

Tasty Trade (TT) has done a wide variety of research on many different concepts. I consider most of this anecdotal because like our author, they fail to disclose complete backtesting methodology.

Nevertheless, I found a segment from August 2015 that looked at high-risk trades closest to 45 DTE from 2005-2017. These trades were held to expiration. Results included:

- Average premium: $666

- Average PnL: $131

- Win ratio: 68%

- Largest loss: -$2679

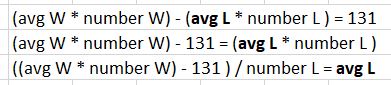

I am most interested to compare average win with largest loss to see how long it might take to recoup losses from a severe DD. “Average PnL” is going to be weighed down by the losses. Here’s the algebra to solve for average L(oss):

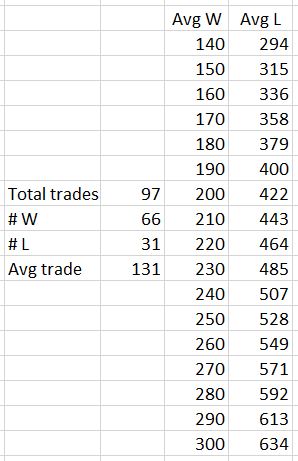

As I vary the average win, the average loss will vary proportionally:

The 97 total trades is 12 years divided by 45 days/trade. The 66 wins corresponds to 68%.

Even assuming an average win of $260 (double the average PnL), the largest loss is still 10.3 times greater. Our author uses a 75% profit target with 60 DTE trades. The losses (and winners falling short of the profit target) will go a full 60 days. Per table here, if the 83% winners (exaggerated because some will likely fall short) take 75% of the total duration and the 17% losers take 60 days, then the average trade length would be 47.5 days. Ten trades (rounding down) to recoup the largest loss would take 475 days, which is over one year three months. That is with exaggerated assumptions. The Part 15 graph, however, shows it taking less than one year to reach new equity highs once trading resumes.

Another red flag appears for me, then, if the largest loss is not filtered out. The high-risk strategy’s 2008 drawdown should be worse than that shown.

With the limited data and methodology given to us by our author, I can’t prove anything wrong here. Maybe 75% winners take less time. Perhaps the largest loss is filtered out. Just by eyeing the VIX chart:

I have drawn (sorry, no straightedge available!) red arrows to the x-axis to bracket the high-volatility period. The period begins after the October (expiration) trade was placed. The November trade would be avoided. These are the two biggest losses in 2008. Which one corresponds to TT’s -2679?

I will continue the analysis next time.

Categories: System Development | Comments (0) | PermalinkShort Premium Research Dissection (Part 23)

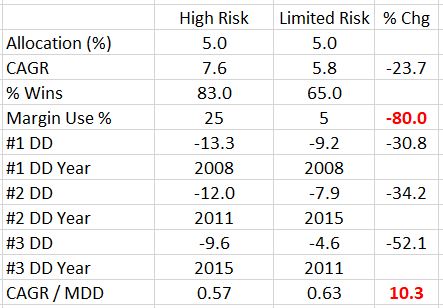

Posted by Mark on May 10, 2019 at 06:30 | Last modified: December 20, 2018 06:04Today I continue with thoughts about our author’s comparison between high-risk and limited-risk strategies (Part 21 table).

I wrote last time about normalizing for DDs and made mention of the top 3 included in her tables. Per my conservative approach, I think it’s important to heed the worst DD and possibly position size based on [150% of] that [since your worst DD is always ahead of you as discussed in second and third paragraph here].

Just looking at worst losses can be misleading, however, which is why I am interested in seeing average* and distribution. One or two outliers [even out of many] can make a bad average look much worse. Given this possibility, I am interested in seeing (or quantifying) the whole [histogram] distribution. Average [win and average] loss along with percentiles (distribution) are part of my standard battery (see second paragraph here).

If the average loss is skewed by an outlier, then maybe I calculate the average without the extreme and attempt to add a hedge to cushion me from greater-than-average losses. I would never re-run the backtest and admire the much-improved performance, though (hello curve fitting). This is something I would do as proactive insurance if it can be done at a low enough cost to preserve profitability for the whole system.

If the average loss for high-risk is significantly larger and deemed to be trustworthy, then an increased position size for the limited-risk strategy may be justified. The standard battery would tell us these things.

Getting back to my Part 22 DD analysis, I am surprised the MDD difference between high and unlimited risk is only a few percentage points despite a horrific crash of 2008’s magnitude. This is only 5% of the total account, however, so perhaps the 34.2%—a percentage of a percentage (often misleading as described in the paragraph below first excerpt here)—better reflects the difference.

This got me looking more closely at the equity curves, which is where something clearly seems amiss. The high-risk equity curve(s) in Part 15 goes horizontal for roughly six months between 2008-9. This makes sense because of the VIX < 30 filter. The defined-risk curve(s) in Part 20, however, is V-shaped across that time interval. It makes sense that these defined-risk positions are hedged and therefore would lose less (or even profit?) during volatility crush but---VIX < 30! That is applicable to both. The defined-risk curve should be horizontal for the same 2008-9 period. If this throws off the remainder of the curve(s) then is her reported CAGR erroneously high? Are her reported DDs erroneously low?

Aside from all of the critical observations I have made throughout this mini-series, perhaps nothing is worse than obvious data flaws or inconsistencies. Any and all conclusions are based off the data and calculations made from it.

This is really bad news. I hope the mistake is mine.

* Arithmetic mean. Use of median is another potential way to correct for outlier distortions.

Short Premium Research Dissection (Part 22)

Posted by Mark on May 7, 2019 at 07:15 | Last modified: December 19, 2018 09:25I left off with discussion of our author’s differentiation between high-risk and limited-risk strategies.

Her final point in comparing the two:

> 5. Significantly lower margin requirements

For me, this is the most intriguing observation and one that raises questions. Apples-to-apples comparison of ROI should be normalized for margin use percentage (MUP).* In this table from Part 21, she states a fivefold difference in MUP between high- and limited-risk strategies. Position size for the latter could be doubled or tripled and still carry a lower MUP. In this case, total returns would significantly outpace high risk.

The issue of margin requirement (MR—also known as BPR and first mentioned in these last two paragraphs) is now very relevant. MR is directly proportional to MUP. In Part 15, I discussed her absurdity in mentioning MR without explaining the calculation behind it. This is necessary to understand the 25% vs. 5% difference. According to Tasty Trade:

> We are able to define Undefined Risk by the

> amount of margin that a brokerage firms

> [sic] requires… this is normally the loss…

> [due to] a 2 standard deviation move in the

> underlying… the broker… will hold this

> amount of capital as margin.

As described in the third paragraph here, PM is similar. The underlying price at 2 SD OTM moves with the market along a curved risk graph, which means PMR is dynamic. Also dynamic is the size of a 2 SD move, which is proportional to underlying price. The move gets smaller as underlying price decreases to ultimately put downward pressure on PMR as the market falls.

While MR calculation for the high-risk strategy should be dynamic on multiple fronts, the limited-risk MR is capped. I am therefore confused how our author arrived at the fixed fivefold difference between the two strategies. I would be a proponent of determining a maximum difference to cover most instances, but even if I give her the benefit of the doubt and assume this to be the case, I need explanation as to why fivefold would be it.

Aside from normalizing returns for MUP, I am also interested in normalizing for [M]DD (see last four paragraphs here). Because the concept suffers from future leak (see footnote), I would make conservative use of it. For example, given a fivefold DD difference I would consider doubling or tripling position size to compare total return.

If a 2-3x position size results in a proportional DD increase, then I wouldn’t do it. DD difference between the two strategies are roughly 30-50% (see Part 21 table). That would be overwhelmed by a 100%-200% change.

When I talk about normalizing for MR and MDD, CAGR/MDD seems to be a comprehensive metric. If the numbers are correct, [unknown sample size aside] then CAGR/MDD is ~10% better for the limited-risk strategy.

The drastic difference in MUP relates back to the author’s first point (Part 21). If MR is calculated correctly, then the question is whether I would implement a high-risk strategy that lost 13.3% in 2008 knowing it could have been far worse had the market crash been more severe.

I will continue next time.

* Suppose you and I put on the same trade for $30,000. If your trade takes up 1% of the account

and mine takes up 50%, then you can be much more brave with regard to holding and adjusting.

Short Premium Research Dissection (Part 21)

Posted by Mark on May 2, 2019 at 07:25 | Last modified: December 19, 2018 08:54I pick up today with comparison between the data provided last time and that shown in Part 15.

Tables are clearer than graphs and thankfully, albeit not the standard battery, our author provides one template for both.

She writes:

> You’ve likely noticed that the returns of the strategy above

> are less substantial than the returns of the high-risk

> strategy discussed in the previous section of the course

With all the inconsistent reporting of statistics and general sloppiness, I actually hadn’t realized until this mention. What effort she did not put forth to make this clear, I did:

I’m not sure why the second- and third-worst drawdown years are different between the two strategies. This didn’t quite cause me to raise an eyebrow although it didn’t escape my notice.

She omits inferential statistics, which means I cannot definitively talk about comparative differences. I last mentioned this in the paragraph below the table here, but the flaw is applicable throughout the report.

Looking past this critical oversight, my general takeaway is that limited risk sacrifices total return for a greater decrease in drawdowns. The limited-risk strategy has a lower winning percentage, which begs me to ask for distribution of losers (omitted). The 0.57 perplexes me since the other high-risk allocations posted 0.63, 0.628, and 0.625. If this is in error and 7.6% should be higher (corresponding to a similar CAGR/MDD), then this whole paragraph goes out the window.

The author distinguishes high- and limited-risk strategies in many ways:

> 1. Risk is known before entering trades.

This really makes all the difference. Defined risk provides a level of comfort. Everything below is corollary.

> 2. Losses cannot exceed limits.

Only a stop-loss can limit losses in a high-risk trade, but a big gap opening is always possible (see last excerpt here).

> 3. No need to watch market intraday

This is huge and follows straight from the first two. It means one could execute this strategy while still working a full-time job; it means one need not be tied to a computer screen or portable device.

> 4. Losing trades may be held longer.

This also follows straight from the first two and means trades have more time to recover (at the cost of PnL per day, perhaps, which gets overlooked per my discussion in the third paragraph here).

I will complete the list next time.

Categories: System Development | Comments (0) | Permalink