Short Premium Research Dissection (Part 6)

Posted by Mark on March 12, 2019 at 07:15 | Last modified: November 30, 2018 09:14I left off with the author’s introduction to fixed position size.

She proceeds to discuss position size as related to trade risk. She explains 100% loss as being equal to credit received when entering the trade. Dividing credit into account value equals percent allocation, which should remain constant. This eliminates the problem of variable trade size mentioned in the final excerpt here. She believes this to be better than sizing positions based on margin (buying power reduction, or BPR), which is not something I had previously considered.

> Of course, margin requirements are real and we must consider

> how much margin we’ll use when implementing a strategy. As a

> rule of thumb, the smaller my loss limit is, the more contracts

> I’ll be able to trade (resulting in higher margin requirements).

> On the other hand, using larger loss limits results in less

> contracts and therefore less margin.

This is where I would like to see details on straddle BPR. As discussed in this second paragraph, just because I can enter a position does not mean I can continue to hold it. Portfolio margin changes constantly. In the report, she may be referencing standard margin, which for naked options is a complex calculation.

The author believes any straddle adjustments to be overly complex and inferior to closing and starting a new trade. Rather than jump to conclusions, I would like to study some basic adjustments as mentioned in the second-to-last paragraph here.

She talks about selling straddles with a target time frame of 60 DTE. I would assume this means selling the straddle closest to 60 DTE but does that mean monthly and/or weekly expiration cycles? I should not need to make assumptions (see fifth paragraph here). Methodology needs to be thoroughly detailed and this report is repeatedly lacking on that front. The folks at Tasty Trade also struggle with this (see fifth paragraph here).

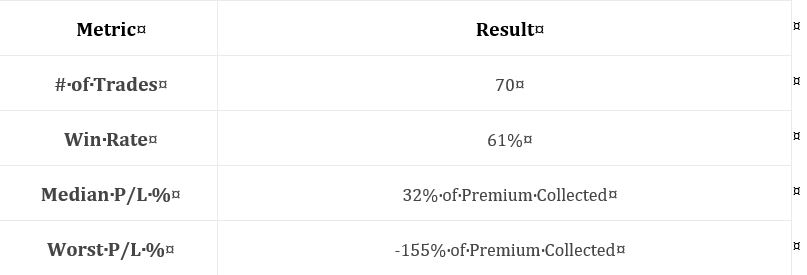

She gives us some initial statistics on strangles:

As discussed in several parts of my Automated Backtester Research Plan, I want to see a broader array of statistics. Examples include distribution of DIT including max/min/average (maybe percentiles), average trade, average win, average loss, profit factor, max drawdown (DD) percentage, compound annual growth rate (CAGR), CAGR/max DD %, standard deviation (SD) of winners, SD losers, SD returns, and total return. In addition to methodology description, inadequate complement of trade statistics is another recurring issue I had with this report.

She does not study daily trades (see second paragraph here). I would be interested to see daily trades backtested and grouped (e.g. 56-60 DTE, 61-65, 51-55, 46-50, 41-45, etc.) or run monthly for each DTE with a statistical analysis to make sure no significant differences exist. Her serial backtest appears to include 70 trades in ~11 years, which is not that many.

I will continue next time.

Categories: System Development | Comments (0) | Permalink