Put Credit Spread Study 1 (Part 4)

Posted by Mark on October 30, 2017 at 07:38 | Last modified: August 14, 2017 13:58Today I will present data obtained from the methodology discussed here.

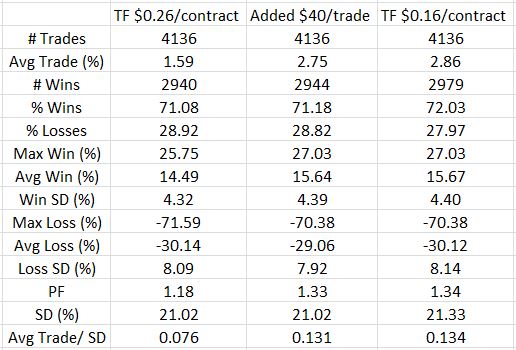

I started by adding $40 to each trade to represent the lower transaction fee. Going from $0.26/contract to $0.16 represents $10 per leg and the trade has two legs each to open and to close: 4 * $10 = $40.

I then recalculated and identified trades with ROI smaller than the -25% SL. I found 188 trades.

I then identified the original SL dates and looked at the chart to determine if these were bottoms. If so then I was probably looking at a flip. If not then I still had a loser and I would have to retest to see how big the loser would be.

This is when I realized that regardless of proposed alternatives, I would have to retest the 188 trades anyway. The previous step identified 40 trades as flip candidates. While that seemed encouraging, I only had part of the picture.

I proceeded to replace the original values of Exp ROI w/25% SL with 188 retested values. I then recalculated trade statistics.

Here are the results:

The third column is an approximation. While accounting for the lesser TF, it neither takes into account flips nor new PnL values for trades evading SL the original day only to trigger SL on a subsequent day.

To see the impact of lowering TF, therefore, the second and fourth columns should be compared. Doing so reveals an improvement in most of the statistics. I don’t see any surprises here. Simply adding $40 per trade is $40 / ($4000 – $40) = 1.01% on net margin. The average trade improved by 1.27%, which seems reasonable when flips are taken into account. Average loss remained about the same and 39 fewer trades actually lost with the lowered TF.

I think the moral of the story is that once again, execution makes a big difference. I am tempted to repeat the process for TF $0.06 but I think there may be cases where options priced $5.00 to $15.00 may incur more than nickel slippage. $0.16/contract may therefore be painting a realistic picture.

Another repetitive theme is the temptation to take only those trades that have gone against me by the slippage amount to improve the effective price. Profitable trades from inception throughout would go unable. Would this missed opportunity more than offset the benefit of improved entry price on all the others? That is the critical question.