Bullish Iron Butterflies (Part 8)

Posted by Mark on September 14, 2017 at 07:01 | Last modified: June 8, 2017 14:07Trading system development is, for me, a learning process and backtesting butterflies has been no different. This post is good background. What I found out last time was a real problem with the concept of width-adjusted MAE.

To be more specific, I do not believe width-adjusted MAE allows for an apples-to-apples comparison across trades. I came up with the “width-adjusted” concept here to correct for the fact that narrow [breakeven] trades seem to hit max loss more often. With regard to MAE, which is related to stop-loss, normalizing for width means the narrowest trades are most diluted in terms of ROI. That is to say the narrower the trade, the more unlikely it is to be stopped out.

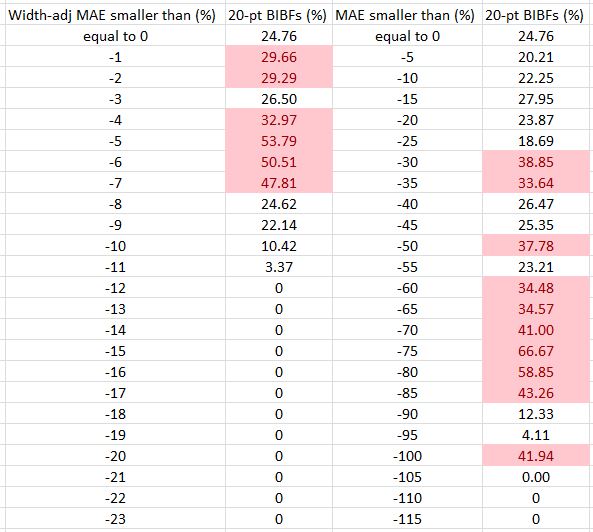

To quantify this, I will study the percentage of 20-point BIBFs across both width-adjusted and non-adjusted MAE categories. I previously calculated that 28.6% of all trades were 20-point spreads. In the following table, cells colored red include a proportion of 20-point BIBFs that exceeds 28.6%:

Indeed, narrow butterflies are more prevalent in the higher percentages of the non-adjusted MAE distribution while being more prevalent in the lower percentages of the width-adjusted MAE distribution. A stop-loss triggering on width-adjusted PnL would therefore be less likely to stop out narrow BIBFs than if based on non-adjusted PnL. Unfortunately the narrow BIBFs are most in need of a stop-loss.

Part of me thinks this is an absolute mess.

Another part of me thinks this is just a reflection of the level of complexity I’m dealing with here.

From a backtesting perspective, this might be an argument for using constant spread width regardless of underlying price. That would eliminate the need to normalize for width altogether. The question would then be what width to use. Perhaps backtesting 20-, 40-, 60-, and 80-point wide spreads would be sufficient for comparison.

Selecting a constant spread width would once again introduce a new degree of freedom into the equation. This variable would be in addition to exit day (introduced in last post), stop-loss (not yet identified), profit target (arbitrarily selected as 10%), and short strike selection (arbitrarily selected as 2-3% above the money).

Categories: Backtesting | Comments (1) | Permalink