Bullish Iron Butterflies (Part 1)

Posted by Mark on August 7, 2017 at 07:09 | Last modified: June 9, 2017 09:02Today I begin my report on the bullish iron butterfly.

The structure of this trade is different from the dynamic iron butterfly. This trade was centered 2-3% above the money (split strikes were used if necessary). Also, this was a balanced (e.g. symmetrical) butterfly. The last backtest only included a few balanced butterflies [when the dynamic criterion so ordered].

Trades were held until a 10% profit target was hit on an EOD (3:30 PM ET) basis or until expiration Thursday. I assessed my usual [arguably excessive] transaction fees.

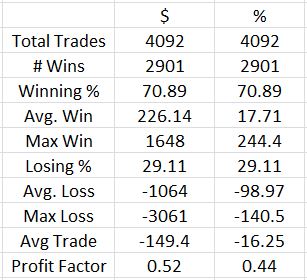

Here are the initial results:

Aside from the ugly profit factor, the first thing I noticed was a max loss of -140.5%. In live trading, the worst loss I would incur on this trade would be a case where one spread goes DITM. OptionVue often shows these spreads to be worth more than their width. While this could potentially happen under low-volume, illiquid conditions, I would never actually close such a spread. Rather, I would hold it until expiration and pay two assignment fees. With this totaling $30 (or less) and the minimum margin requirement ever recorded of $400, the worst loss I could ever technically incur would be -108% ($430 / $400).

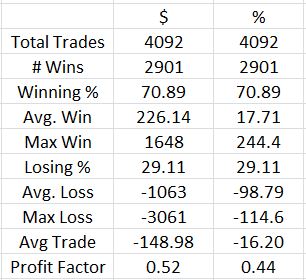

For this reason, I went back and changed the max loss on any trade to -108%:

The effect of the changes was minimal. 176 additional trades showed a loss between -108% and -115% but based on the minor impact from mitigating the most extreme losses, I don’t think it’s worthwhile going back to change the others.

I’m just getting started with this backtesting analysis but I do not think this is an optimistic start! Between 2001 and 2017, I backtested the bullish iron butterfly through many market environments and conditions. While I will separate some of these out and compare in an attempt to identify differences, part of me believes a robust trade should backtest profitably on the whole. This clearly did not.

Categories: Backtesting | Comments (2) | Permalink