Musings on Naked Puts in Retirement Accounts (Part 1)

Posted by Mark on May 23, 2017 at 07:25 | Last modified: April 3, 2017 13:24I am not a proponent of trading naked puts (NP) in retirement accounts. The addition of a long put converts the NP to a put vertical spread. Might the vertical be a candidate for retirement account trading?

My argument against NPs in retirement accounts begins with the observation that retirement accounts cannot be margin accounts. I was unable to find a particular regulation that prohibits this but I don’t know of any brokerage that allows an [Roth] IRA to support any kind of loan. Margin is a loan, which would therefore be prohibited in an [Roth] IRA account.

Being resigned to trade NPs in a cash account simply does not seem like an attractive use of capital. If I have a $100,000 account then I can only sell one 1000 NP. If the put trades for $3.00 then this is a 0.3% return. If I can do this once per month then my potential annualized return is about 3.6%. As Shania Twain used to say, that don’t impress me much.

Portfolio margin—not suitable for a retirement account (see above)—makes the most sense to me for trading NPs.

Employing leverage by purchase of a long put is one alternative to make NPs more attractive for retirement accounts. In the previous example, if I buy the 900 put for $1.00 then I cut risk by 90%. Now I might be looking at a return of 2% per month or 24% per year. This is worth considering.

While purchase of the long significantly boosts potential ROI, it is not a panacea. The vertical spread does not affect maximum drawdown (DD) unless the market falls far enough to put the long put ITM. If the long put is purchased for cheap then this represents a significant market crash, which is rare. Similarly, the vertical spread does not decrease standard deviation of returns (another measure of risk as discussed here and here) unless that “significant market crash” occurs.

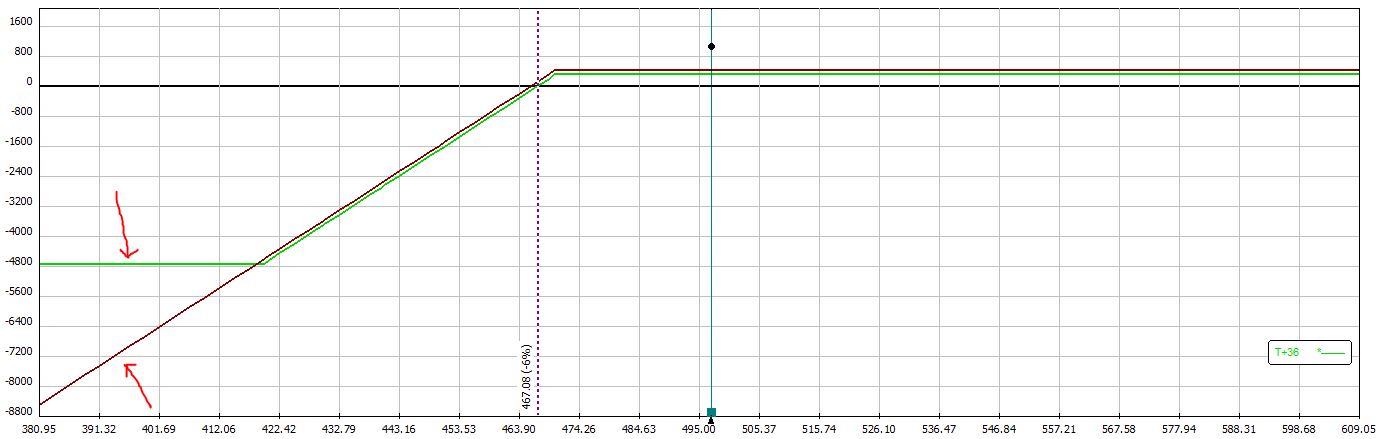

To illustrate, below is a risk graph of a naked put and a put vertical spread:

The red arrows highlight how the vertical spread stops losing money by 419 on the downside (green line) whereas the NP continues to lose money as the market drops below 419 (brown line).

Other disadvantages to the vertical spread include the additional cost and transaction fees. Being two options instead of one, a vertical spread usually incurs twice the transaction fees as a NP. Based on my experience trading in fast-moving markets, I would expect to pay [much] more than 2x under these rare conditions. This makes sense to me because under these circumstances, the most efficient way for a market maker to survive is by taking the simplest trades and executing them quickly to serially mediate risk.

I will continue this discussion next time.

Categories: Financial Literacy | Comments (2) | Permalink