Dynamic Iron Butterflies (Part 2)

Posted by Mark on February 7, 2017 at 06:57 | Last modified: December 6, 2016 11:14Last time, I presented the overall trade statistics for my first study of dynamic iron butterflies (DIBF). The results were not pretty. Today I want to address the impact of transaction fees (slippage + commission).

I have previously discussed how transaction fees can make or break a study. I subtracted $0.26/contract because I was backtesting some expensive, at-the-money options and when I have to estimate, I prefer to bias in favor of loss. Despite only trading a handful of live butterflies to date, I have never paid more than $0.13/contract in transaction fees (sometimes $0.06). Fast-moving markets could take more than $0.26 but such adverse conditions are rare.

Let’s compute how an overestimation of transaction fees may have affected results. The mean margin requirement (MR) across all trades was $4,878. I subtracted $26 * 8 = $208 from each trade for transaction fees. Cutting that by 50% adds $104 / $4,878 * 100% = 2.1% ROI to each trade. The average trade lost 1.4% so this modification makes the backtested DIBF a winning trade (+0.7%). If even 50% is estimating high then I should reduce transaction fees between $104 – $156. If I use the middle of that range then the average trade gains 1.2%.

Transaction fees alone can make the difference between a 1.4% loss and a 1.2% profit per trade. Financially speaking, those are worlds apart. Thinking about how many traders omit transaction fees entirely for the sake of simplicity just boggles my mind. No wonder so many statistics suggest up to 90% of traders fail within the first five years.

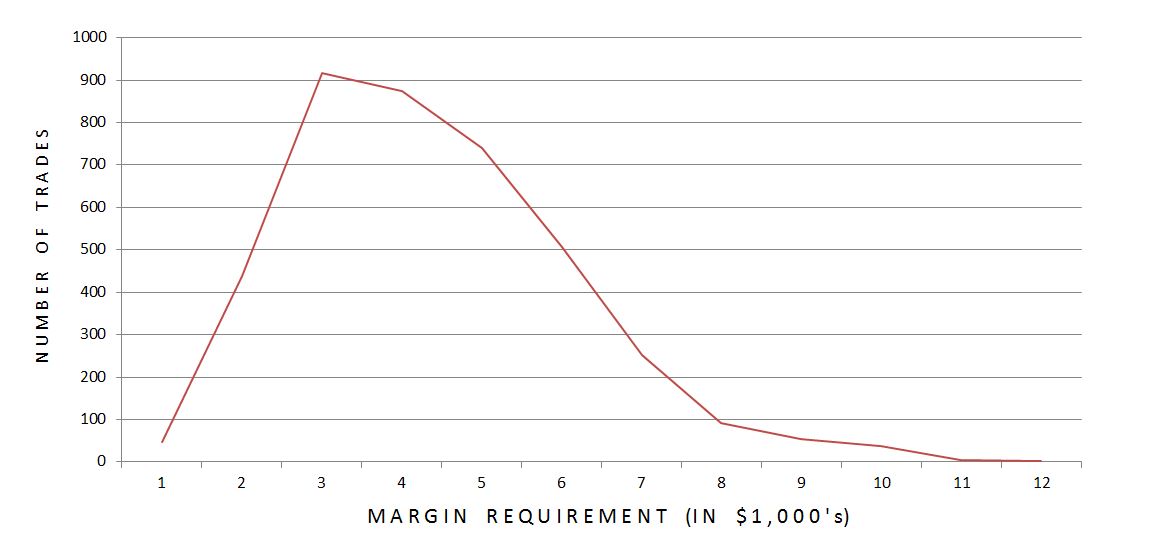

These calculations are based on averages but the exact MR should be considered. Reducing slippage by $52 impacts a $2600 trade twice as much as a $5200 trade. More expensive trades occur in higher IV, which occurs less frequently. I would therefore hypothesize lower MR trades to dominate the distribution, which might boost average ROI further:

Indeed, 88.8% of trades had MR within the lower half of the range. While cheaper trades significantly outnumbered expensive ones, only 54.8% of trades had MR below the arithmetic mean. The impact of this skewed distribution is questionable.

Having a more significant impact would be trades where the long option(s) would have been left to expire worthless in live trading. These seemed to occur later in the data series at higher prices for the underlying. Being forced to allow one or two long options to expire worthless saves approximately $20 or $40 per trade, respectively.

I will continue the discussion in my next post.

Categories: Backtesting | Comments (1) | Permalink