Dynamic Iron Butterflies (Part 1)

Posted by Mark on February 2, 2017 at 07:13 | Last modified: December 2, 2016 14:50I want to trade butterflies and the only way I can get myself to trade something new is to backtest it. This study is based on a Tasty Trade segment from April 1, 2016.

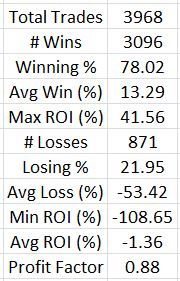

The subject of this analysis is dynamic iron butterflies (DIBF). Without further ado, let’s jump ahead to the results:

This is a completely different profile than that presented in the Tasty Trade video! Make no mistake: with an average loss posted after 3,900 trades, this is ugly.

These negative results were very surprising to me. I have been conditioned to be a believer in short strangles (the butterfly’s undefined-risk counterpart) and I have personally done some backtesting to support that belief.

Before throwing the proverbial baby out with the bathwater, let’s step back and critique the methodology.

My first thought is that I was probably heavy on the transaction fees. $26/contract might be reasonable during fast-moving markets but is probably excessive in most cases.

Second, instead of expiring DOTM longs in the later years of backtesting, I sold them for the nickel (or less) they were stated to be worth. In reality, I probably would not have been able to sell them so close to expiration and I would have been spared that $26/contract. Proceeding in this fashion saved time (it took me four months to do this study) and I am typically comfortable with backtesting bias that favors the losing side.

My third question mark surrounds asymmetrical loss, which may or may not be an issue. I calculated profit/loss in terms of ROI(%) because the margin for a 1-contract trade ranged from $1,401 to $12,400. With ROI(%) itself serving as normalization, I discovered the discrepancy. In some cases the market moved far against the trade to the downside causing > 100% loss (transaction fees). In other cases the market moved far to the upside causing a more limited loss (e.g. 50 – 90%). Some trades also ended up symmetrical: maybe these should be separated out?

The average loss was just over four times the average win, which completely nullifies the benefit of 78% winners. That suggests an MAE analysis to see if stops could be beneficial.

Categories: Backtesting | Comments (2) | Permalink