Maximum Adverse Excursion Study (Part 1)

Posted by Mark on November 23, 2016 at 07:30 | Last modified: February 3, 2017 09:29Hopefully motivated by my last post, yesterday I took some time and ran a maximum adverse excursion (MAE) study.

MAE is the largest end-of-day drawdown faced during the lifetime of a trade. I blogged on MAE here. MAE may be used to demonstrate the maximum risk ever faced in a single trade. It’s also useful to assess viability of a system with regard to available capital in case an insurmountable margin call were to be historically triggered.

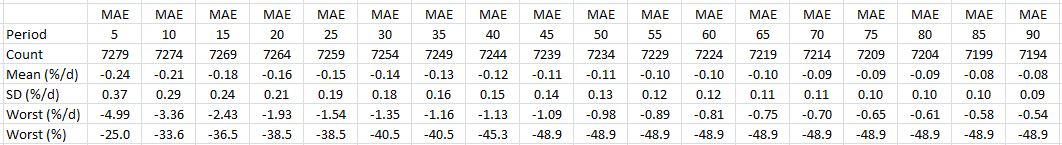

I started by downloading data from 8/10/1987 through 8/1/2016. I then calculated MAE (%) per day for long positions lasting 5 – 90 trading days in multiples of five. I expected period to be proportional to MAE because time is opportunity for a trade to go south. To prevent this relationship from masking other trends I divided by period to normalize the variable.

Here is the summary:

The first thing I noticed was the ~67% decrease in mean MAE/day and ~75% decrease in standard deviation (SD) per day as period increases from 5 to 90. At first I thought this was evidence that mean-reversion increases with time. A decrease in SD/day suggests more consistency and a decrease in MAE/day suggests lower drawdowns.

This is also consistent with the long-term positive drift of the stock market. Longer trades have more chance to profit at a cost of fewer trades per fixed amount of time. Perhaps it’s less about mean-reversion and more about positive drift. Finance would say I must get something extra (return) in exchange for the added risk (e.g. compared with Treasuries) I take with stocks and “positive drift” is that something.

Statistical tables often contain lots of information and I believe critical analysis is essential to understand what the numbers are [not] saying despite occasionally seeming otherwise. The dramatic decrease in MAE/day was initially a surprise. I then added the last row that does not normalize for time. MAE never increases beyond 45 days. Even when it does increase (e.g. -25.0% to -33.6% from 5- to 10-day period), it is less than directly proportional to time.

So yes, I could talk about positive drift or more mean-reversion over longer time periods but it’s also a simple mathematical consequence of being less than directly proportional. The real question is whether this is actionable.

I will continue the analysis in my next post.

Comments (3)

[…] small MAEs are definitely in the majority. This makes more sense given the market’s previously-described positive drift. Many trades had no MAE, which meant the market went up from inception and never […]

[…] previously did a study on maximum adverse excursion. Today I will discuss another study I did on maximum excursion (ME) in November […]

[…] improve the PnL. Being directionally long also favors EOD trading by giving more time to allow for positive drift. The observations that many trades have small MAEs and only a select few have huge MAEs is […]