Is Option Trading Too Expensive? (Part 2)

Posted by Mark on August 5, 2016 at 06:27 | Last modified: May 25, 2016 14:59I occasionally get the sense that option trading, specifically naked put (NP) selling, is quite expensive. Today I will provide a couple other snapshots explaining why this is not the case.

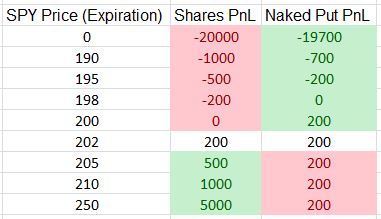

Consider the purchase of 100 SPY shares at $200/share. This will cost $20,000. Suppose I sell one SPY 200 put for $2.00. This will cost me $19,800 in a retirement account. The PnL of each trade at option expiration is:

Green (red) cells indicate the more (less) profitable position. The NP trade is 1% cheaper and the naked put never loses more than the long shares. The NP underperforms to the upside but not because it loses more money—only because it doesn’t make as much. With risk traditionally defined as how much I can lose, NPs are never more risky than shares (score a second point for trading options over stock).

Are NPs too expensive? Clearly not: if I have money to buy the shares then I have money to sell the put.

I can also dramatically cut the cost of the NP by purchasing a long option. For example, in last post’s SPX example, a 1500 long put would cost $0.45. This cuts my profit from $2.13 to $1.68, which is a decrease of 22%. This cuts the trade cost, however, from $178,787 to $29,000, which is a decrease of 83%. Put another way, the potential annual return has just increased from 1.4% to 6.9%.

In the last post I discussed the possibility of selling an SPX option for 1% of the strike price to target 1% per month. The option premium increased from $2.13 to $20.75: almost 10-fold. The strike price increased from 1790 to 2010: about 13%. The former is the numerator of the ROI calculation whereas the latter is the denominator. Ponder this in terms of how much cheaper (more profitable) the trade can potentially be. Trade-offs always exist and in this case the trade-off is a decreased frequency of winning (probability of profit).

So in the final analysis, how expensive is it to trade options? Perhaps the best answer is “as expensive [or cheap] as you want it to be” (score a third point for trading options over stock).

Categories: Option Trading | Comments (0) | Permalink