Lessons from David Dreman (Part 2)

Posted by Mark on May 31, 2016 at 06:30 | Last modified: April 21, 2016 05:43David Dreman uses a contrarian investing approach in an attempt to profit from irrational heuristic thinking. Today I want to discuss Dreman’s suggestions to protect yourself from such harmful cognitive biases.

With regard to the representativeness heuristic, Dreman suggests focusing on relevant factors that may result in an entirely different investment result. Do not be blinded by similarity. Sometimes only a slight similarity is necessary to significantly resonate with us especially if a big profit/loss was realized in the previous instance.

Dreman cautions against being influenced by short-term returns of a money manager, analyst, or any kind of financial adviser. The better the numbers, the more alluring the results but this is based on an insufficiently small sample size. Look for stronger supporting evidence like a longer term track record.

Dreman suggests being doubly cautious of short-term returns when they deviate significantly from long-term averages. This applies to performance of money managers, analysts, and advisers as well as to individual stocks or funds. Mean-reversion is the rule, not the exception.

Dreman recommends patience with new investment strategies rather than expectation of quick success. Investors are more likely to adopt strategies that have recently done well, which implicates mean-reversion as an immediate headwind. One way to offset this would be to enter a strategy when it seems somewhat out-of-favor. Such a strategy has already mean-reverted or is broken altogether, in which case future outperformance will no longer result. Only in retrospect can these two possibilities be differentiated.

These are four ways to prevent biases from affecting your investing decisions.

Dreman suggests purchasing out-of-favor stocks (e.g. low price-to-earnings ratios) as one way to profit from the biases of others. While this idea sounds good, as with most other strategies I would be interested to see a large backtest to better understand context.

Categories: Wisdom | Comments (0) | PermalinkLessons from David Dreman (Part 1)

Posted by Mark on May 26, 2016 at 07:19 | Last modified: April 19, 2016 10:27David Dreman founded Dreman Value Management in 1977 and has written many books and articles on contrarian investing. In this mini-series I will highlight certain aspects of his investment philosophy that resonate strongly with me.

According to Dreman, sound investment decisions are obstructed by psychological biases that I have called heuristic thinking. Crowd behavior is therefore irrational, which leads to market bubbles and violent selloffs. Contrarian investing aims to profit from the excess.

Dreman discusses the representativeness heuristic: human tendency to draw analogies and see similarities in things that are completely different. Overemphasis on similarity leads to miscalculation if we forget to assess the actual probability of an event occurring. One example would be recognizing a company as belonging to the automotive industry and remembering what happened last time an automotive stock was purchased. Representativeness reduces perceived importance given to the variables critical in determining actual probability of the event (e.g. the stock moving higher).

Dreman discusses the law of small numbers, which is a judgmental bias that occurs when one assumes characteristics of a sample population can be estimated from a small number of observations or data points. An example would be investors flocking to the hottest mutual fund. Research suggests funds that outperform in one time period often underperform in the next. Investors also tend to follow stock analysts who have demonstrated recent accuracy rather than checking the analyst’s performance over time for a logical measure of accuracy.

Investors ignore regression to the mean. Data show a tendency for valuations and returns to revert back to long-term averages—a conclusion overlooked by investors who pile in to buy a hot stock or rush to dump out-of-favor shares.

Investors fall prey to information overload, which is related to information bias. When under siege by information, people tend to see only what they are interested in while blocking out the rest. This is related to confirmation bias. Information bias is a delusion that more information guarantees better decision making.

In the next post I will review Dreman’s recommendations to overcome heuristic thinking.

Categories: Wisdom | Comments (2) | PermalinkIs There a Better Way?

Posted by Mark on May 20, 2016 at 07:14 | Last modified: July 16, 2020 11:35This morning I take a macroscopic view wondering what I’m trying to do here and why I seem to disagree with so many others in the financial industry. It’s not just that I’m trying to find a better approach: I’m trying to determine whether a better approach even exists.

I am not exaggerating when I say almost everywhere I look, I see marketing of a better trading/investing approach (substitute “Holy Grail” to make for slight exaggeration). Many seemingly innocent, matter-of-fact claims are actually the Holy Grail in disguise but that’s beyond the scope of this post.

Just as I questioned whether successful traders exist, I question whether a better trading/investing approach exists.

Consider the following observations:

–The disappearance of popular/outspoken traders over time

–Frequent flaws in advertising/marketing claims (e.g. affirming the

consequent, hasty generalization, fallacy of the well-chosen example)

–Rampant confirmation bias

–General ignorance about trading system development and inferential

statistics: tools capable of installing meaningful objectivity into an

environment of variable moving targets

–Multiple “professionals” telling me that generation of consistent, modest

annual returns [in comparison to what many investment newsletters and

trader education programs advertise] would have the big money storming

down my door to invest if I were to start a hedge fund

–Repetitive articles in financial planning and investment periodicals about

slight outperformance relative to benchmarks translating to large AUM

—American Greed on CNBC

–Financial industry’s overall ignorance about and misrepresentation of options

to the general public

–Attraction of discretionary trading as the Holy Grail for many profit seekers

If the concept of “a better investing approach” were on trial then perhaps none of these observations taken individually would be sufficient for debunking. Taken together, however, I see a boatload of reasonable doubt.

Sometimes I feel like X-Files. On the TV program, Mulder feels compelled to continue searching to ultimately discover “the truth is out there.” With regard to finance, I wonder if there is no particular truth to be found (i.e. a better way) even though everywhere I look I see advertising suggesting there is.

Categories: About Me | Comments (0) | PermalinkBirds of a Feather

Posted by Mark on May 16, 2016 at 06:36 | Last modified: April 2, 2016 08:38“Birds of a feather flock together.” So why don’t we as retail investors? I want to spend some time discussing this based on my time spent trying to network with others and meeting with trading groups.

I have had a difficult time trying to find other traders with whom to discuss option trading much less to collaborate on trading system development. I have already written about trading as a lonely pursuit.

If I were a conspiracy theorist then I would say this happens by design. “Divide and conquer” must be an institutional mantra because working unchecked, we [retail traders] fall prey to heuristic thinking. This probably contributes in large part to the fact that 80-90% of retail traders lose money to institutional coffers.

Except I am not really a conspiracy theorist.

Varied style preferences are perhaps the biggest reason traders have difficulty hooking up. Preferences are responsible for what tickers I like to trade, what software I like to use, what time frame I like to trade, and many other considerations. Incongruity amid any of these factors may be sufficient for incompatibility. If I am lucky enough to find a trading group where 10-20 people come together then what’s the probability I will find matches across the spectrum?

Aside from individual preferences, differences in personality traits can derail a potential partnership. I may not like anger, sarcasm, conceit, or laziness. It’s almost like we need eHarmony’s 29 dimensions of compatibility to discover who will get along. This isn’t like a corporate job, either, where people are forced to cooperate or be fired. When we can walk away without obligation, we will. I have found traders (myself included) to be a very fickle lot.

Bottom line: when I overlay the low probabilities of finding an overlap in style with finding a solid personality match, it’s no surprise why the trading space ends up seeming sparsely populated. Suddenly it makes more sense why people turn to commercial means (e.g. selling newsletters, trading services, or forming “trader education” companies) in an effort to create a following and to foster community.

Categories: Networking | Comments (1) | PermalinkLike Statistical Minds?

Posted by Mark on May 13, 2016 at 06:21 | Last modified: March 31, 2016 06:51Several weeks ago I listened to a presentation by David Wilt, co-founder of QuantyCarlo [QC], and for perhaps the first time in the option trading space, I heard what sounded like a kindred spirit. Today I will post some excerpts.

“With this tool you can propose a set of values for DTE, study them, and then evaluate

them: which gives you the best results and whether or not—and this is tremendously

important—any of those results are statistically significant or whether you are simply

looking at the random, stochastic behavior of trades in a sample space.”

“Desirability index is a standard method in inferential statistics and modeling—a single

measure (from 0 to 1) that reflects outcomes of interest to you.”

“When we have results from any kind of backtest… the first question you have to answer

is whether results are statistically significant: can you feel comfortable that when you

trade live you will get similar results?”

“QC Enterprise… provides you with a statistically sound (scientifically sound means to

provide significant, predictable, reliable improvements)…”

“I am absolutely convinced that 20-30 years from now, people will look back on this

and say ‘well that was easy. That was a no-brainer.’ I think what we’re really doing

here is taking a series of methods and techniques that have been applied in other

industries and bringing them to the options trading space and what we have here

is a tool that allows us to do the tests fast enough and sufficiently enough to

apply these statistical models and give us the kind of predictive capability that

has been achieved in other industries.”

“We want to get this in front of the people because there are a huge number of

smart people out there. We believe strongly that if we can engage them… if

they will share with us their views of QC: good, bad, or indifferent… if we

can learn from them then we will be able to continuously enhance this product.

The engagement with folks and the learning that we can anticipate from engaging

with them is invaluable and we appreciate the time and we appreciate people’s

questions and we appreciate their comments because that’s so important to

making this product and making the community more successful and I think

that’s really what we’d like to see. So I want to personally thank everybody

and say I look forward to the continued dialogue and I’m sure… QC [will] be

better for it.”

I look forward to learning more about QuantyCarlo!

Categories: Trading Software | Comments (0) | PermalinkWatching Out for Risk

Posted by Mark on May 10, 2016 at 06:46 | Last modified: March 28, 2016 09:16Many of my blog posts are inspired by forum discussions I have with other traders because thoughts had by others are often thoughts I once had too. Today’s example is about risk.

Over a year ago I was compelled to respond to “Pete,” a guy who had some definitive, optimistic words for trading strategies he claimed to be using. He posted a number of times before I responded with the following:

> If there’s potential reward then there is no such thing

> as zero risk.

>

> Your posts have full of phrases like:

>

> –“consistent weekly profits”

> –“‘gravy’ forever into the next generation”

> –“the coast is clear to keep it and make premiums

> until it runs up again”

> –“those who stayed are rich and retiring”

> –“sounds to me like profit all day long and all

> the way to the bank”

> –“this is a triple grand slam with insurance.”

>

> Where’s the one about trading being like an ATM

> machine that continuously spits out cash?

>

> Nothing about trading or investing is free, nothing

> is guaranteed, and nothing here is ever worth the

> kind of exuberance you seem to project with your

> posts. There’s risk inherent with everything and

> if you trade too large aiming to be too greedy then

> you will one day learn the hard way by getting

> blown out of the game for good.

Pete responded by asking me what I felt could possibly be wrong with some of the trades he was putting on. I replied:

> I’m not going to specifically analyze the pros/cons

> of your trade because we have other wonderful

> traders here who routinely share such insights

> Hopefully they can help with some of your analysis.

>

> Based on my real-world trading experience, though,

> focus on what I said in my last post. It’s at

> least urban legend (if not definitive truth: nobody

> knows) that over 80% of all traders lose money.

> Personally, I think the #1 culprit is unrealistic

> expectations. If you enter the markets thinking

> you’re going to make too much per month then

> you’re going to get beheaded. Your phrases that I

> quoted all suggest just that.

>

> Hence my caution: learn how to determine the real

> risk, watch your back, and be careful. If you don’t

> see the risk then walk (or run) far away.

I think this is good advice for everybody and that includes, first and foremost, myself. I try to remember this stuff each and every day.

Categories: Money Management | Comments (0) | PermalinkFixed Position Sizing in Trading System Development

Posted by Mark on May 5, 2016 at 06:20 | Last modified: March 24, 2016 12:31I have mentioned the importance of fixed position sizing on multiple occasions. Today I want to present another example.

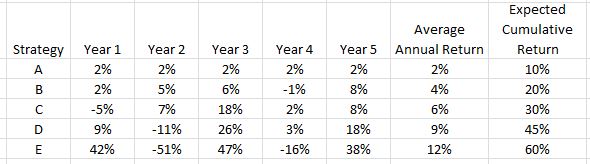

Here is a table showing performance of five different investing strategies. Which one is the best?

Do you agree with E > D > C > B > A?

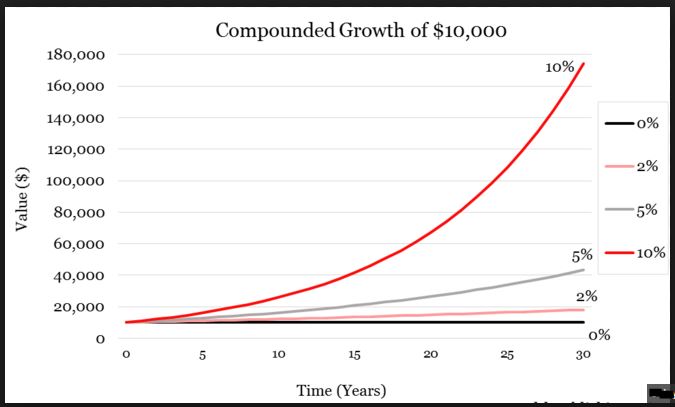

This assumes fixed position sizing. No matter how good or bad the strategy does in any given year, fixed position sizing means I risk the same amount for the following year. This is not typically how longer-term investing is modeled. You’ve probably seen the compound growth curve that so many investing firms and newsletters like to market:

I will not get curves like this by doing the math shown under the “Expected Cumulative Return” column. Beautiful exponential curves are only possible if I remain fully invested. As the account grows, my position size grows. Exponential returns are not a by-product of fixed position sizing.

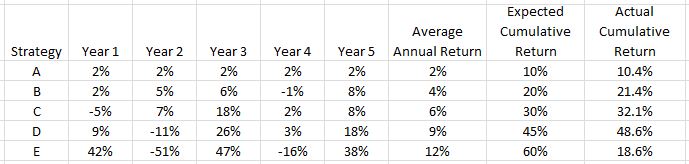

Following a fully-invested, compound-returns financial plan will generate the following from our five investing strategies:

Now it seems the investment strategies should be ranked D > C > B > E > A. Note how the mighty (E) has fallen! This is the risk of trying to compound returns. Big percentage losses early leave a small amount in the account to grow when the strategy performs well. Big percentage losses late when account equity is at all-time highs have the biggest gross impact.

So which strategy is best?

We must first determine whether fixed or variable position sizing is used to better understand what we are looking at.

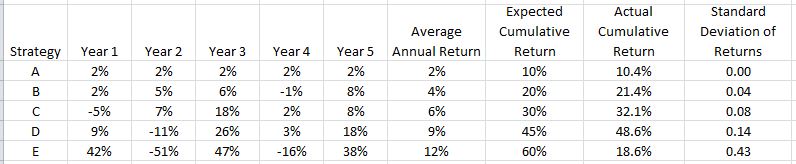

One additional column presents some revealing information:

E, the strategy that initially looked best but proved to be rather poor, has by far the highest standard deviation (SD) of returns. SD measures variability of returns. This is why the Sharpe Ratio—a performance measure where higher is better—has SD in the denominator.

In summary, when comparing performance higher average annual returns are better but only to a point. Returns must also be consistent because excess variability can be detrimental. This is why I often study maximum drawdown: the kind of variability capable of keeping me up at night and causing me to bail out of a strategy at the worst possible time.

Categories: System Development | Comments (1) | PermalinkDay Trader Meetup Review (Part 3)

Posted by Mark on May 2, 2016 at 05:58 | Last modified: March 4, 2016 12:46Today I will conclude my review of the first day trader Meetup.

Once we finally got around the table and through the introductions, the organizer took 15 minutes to present one strategy and a few other slides. We then got to eating and talking among ourselves. It seems like a good group of people. Being filled with newbies, I think the group could benefit from some basic presentation about trading. This would include some teaching on trading system development, countering heuristic thinking tendencies, and general tenets of optionScam.com.

Later that evening, WM posted a comment on the website:

> I came to a day trading group with undesired long term ideas. I

> then tried to force them on the group. SORRY won’t happen again.

My intent was not to make this guy feel bad but rather to teach him something. I figured that unfortunately, he would just go on studying Hurst and continuing to get nowhere. WM is like the occasional entrepreneur we see on Shark Tank who has spent a huge amount of money [and time] trying to develop a product/business. Without revenue the Sharks often shake their heads and say things like “this is just a bad idea,” or “cut your losses already and move onto something else.”

The Holy Grail is advertised and marketed in many places. I firmly believe it is myth and only capable of impeding my progress by draining resources. One way I avoid this trap is to steer clear of anything too complex. In WM’s case, the advanced theoretical math is literally way over his head. Anything “proprietary” is also too complex for me because by definition, I will never know what it is.

A second Meetup was held a few weeks later on a Wednesday evening and only three of us (WM, the organizer, and myself) showed up. Yes, WM was still trying to preach Hurst theories and he eventually stood up and said “thanks guys but this group just isn’t for me.” I think he’s too brainwashed to contribute but I do hope others attend future Meetups.

Categories: Networking, Trader Ego | Comments (0) | Permalink