Risky Proposition (Part 2)

Posted by Mark on January 29, 2016 at 06:50 | Last modified: February 1, 2016 11:25I believe we should always be thinking about the likelihood of history to repeat before concluding too much from historical backtesting. Usually, the answer is “unlikely to repeat” and Monte Carlo simulation to randomize trade sequence seems like a logical solution. Studying only one historical equity curve introduces selection bias to the system development process.

Lines 4-6 in the last post suggested dividing initial equity by the maximum drawdown (DD) to best understand trading system risk. This prevents someone from inflating potential returns by advantageously changing the backtesting start date. Certainly when developing my own system I also want to avoid underestimating risk. In live trading if I lose much more than expected then the result could be catastrophic.

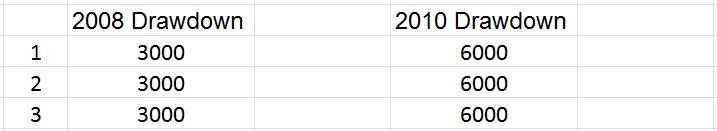

Lines 1-3 address accurate assessment of DD risk. I love to see an equity curve grow exponentially but the way to do that is by increasing position size along the way. DDs occurring later in the trade sequence will be proportional to position size and this can distort our understanding of risk. For example, which year has the worst DD for each system shown below?

Clearly the 2010 DD is twice that of 2008 for each system. Does the additional information shown below change your perception?

The 2010 DD is worse for system 1, the 2008 DD is worse for system 3, and the DDs are equivalent for system 2. I now can better understand how DD should be understood in terms of position size.

Using a constant position size during development of a trading system helps remove the bias produced by order-dependent testing results. We may already have a selection bias introduced by choosing an equity curve that is better than the mean. Do not compound that by adding artificial equity growth due to trade sequences not likely to be repeated.

Put in simpler terms, when analyzing DDs I need to keep position size constant to ensure apples-to-apples comparison.