Posted by Mark on December 31, 2015 at 07:55 | Last modified: November 18, 2015 17:23

Mandell gives a bad name to motivational speakers, to personal coaches[ing], and to some aspects of cognitive behavioral therapy. The idea that my mission could be synonymous with sociopathic behavior is very troublesome.

What kind of world do we live in where the passionate causes of good, altruistic people can themselves be mistaken as fraudulent advances? I like to teach and I would love to get up in front of a group and speak fervidly about the virtues of positivity, of meditation, and of visualization. My aim is not to take or steal: I aim to give back. Now I realize in the midst of my outpouring someone could raise their hand and say “are you trying to scam us?” That’s a reasonable question because Ross Mandell is high-profile precedent.

The reality is no matter how strongly we may feel about altruistic causes, those on the outside may (and perhaps should) always question our true intentions.

As a more general statement, intersubjectivity (described here) is one way to check fraudsters at the door. My true intentions cannot be verified because nobody can read my mind. A better understanding could be gathered by studying my behavior over time and across situations for consistency. This is how we get to know people on a personal level.

Intersubjectivity is one reason awareness was given as a way to combat fraud. “Only a very small percentage of people ever report… fraud… As long as that continues, fraudsters… will continue…” Share with others and talk about it. That is intersubjectivity at work.

Intersubjectivity was also discussed as one of your strongest defenses against fraudsters based on the way con artists “separate you from your friends and family by placing extreme secrecy on all facets of the deal.”

Intersubjectivity is also discussed in the last post:

“The next step is to make himself or herself appear to be

the only person on whom you can rely for the fulfillment

of your wishes, desires, and/or personal safety…”

The emphasis is mine.

Categories: About Me, optionScam.com | | Permalink

Posted by Mark on December 30, 2015 at 07:23 | Last modified: November 10, 2015 14:26

Today I want to finish quoting some highlights from the Fraud Aid website, which is an excellent source of information that I encourage everyone to visit for a more comprehensive presentation.

“The next step is to make himself or

herself appear to be the only person

on whom you can rely for the fulfillment

of your wishes, desires, and/or personal

safety. Keep in mind that in order for

the scam to work, the scam artist will

gain your complete and unquestioning

trust, and they are very, very skillful

at doing this.

The final step is the move on your

money or property… you will be instilled

with a fear of contacting the authorities.

To accomplish this, the scam artist will

use whatever fear is uppermost in your

emotional catalog. In your mind, you

will feel that to take any action will

either make you look foolish, and/or

you will fear retribution from the con

artist, and/or you will fear even the

authorities themselves. If the scam

has gone on long enough, you have

been brainwashed, quite literally, into

believing the scam artist more than

the authorities and those close to you.”

Fraudsters gain access through emotional vulnerability. Any heartfelt cause can serve as such a vulnerability. Alignment with something I am passionate about can instantly make me feel comfortable and/or trusting of a complete stranger. American Greed has shown us many causes used to this end including religion, charity, and family/health.

What struck me about the November episode was the addition of a new cause to the list: motivational speaking. Here’s a guy in Ross Mandell acting as a motivational speaker but interested only in stealing from others!

I am a strong believer in the motivational speaking/coach mentality because it embodies positivity. As traders we incur losses/setbacks but we must remain confident and positive/strong in order to succeed. I could do any number of blog posts on subjects like positivity, meditation, and affirmations. To now realize that a fine line exists between something about which I believe so strongly and a tool for fraud and chicanery does not make for a happy day.

Categories: optionScam.com | | Permalink

Posted by Mark on December 29, 2015 at 07:21 | Last modified: November 10, 2015 13:51

As I said in Part 1, trading/finance is an industry rife with liars, cheaters, and fraudsters. Don’t believe me? Look back at every blog post I have categorized under “optionScam.com.” The the nonprofit organization Fraud Aid is an excellent source of relevant information and today I want to quote more highlights from their website for the sake of raising awareness:

“…con artists look for ways to manipulate strengths

and weaknesses. They will either paint a picture of

wealth and ease, or increase your darkest fears, or

a combination of both.

In order to do this, a con artist will:

play on your sympathies;

instill in you a sense of security in

dealing with him or her;

separate you from your friends and

family by placing extreme secrecy on

all facets of the deal;

convince you to depend only on the

scammer and to believe only in the

scammer; convince you that your

friends and family, banks and law

enforcement, are all lying and that

only the scammer is telling the truth;

and distract you from what is really

going on using lies laced with enough

truth to make the matter believable.

Their goal is to make you completely dependent

on them.

Part of instilling complete dependency is to make

you feel that your world may not be safe without

their guidance. Once you realize that none of the

promises are forthcoming as you expected, the

con artist uses that dependency as a threat. He or

she will yank the leash they have wrapped around

your survival instincts, using either subtle

scare tactics or outright threats of physical

harm to you and your family.

The first step is for the con artist to determine

your personality profile and identify your needs.

He or she might zero in on your pride, your ego,

your fears, your dreams, visions of riches,

religious conviction, an illness, or your desire

to get a special deal, or a combination of

several traits. Whatever works best for the

given situation.”

I will finish up with Fraud Aid in the next post.

Categories: optionScam.com, Trader Ego | | Permalink

Posted by Mark on December 28, 2015 at 06:45 | Last modified: November 9, 2015 07:16

Before I continue, I want to discuss some basic concepts of fraud. Fraud Aid is a fraud victim advocacy nonprofit organization. I strongly encourage you to visit their website, which discusses the subject masterfully.

From their website, I am going to quote some highlights:

“Fraud is an insidious, sneaky crime that ruins individuals

and families, causes corporations to go under… raises

insurance costs, raises product costs, and produces untold

grief at all levels of society worldwide.

It steals food from the mouths of the hungry; it causes

homelessness, unemployment, increases the welfare tolls

and yes, even brings death…

…And yet, fraud can be stopped. You and me, we can

stop fraud.

All it takes to stop fraud is awareness… for each and

every person who had an experience with a scammer to

tell a friend, a neighbor, the cashier at the grocery

store, a cousin, a sister, a brother, a mother, a child.

No one is immune to fraud… What is an obvious fraud

to one sounds like an opportunity to another…

…Working together we can make it so difficult for

fraudsters to pander their false hopes that the numbers

will actually begin to dwindle.

How can that be accomplished? By ensuring that every

incident of fraud is reported as a theft report, and

by ensuring that every suspicion of fraud can be

reported without fear of ridicule from those who

should be offering support…

Only a very small percentage of people ever report

a fraud theft or identity theft, and so the numbers

appear small. As long as that continues, fraudsters

will continue to thumb their noses at law enforcement

and at all of us.

Fraudsters are laughing like hyenas. They laugh at

law enforcement and they laugh at their victims. They

will keep doing so until we, working together, turn

their greedy joy into tears of frustration.”

Categories: optionScam.com | | Permalink

Posted by Mark on December 24, 2015 at 06:29 | Last modified: November 9, 2015 07:08

In an industry rife with liars and cheaters, I believe the road to long-term success must include education about fraud to avoid being sucked dry from others before trading strategies capable of generating consistent income are mastered.

CNBC’s American Greed is precisely the kind of documentary show to provide this sort of education. On November 6, 2015, CNBC featured the story of Ross Mandell.

From the episode, narrated by Stacy Keach:

“In June 2011, Ross Mandell was tried in New York Federal Court,

Manhattan. After five weeks he was found guilty on all counts and

sentenced to 12 years in prison [securities fraud]….

…for anyone else, this might be the end of the story. But not so for

Ross Mandell. Before he’s supposed to report to federal prison, he

catches a break and he’s allowed to remain free while his case works

its way through the appeals process. For the next three years, he

lives with a GPS ankle monitor at his Boca Raton mansion with his

family and becomes a self-described motivational speaker with his

own web series, ‘Our Time with Ross Mandell.'”

[Ross Mandell screenshot from his web show] “This is OUR time. I

come to you today with a sense of outrage!”

[Keach narrating] “He has titles like ‘This Too Shall Pass…'”

[Ross Mandell on screen talking] “One day, the sun will shine if

you allow it.”

[Keach narrating] “‘Yes I Can…'”

[Ross Mandell on screen talking] “Losers say yesterday and winners

say yes today.”

[Keach narrating] “…and ‘Dress for Success.'”

[Ross Mandell on screen with black sportscoat and white tie talking]

“I know what you’re thinking: man, that dude looks handsome today.

Suit and tie, money, power: that’s what I’m after.”

[Keach narrating] “But in May 2014, the Second Circuit of Appeals

hands down its judgment: there will be no change in Mandell’s

status. And three months later, he finally reports to federal

prison where he will serve out his 12-year sentence.”

This is an interesting case study that bothers me immensely.

Categories: optionScam.com | | Permalink

Posted by Mark on December 22, 2015 at 06:39 | Last modified: November 7, 2015 12:58

I suspect my discussion about leverage is as important a concept to explicate as anything else regarding this approach.

I started by comparing naked puts and long shares with equal capital risk. The graph makes it clear that long shares are more profitable. To get that profit, though, I was going to have to endure a whole lot of pain.

This process also helped me realize the trade can be very expensive in terms of capital risk. With options it looks possible that I can take on even more capital risk and still be safer (historical drawdowns) in bear market conditions.

As a cautionary note, I feel people must understand other details I did not cover before trading this strategy. I did not take several more blog posts to explain technicalities I work with every day. One should understand differences between underlying markets, what options to trade, and when to trade them. One should also understand details about execution and about transaction fees. I took all this into account when running the numbers.

Specific details will also vary from one trader to another in terms of position sizing. One needs to understand what kind of accounts will allow this type of trade. One needs to understand margining and what to expect as the market moves. Fixed vs. variable position sizing should be understood along with particular implications about the graphs as I have presented them. These are things people learn as they take time to study how options work and how to trade them. Many of these details I have described elsewhere in this blog.

I may come back at a later time and flush out more of the technical details. For now though, I will affix the bow: that’s a wrap!

Categories: Backtesting | | Permalink

Posted by Mark on December 21, 2015 at 07:09 | Last modified: December 7, 2015 14:43

In my opinion, trading system development is similar in importance to hypothesis testing and inferential statistics in addition to being something most traders don’t know much about.

Aside from my familiarity with statistics, I am a student of trading system development. Trading system development looks at measures related to profitability, consistency, drawdowns, and much more.

While I find this all interesting and potentially very useful, at the outset maybe I just want to know if my system is better than trading at random. Maybe I just want to know if my system is better than zero profitability. These are questions that lend themselves to inferential statistics because the null hypothesis would say “the system is not profitable.”

In the final analysis, I think we have at least two different approaches to trade validation. One approach involves hypothesis testing and inferential statistics. Aside from those with research backgrounds of some sort, I’m not sure who might think to employ statistics for this purpose. I think trading system development is more popular among algorithmic traders and those employed in finance since it uses parameters and jargon created specifically for the industry.

Perhaps the two are accomplishing the same thing but from completely different theoretical angles. I may never know.

Categories: Financial Literacy, System Development | | Permalink

Posted by Mark on December 18, 2015 at 06:16 | Last modified: March 31, 2016 06:27

I left off with a general description of the statistical hypothesis testing process.

Once the assumptions behind a sample or experimental design are identified, the next step is to choose an appropriate statistical test to run on the data.

Select a level of significance (greek letter alpha: α), which is a probability threshold below which the null hypothesis will be rejected. Common values used are 0.05 or 0.01. By definition, status quo is likely to maintain. α states “if the chance of the sample being status quo is less than one in 20 (or 100, respectively), then I believe it is not status quo (i.e. reject H0) but rather something different (i.e. accept HA).”

Perform the statistical test, which will output a p-value. The p-value gives the probability of the groups being from the same population (e.g. no difference, or H0 is true). If the p-value < α then reject H0 and accept HA.

Hypothesis testing is not perfect. A type I error occurs by rejecting H0 when H0 is in fact true. This is also known as a “false positive” and the probability of making this mistake is equal to α. On the flip side, a type II error occurs by not rejecting H0 when H0 is in fact false. This is a “false negative.”

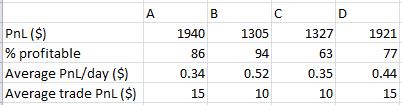

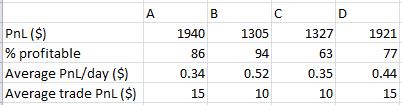

People spend so much time backtesting trading strategies but I believe without statistics, essential context is missing to make sense of it. As an example, here is some data I saw recently:

With regard to average trade, groups A and D look best but we need something more to conclusively determine. An average trade PnL of $15 for groups A and B is 50% more than groups B and C! Is that a real difference or is it likely to have occurred by chance? Sample sizes would affect our evaluation of this question as would variance within/between the groups. Inferential statistics wrap all these factors together into context we can definitively understand. Without the inferential statistics we really can’t know much at all.

Categories: Financial Literacy | | Permalink

Posted by Mark on December 17, 2015 at 07:48 | Last modified: November 6, 2015 08:50

Most people who know anything about statistics understand descriptive ones: numbers used to summarize and describe data. I feel strongly that as traders, we need to understand inferential statistics too.

Inferential statistics are used to reach conclusions that extend beyond the immediate data alone. These might be used to infer from a sample characteristics about the whole population.

Inferential statistics are also used to determine whether an observed difference between groups is dependable or simply a chance occurrence. This is called hypothesis testing.

I said one could lie with descriptive statistics by including certain things and excluding others.

Inferential statistics may also mislead by including/excluding certain differences/similarities in experimental design. Even before hypothesis testing begins, validation of experimental design is essential albeit beyond the scope of today’s post.

Hypothesis testing begins by defining the hypotheses. The null hypothesis (Ho) generally states that both (all) groups are the same. The value of a group is often given in terms of an average (e.g. arithmetic mean) and standard deviation. The null hypothesis represents the status quo. The alternative hypothesis (HA) generally states the groups are not equal. HA may or may not go one step farther and state which group is thought to be greater than the other.

The next step is to consider the statistical assumptions being made about the sample(s) involved. For example, a given statistical test may require the samples be independent (e.g. not affecting each other) or that the distribution (shape) of a sample be “normal” (bell curve, which has a specific mathematical definition), etc. If the assumptions for a statistical test are not met then the test should not be used or the caveats/limitations should be discussed to put reasonable context around any conclusions.

I will continue next time.

Categories: Financial Literacy | | Permalink

Posted by Mark on December 15, 2015 at 07:21 | Last modified: November 6, 2015 05:55

I could go on with incriminating quotes throughout history about statistics:

“There are three types of lies — lies, damn lies, and statistics.”

–Benjamin Disraeli

“Facts are stubborn things, but statistics are pliable.”

–Mark Twain

“If your experiment needs a statistician, you need a better experiment.”

–Ernest Rutherford

“All statistics have outliers.”

–Nenia Campbell, Terrorscape

“There are two kinds of statistics, the kind you look up and the kind you make up.”

–Rex Stout, Death of a Doxy

During my undergrad years I saw a number of students develop an antipathy toward statistics because it was a subject that either clicked or totally did not. I think much of the negative press statistics gets is partially a result of the fact that many people simply do not understand it.

I have a decent familiarity of statistics. I took an advanced stats class in undergrad and I used statistics in my published manuscript as well as my Pharm.D. research project. That education has made me statistically-minded, which is probably one reason option trading feels comfortable. I constantly think in terms of sample sizes and the relevance of conclusions. I believe these are things anyone on the path to trader success should understand.

I agree with some of the negativity reflected in the quotes above. Just because you have a statistic does not mean it’s a valid one. Scrutiny must be applied to see if the experimental design makes sense and was conducted properly.

Most people only know about descriptive statistics: numbers used to summarize and describe data. These are your averages, standard deviations, and ranges. These are found everywhere when talking about sports. Descriptive statistics can certainly be skewed to include certain things and to exclude others, which is where much of the lying comes from.

I believe another branch is equally, if not more important than descriptive statistics. I will talk about that next time.

Categories: Financial Literacy | | Permalink