Catastrophic Loss (Part 4)

Posted by Mark on September 25, 2015 at 07:41 | Last modified: October 22, 2015 08:42For years I’ve felt that catastrophic loss is the worst thing possible but in the big picture, it’s not uncommon.

By the very nature of the word, “catastrophic” sounds like an outlier. The second definition is:

> extremely unfortunate or unsuccessful [italics mine].

“Outlier” and “extreme” are synonymous.

For something so extreme, though, catastrophic loss is all around us. This need not be loss of life although that certainly would qualify. I’m thinking more akin to Serena Williams’ loss to unseeded Roberta Vinci in the 2015 U.S. Open a couple weeks ago. That ended her bid for the Calendar Slam, which would have been one of the great tennis accomplishments of all time. Another example comes from Survivor: Second Chance: we heard some players talk about losing in previous seasons and how catastrophic it was because they were so close to winning $1M. I think anytime we put our heart and soul into something and then get blindsided and/or fail to accomplish, the result is catastrophic.

In psychological terms, maybe “devastating” is the word used more often. Like the loss of a loved one, it can be associated with grief. Those who are true champions will be able to deal with it and bounce back. These make for many of the inspirational stories the evening news loves to report.

Going forward, the best course of action would be to get my checklist in place to decrease the possibility of catastrophic loss from ever occurring again. Given that I’m now in financial drawdown and emotional recovery, though, I also need to focus on a bright future, positive things, and pulling myself up by the bootstraps.

For the time being, I’ve said quite enough about catastrophic loss. Let’s go out and make some money, shall we?

Categories: About Me, Option Trading | Comments (0) | PermalinkCatastrophic Loss (Part 3)

Posted by Mark on September 22, 2015 at 07:30 | Last modified: October 22, 2015 07:37In Part 2, I gave some background about what led to my latest catastrophic loss.

One thing I find tricky about the trading business is that catastrophic loss often looks foolish in retrospect. When I contemplate what happened to me in August, it seems absolutely absurd! Hindsight is always 20/20, though. More often than not, I’ve found sharing these stories with other people to be met with a lot of head nodding. We’ve all been there and many stories are commonly held.

One thing that makes my catastrophic losses difficult to stomach is the fact that I trade in a discretionary manner. With a systematic trading approach, I can see exactly where the profit and loss falls with regard to numerous other copycat trades. Discretionary trading means every trade is different and I have no context. Making things worse for this particular case is the fact that I’m quite sure the current drawdown would have been much lower with a more systematic trading approach. In this pursuit that is already boring at times, discretionary trading does help keep me engaged. However, when that means constantly battling the market and becoming emotionally drained, I can end up more vulnerable to catastrophic loss should a true market challenge present. Case in point: August 2015.

The emotional impact of catastrophic loss can be devastating. In the past, I have felt depressed and unwilling to get out of bed in the morning. I have felt like a failure and seriously considered going back to work as a pharmacist (e.g. “throwing the baby out with the bathwater”). I’ve felt gun-shy and very fearful about getting back into the market. I know one other guy who trades full-time. I heard from him a few weeks ago and asked how he managed the correction.

“I took a huge hit,” he said in his message. “I’m going back to work a real job.”

Talk about catastrophic loss and devastation! I was shocked and despite repeated calls, I haven’t heard back from him since. I’m not at all surprised he hasn’t wanted to face it and share his story. Most people don’t.

Categories: Money Management | Comments (2) | PermalinkCatastrophic Loss (Part 2)

Posted by Mark on September 18, 2015 at 08:02 | Last modified: October 17, 2015 10:31Last time I discussed more positives than negatives about my trading business. Today I want to inch closer to this concept of catastrophic loss.

When catastrophic loss happens I try to do a postmortem to better understand exactly what happened. I try to find pearls that will prevent it from happening again. I often come up with a checklist: things to watch for each and every day to make sure I am avoiding potential landmines.

Unfortunately, I believe even the best laid plans sometimes cannot avoid catastrophic loss. When histograms of trade returns are plotted, most results end up somewhere in the middle but a few will locate far to the left (i.e. Black Swan). Maybe it’s a cost of doing business? Perhaps it’s just a necessary evil of trading. As luck (randomness) often giveth, (bad) luck may also taketh away. At the end of the day, if Green > Red then it might be “winner winner chicken dinner.”

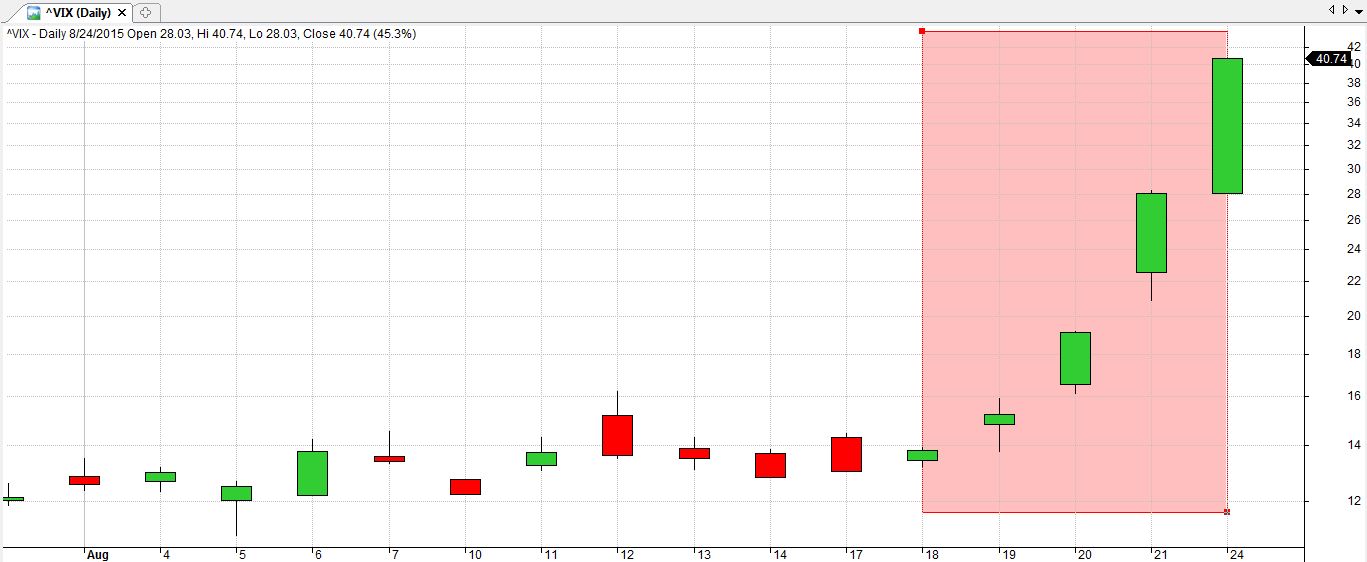

One thing I find tricky about the trading business is that catastrophic loss can happen at any time. I find my head must always be on a swivel because in retrospect, the rough times always came out of nowhere and occasionally to a staggering extent. Sometime I should tell the GC story. The whole motivation for writing on this subject now is because of what happened last month with stocks. From August 18 to August 24, the market fell 9.3%. While that is surprising, what happened to volatility is utterly earth-shattering: up 212% in five trading days!!!

That’s enough to destroy many option traders who are trying to play the odds.

Hell, that was the first time I ever used red text in this blog! If that doesn’t say it all…

Not a typo: up 212% in five trading days! I need a break.

Categories: About Me | Comments (2) | PermalinkCatastrophic Loss (Part 1)

Posted by Mark on September 16, 2015 at 07:43 | Last modified: October 17, 2015 10:02I do not feel like I have managed this correction very well and I want to spend some time reflecting on it.

For me, “catastrophic loss” is losing much more in a single month (or less) than I usually make in a profitable month. Unfortunately in my seven-year trading career, I have experienced this 4-5 times. Every time I hope it never happens again. Every time I vow to improve.

Before I explore the dark side, I need to fill in context with some details about the upside. My trading business is profitable after seven years. I am immensely grateful to have been able to leave my corporate job and work for myself largely on my own schedule. People often say this is their dream and I am living it.

The way I trade, I make money most of the time. When things are going well, my business is boring. Sometimes this actually drives me stir-crazy! I won’t take up much space dissecting the ridiculous irony of that statement but it will suffice to say I’ve lost any rights to sympathy from others. If anything, this adds pressure to succeed and hopefully that will serve as positive motivation rather than suffocating burden.

The “stir-crazy” nature of my business is one reason I spend time here. While I maintain the blog to keep myself on-track with projects, to organize my thoughts about the financial industry, and to keep myself sharp by practicing writing skills, let’s be frank: I also do it to pass the time! Maybe I also do it to give my carpal tunnel a break from backtesting too much but that’s a separate medical discussion.

Despite the positives, it behooves any good businessperson to keep an eye out for potential threats and for me, the biggest potential threat is catastrophic loss. I will continue with this in the next post.

Categories: About Me | Comments (2) | PermalinkThe Stealthy Sisters of Spin and Speculation (Part 6)

Posted by Mark on September 14, 2015 at 05:25 | Last modified: October 15, 2015 12:40In the last few posts I have argued when it comes to investing and trading, people often miss the forest for the trees.

I strongly believe this but I also think it makes me sound rather arrogant. My philosophy is based on study of a lot of commonly taught trading techniques and a failure to see definitive edge. I know the extensive work I have done to get where I am but you do not and I could be a glorified writer of fiction.

Going forward, rather than trying to explain what “responsible trading/investing” is or should really be about, I will focus what it is about for me. It will eventually make sense why this puts me in the minority.

I offer two caveats.

First, no matter what I do, I am not going to change the world. Quite honestly, I’m not going to even try.

Second, I welcome all market participants no matter why they are here. I googled the oft-quoted saying “it takes two people to make a market” only to find out it’s not often quoted! Nonetheless, I believe it is true and in many cases, the two participants have significantly different outlooks. This may be why one party is buying and one party is selling. Whether someone is here because of spin, speculation, or just to pass the time. I will trade with them. The more the merrier too, or in financial parlance, the more there are the greater the liquidity.

For me, this comes down to business and as Mr. Wonderful says, business is all about making money.

Categories: About Me | Comments (1) | Permalink