Ghost Education (Part 7)

Posted by Mark on February 26, 2015 at 07:46 | Last modified: May 11, 2015 13:19Terry Lane’s article certainly qualifies as ghost education. Should we have expected anything more?

“About the Author” reads:

> Terry Lane has been a journalist and writer since 1997.

Journalists and writers don’t necessarily know anything about trading.

> He has both covered, and worked for, members of

> Congress and has helped legislators and executives

> publish op-eds in the “Wall Street Journal,” “National

> Journal” and “Politico.”

Op-eds usually have nothing to do with trading: even (especially?) those in the WSJ.

> He earned a Bachelor of Science in journalism from the

> University of Florida.

I wonder if he had to take any finance classes as part of that concentration?

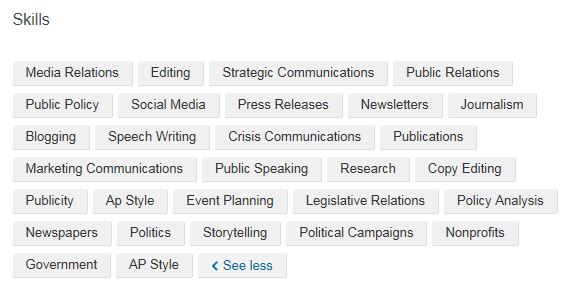

According to Lane’s LinkedIn page, his background includes nothing about trading or finance. He has listed as “Skills:”

Apparently, Lane has no investing background, no background at all in the financial industry, or even specifically the financial media. I wonder if he has ever traded a stock or option contract in his life? It might be bad enough for the average investment adviser with no trading experience to report on this. What the devil is someone completely outside the financial industry doing by trying to report on it?!

I mean nothing against Terry Lane. He seems like a solid writer. He could be a very nice guy, a wonderful family man, and he may be great at what he does: writing and communications.

Lane seems extremely unqualified to be writing any kind of article about trading, though, and that is exactly what his article reflects from a content standpoint. This is ghost education: a subset, in my opinion, of optionScam.com. Many people will read this article expecting to learn and learn they will not. Lane might get hits for Demand Media, which may be his job. To me and the rest of us traders, though, Lane’s content is absolutely meaningless and a waste of our time.

Categories: optionScam.com | Comments (0) | PermalinkGhost Education (Part 6)

Posted by Mark on February 23, 2015 at 07:24 | Last modified: May 11, 2015 13:00In the last installment I defined “ghost education:” an article that purports to provide instruction but actually provides nothing actionable at all. Both the Lane and Option Alpha articles are ghost education. Did you see the contradiction between the two?

The Option Alpha article concludes:

> We have found that the most consistent strategy

> is to SELL the options that are far out of the

> money and keep the premium as they expire

> worthless.

Lane’s article concludes:

> When these events can’t discount the volume, it

> may signal that investors have reasons to be

> optimistic about the options and could be a buying

> opportunity.

First, the Option Alpha article implies we must determine why the options are being traded in order to make money off the opportunity. Although that is impossible to do, Lane suggests we have an opportunity when we can’t determine a reason. These are contradictory.

Second, the Options Alpha article suggests selling high-volume options. Even though that fails because the options have zero bid, Lane suggests buying the options. Again, these are contradictory.

To recap, what we have here is ghost education by Terry Lane that is based on ghost education by Option Alpha. Terry Lane’s article is ghost education because he purports to tell us how to profit and he never does. He seems to be basing his approach on the Option Alpha article but he gets it backwards.

This is optionScam.com, folks.

I will make one further observation in the next post.

Categories: optionScam.com | Comments (1) | PermalinkGhost Education (Part 5)

Posted by Mark on February 19, 2015 at 05:08 | Last modified: May 13, 2015 11:23The Option Alpha article ends by saying once we determine why high volume options are being purchased, we can decide how to profit on them. This is ludicrous since we can never know the “why.” The absurdity doesn’t end there.

Maybe these options aren’t even being bought. Christine asked this question in the Comments section and Kirk (the author, I presume) responded:

> well you usually won't [sic] know who's [sic] doing what…

He admits the obvious! We can’t know. This makes me laugh. Volume and open interest just are. They don’t indicate what is bought and what is sold. He goes on:

> But you can usually assume that extremely high volume

> with out-of-the-money options is the work of buyers who

> are hedging.

Assume anything you want but ultimately, nobody can know since we can’t interview market participants. Period.

We’re pretty much left with nothing, here, since the article is telling us to decide how to profit based on why they are being traded, which we can never know.

This is the epitome of what I call “ghost education:” the title of this blog mini-series. Ghost education is an article, or other presentation, that purports to deliver something real but, in fact, delivers absolutely nothing.

The Option Alpha article concludes:

> We have found that the most consistent strategy

> is to SELL the options that are far out of the

> money and keep the premium as they expire

> worthless.

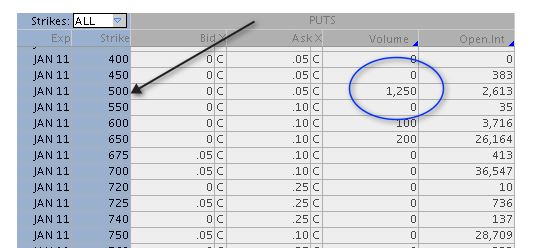

In the example of the Jan 11 500 put, how much could I make by selling the option? Look back at the option chain: the bid is zero. I would make nothing. There is nothing actionable here. Ghost education once again…

In my next post I will address another point.

Did you notice a contradiction between the two articles?

Categories: optionScam.com | Comments (3) | PermalinkGhost Education (Part 4)

Posted by Mark on February 17, 2015 at 06:28 | Last modified: May 11, 2015 11:39The last sentence of Lane’s article told us the key to profit is to buy options traded in high volume with no discernible cause. Because this seems a bit weak, I want to scrub the cited Options Alpha article to make sure I have not missed anything.

The Options Alpha article gives an example of high SPX option trading volume:

The article writes:

> CLEARLY, this is a classic example of hedging buy [sic]

> a large institutional trader and/or hedge fund.

This is an unverifiable claim and there is nothing “clear” about it. Yes, this could be a deliberate attempt to hedge, which is #2 of three main reasons the article gives for high option trading volume. This could also be #3: an example of “an idiot getting loose in the market” and speculating on a big drop by purchasing cheap OTM options. This could also be #1: upcoming news. We see predictions almost every day in the financial media warning of a catastrophic market crash just over the horizon. Maybe someone read one of these news articles and thought there was reason to buy this option.

To muddle the waters further, I will suggest this could have been a trading error! Any seasoned trader will talk about “Laurel and Hardy” trading mistakes. Maybe the trader(s) intended to buy 1000 strike puts and selected the 500 strike instead. Maybe the trader intended to buy 125 contracts instead of 1250. Purchase of 1250 contracts at a nickel each would only have cost $6,250 plus commissions. That could be but a pittance for an institutional trader, but it could be a retail trader as well (yet another detail that isn’t clear like the article suggests).

The article continues:

> Once you find out who is buying these options then only

> can you decide how YOU would like to make money off THEM.

No, we can never find out who is “buying” these options. Does this mean we can never do anything in terms of making money “off THEM?”

I will continue next time.

Categories: optionScam.com | Comments (1) | PermalinkGhost Education (Part 3)

Posted by Mark on February 13, 2015 at 06:36 | Last modified: May 11, 2015 11:31I am in search of instruction on how to trade for profit, which this article’s title promised to be forthcoming. In 4+ paragraphs thus far, Terry Lane has failed to deliver on that promise. Today I will continue with the final paragraph:

> Options trade at higher volumes when the strike price is close

> to the current market price, as they are more likely to expire

> “in the money.”

This does not tell me how to trade for profit.

> An option trading at 200 percent or more than similar strike

> prices signals unusually high volume, according to Option

> Alpha.

Here is another article citation. Still in search of that secret to profit…

> Trading volume can be high because of news events, such as

> earnings or product launches, or from hedging by institutional

> investors.

Potential reasons for high volume do not tell me how to profit…

> When these events can’t discount the volume, it may signal

> that investors have reasons to be optimistic about the

> options and could be a buying opportunity.

That’s the end! No more. This must be therefore be the secret to profit: buy options traded in high volume without any apparent reason.

I should scrub the Options Alpha article to make sure I haven’t missed anything. As good writing practice, Lane should have highlighted relevant points from that article in his. I will double check.

The Option Alpha article is entitled “Learn How To Profit From Unusual And Abnormally High Options Trading Volume.” The article says three main reasons exist for high options volume: upcoming news, hedging, and uninformed retail investors.

I think these are possible reasons but how can we ever know? In order to know why options volume is high I would have to interview everyone who traded that option on the day in question. This can never be done since buyers and sellers are anonymous. The door is wide open to speculation and the financial media takes full advantage of this each and every day.

I will continue in the next post.

Categories: optionScam.com | Comments (1) | PermalinkGhost Education (Part 2)

Posted by Mark on February 10, 2015 at 06:25 | Last modified: May 11, 2015 09:05I previously introduced an exemplar of what I am calling “ghost education.” Its title is what drew me to the article via a Google search and I discussed how the title seems to fit the marketing mold quite well. Let’s look now to determine whether the rest of the article is good as advertised.

How are we going to profit, Terry Lane?

The first paragraph defines “volume,” “options,” and “calls.” He makes no mention about profit.

The second paragraph explains why people trade call and put options. Lane also writes:

> Options can be risky investments that are often traded by

> advanced and sophisticated investors.

I would say options are not risky when traded by advanced and sophisticated investors who thoroughly understand them. When traded by newbies who have been blinded by outrageous promises of excess return, yes they are very risky. I see nothing in this paragraph about profit, though.

The third paragraph describes an options chain. Again, he writes nothing here about profit.

The fourth paragraph talks about volume and slippage. Once again, Lane writes nothing about profit. The article is only five paragraphs long, which means my sole purpose for reading must be immediately forthcoming!

With baited breath, I embark onto the fifth paragraph:

> Unusually high trading volumes can indicate a buying

> opportunity, according to The Options Playbook.

A “buying opportunity” suggests an opportunity for profit. Since the title said “How to Trade… for Profit” this would seem to be false advertising since profit and the opportunity for profit are different. Nevertheless, we can click on the link to see what Terry is citing.

The Options Playbook was written by Brian Overby. Overby is a Senior Options Analyst at TradeKing. I have watched a number of his presentations and I respect him a lot for his ability and approach to teaching.

In Overby’s cited article, however, no mention is made about profit. This is an article about open interest and liquidity. Why did Lane cite it?

Perhaps we need to read on to find out…

Categories: optionScam.com | Comments (1) | PermalinkGhost Education (Part 1)

Posted by Mark on February 5, 2015 at 07:05 | Last modified: May 8, 2015 10:42Today I am going to detail a particular sort of content available across the internet. For lack of a better term, I am going to call this “ghost education.” I believe to succeed as traders, we should understand what ghost education is and how it fits into the financial landscape.

In order to develop this concept of ghost education, I am going to pick on one particular article. Please understand, however, that what I discuss here applies to a plethora of articles I have found over the years.

This is the article I will dissect today. I encourage you to go to the link and take a quick read.

I am no marketing guru but in order to design a successful advertising campaign, here might be some observations to keep in mind:

1) People are interested in ways to make money.

2) People tend to be especially interested in quick ways to make a buck.

3) The less people have to pay for 1) and 2) the better.

The title of this article is an embodiment of this psychology:

> How to Trade High Volume Call Options for Profit

1) is described by the last word: “profit.”

2) is communicated by the word “options.” People tend to think options are speculative and risky. Many people consider them to be gambling. They are known as a way to make fast money especially if stock direction can be correctly predicted.

3) is suggested by the first words. “How to” material is usually educational. When found on the internet, these articles are often free. How-to seminars also exist but quite often cost thousands of dollars. I think people are very willing to take a couple minutes reading an article that might provide some useful information especially given the alternative of taking a chance by spending thousands of dollars on something that might teach them very little.

I will continue in the next post.

Categories: optionScam.com | Comments (0) | PermalinkUsing Implied Volatility to Screen for Option Trades (Part 3)

Posted by Mark on February 2, 2015 at 05:46 | Last modified: May 7, 2015 12:49Last time I presented a generic screen to identify high implied volatility percentile candidates. Today I will conclude discussion on this strategy.

Criterion #3 searches for stocks with a minimum average true range. Average true range is a measure of stock price movement in relation to the previous close. Generally stocks that move very little have options that are very cheap. While a tradeoff exists, profit potential is generally limited when selling cheap options.

Criterion #4 searches for stocks with current implied volatility (IV) percentile in the top 5% of their 12-month IV range. Being mean-reverting, according to theory, IV will be likely to drop in the near future. Short options will profit when IV falls.

Once the screening is complete, the next step is to inspect the price charts of stock candidates. Any stocks that are at solid support levels are candidates for short puts or put credit spreads. Any stocks that are at strong resistance levels are candidates for short calls or call credit spreads. Stocks that seem range-bound, or trading sideways, are candidates for iron condors or naked straddles/strangles.

For each stock that turns up on the screen, we must be sure to identify the earnings announcement date. IV tends to peak just before earnings are announced. After the announcement, IV crashes. This is good for a short premium strategy. However, stocks tend to make big price moves following earnings announcements too. Depending on how much price risk a proposed trade has, we may want to avoid earnings announcements to decrease risk of earnings-induced price shocks.

Finally, look for news that might signal reason for high IV percentile. Pharmaceutical stocks (especially biotechnology) are notorious for big price moves related to FDA approvals or bans. Similar to earnings announcements, we may want to avoid placing trades if an FDA decision is imminent.

Categories: Option Trading | Comments (0) | Permalink