Day Trading is Not All That (Part 1)

Posted by Mark on November 25, 2014 at 06:52 | Last modified: May 1, 2015 08:26A couple years ago, I read an article by Louis Horkan Jr. on daytrading at About.com. I found the article interesting enough to cut and paste it as a blog idea, which I will present today.

He wrote:

> The allure of day trading is powerful to most people. Who isn’t drawn

> to the notion of trading stocks, crude oil or the Euro and making good

> money, setting your own schedule and working from anywhere you can

> establish an Internet connection, be it the beach, the gym, Starbucks

> or trading from home while lounging in shorts and flip flops?

>

> Sound almost too good to be true? That’s because it is too good to be

> true and the romantic or cool notions that people harbor about trading

> for a living are far afield of reality. While that sounds pessimistic,

> it is a harsh reality that must be dealt with up front.

>

> Truth is that for the vast majority of people, trading for a living

> (day trading) and dealing with trading risk makes absolutely no

> sense – they have no business doing so. It’s not about being smart

> enough or having nerves of steel to stare down some imaginary

> opponent or any of the other preconceived ideas that abound.

>

> No, the reality is that most people wouldn’t enjoy trading, nor

> would they ever start doing so daily if they understood what it was

> really all about. Yet most people who do decide to trade simply

> jump in before ever learning what is entailed or what it takes

> for success – let alone knowing whether they’d actually want to do

> this type of work.

>

> Such an approach is doomed to failure from the very start – much

> akin to starting a business you know nothing about, with a high

> degree of likelihood you’ll hate the actual work once you’re

> knee-deep in the endeavor. Most people would run from such a

> situation when put in that perspective.

Some further thoughts in my next post.

Categories: Wisdom | Comments (2) | PermalinkGrow Up! (Part 3)

Posted by Mark on November 20, 2014 at 05:35 | Last modified: April 29, 2015 09:55The last post was my response to a disgruntled student trader who lost big money on a collar trade. I have one further critique for today: I don’t think her claim even makes sense!

JD tried to accuse X for big losses on a collar trade due to undisclosed risk of the collar trade itself.

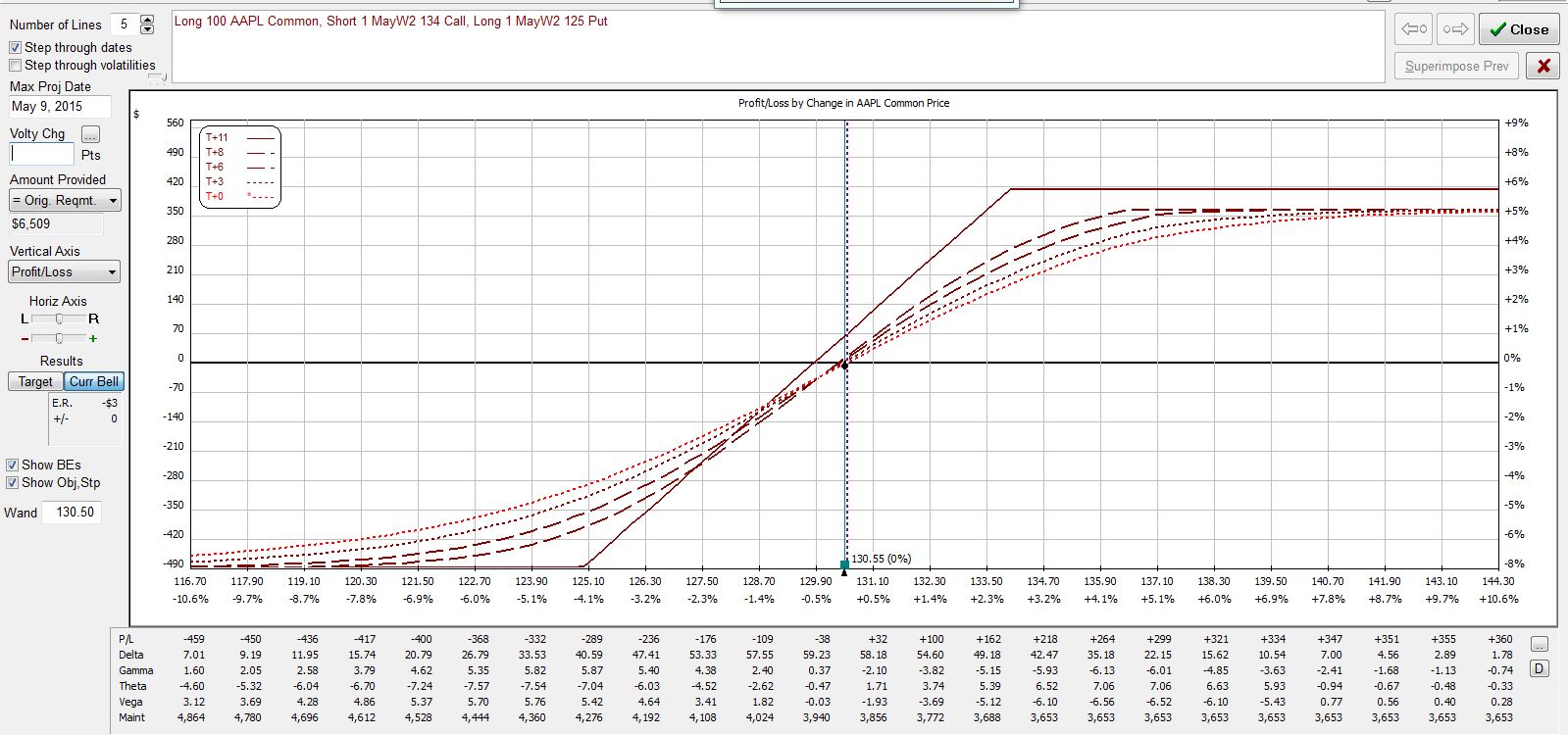

Here’s the risk graph for a zero-cost collar trade:

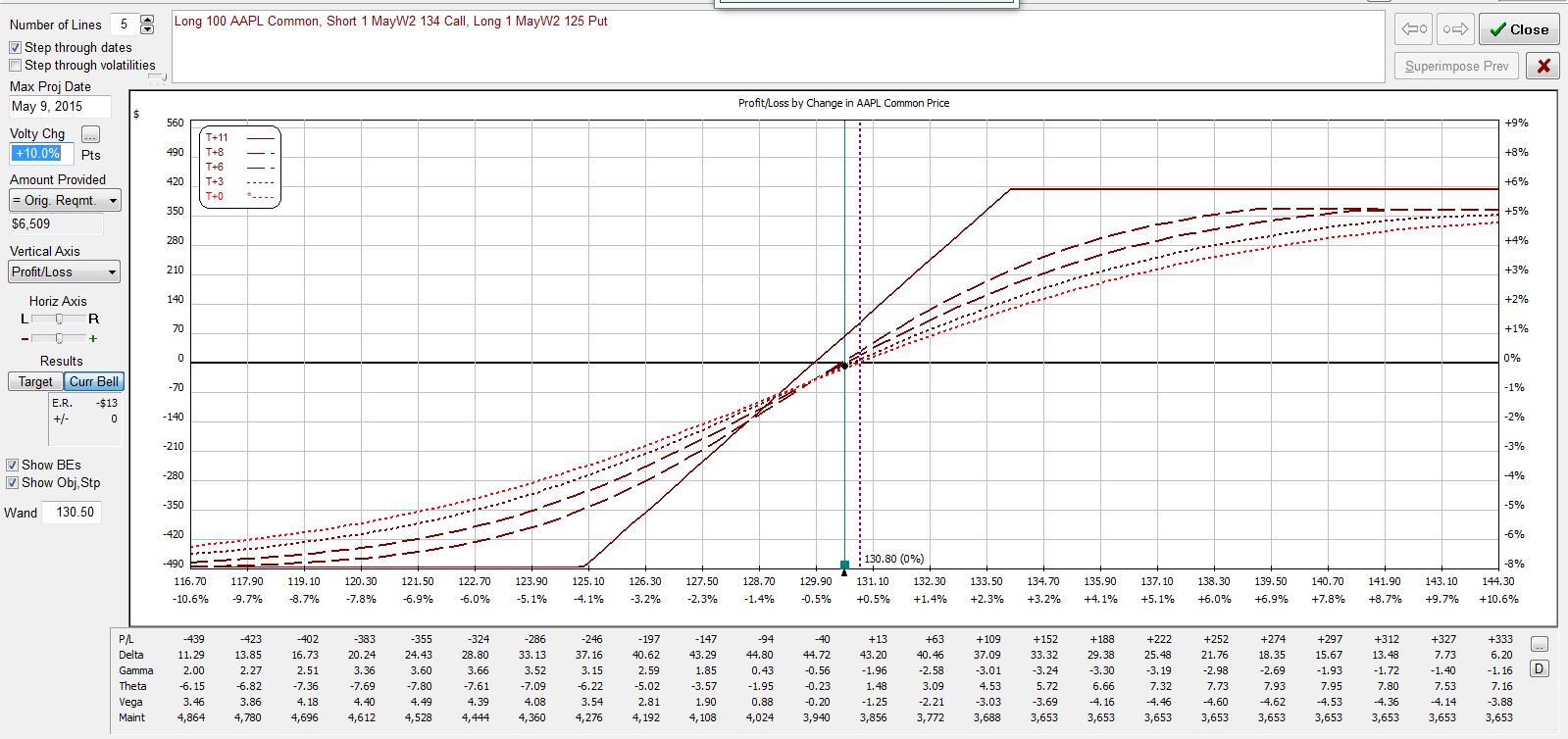

For her to lose on the trade, the stock must have gone down. If implied volatility increased by 10% then the risk graph would look like this:

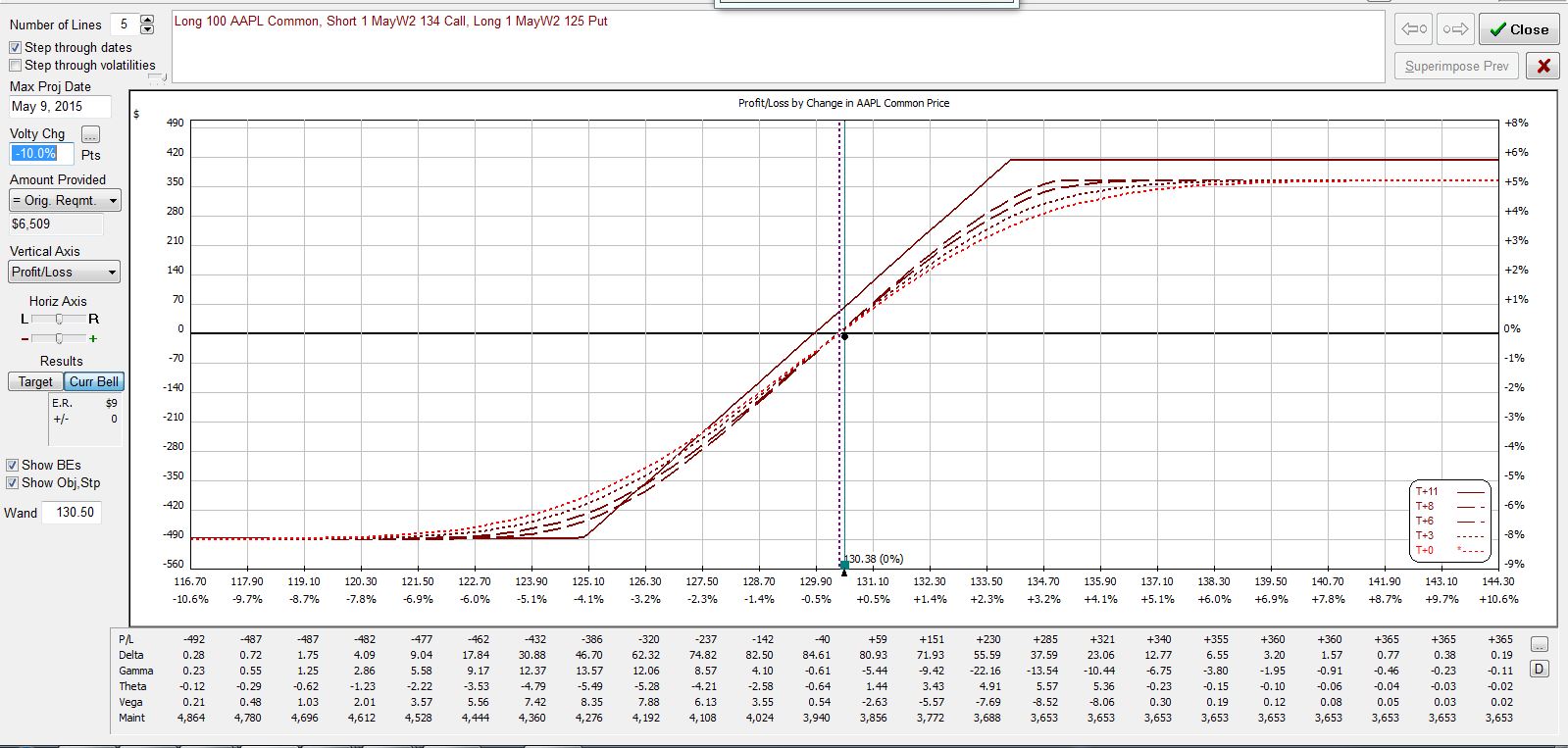

The T+0 line (today) actually flattens out, which prevents the loss from being as big! If this were earnings and implied volatility actually decreased by 10% then the risk graph would look like this:

Compared to the first image, losses along the T+0 curve are worse here. However, note that in all three graphs, the expiration curve is identical. Even if losses were worse today, in 11 days there would be no difference.

Aside from not blaming anyone but herself, the only thing JD really should have critiqued was her stock selection. This trade lost money because the stock went down: period! A collar trade is a collar trade: it caps potential losses. To blame the collar trade strategy for losses really makes no sense in any context.

The bottom line here is about trader psychology. I believe to be successful we must own responsibility for every trading-related activity we do. I am the only one who submits orders and clicks the execute button. If I am going to blame anyone then it should be me.

On another hand, I could just realize “you can’t win ’em all” and expect some trades to be losers. In that case, I have no need to blame anyone for trades that do not go my way.

Categories: Trader Ego | Comments (0) | PermalinkGrow Up! (Part 2)

Posted by Mark on November 17, 2014 at 07:21 | Last modified: April 29, 2015 09:28Today I continue with my response to a forum post from a disgruntled student of options trading:

> Disclaimer: I mean no offense here, JD, but I do hope you

> learn something.

>

> I believe your post is inappropriate. Your post does nothing

> less than blame X for losing money. As a student, you should

> only be doing paper trades for now and paper losses do not

> justify the harsh tone of your post. If this were a real

> trade then you deserve the consequences because you should

> not yet be trading real money! That has been repeated over

> and over and over around here. If you are a graduate of this

> program and do not know the real risk of collars then you

> clearly didn’t put much effort into learning the material

> and/or listening to lectures.

>

> Ultimately, if you’re going to be a successful trader then

> you need to take responsibility for yourself. You will have

> winning trades and you will have losing trades. The losing

> trades are not the market’s fault, not X’s fault, not a

> coach’s fault: they are your fault and your fault alone.

>

> Understand the responsibility and own it. If you traded

> too large and suffered a loss too great for you to bear

> then learn the lesson and vow to do better next time

> so it doesn’t happen again.

>

> In trader psychology terms, grow up JD.

That pretty much says it all.

I’ll save one more thought on this matter for the next post.

Categories: Trader Ego | Comments (1) | PermalinkGrow Up! (Part 1)

Posted by Mark on November 14, 2014 at 06:21 | Last modified: April 29, 2015 09:24My last series of posts was based on an e-mail correspondence I had a few years ago. Today I continue that “blast from the past” with a quick hitter: a forum post from March 2013.

This post was made in the forum belonging to an option education community. She wrote:

> The down side of collars

>

> I went to your summit lecture on collars and came away thinking

> this was a way to protect a position. No where did you explain

> about what you are risking by putting on a collar. So I put on

> a collar on ARMH since it’s PE is so high and there was some

> uncertainty about just how much the Arm chips would contribute

> to the Galaxy 4 announced Thursday.

>

> The result was I’ve now lost almost $13,000. You never said

> that the cost of the collar if the stock goes up is so high!

> Not only is there the cost of the options but all my gains

> from the stock going up are offset by the decline in option

> value. The collar is a dangerous trade unless you are really

> convinced that the stock is going down. Just my opinion but I

> really think you should have told us about the substantial

> down side of using options.

>

> Signed,

> JD

I will continue with my response in the next post.

Categories: Trader Ego | Comments (1) | Permalink