The Tall Tale of Martingale (Part 1)

Posted by Mark on March 13, 2014 at 06:07 | Last modified: February 21, 2014 05:34Dollar cost averaging (DCA) appears to be a panacea based on Rich MacDuff’s position archives. To best explore the risk and downside of DCA, I’m going to borrow from the world of gambling and explore the Martingale betting system.

Martingale betting systems date back to 18th century France.

The typical Martingale betting system works as follows. Start by making a standard bet on a [roughly] even-money gamble like red in roulette or Tails on a coin flip. If you win then repeat the standard bet. If you lose then double your previous bet. After a series of losers, when next you win your net profit on the series of games since the last win will be the standard bet.

Let’s go through a Martingale example. Suppose I bet $5 and win. I bet $5 again but this time I lose. Next I bet $10 and I lose. Then I bet $20 and I lose. Sticking to my system, I then bet $40 and I win. Two winners (in five attempts) and I am up $10. As long as I can double my bet after losing, I am guaranteed to come out ahead when I win.

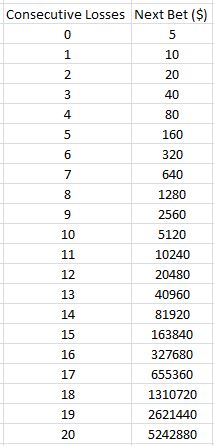

Unfortunately, in real life I cannot always continue to double. One reason is because at some point I will likely run out of money. While rare, extreme losing streaks do occur. If I lose 11 consecutive games as described above then…

…I will have to risk $10,240 for the next bet. If I cannot afford that, then I will realize a $10,235 (minus the number of wins multiplied by $5) loss.

Do most people even have ten grand when they walk into a casino? I would probably need a briefcase or a big duffel bag to carry that around and that would make me nervous! I’d probably want a security detail to avoid being robbed.

I will continue this discussion in the next post.

Comments (1)

[…] devoted the last four posts to discussion of the Martingale betting system because martingaling is to gambling what […]