Covered Calls and Cash Secured Puts (Part 33)

Posted by Mark on February 27, 2014 at 06:22 | Last modified: February 14, 2014 07:04Dollar cost averaging (DCA) is a CC/CSP position management technique I have alluded to in recent posts.

In Systematic Covered Writing, Rich MacDuff writes:

> The [DCA] strategy can be very advantageous

> when used with stocks that lose value… with a

> lower averaged cost basis, it will be easier to

> have the position go back to cash at a profit…

> [because] reaching a Continued trade status

> will occur at a lower strike price…

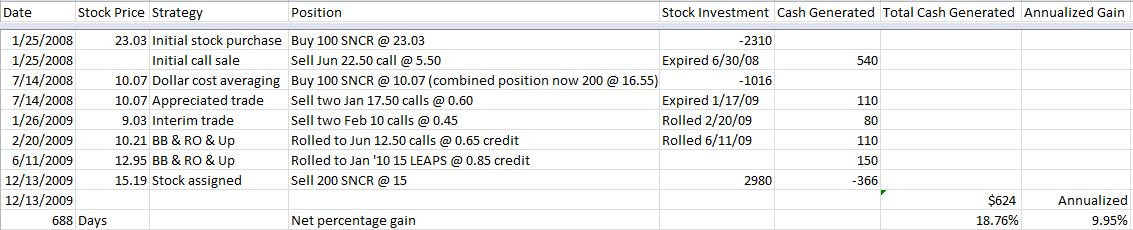

Here is a simplified example from the MacDuff archives:

In the first six months, SNCR fell ~56%. When a stock falls substantially, the short call strike will have to be lowered as little premium is available to sell regardless of expiration.

DCA lowers the cost basis (CB) over 28%, which leaves $6.48 less to recoup for position profitability. This can save months!

After DCA, “Appreciated trade” appears on 7/14/08 because the strike price exceeds the new position CB. Getting assigned at $17.50, in other words, would result in a profitable position. Note that in order to maintain a [$7.43] higher [than the stock] strike price, MacDuff sold an option six months out in time.

SNCR’s continual decline forces an “Interim trade” on 1/26/09 because the new strike price is less than the CB. Positions with interim trade status will result in loss if they end with assignment at the lowered strike. Because of this risk, interim trades involve selling short-dated options to allow less time for the stock to turn around and move strongly above the short strike.

Two BB & RO & Up adjustments were used to manage the bullish reversal in SNCR.

Finally on 6/11/09, the short call strike was raised to $15. While this is still less than the average stock price, it is greater than the position CB thanks to the series of credit trades. When SNCR was assigned at $15.00, this position made 18.76%.

Without the options, 100 shares posted a loss (from $23.03 to $15.19) and 100 shares posted a gain (from $10.07 to $15.19) resulting in an average return of 8.40%.

This would have drastically underperformed the CC position.

Categories: Option Trading | Comments (0) | Permalink