Covered Calls and Cash Secured Puts (Part 30)

Posted by Mark on February 18, 2014 at 07:06 | Last modified: February 12, 2014 05:57The current discussion regards evaluating the value of a position adjustment.

Remember, the goal is to raise cash with every trade. Ideally, MacDuff would like us to raise cash at an annualized rate of 15% or more to ensure a profit of at least 15% annualized when the position is closed.

For a RO & Up short call adjustment, I take the net credit (debit) of the trade, add the decreased intrinsic value of the replacement option, divide by the cost basis, and divide by number of additional years sold. For example, suppose XYZ trades at $51.23, I have a short Feb(8) 50 call in place, and I can roll to the Jun(127) 55 call for a credit of $3.03. I have sold:

(127 days – 8 days) / (365 days / 1 year) = 0.326 years.

The adjustment return is:

($3.03 + $1.23) / $51.23 = 8.32%

The annualized return is:

8.32% / 0.326 years = 25.51%

That would be a valuable adjustment!

I can perform a similar calculation for a roll down and out put adjustment. For every point the stock price falls below the short put strike, I owe $1/share if assigned. If I can roll the CSP down then I basically take the decreased intrinsic value back into my pocket. This typically costs money, which I may be able to recoup by rolling the option out in time.

For example:

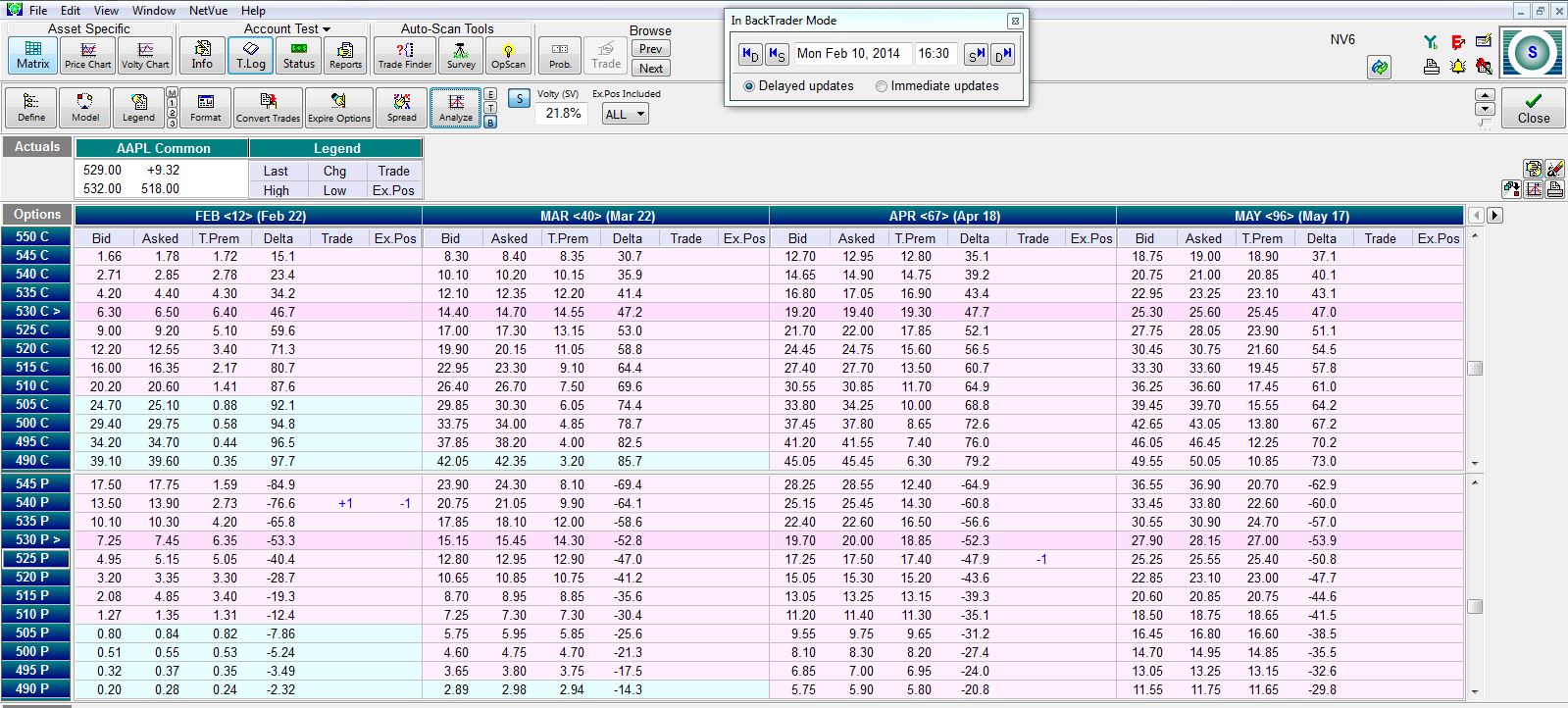

Here I am rolling out 67 – 12 = 55 days, which is 55 / 365 = 0.151 years.

The net credit on this trade is $17.25 – $13.90 = $3.35.

The decreased intrinsic value is $11.00, which makes the total return ($11.00 + $3.35) / $540 = 2.66%

Annualized return = 2.66% / 0.151 years = 17.64%

Once again, this is a valuable adjustment.

For Interim trades where short calls are rolled down, I can calculate the overall potential annualized return of the whole position to determine whether the adjustment is worthwhile.

For appreciated trades where short puts are rolled up, I can calculate the overall potential annualized return of the whole position to determine whether the adjustment is worthwhile.

A nasty situation occurs when the stock rallies sharply above a lowered short call strike (Interim trade) if the strike is below the current cost basis of the position. I will discuss this situation in the next post.

Categories: Option Trading | Comments (1) | Permalink